Understanding What Margin Level Is in Forex Trading

Welcome to today’s lesson! In this session, we’ll be exploring what margin level means in the forex market.

Margin level is one of the key metrics every serious forex trader must monitor. It gives you a clear picture of the overall health of your trading account and plays a major role in risk management. With a proper understanding of margin level, you’ll be well-equipped to avoid dreaded margin calls and stop-outs caused by insufficient funds. So, let’s dive in!

What Is Margin Level in Forex?

Margin level is a crucial metric that shows how much of your funds are still available to open new positions in the forex market. It reflects your account’s financial strength in percentage terms. In simple terms, margin level = (Equity ÷ Used margin) × 100%.

Brokers use this percentage to determine if you can open new trades. A higher margin level means you have more free margin to trade, while a lower margin level indicates limited room to take on new positions.

Since it’s closely tied to free margin, the more your margin level rises, the more trading flexibility you gain. But if your margin level falls too low, your trading freedom becomes restricted, and you risk being stopped out.

How to Calculate Margin Level in Forex

Calculating your margin level is quite simple, especially since most brokers display it automatically on your trading platform. Still, it’s wise to understand how to calculate it manually, especially if you aim to become a professional forex trader.

If you have no open trades, your margin level is zero, and there’s nothing to calculate. But when you have active positions, use the formula:

Margin Level = (Equity / Used Margin) × 100%

Most brokers set a margin level threshold of 100%. It means if your equity becomes equal to or falls below your used margin, you won’t be allowed to open new positions unless you free up funds, either by closing existing trades or depositing more money.

Practical Example: Margin Level Calculation

Let’s walk through a real-life example.

Scenario:

- Account Balance = $3,000

- You spot a solid buy setup on the USD/CHF pair

- You decide to enter a long trade using one standard lot (100,000 units)

- The margin requirement is 1%, which equals a 1:100 leverage

Let’s break it down:

Step 1: Calculate Required Margin

Since USD is the base currency in USD/CHF, the notional value of your trade is $100,000.

Required Margin = Notional Value / Leverage

Required Margin = $100,000 / 100 = $1,000

Step 2: Determine Used Margin

Since this is your only open trade, the used margin = $1,000.

Step 3: Calculate Equity

Imagine a high-impact news release drives the market in your favor, and your trade is now floating $200 in profit.

Equity = Account Balance + Floating P/L

Equity = $3,000 + $200 = $3,200

Step 4: Calculate Margin Level

Now apply the margin level formula:

Margin Level = (Equity / Used Margin) × 100%

Margin Level = ($3,200 / $1,000) × 100% = 320%

Your current margin level is 320%, which is excellent and provides you plenty of breathing space in the market.

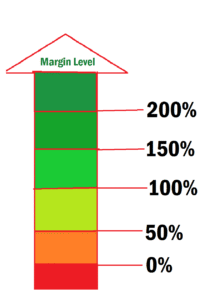

Margin Level Thresholds

Margin levels typically fall into the following categories:

- Above 100%: You’re good. Sufficient free margin is available.

- At or Below 100%: Warning! It could trigger a margin call, depending on your broker.

- Below 50% (in many cases): You’re in the danger zone. Your broker may automatically start closing your positions to protect itself.

Final Thoughts

Now you understand how vital margin level is to your success as a trader. It helps you monitor your account’s strength, manage your risk better, and avoid sudden stop-outs. Always keep an eye on your margin level to stay in control of your trades.

In our next lesson, we’ll take it a step further as we dive into the topic of “Margin Call.” You don’t want to miss that. See you there!