Understanding the ICT PD Array in Forex Trading

In today’s session, we’ll delve into “Understanding ICT PD Array in Forex Trading,” one of the most powerful concepts within the Smart Money trading approach.

PD Array, short for Premium and Discount Array, is an advanced ICT (Inner Circle Trader) trading concept every Smart Money Concept (SMC) trader must master. Understanding PD Array allows you to make precise trade entries within a price range by effectively using institutional reference points such as breaker blocks, order blocks, mitigation blocks, and fair value gaps (FVGs).

When you have a strong grasp of PD Arrays, you gain the ability to identify premium and discount areas in the market, helping you enter trades with higher accuracy and improved profit potential.

Why PD Array Matters in Forex Trading

A currency price chart reflects the actions of buyers and sellers in the market. It represents market sentiment and traders’ perspectives toward a currency at any given moment.

In the forex market:

In the forex market:

- No trader wants to buy when prices are high

- No trader wants to sell when prices are low

Instead, traders aim to sell at high prices (premium) and buy at low prices (discount) to maximize profit. Understanding this principle alone can completely shift the way you approach trading.

However, remember, forex is based on probabilities, not guarantees. No strategy works 100% of the time. That’s why it’s wise for beginners to start with a demo account to practice and refine their strategy before risking real money in the live market.

What is ICT PD Array in Forex?

In simple terms, the ICT PD Array is the arrangement of ICT trade entry models within premium and discount zones of a price-dealing range. It is a market structure framework that helps traders identify optimal buying and selling zones based on price positioning relative to the equilibrium (midpoint).

- Premium Zone: The best area to sell within a price range.

- Discount Zone: The best area to buy within a price range.

How to Identify Premium and Discount Zones

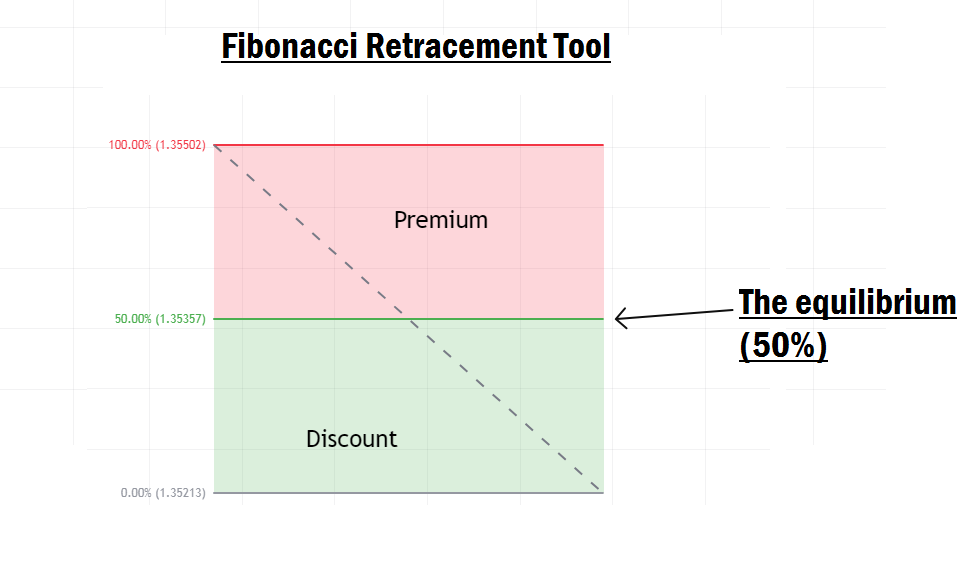

Finding these zones is simple using the Fibonacci retracement tool:

- Premium Zone: 50% to 100% of the Fibonacci level, optimal for sell opportunities.

- Discount Zone: 0% to 50% of the Fibonacci level, optimal for buy opportunities.

- 50% Level: Known as the equilibrium point, where the market is balanced.

What is a Price Range?

