Pips And Pipettes In Forex Trading.

Today, we’re going to take a deeper dive into understanding pips, pipettes, and lots.

As we’ve always emphasized, forex trading is all about speculation and prediction. The way you position yourself in the market determines whether you’ll make a profit or incur a loss.

Are you ready? Let’s get started.

Recap and Deeper Dive into Pips and Lots

In our previous lesson, we introduced the concept of pips and lots. This time, we’ll go deeper with some mathematical insights. So, pay close attention.

What Is a Pip?

The term PIP stands for “Point in Percentage.”

Let’s break it down with an example:

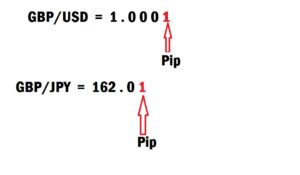

If you’re trading the GBP/USD pair and you buy GBP at 1.0001, and later it moves to 1.0002, this means the price has increased by one pip.

When we discussed how to read Forex charts in earlier lessons, you learned that the charts have rows and columns. The rows represent price levels, and the columns represent time intervals. A pip is typically the last decimal place of a price quote.

Most major currency pairs are quoted to four decimal places. However, JPY (Japanese Yen) pairs are an exception. They are usually quoted to just two decimal places.

So, in summary:

- For GBP/USD, one pip equals 0.0001.

- For GBP/JPY, one pip equals 0.01.

When looking at your chart, that final digit in the price quote is your pip. Refer to the diagram below for clarity.

Understanding Pipettes

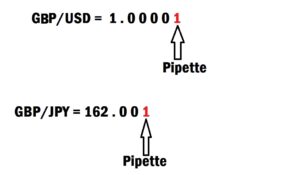

Now, let’s talk about something we haven’t discussed before: Pipettes. Think of a pipette as a fraction of a pip, similar to how 60 seconds make one minute. In forex, 10 pipettes make one pip.

Some brokers quote currency prices with five decimal places instead of four. In those cases, the fifth decimal represents the pipette.

For JPY pairs, which usually have only two decimal places, the third decimal would be the pipette. Keep in mind that not all brokers display pipettes, but understanding them is important since your broker might.

Examples:

- In GBP/USD, a pipette would be 1.00001 (5th decimal).

- In GBP/JPY, a pipette would be 162.001 (3rd decimal).

Refer to the diagram below to visualize the concept of pips and pipettes.

This foundational knowledge will help you better calculate potential profits and losses and make more informed trading decisions.

What Is Pip Value?

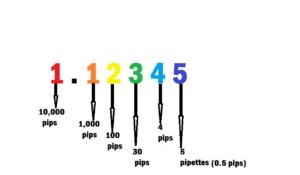

A pip is the smallest price movement in forex, usually 0.0001 for most currency pairs except for JPY pairs, where it’s 0.01.

Formula to Calculate Pip Value

Pip Value is Pip Size multiplied by Lot Size and divided by Exchange Rate. Where:

- Pip Size:

- 0.0001 for most pairs

- 0.01 for JPY pairs

- Lot Size:

- 1 standard lot = 100,000 units

- 1 mini lot = 10,000 units

- 1 micro lot = 1,000 units

- Exchange Rate:

- The current price of the pair you’re trading.

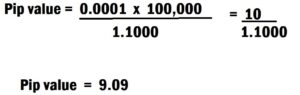

Let us use GBP/USD with 1 Standard Lot as an example.

- Pip Size = 0.0001

- Lot Size = 100,000

- Exchange Rate = 1.1000

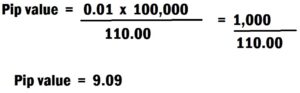

Let us use USD/JPY with 1 Standard Lot as an example for JPY pairs.

- Pip Size: 0.01

- Lot Size: 100,000

- Exchange Rate: 110.00

Tip for Account Currencies

If your account is in USD and you’re trading a pair where USD is the quote currency (e.g., EUR/USD), then the pip value is fixed:

- Standard lot: $10 per pip

- Mini lot: $1 per pip

- Micro lot: $0.10 per pip

If USD is the base currency (USD/CAD), you’ll need to divide by the exchange rate.

In our next lesson, we will dive deep into “understanding Forex Lingo.” Let’s keep building your forex mastery!