In this session, we’re diving into: “Market Structure Shift Trade Entry in Forex Trading.”

One of the most challenging aspects of forex trading for beginners and struggling traders is determining the optimal entry timing. Identifying the perfect moment to enter a trade can be confusing, especially when the market doesn’t behave as expected. That’s why this lesson is focused on market structure shift (MSS), also known by some traders as “Change of Character” (CHoCH), to help you gain more clarity and precision in your trade entries.

Many traders can recognize a market structure shift at their Point of Interest (POI), yet they still struggle with executing their entry effectively. This lesson is designed to solve that problem once and for all.

Why Understanding Market Entry at Your POI Matters

Knowing how to execute a trade at your POI doesn’t just make trading more efficient; it makes your entries tighter, your stop losses smaller, and your reward-to-risk ratio more favorable. And remember, the smaller your stop loss, the better your trade outcome.

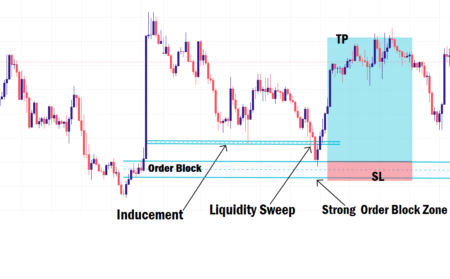

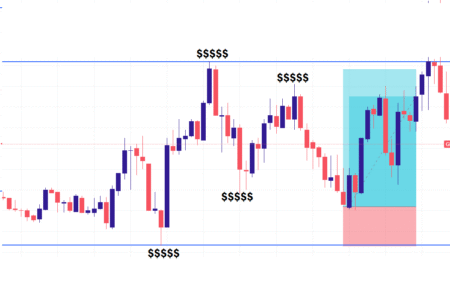

Every professional trader operates with a well-defined POI, which is an area in the market where they anticipate a reaction, often formed by key zones or order blocks on the higher time frame. Once you’ve identified these zones, they serve as strategic hot spots to monitor for trade setups.

However, your POI must answer one crucial question:

“Why is this my point of interest?”

If you can’t confidently justify it, the trade isn’t worth taking. A strong, logical reason must back every high-probability setup. A solid rationale boosts your confidence, and confidence eliminates emotional trading.

Trading based on fear, doubt, or hope is a major reason why many traders fail. But with a strong POI and a reliable strategy like MSS, you begin to trade with clarity and control. So, let’s break it down!

What Is a Market Structure Shift (MSS) in Forex Trading?

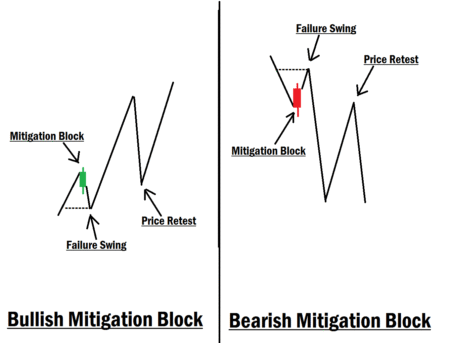

A Market Structure Shift is a technical price action signal that suggests a potential trend reversal. It occurs when price breaks through a significant swing high or low, signaling a change in market direction. This concept is central to the ICT (Inner Circle Trader) trading approach and is widely used to pinpoint potential entry zones.

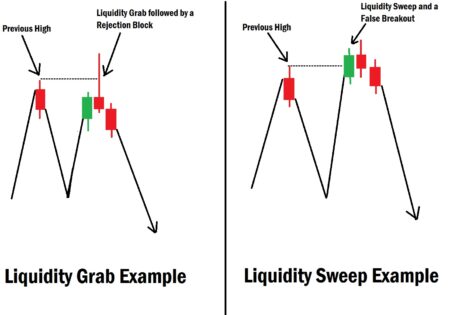

An MSS is not the same as a shallow pullback; it must come with strong momentum. This momentum shows that either buyers or sellers are stepping in with significant pressure to drive price in the opposite direction. If the break lacks momentum, it’s likely a fakeout and should be treated with caution.

