Understanding “Account Balance” in Forex Trading

In today’s lesson, we’ll explore a fundamental concept every trader must understand: Account Balance in Forex Trading.

Just by hearing the term account balance, you probably have an idea of what it means, especially if you’ve ever received a text or email alert from your bank after a transaction. In forex, the concept is quite similar to what you experience with your bank account.

What Is Account Balance in Forex?

Your account balance in forex refers to the total amount of money available in your trading account after all open positions have been closed.

Before you begin your trading journey, you need to open a trading account with a reliable, regulated forex broker or CFD provider. Once your account is set up, you’ll deposit funds into it — this is referred to as your risk capital.

⚠️ Important: Only deposit what you can afford to lose. As a beginner, you’re still developing your trading skills, so it’s wise to manage your risk carefully.

What Can Cause Your Account Balance to Change?

Your account balance changes when you:

- Make a profit or incur a loss on a trade.

- Are charged or credited swap/rollover fees (if your trade remains open overnight, note that not all brokers apply these fees).

- Deposit or withdraw funds.

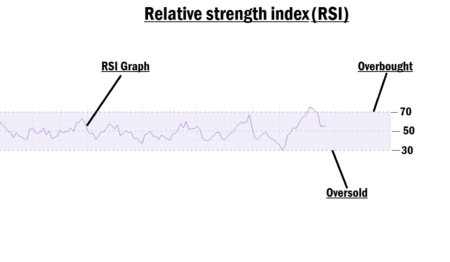

What Are Swap or Rollover Fees?

Swap (or rollover) fees are small charges (or credits) applied by some brokers if you keep a trade open past the trading day. This process of carrying over your open position to the next day is called a rollover.

Here’s how it works:

- If your position remains open overnight, your broker may apply a swap fee, either crediting or debiting your account, depending on the currency pair you’re trading and the interest rate differential between them.

- These fees do not apply to pending orders. Only active buy or sell positions are affected.

- While the fee is typically small, it can become significant for large positions.

In MetaTrader, you can view swap fees on your open trades by opening the “Terminal” window and clicking on the “Trade” tab.

Note: We’ve included this explanation just for clarity, even though it belongs to a separate topic. Understanding this now will help you trade more effectively.

In Summary

Now, you understand that your account balance reflects the actual money in your trading account once all trades are closed. It changes based on your profits or losses, swap fees (if applicable), and deposits or withdrawals.

In the next lesson, we’ll break down two important concepts: Unrealized Profit/Loss (P/L) and Realized Profit/Loss (P/L).

See you in that class, superstar trader!