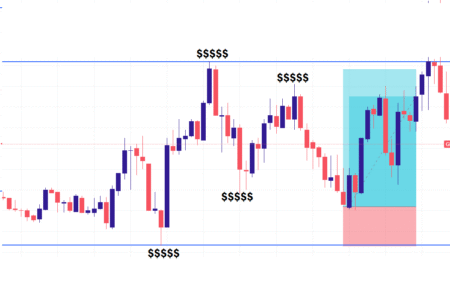

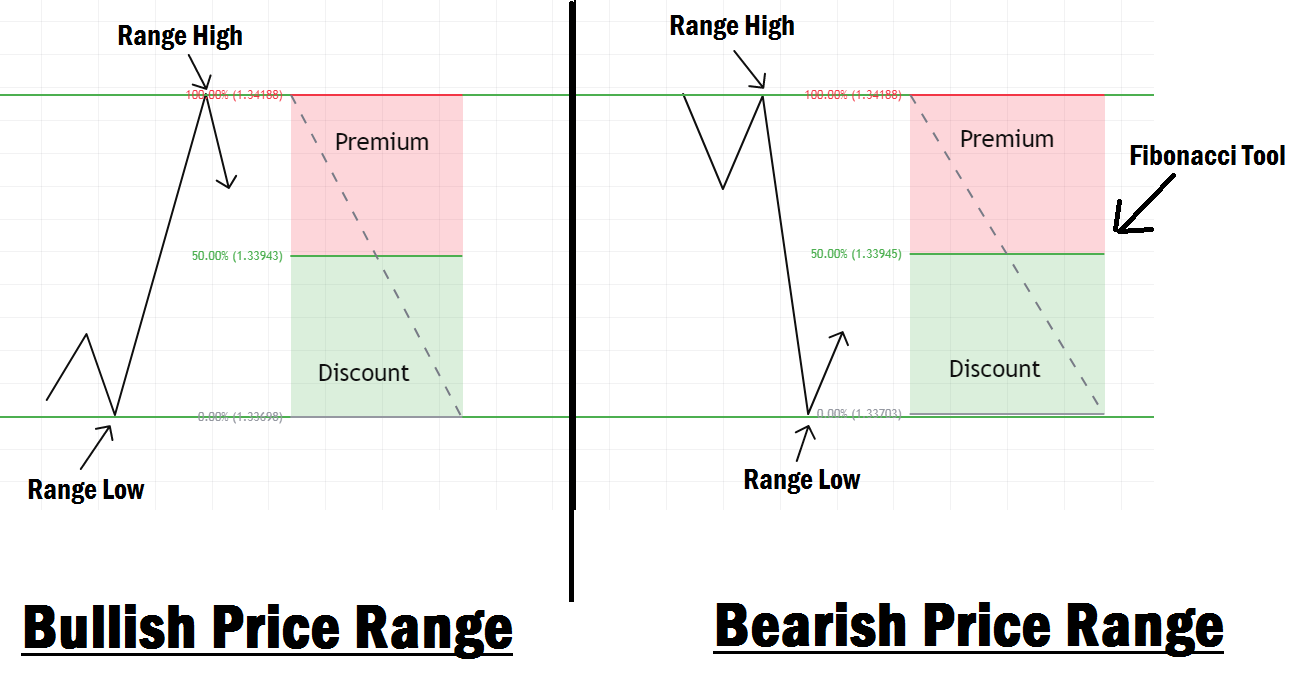

A price range (or dealing range) is the distance between a clearly defined swing high and swing low after a significant price move.

It can be either:

It can be either:

- Bullish Price Range: Measured from swing high to swing low; buying opportunities arise when price retraces into the discount zone.

- Bearish Price Range: Measured from swing high to swing low; selling opportunities arise when price retraces into the premium zone.

For a detailed breakdown of dealing ranges, refer to our previous lesson.

The Goal of PD Array

The main goal of PD Array is to help traders effectively use the 7 Institutional Reference Points in order of importance, depending on whether price is in the premium or discount zone.

The 7 Institutional Reference Points:

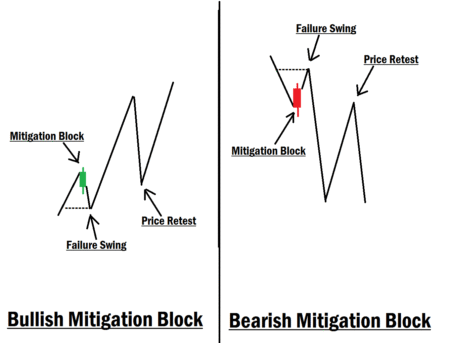

- Mitigation Block (MB)

