Types of Orders in the Forex Market (Explained for Beginners)

Welcome to today’s lesson!

In this session, we’re diving into one of the core fundamentals of trading, the different types of orders in the forex market.

When you hear the word “order,” the first thing that probably comes to mind is a “request.” In forex trading, that’s exactly what it is. An order is simply a request or instruction to carry out a specific transaction in the financial market.

What is an Order in Forex?

In forex, an order is an instruction given to your broker to execute a buy or sell transaction on your behalf.

These orders can either open a position (entry) or close it (exit). While brokers may offer different order options, there are some standard types of orders that almost every broker supports.

Basic Types of Orders in Forex Trading

There are two major types of orders you’ll frequently use in forex:

- Market Order

- Pending Order

1. Market Order

A market order is an instruction to buy or sell a currency pair immediately at the current available market price. It’s perfect for when you want quick access to the market.

Example:

Let’s say you’re watching GBP/USD and waiting for the price to hit a certain zone. The moment the market reaches that zone, you click the “Buy” or “Sell” button, and boom, your trade is executed instantly. That’s a market order in action!

2. Pending Order

A pending order is an instruction to buy or sell at a price that is not yet available in the market. You’re basically telling your broker, “Execute this trade only when the price hits this specific level.”

Example:

You expect the price to reverse at a particular zone, but you can’t sit and wait for it all day. So, you place a pending order. If the market reaches your specified price, the trade will be executed. If it doesn’t, the order won’t be filled.

Types of Pending Orders in Forex

Pending orders are further broken down into two key types:

- Buy/Sell Limit Orders

- Buy/Sell Stop Orders

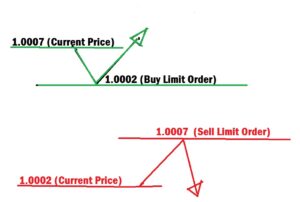

Buy/Sell Limit Order

Buy Limit – This is an order to buy below the current market price.

Example: If the current price is 1.0007, you tell your broker to buy if the price drops to 1.0002.

Sell Limit – This is an order to sell above the current market price.

Example: If the current price is 1.0002, you instruct the broker to sell when the price climbs to 1.0007.

Limit orders are perfect when you believe the price will reverse after reaching a certain level.

See the diagram below for better understanding.

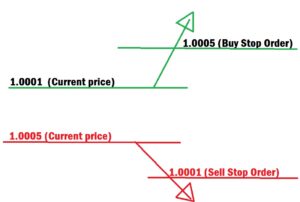

Buy/Sell Stop Order

Buy Stop – This is an order to buy above the current price.

Example: If the price is 1.0001, and you expect a breakout, you tell your broker to buy if it hits 1.0005.

Sell Stop – This is an order to sell below the current price.

Example: If the market is at 1.0005, you can place a sell stop at 1.0001 to catch a potential drop.

Stop orders are great for catching momentum trades when you expect the price to break out of a zone.

See the diagram below for better understanding.

Other Important Order Types in Forex

Besides entry orders, there are special types used for risk management:

- Stop Loss (SL)

- Take Profit (TP)

What is a Stop Loss (SL)?

A Stop Loss is a safety net. It tells your broker to automatically close your trade at a certain price level if the market goes against you. It’s how you manage risk and protect your capital.

Example:

You buy GBP/USD, but to limit your loss, you place a Stop Loss order below your entry. If the price drops to that level, the trade closes automatically.

A stop loss is always in the opposite direction of your main trade. If you buy, your SL is a sell; if you sell, your SL is a buy.

What is a Take Profit (TP)?

A Take Profit is your target. It tells the broker to close your trade once a certain level of profit is reached.

Example:

You open a buy trade and set a TP above your entry. If the market hits that level, the broker closes the trade automatically, locking in your profits. Your Take Profit is in the same direction as your entry, unlike Stop Loss which is the opposite.

See the diagram below for better understanding.

Trailing Stop Explained

A Trailing Stop is a dynamic form of Stop Loss that moves with the market. If the trade moves in your favor, the Trailing Stop also shifts, helping you lock in profits.

Example:

You buy GBP/USD at 1.0005, set SL at 1.0002, and TP at 1.0009. If the price moves up to 1.0008, the Trailing Stop might move SL up to 1.0005, protecting your gains even if the market reverses. This tool is super helpful for securing profits in a volatile market.

Time-in-Force (TIF) Orders

Time-in-force (TIF) orders allow you to control how long a pending order stays active. If it’s not filled within your set time, it gets canceled automatically.

This gives you more flexibility and control over your trades, especially if you don’t want an order hanging around forever.

Final Thoughts

Trading takes time, practice, and patience. Don’t rush into using real money if you haven’t yet developed a strategy you trust.

In our next lesson, we’ll break down the advantages and disadvantages of each order type.

Until then, stay focused, keep learning, and remain blessed.