In this session, we will be diving into “Triple Top Chart Pattern Modern Trading Strategy”

In the world of forex trading, chart patterns play a crucial role in helping traders understand price action and predict possible market movements. One of the most powerful reversal patterns that traders rely on is the Triple Top chart pattern.

This pattern does not just signal a potential change in market direction, but it also provides traders with clear entry and exit points to maximize profitability while minimizing risks. Whether you are a beginner or an experienced trader, understanding how the Triple Top works can sharpen your technical analysis skills and improve your overall trading performance.

The Triple Top chart pattern is a simple, effective strategy used for decades in forex. Its long-term performance proves it is a reliable trading edge that beginners can use easily. Many professional traders use the Triple Top to capture consistent, profitable trades. This pattern is easy to spot on a chart, making it beginner-friendly.

This chart pattern works best near strong support or resistance, letting you anticipate reversals confidently. Although the Triple Top is a quality trading edge, some traders now mistakenly see it as outdated. No solid trading edge is ever old-fashioned. The key is learning to combine it with modern trading models and refine it for better results.

Forex trading has evolved from traditional methods into a more advanced approach due to the introduction of the Smart Money Concept (SMC) by ICT (Inner Circle Trader). However, chart patterns like the Triple Top are still very effective, even if some consider them old-fashioned. By the end of this session, you will be able to identify valid Triple Tops on any timeframe, blend SMC with classic patterns for precise entries, and avoid common mistakes traders make with the Triple Top pattern. In this session, we will cover everything you need to know about the Triple Top chart pattern, what it is, how to identify it, why it forms, trading strategies, common mistakes to avoid, and how to combine it with the Smart Money Concept for better results.

Why Combine Triple Top with Smart Money Concept (SMC)?

Combining the Triple Top chart pattern with Smart Money trading strategies gives you stronger results. SMC lets you make precise entries, avoiding blind trades that lead to losses. It helps you understand each candlestick movement and its meaning. SMC also reveals institutional traders’ footprints, showing how big players target retail stop losses. Most importantly, SMC provides a deeper understanding of liquidity, the primary focus of smart money in the market. If you’re new to SMC, explore free masterclasses to understand how it works today.

What is a Triple Top Chart Pattern?

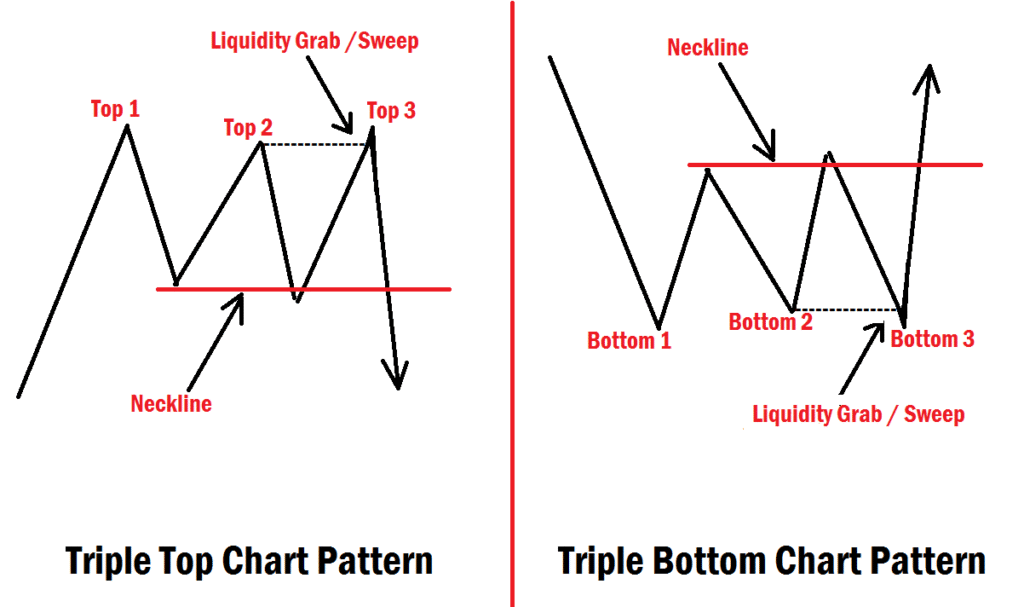

A Triple Top chart pattern is a bearish reversal pattern that forms after an extended uptrend. It indicates that buyers are losing strength and sellers are beginning to take control of the market.

The pattern is made up of three peaks (high points) at nearly the same price level, with two valleys (retracements) in between. Once the price fails to break above the resistance level for the third time and eventually breaks below the support line (also known as the neckline), the Triple Top is confirmed, signaling a potential downtrend.

Simply put:

- The market tries to push higher three times.

- Each time, it fails at the same resistance level.

- Once sellers break below support, momentum shifts downward.

Key Characteristics of a Triple Top Pattern

To correctly identify a Triple Top pattern, you should look for the following features:

- Uptrend before formation – The pattern must form after a sustained bullish move. Without an existing uptrend, the pattern has little meaning.

- Three peaks – Each peak should reach a similar level, showing strong resistance. The highs don’t have to be perfectly equal, but they should be close.

- Two retracements (valleys) – Between the three peaks, the price will pull back, forming two intermediate lows. These lows create the support line (neckline).

- Breakout confirmation – The Triple Top is not valid until price closes below the neckline. It confirms that sellers have taken control.

- Volume decline – Often, trading volume decreases with each successive peak, showing that buying pressure is weakening. When the breakout finally occurs, volume usually spikes as sellers dominate.

