Understanding Stop Out Level in Forex Trading

In today’s lesson, we’re diving into a critical concept in forex trading—the Stop Out Level.

The Stop Out Level is one of the most important risk-related metrics every trader must understand. Picture this: you’ve opened several trades with confidence, hoping the market moves in your favor. But when you return to your trading platform, you’re shocked to see some of your positions closed, even though your stop loss wasn’t hit. What happened?

You’ve crossed the margin call level and entered your broker’s Stop Out Level. It means your broker has automatically closed some of your losing positions to free up margin and protect your account and themselves.

What Is a Stop Out Level?

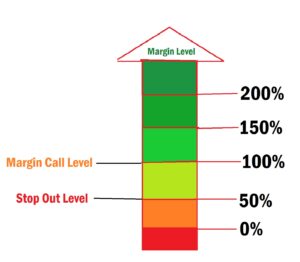

The Stop Out Level is a specific margin threshold set by your forex broker. When your margin level drops to or below this threshold due to accumulated losses and insufficient equity, the broker begins to close your open trades automatically. The goal is to prevent your account from falling into a negative balance.

While the margin call level is a warning, the Stop Out Level is action. It’s not friendly, it’s final.

When your equity falls below a certain percentage of your used margin, the Stop Out Level is triggered. Your broker will then begin liquidating your trades, starting with the most unprofitable ones, until your margin level rises above the Stop Out threshold.

A Practical Example: Stop Out at 50%

Keep in mind that every broker has its own Stop Out Level, which is defined in their trading policy. It’s crucial to check this detail before placing trades.

Let’s say your broker sets the Stop Out Level at 50%. It means:

- If your margin level drops to 50% or lower, your broker will start closing your trades.

- This action happens after a margin call is issued. But if you don’t act fast, the Stop Out process is automatic.

In simple terms:

Stop Out Level = Margin Level at 50%

For example, suppose your margin level has already fallen to 100%, and your broker issues a margin call. You ignore it, hoping the market turns in your favor. But later, you return to find your margin level at 53% and still dropping. If it hits 50%, your broker will start closing trades automatically.

That could mean another blown trading account! What a heck was that!

If you had multiple positions open, your broker might close:

- The trades with the largest losses, or

- Profitable trades that will help restore your margin level quickly.

Their goal is to protect both you and themselves from deeper financial risk.

Why Do Brokers Use Stop Out Levels?

Brokers implement Stop Out Levels to:

- Protect traders from losing more money than they deposited.

- Minimize their own risk, especially when leverage is involved.

If your account continues to lose and reaches zero, you could end up with a negative balance, meaning you owe your broker money. Stop Out Levels help prevent that scenario.

Final Thoughts

Greed is a silent killer in forex trading.

Never open more positions than your account size can realistically support. The market won’t always go your way. And when it doesn’t, overleveraging can wipe out your account in minutes.

Trade with discipline. Use leverage wisely. Manage your risk like a pro.

Up Next:

In our next lesson, we’ll explore “Forex Acronyms and Abbreviations with Their Full Meanings.”

You don’t want to miss this! Knowledge is your best weapon in the forex world!