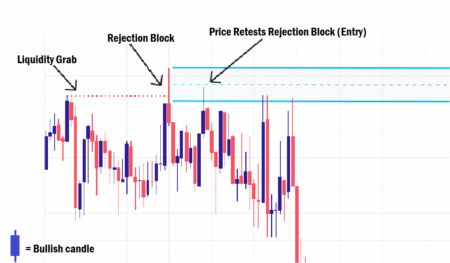

Think of MSS as similar to classic chart patterns like the double top or double bottom. In fact, ICT traders often refer to these patterns as forms of structure shifts. For example, when price breaks the neckline of a double top and retests it, that retest becomes a prime entry point. It is exactly how MSS works.

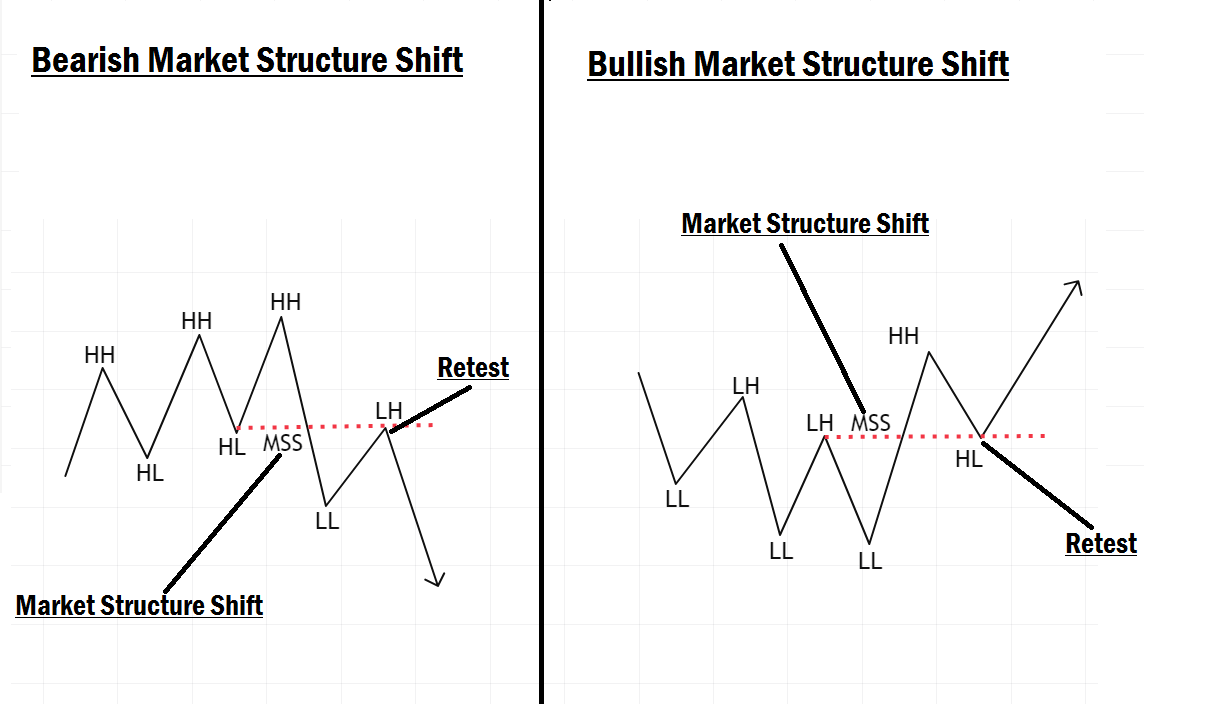

A true MSS happens when the market transitions from creating Higher Highs (HHs) to Lower Highs (LHs) or vice versa. This change indicates a shift in market behavior and gives you a window to enter with a defined edge.

How to Enter Trades Using Market Structure Shift

Let’s assume you’ve already identified your high-probability zones or order blocks on a higher time frame chart. These areas become your POI. When price trades into one of these zones, you then drop down to a lower time frame to look for your trade entry.

One of the most reliable confirmations for entry is when you see a market structure shift at your POI.

Here’s how you enter:

Example 1: MSS in a Downtrend (Buying Setup)

- Price is in a downtrend, forming Lower Lows (LLs) and Lower Highs (LHs).

- It reaches your POI and forms another LL and LH.

- Then suddenly, price breaks the most recent LH, creating a Higher High (HH), instead of another lower low (LL).

- That’s your market structure shift, a signal that the trend may reverse.

Now wait for a pullback.

