Why Beginners Should Avoid Signal Groups in Forex Market

As a beginner in forex trading, joining free or paid signal groups might seem like the fastest way to success, but in reality, it can do you more harm than good. Every professional forex trader who truly makes money in the market guards their trading strategy closely. Think of your trading strategy as your competitive edge, much like a patent that safeguards your inventions. In trading, exposing your strategy unwisely can attract unwanted attention and create vulnerability due to increased liquidity at your point of interest, which is risky.

Here’s why.

Like we discussed in our previous topic, the forex market is designed to move against your entry unless there’s an opposing order large enough to balance it. For you to sell effectively, there must be enough buyers, and for you to buy effectively, there must be enough sellers.

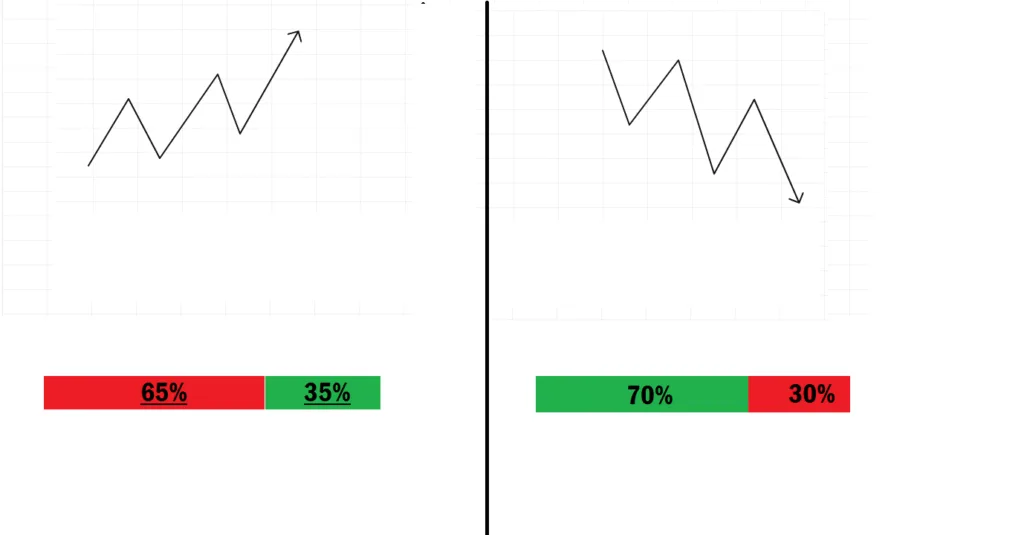

Now, imagine being in a Telegram signal group with over 300,000 traders waiting for the same signal. A few hours later, a buy signal drops, and everyone jumps into a buy trade. Consider this: if each trader in that group decides to buy a mini-lot, that’s 300,000 mini-lots pushing one side of the trade. If there are only 100,000 mini-lots from sellers on the other side, the imbalance in supply and demand becomes apparent, causing price to fluctuate unpredictably. Price will move against you because there are not enough sellers to outweigh your collective buying volume. And if there aren’t enough sellers at that point, the trade could still end in a loss because there’s no proper liquidity to support your position.

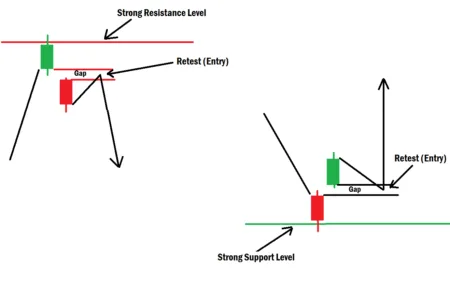

This is one major reason why most of these “popular trading strategies” often fail. You’re entering the market where liquidity is waiting, usually where stop losses are stacked.

Liquidity is not static; it’s dynamically added into the market. Most of the trading strategies made available for free or sold to the public were designed by institutional players to attract liquidity to specific price points. When a seemingly perfect buy setup appears, smart money players often use it as an opportunity to sell, capitalizing on the heavy liquidity built by retail traders in that zone.

That’s why many traders jump from one signal group to another without consistent results. Any professional trader who truly understands how the market works will never give out their real signals or expose their full trading strategy. Forex trading is about personal discovery and secrecy.

Think about it this way: a successful business owner will never reveal which product brings in the highest profit. Scarcity drives profit, and when something is scarce, its value increases, much like how limited buyer interest in the market can drive prices up. If the business owner shares the profit-making product, everyone would start selling the same item, supply would exceed demand, and the price would fall. In that case, there would be more sellers than buyers, and only the buyers would benefit because they could buy cheap and sell high.

The same principle applies in forex. When there are too many sellers, they end up losing while price moves in the direction of the fewer buyers. Understanding this concept transforms you into a real forex trader.

To make a profit as a seller, you need more buyers in the market. Forex is all about who controls the price. For instance, if you give out your buy signal, you’re inviting more buyers into the market, reducing the number of sellers, and as a result, price may drop instead of rising.

In summary, signal groups make you trade like the crowd, and in forex, the crowd is the liquidity. Stay smart, stay independent, and learn to read the market for yourself.