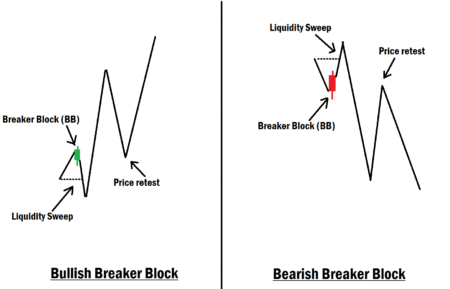

- Breaker Block (BB)

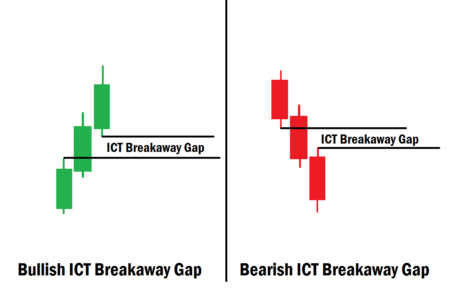

- Liquidity Void

- Fair Value Gap (FVG)

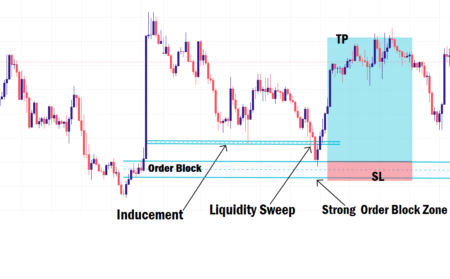

- Order Blocks (OB)

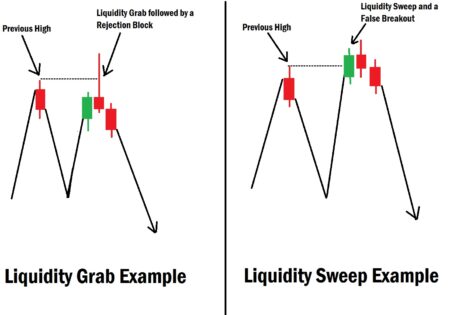

- Old Lows or Highs

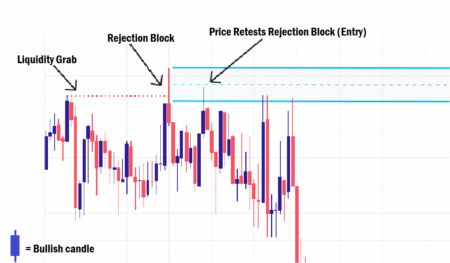

- Rejection Block

How to Trade Using PD Array

1. Bullish Scenario

- Identify a bullish price range.

- Use Fibonacci to measure from swing high to swing low.

- Focus on buy opportunities in the discount zone (below 50%).

- Look for institutional reference points in this zone.

- Confluence (when two or more reference points align) gives the highest probability setups.

-

- Example: A breaker block aligning with an FVG in the discount zone.

2. Bearish Scenario

- Identify a bearish price range.

- Use Fibonacci to measure from swing high to swing low.

- Focus on sell opportunities in the premium zone (above 50%).

- Look for institutional reference points or confluences in this zone.

