Inducement in Forex Trading Simplified

In this session, we are going to be looking into “Understanding Inducement in Forex Trading.”

Understanding the concept of inducement is absolutely essential for every beginner entering the forex market. To grasp its importance, picture this: A retail trader on a winning streak sees an upward trend one afternoon. Confidently, enter a position, only to watch in disbelief as the market suddenly reverses, erasing an entire week’s gains in minutes. Such incidents are common but avoidable, highlighting how a solid understanding of inducement can help you avoid unnecessary losses and frequent liquidation in financial markets.

Inducement is a powerful technique used by institutional traders and other smart money players to lure uninformed retail traders into taking wrong trades. By mastering this concept, you can make better trading decisions and increase your chances of entering profitable trades.

Remember, forex trading is risky, and your capital is always at stake. Before you begin trading with real money, practice consistently with a demo account, master your trading strategy, and develop strong personal trading skills.

As a Smart Money Concept (SMC) trader, understanding inducement is extremely important. In this session, we will cover:

- What an inducement is in forex trading

- Why inducement happens

- How to avoid inducement in the market

If you are ready, let’s dive in!

What Is Inducement in Forex Trading?

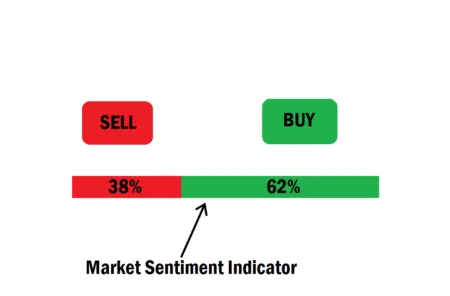

In forex, inducement is a strategic price movement created by institutional traders to trap retail traders into taking positions at unfavorable prices. These moves often appear as strong signals of trend continuation or reversal, but in reality, they are false setups designed to collect liquidity from retail stop losses. Once liquidity is gathered, the market typically reverses in the true direction intended by the smart money. To visualize this, consider: If price spikes 30 pips off support but volume is thin, suspect inducement. This pattern recognition can help in swiftly identifying false moves without needing visual charts.

In simple terms, inducement is a false price movement engineered to trick inexperienced traders into entering the market too early, often before price reaches a strong key level such as support, resistance, or an order block.

Think of inducement as a liquidity bait, just like a fisherman uses bait to lure fish into a trap. The goal is to make traders commit too soon so their stop losses can be used as liquidity before price makes its true move. In most cases, inducement leads to a liquidity sweep right before a major reversal or continuation, depending on what you are anticipating in the market.

Why Does Inducement Happen in Forex?

The primary reason inducement occurs in the forex market is to lure retail traders into positions at weak levels, creating the liquidity institutional players need to execute their larger orders.

Inducement typically occurs when the price is approaching a strong zone, such as an order block, a supply and demand level, or a key support and resistance level. At this point, inexperienced traders often assume price will reverse early, and they rush into trades prematurely. This impatience becomes their downfall, as their stop losses serve as liquidity for institutional traders to execute at the real zone of interest.

Interestingly, inducement is also a clue. It often signals that the zone price is approaching, is strong, and has a high probability of holding. When an inducement occurs before a level is reached, it shows that institutional traders are interested in that zone. They induce retail traders, sweep liquidity, and then let price tap into the real zone before reversing.

How to Avoid Inducement in Forex Trading

To avoid falling victim to inducement, you must learn the art of patience and emotional discipline. Most traders who get induced are those who cannot wait for the market to come to their Point of Interest (POI).

Here are some tips to avoid inducement traps:

- Always wait for price to reach your POI

If you have marked a strong reversal zone, do not jump into a trade until price taps into that level. Any early reversal you see before price gets there is most likely an inducement. - View inducement as confirmation

When you spot price faking a reversal before hitting your zone, take it as confirmation that the zone has a higher probability of holding. This should increase your confidence, not your impatience. - Accept missed trades

If price fails to come back to your zone after the inducement, let it go. A missed trade is always better than a losing trade. Instead of viewing missed trades as missed opportunities, see them as invaluable data. Ask yourself, “What confirmed my decision to stay out?” By reflecting on skipped setups, you can turn them into analytical insights. This approach can strengthen your strategy and decision-making process in future trades. - Understand market structure

As a Smart Money Concept trader, mastering market structure is essential. It will help you read price movements correctly and recognize when inducement is taking place.

Final Thoughts

Inducement is one of the biggest traps in forex trading, used by institutional players to sweep liquidity from impatient traders. The key to avoiding it is patience, discipline, and sticking to your plan. Always wait for price to reach your zone of interest before taking action.

To further enhance your understanding of inducement and to apply this knowledge practically, I challenge you to spot three instances of inducement on live charts this week. Observe how these instances develop and take note of any patterns or signs that precede and follow them. Reflect on your observations and consider sharing your findings in the comment section below. This exercise not only reinforces the concept but also builds confidence in your ability to detect and respond to inducement in real trading scenarios.

If you have further questions on inducement in forex, feel free to drop them in the comment section below. See you in the next session, and as always, trade wisely.