In this session, we’ll be diving into “understanding what a fair Value gap (FVG) is in forex trading.”

Fair Value Gap (FVG) is one of the most powerful elements in price action trading. Mastering how it works and how it influences market behavior can significantly improve your trading decisions and lead to more profitable outcomes. As a smart money concept trader, FVG is among the key institutional reference points you should always monitor when taking high-probability trade setups.

Every professional smart money trader uses Fair Value Gaps in conjunction with order blocks or other institutional reference points to identify strong points of interest (POIs) for trade entries. When you know how to combine FVGs with other institutional tools to mark out potential price reversal zones, your chances of catching consistent profitable moves in the forex market increase. However, misuse or poor interpretation of FVGs can also expose you to heavy losses.

If you’re a beginner, keep in mind that forex trading is never about certainty. No strategy works 100% of the time. Trading is a game of probabilities, and this makes it inherently risky. That’s why it’s crucial to trade when the odds are in your favor, and to stay out when they aren’t. To succeed with any strategy, you must learn, practice, master, and personalize it, starting with your demo account. If you can’t consistently profit in the demo, you won’t succeed with real capital. It’s just that simple.

In this lesson, we’ll break down what a Fair Value Gap is and how you can combine it with order blocks to mark out strong support and resistance zones in the forex market. Let’s get into it!

What Is a Fair Value Gap in Forex Trading?

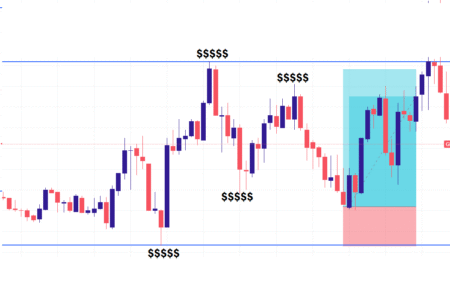

A Fair Value Gap (FVG) is a price range on a chart where there’s an imbalance between buyers and sellers. It is typically formed in a three-candle sequence, where the wick of the third candlestick does not overlap with the wick or body of the first candle. It leaves a visible “gap” that shows an inefficiency in price delivery, usually caused by momentum-driven movement.

In simpler terms, FVG is a three-candle price formation where the third candle’s wick fails to touch the first candle’s wick or body. This price imbalance is what smart money traders consider a key clue of institutional activity.

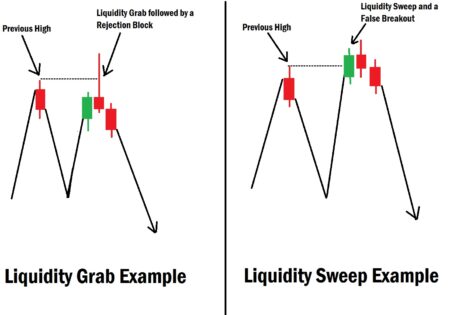

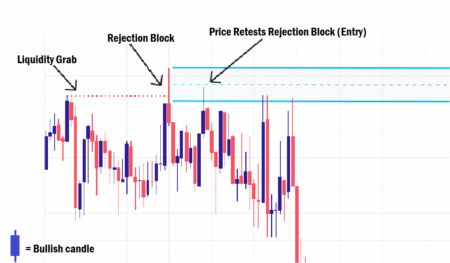

FVGs are also referred to as price inefficiencies. When price moves too quickly in one direction, it often leaves behind unfilled zones (gaps), which price may later return to fill before continuing in the original direction. That’s why FVGs act as strong points of interest for institutional traders.

- A bullish FVG occurs when there’s a sell-side imbalance and buy-side inefficiency.

- A bearish FVG occurs when there’s a buy-side imbalance and sell-side inefficiency.

How Do I Trade with FVG in Forex?

To trade FVGs effectively, you need to combine them with other strong institutional reference points, especially the Order Block (OB).

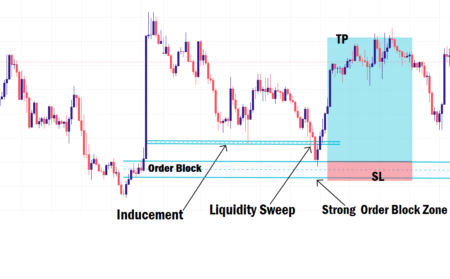

One powerful feature of FVGs is that they validate order blocks. An order block that doesn’t create an FVG is considered weak or invalid. For an OB to be valid, it must cause:

- A Fair Value Gap

- A Break of Structure (BoS) or Market Structure Shift (MSS)

This sequence confirms the presence of momentum driven by institutional trading activity.

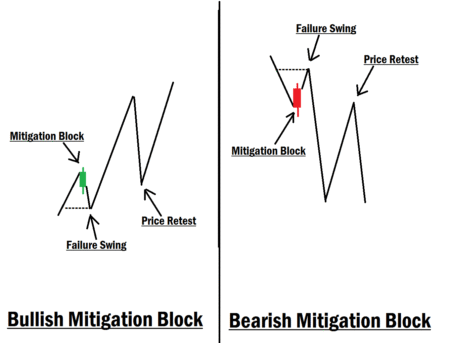

When price retraces back into an FVG or order block, it is considered mitigated. Once mitigated, the zone loses its power to support or resist price, and is no longer considered a high-probability entry zone. In short, FVGs are single-use zones.

- A bullish order block is the last bearish candle before a bullish impulsive move.

- A bearish order block is the last bullish candle before a bearish impulsive move.

An order block precedes an impulsive price move that forms an FVG, highlighting institutional activity. Price typically retraces to fill the FVG or mitigate the OB before continuing in the original direction, giving you a high-probability setup.

Example Strategy Using FVGs

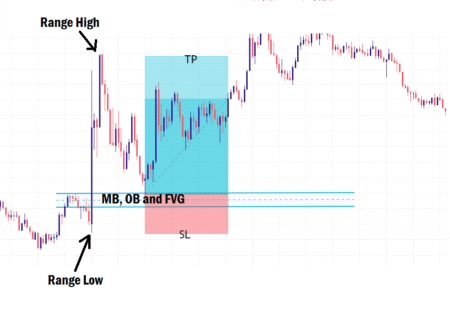

Let’s say you spot a strong bearish impulsive move on a higher time frame (e.g., 1H, 4H, or daily), and it broke market structure while leaving behind a Fair Value Gap.

- Mark the last bullish candle before the drop as your bearish order block.

- Mark the FVG near it as a point of interest.

- Wait for price to retrace back into the FVG or OB zone.

- Drop down to a lower time frame (e.g., 15M, 5M, or 3M) and watch for a market structure shift (MSS) inside your market zone.

- Once you see a clean MSS, it signals that price is likely done with filling the imbalance and ready to move in the original direction.

You can then:

- Enter a sell position.

- Place your stop loss (SL) just above the MSS.

- Set your take profit (TP) to 2–3x the size of your SL.

The same process works in reverse for a bullish scenario.

Final Thoughts

At times, price may only mitigate the FVG and leave the order block untouched. That’s why it’s important to confirm your entry on a lower time frame before committing to the trade.

Remember: nothing in forex works 100% of the time. Your success depends on how well you practice, master, and develop your personal skills using demo trading, just like professional traders do.

In our next lesson, we’ll be covering: “Dealing Range.”

Make sure you don’t miss it.