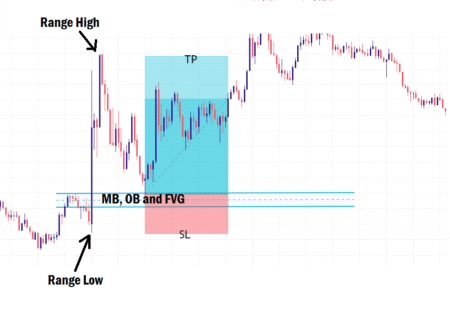

When price retests the broken LH (which is now a support level), that’s your entry zone.

- Entry: At the retest of the broken LH.

- Stop Loss (SL): Below the most recent LL before the shift.

- Take Profit (TP): 2x or 3x your SL, or even more, depending on market potential.

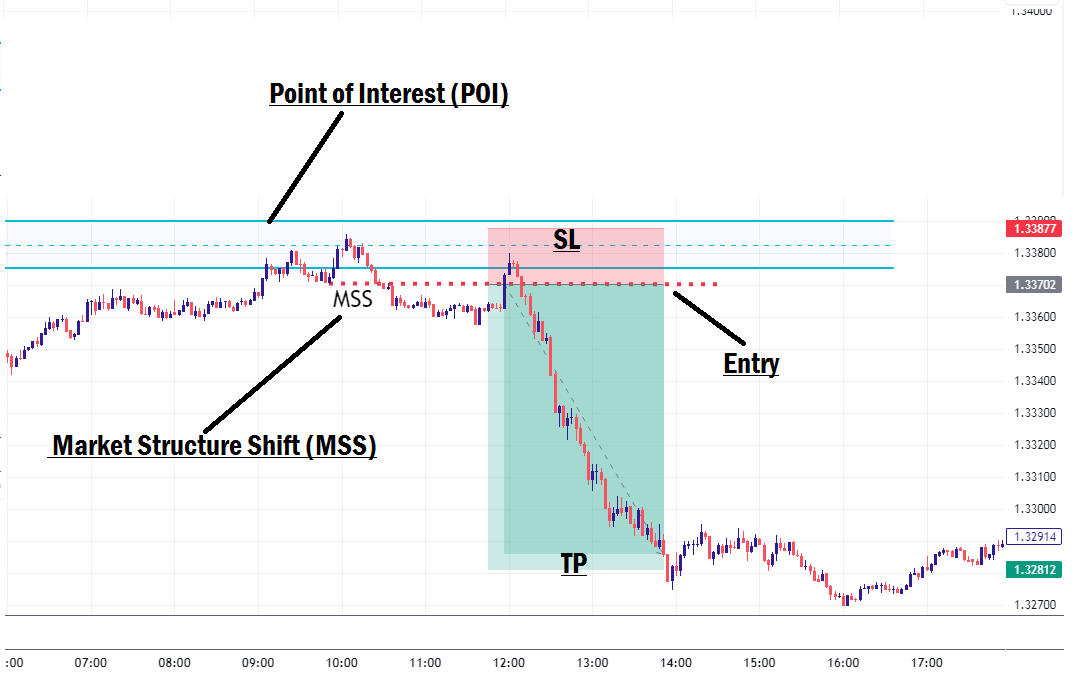

Example 2: MSS in an Uptrend (Selling Setup)

- Price is in an uptrend, forming Higher Highs (HHs) and Higher Lows (HLs).

- It reaches your POI and forms a new HH and HL.

- Instead of continuing up, price breaks the most recent HL, creating a Lower Low (LL).

- That’s a bearish MSS and a sign of a potential reversal.

Wait for the retest of the broken HL.

- Entry: At the retest of the broken HL.

- Stop Loss: Above the most recent HH before the shift.

- Take Profit: Target at least 2x to 3x your SL.

This approach keeps your entries precise, your SL small, and your TP realistic, all key ingredients for consistent profitability.

Final Thoughts

The key to recognizing a true MSS is momentum. The main difference between a fakeout and a valid structure shift is how strongly price breaks the structure. Momentum reveals the intensity of buying or selling pressure.

Also, don’t expect every MSS to look picture-perfect. Market conditions can be choppy or messy. That’s why practice and experience are essential. You must train your eyes to spot structure shifts, even in rough, unclear markets.

We strongly recommend that you practice this strategy on a demo account first. Refine your understanding and build your confidence before applying it in the live market. And remember, no strategy works 100% of the time. Your goal is to trade with consistency, strategy, and discipline.

In our next lesson, we’ll dive deep into “Break of Structure in Forex.” Don’t miss it!