Understanding The Three Main Types of Forex Analysis

Whether you’re a beginner or a seasoned professional, you simply cannot afford to jump into the forex market and place a buy or sell order without conducting proper analysis. Every successful trader understands the value of price analysis before making any trading decision. It’s the foundation of informed and strategic trading.

By analyzing price behavior, you gain insight into what the market is currently doing, helping you determine your next step. Once your analysis is complete, you can confidently decide whether to open a buy or sell position in alignment with current market conditions.

Why Is Price Analysis Crucial Before Placing a Trade?

Great question!

Before executing any trade, you must first interpret what the market is doing at that specific moment. It allows you to forecast the next possible price direction. Price analysis reveals whether the market is trending upward, downward, or moving sideways (consolidating).

It also helps you determine order flow, daily bias, and anticipate the release of high-impact economic news. This kind of news can significantly influence price movement and may affect your trade, especially if your position contradicts the market’s reaction.

Ultimately, proper analysis enables you to flow with the market and make sound, profitable trading decisions.

The Three Major Types of Forex Analysis

In the world of forex trading, there are three primary types of market analysis, namely:

- Technical Analysis

- Fundamental Analysis

- Sentiment Analysis

Let’s break down each of them so you can fully understand how they work and how to apply them effectively.

What Is Technical Analysis in Forex?

Technical analysis is a method of forecasting future price movements by studying historical price charts and market data. The core belief is that price patterns tend to repeat themselves, which makes it possible to anticipate future trends based on past behavior.

This type of analysis helps traders determine if a currency pair is trending up, down, or moving sideways. It gives you a big-picture view of market direction, allowing you to align your trades accordingly.

- If the market is in a downtrend, look for selling opportunities.

- If it’s in an uptrend, seek buying opportunities.

- If the market is consolidating, it’s best to wait for a breakout, unless you use a support and resistance strategy, in which case, consolidation can offer great trading opportunities.

(Don’t worry, we’ll cover how to trade effectively using support and resistance lines in our upcoming lessons.)

How Technical Analysis Works

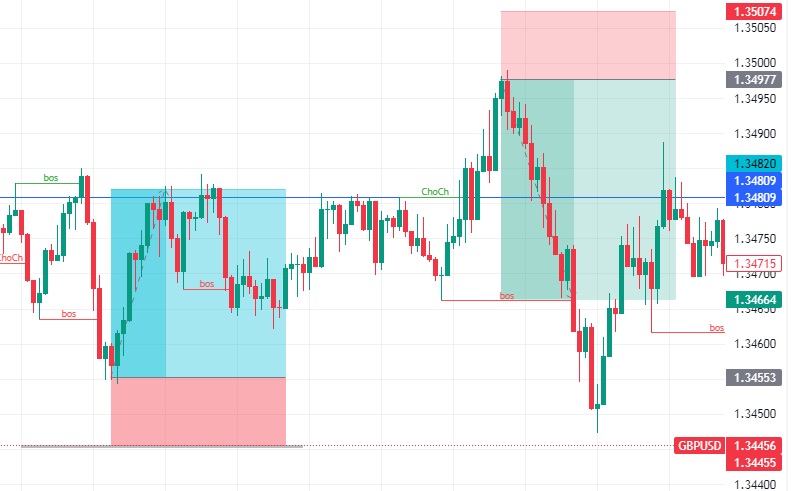

Technical analysis starts from the higher time frame charts, where you identify the market structure, whether the market is trending or consolidating. Once you get that overview, you drop down to the lower time frame to find your entry model, based on your preferred trading strategy.

Example:

- Open the 4-hour time frame.

- Look for market structure:

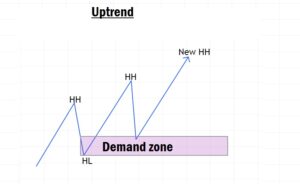

- If the market forms Higher Highs (HH) and Higher Lows (HL), it signals an uptrend. Wait for a pullback to a demand zone to form a new HL. Then, move to a lower time frame to find your buy entry model.

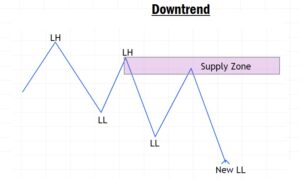

- If the market forms Lower Lows (LL) and Lower Highs (LH), it signals a downtrend. Wait for a pullback to a supply zone to form a new LH. Drop down to a lower time frame and look for your sell entry model.

No matter the time frames you choose, the process remains the same. Analyze the structure above and refine your entry below.

What Is Fundamental Analysis in Forex?

Fundamental analysis involves evaluating the economic, political, and social conditions that influence currency strength and market direction. Unlike technical analysis, which relies on charts, this approach focuses on macroeconomic data and events.

By reviewing key indicators such as Interest rates, Inflation, Gross Domestic Product (GDP), Unemployment rates, and Central bank decisions, you can assess whether a currency is undervalued or overvalued and forecast its likely movement.

Most traders use websites like Forex Factory or Investing.com to access real-time economic calendars and upcoming news events.

How Fundamental Analysis Works

To trade using fundamentals:

- Visit Forex Factory.

- Navigate to the Economic Calendar.

- Look for high-impact news events (marked in red).

- Wait for the news release and market reactions.

- Once the market reacts and forms a clear trend, enter your trade in that direction using your preferred market entry strategy.

High Impact Economic News to Watch:

- Central Bank Interest Rate Decisions (e.g., FOMC, ECB, BoE)

- Consumer Price Index (CPI)

- Non-Farm Payrolls (NFP)

- Unemployment Rate

- Gross Domestic Product (GDP)

- Retail Sales

- Producer Price Index (PPI)

- Trade Balance Reports

These events often lead to strong volatility and create solid trade opportunities for those who are prepared.

What Is Sentiment Analysis in Forex?

Sentiment analysis is the process of gauging the collective attitude of market participants, whether they are bullish (optimistic) or bearish (pessimistic) about a currency pair or the entire market.

While often overlooked, sentiment analysis is extremely powerful. It helps you understand the behavior of the majority and positions you either with or against the crowd, depending on your strategy.

Most brokers now provide sentiment indicators directly in their trading platforms. These tools show the percentage of traders who are buying or selling a particular pair at any given time.

With this data, you can make smarter decisions about whether to follow the majority or go against the crowd when your trading setup aligns.

Final Thoughts

Each type of forex analysis plays a vital role in your trading success. While you can use them independently, combining all three, technical, fundamental, and sentiment analysis, will help you make more informed trading decisions.

In our next lesson, we’ll be diving into “Fibonacci Retracement Discount And Premium In Forex.”

You don’t want to miss it!