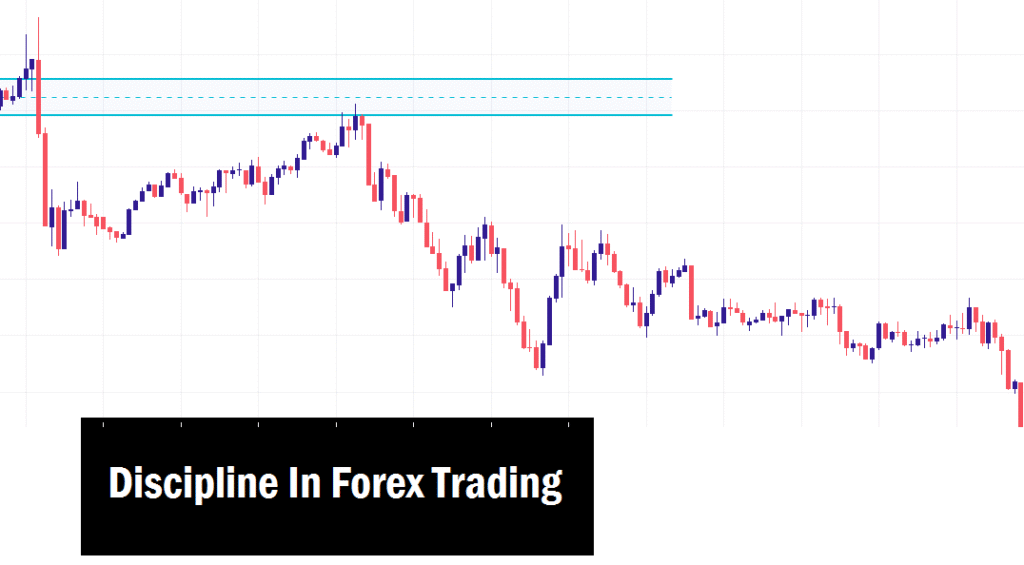

In this session, we will explore what discipline really means in forex trading

Most beginner traders often misunderstand the concept of discipline when it comes to trading. They usually ask:

“We know discipline in the English dictionary means obeying rules or a code of behavior, sometimes enforced by punishment. But how does this apply to forex trading?”

“We know discipline in the English dictionary means obeying rules or a code of behavior, sometimes enforced by punishment. But how does this apply to forex trading?”

After a little smile, the answer becomes clear: in trading, the definition does not change, except for one thing. Unlike life, where someone else punishes you for breaking rules, in forex trading, the market itself will punish you. And trust me, those punishments usually come in the form of massive losses.

If you’re a beginner, let this sink in: forex trading is risky. You must first learn, practice, and master your craft on a demo account before risking your hard-earned money. Ignoring this advice is a form of indiscipline, and the “punishment” is simple: losing your money.

Making trading rules is easy. The real challenge lies in following them consistently. We’ll cover the definition, importance, and three practical techniques. That’s why in this session, we’ll break down:

- What discipline really is in forex trading

- Why discipline is so crucial for success

- How you can build and maintain discipline in the market as a beginner

What Is Discipline in Forex Trading?

In forex trading, discipline means strict adherence to your trading plan and risk management rules, while maintaining emotional control instead of making impulsive decisions out of fear or greed.

It involves:

- Following a systematic trading approach

- Consistently executing your strategy

- Practicing patience and self-control

- Managing risk effectively

- Protecting your capital in volatile markets

In simple terms, discipline is following the rules of your trading strategy without compromise. Every strategy has guidelines designed to improve performance, such as:

- Entry criteria

- Lot size

- Stop-loss and take-profit placement

- Trading times

Ignoring these rules weakens the strategy, while strict adherence boosts its effectiveness.

Why Discipline Is Crucial in Forex Trading

Without discipline, no trading strategy, no matter how good, can reach its full potential. Many traders lose money not because their strategy is bad, but because they lack discipline. A practical way to safeguard against this is to adhere to a rule of risking no more than 1–2% of your total capital per trade. This concrete limit helps in managing risk effectively, allowing you to stay in the game longer even when trades do not go as planned.

Imagine knowing everything about a profitable strategy, yet ending every week with little or no gains. That’s the reality of an undisciplined trader. Let me illustrate with a real-world story: consider a trader named Hakim, who once moved his stop-loss in an impulsive decision during a volatile session. Hoping the market would reverse in his favor,Hakim ignored his own rule of a strict stop-loss placement. Instead of a minor setback, he faced a substantial 5% loss of his trading capital. This one decision erased weeks of gains, solidifying the importance of discipline. As an undisciplined trader, you end up chasing prices, forcing trades, and trading with emotions instead of logic.

Here’s why discipline matters:

- Improves Profitability

Discipline helps you unlock the full profit potential of your trading strategy. - Reduces Emotional Trading

Lack of discipline leads to fear-driven or greedy decisions, such as moving stop-losses, closing trades too early, or forcing trades without proper setups. Imagine closing a trade because it’s heading to your stop-loss, later you realize that it did not get to the stop loss before reversing and hit the take profit. - Promotes Long-Term Success

By following your plan, you’ll build consistency and avoid unnecessary losses caused by emotional mistakes. - Minimizes Risk

Without discipline, you’ll constantly switch strategies, get confused, and suffer repeated losses. Sticking to your rules lets you properly evaluate performance and reduce unnecessary risks.

Key Ways to Maintain Discipline in Forex Trading

Creating a trading plan is easy, but living by it is the real challenge. Discipline is something you develop over time, not overnight.

For example, imagine sitting at your trading desk, waiting for a setup. If none appears, the disciplined thing to do is walk away and wait. Don’t chase the price; let the price come to you.

Here are three simple ways beginners can build and maintain discipline as a beginner:

After you read through these methods, take a moment to write down your top three trading rules. Jot them on a sticky note and place it above your screen. This micro-commitment can significantly boost your ownership and internalization of these strategies.

1. Use Price Alerts

Set price alerts for key entry levels. This keeps you from staring at the charts and getting tempted to force trades. Many beginners feel the need to always be in a trade, but this leads to poor decisions. With alerts, you only return to the charts when your setup is ready.

2. Walk Away After Executing Trades

Watching your trade can trigger emotional decisions, closing early, adjusting stops, or panicking. The best practice? Place your trade, walk away, and let the market play out. If you close a trade prematurely, you might miss out on profits that would have hit your target.

3. Create a Simple Trading Plan

Keep your plan straightforward to avoid confusion. Include:

- Entry and exit criteria

- Position sizing

- Stop-loss and take-profit rules

Document your trades to review performance, track patterns, and learn from both wins and losses. Consider using a simple “trigger-emotion-rule-outcome” journal template. This can help you identify the emotions you felt at entry, during, and at exit of the trade, turning discipline from concept into habit. By monitoring your emotional responses, you can better align your actions with your trading plan. Most importantly, treat trading as a business, not a gamble.

Final Thoughts

Indiscipline is a silent killer of trading careers. Treat forex trading like a business. If there’s no valid setup, step away, don’t invent opportunities that aren’t there.

At the end of the day, discipline is the key to maximizing your trading potential. Without it, no strategy will work consistently. With it, you’ll build confidence, consistency, and profitability.

If you have more questions about this topic, or a subject you’d like us to simplify, drop them in the comments below. See you in the next session, and remember: always trade with discipline.