The opposite of a triple top chart pattern is a triple bottom. It is the same with triple top, but in an inverse pattern. Triple bottom signals a reversal of a bearish trend. So, a triple top reverses a bullish trend, while a triple bottom reverses a bearish trend.

Why Does a Triple Top Form?

The Triple Top represents a battle between buyers and sellers:

- At the beginning, buyers are strong, pushing the price upward.

- When the price hits resistance (the first peak), sellers push back.

- Buyers try again but fail at the same resistance (second peak).

- The third attempt confirms that buyers cannot overcome the resistance.

- Sellers gain confidence and push the price below support, causing a reversal.

In essence, the pattern shows market exhaustion on the buyer’s side and a shift of control to sellers.

How to Trade the Triple Top Pattern Alongside SMC

Combining a triple top or bottom chart pattern with SMC helps prevent you from making an early entry due to a lack of precision. With smart money institutional reference points like fair Value gap (FVG), order blocks (OB), and breaker block (BB), you can make a confident and precise entry after the third top has formed.

Trading the Triple Top requires patience and discipline. Many traders make the mistake of entering too early before confirmation. Here’s a step-by-step guide:

1. Identify the Pattern

Look for three clear peaks at the same level after a strong uptrend, with two valleys in between. The pattern must form around a strong key resistance area marked on the higher time frame chart. The third top needs to sweep or grab liquidity from the second top in order for it to be regarded as a valid setup.

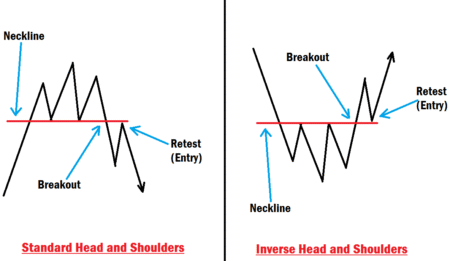

Wait for the Breakout

The most important step is waiting for price to break below the neckline. This confirms that sellers have won the battle. Entering too early could expose you to false signals. To emphasize the importance of patience, consider this scenario: if you entered before the neckline break and the price reversed, you might face a drawdown. In contrast, waiting for the breakout could help you avoid such losses.. Once the price breaks the neckline and pulls back to retest it, your point of interest should be any institutional reference found in the area around the neckline.

3. Enter the Trade

You can enter a sell trade once price retraces to mitigate a fair value gap (FVG)), or a breaker block (BB) found within the neckline for precise entry. The breaker block or an FVG within the neckline acts as resistance after the breakout.

4. Set Stop-Loss (SL)

A good stop-loss placement is slightly above the last peak (third top). This protects you if the market reverses back into the range.

5. Set Take Profit (TP)

Your take profit should be at least 2x the size of your stop-loss or more, depending on the momentum of the breakout.

The same process is applicable to triple bottom, which is the inverse of triple top.

Mistakes Traders Make with the Triple Top

Let’s look at the story of Zak. Zak had been trading for a few years and was always on the lookout for reliable patterns to guide his trades. One day, he spotted what seemed to be a textbook Triple Top pattern. Excited by the potential trade, Zak hastily entered a sell position without considering the volume. The market briefly dipped below the support level, convincing Zak that his prediction was correct.

However, the volume had been steadily declining throughout the formation of the pattern, a clear sign that the bullish momentum was not exhausted. Ignoring this crucial aspect, Nick watched as the market quickly reversed, trapping him in a losing position. The price surged, and Zak was forced to exit his trade at a loss. This painful experience taught him the importance of considering volume before making trading decisions. Declining volume on each peak is a key confirmation of weakening buyers. Make sure not to ignore volume and avoid these other four common mistakes, which are:

- Entering too early – Don’t sell just because the third peak forms. Wait for neckline entry at an institutional reference point.

- Ignoring the trend – The Triple Top is only valid after an uptrend. If the market is ranging, it may not work.

- Forgetting stop loss – No pattern is 100% accurate. Always manage risk with a stop loss.

- Misidentifying the pattern – Sometimes what looks like a Triple Top may just be a consolidation or a different pattern.

Advantages of Trading the Triple Top

- Clear entry and exit points – Easy to spot and trade with a neckline breakout.

- Reliable reversal signal – When confirmed, it strongly suggests a shift to bearish momentum.

- Risk-to-reward ratio – Stop loss and take profit levels are straightforward.

Limitations of the Triple Top

While effective, the Triple Top has some drawbacks, which are:

- False breakouts – Price may break the neckline but quickly reverse. According to a study of historical forex data, approximately 40% of Triple Top formations experience such false breakouts, emphasizing the need for caution and additional confirmations.

- Time to form – The pattern requires patience since it takes time for the three peaks to develop.

- Not always perfect – Peaks may not be the same level, which can confuse beginners. Understanding these limitations, backed by statistical insight, can help traders manage risks more effectively.

Final Thoughts

The Triple Top chart pattern is a powerful tool for spotting bearish reversals in forex trading. By understanding how it forms, recognizing its structure, and waiting for proper confirmation, you can use it to identify high-probability sell opportunities.

Remember, patience is key. Never rush into a trade just because you think you see a pattern. Wait for the breakout below the neckline, protect yourself with a stop loss, and aim for realistic profit targets.

When combined with other technical tools like support and resistance, volume analysis, and SMC, the Triple Top can become a highly reliable trading strategy.

Mastering this pattern will not only improve your technical analysis skills but also give you the confidence to trade reversals with discipline and precision.

2 Comments

Great article, Thanks.

Thanks for the feedback!