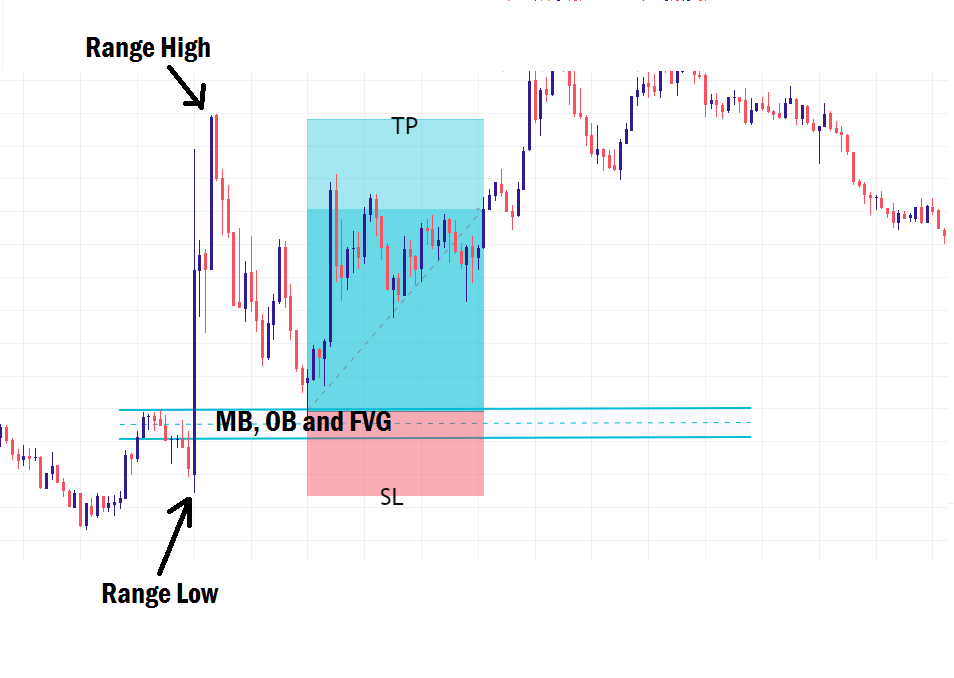

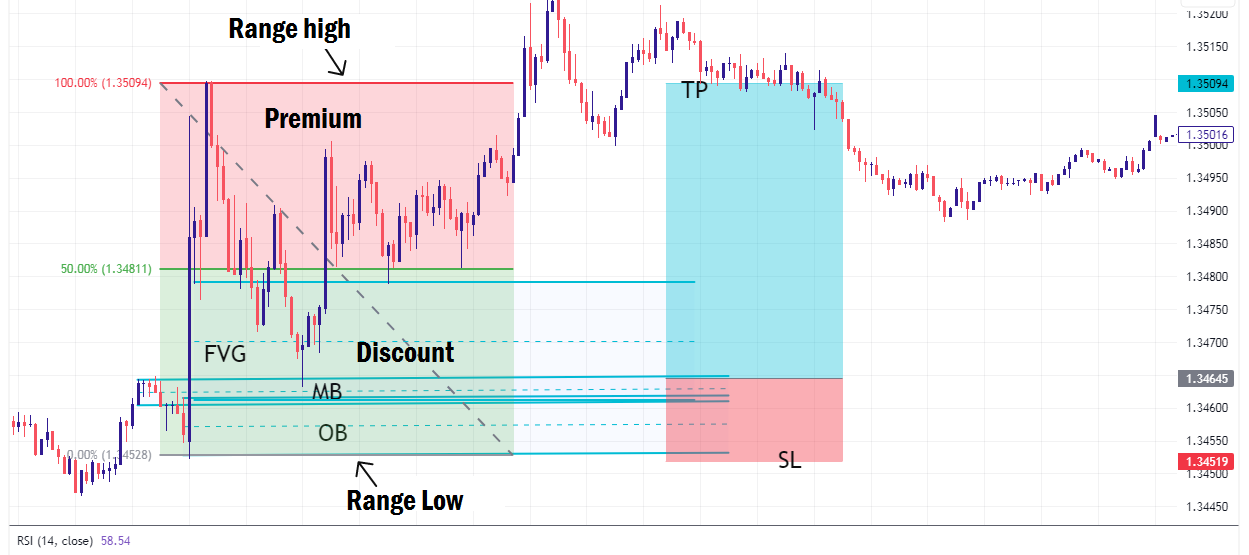

Bullish PD Array Example

In the example below, a bullish price range was identified. Using Fibonacci, we measured from swing high to swing low.

At the discount zone, we spotted a Mitigation Block (MB), Fair Value Gap (FVG), and Order Block (OB) clustered together. Since mitigation block ranks highest in our list and is aligned with a liquidity void-created FVG, this became a high-probability trade entry point.

At the discount zone, we spotted a Mitigation Block (MB), Fair Value Gap (FVG), and Order Block (OB) clustered together. Since mitigation block ranks highest in our list and is aligned with a liquidity void-created FVG, this became a high-probability trade entry point.

- Entry: At the mitigation block

- Stop Loss (SL): Below the order block

- Take Profit (TP): At the range high

The bearish case is simply the reverse process.

Final Thoughts

- Always use proper risk management; no method works 100% of the time.

- Practice PD Array setups on a demo account before trading live.

- Over time, adapt and refine your PD Array strategy to suit your personal trading style.

In our next lesson, we’ll cover “The ICT Trade Entry Models.” Don’t miss it!