In this session, we will be diving into “Liquidity Void” in forex trading.

Liquidity void is an ICT (Inner Circle Trader) trading model that every smart money concept trader must learn and understand. It is a simple yet powerful institutional footprint that can offer you high-quality trading opportunities in the market if used correctly. However, it can also be dangerous if you fail to master how it works.

When properly understood, a liquidity void can provide you with profitable setups. Many experienced traders use this concept to make profitable moves in the financial market.

As a beginner, you must first learn, practice, and master it before you deploy it as part of your trading strategy.

You need to understand that trading strategies are not magic formulas. They simply guide you on how to approach the market. They do not guarantee success unless you invest time into learning, practicing, mastering, and fine-tuning them to match your personal trading style.

There’s no holy grail strategy in forex. Every method works on probabilities, not certainty. That is why it’s crucial to practice on a demo account until you develop consistency before trading with real money in the live market.

What Is Liquidity Void In Forex Trading?

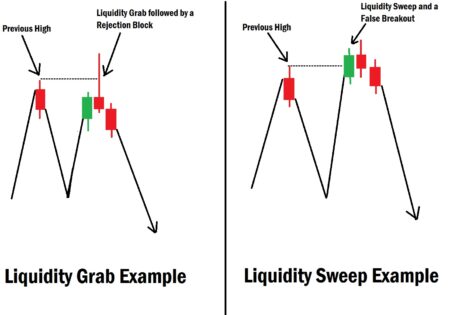

A liquidity void occurs when price moves aggressively in one direction with large momentum. It is usually characterized by large candlestick bodies and minimal pullbacks, indicating little trading activity as price moves swiftly in one direction.

Liquidity void happens when there is a major imbalance in price delivery. The idea is that price will likely return later to fill the void, offering traders an opportunity to capitalize on the return move.

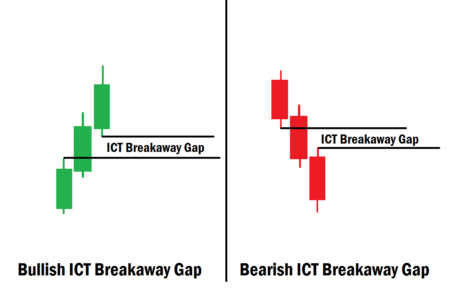

When a liquidity void is created, it means there is not enough liquidity in the market at that time. If institutional traders place large orders during this low-liquidity period, it causes a significant price displacement, which in turn creates large Fair Value Gaps (FVGs).

Eventually, those institutional traders will return to the scene to balance out the market by filling the FVGs created by their earlier trading activity. If you understand this process, you can take advantage of these price movements and catch profitable trades.

How To Take Advantage Of Liquidity Void To Catch High Probability Trading Opportunity

Once you spot a liquidity void, there is a high chance that price will come back to fill the FVGs left behind by the earlier aggressive move. A liquidity void can be bullish or bearish, but the approach to trading it remains the same.

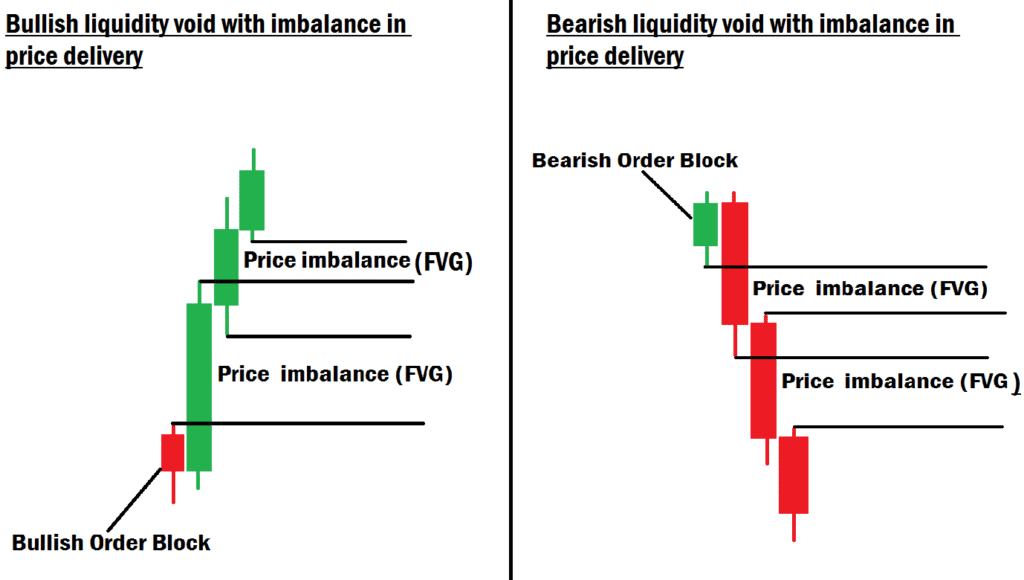

- A bullish liquidity void occurs when price is displaced significantly to the upside. It is referred to as sell-side imbalance and buy-side inefficiency.

- A bearish liquidity void occurs when price displaces to the downside. It is referred to as buy-side imbalance and sell-side inefficiency.

There are two main ways to trade liquidity voids:

- Using the order block approach

- Using the price balance approach

1. Order Block Approach

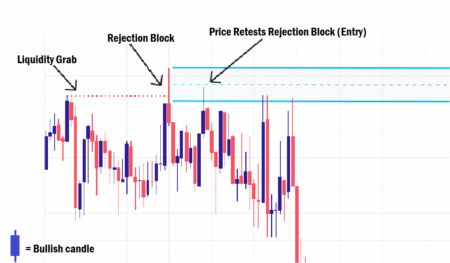

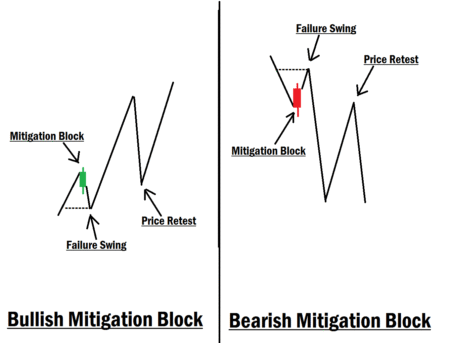

In this approach, the last bearish candlestick before a strong bullish move is a bullish order block, while the final bullish candlestick before a strong bearish move is the bearish order block.

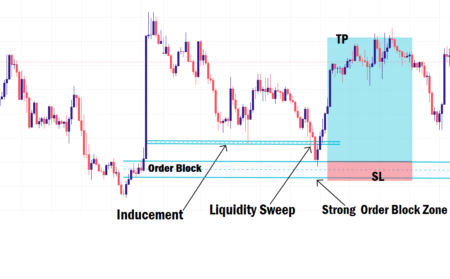

When price returns to a strong order block, there’s a high probability that price may reverse from that zone.

Here’s what to do:

- Wait for price to trade into the order block zone.

- Look for a clear Market Structure Shift (MSS) around that zone in the lower time frame chart.

- Once you see the MSS confirmation, place your buy or sell trade depending on the setup.

- For more precision, mark the order block on a higher time frame, then drop down to a lower time frame to wait for price to enter your zone.

- When price enters the zone, wait for a clear MSS on the lower time frame before placing your entry.

To learn more about the order block entry strategy, click here.

2. Price Balance Approach

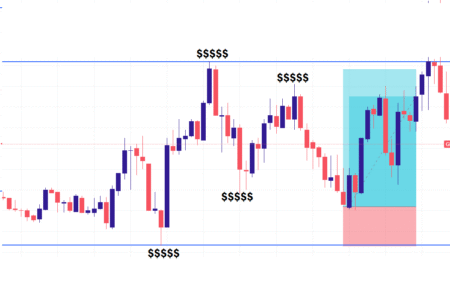

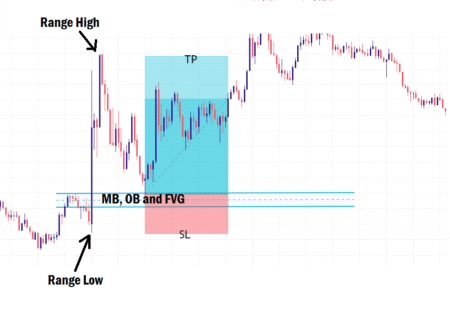

This method involves waiting for confirmation that institutional traders are likely to return to fill the FVGs caused by the liquidity void.

In this case, you can ride along with them and target just before the order block as your exit point.

Example:

Let’s say you identify a bearish liquidity void on your 1-hour time frame.

Now go down to the 15-minute or 5-minute time frame and look for a solid Market Structure Shift (MSS) pointing towards the void direction on the 1-hour chart.

This MSS is a sign that institutional traders may be getting ready to fill that void. At this point:

- Enter your buy position after MSS confirmation.

- Target just before the order block as your Take Profit (TP).

- Place your Stop Loss (SL) below the MSS low.

If you spot a bullish liquidity void, follow the same process:

- Go to a lower time frame.

- Wait for a solid MSS in the opposite direction.

- Enter your sell position, target just before the order block as your TP, and place your SL above the MSS high.

Final Thoughts

Practice both of these approaches using your demo account to see which one aligns better with your trading personality. Take your time to understand how each one works and develop your personal edge before stepping into the live market. That’s how professional traders succeed, through practice, patience, and mastery.

In our next lesson, we will be looking into “Fair Value Gaps (FVGs).” Don’t miss it