In today’s session, we will be diving into “Trend Reversal Trading Strategy in Forex.”

The Trend Reversal Trading Strategy is another powerful yet simple technique that has helped many professional traders capture massive profits from the forex market. When you successfully catch the beginning of a new trend, it can yield a highly favorable risk-to-reward ratio, commonly referred to as a sniper entry. Mastering how to trade trend reversals the right way can be extremely rewarding and turn your trades into high-probability money-makers.

This strategy revolves around identifying the precise turning points of price. In forex or any other tradable financial market, trends do not last forever. When one trend ends, another begins. Typically, after an uptrend ends, price enters a brief period of consolidation before a new trend emerges. It could either continue the previous trend or reverse direction entirely. The trend reversal strategy focuses on identifying those major shifts, when the market moves from an uptrend to a downtrend or vice versa.

As we always remind you, no trading strategy is foolproof. Trading is based on probabilities, not guarantees. That’s why forex is considered a high-risk venture that demands deep knowledge, patience, discipline, and constant practice. Always test every strategy thoroughly using your demo account to understand how it performs before committing your real money.

What Is a Trend in Forex?

A trend in forex refers to the directional movement of price over a period of time. In an uptrend, price forms a series of higher highs (HH) and higher lows (HL). Conversely, a downtrend is characterized by lower lows (LL) and lower highs (LH).

Price doesn’t move in a perfectly straight line; it fluctuates, forming waves. Additionally, trends don’t persist indefinitely. The market constantly transitions from one directional movement to another, which is why identifying trend changes is crucial for profitability.

What Is a Trend Reversal in Forex?

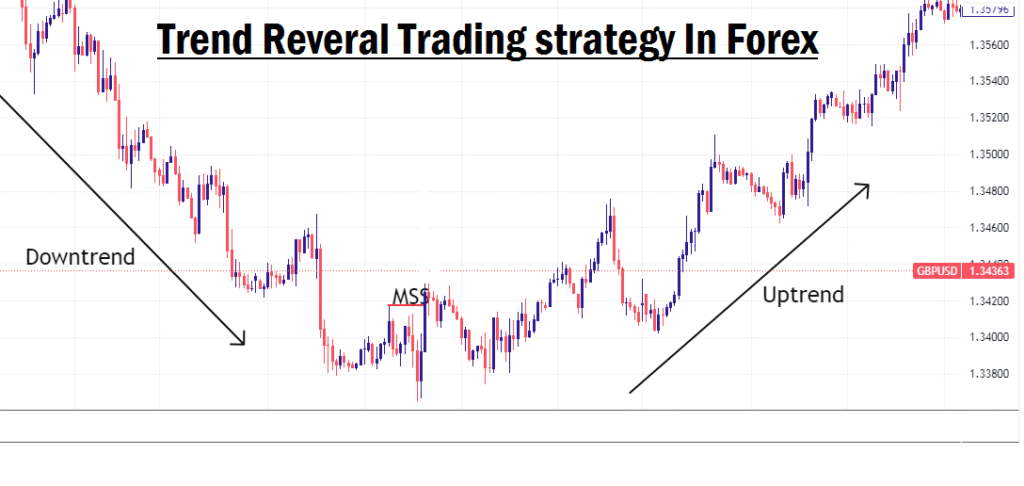

A trend reversal in forex indicates a change in the prevailing direction of price movement. For instance, when a persistent downtrend (marked by LLs and LHs) transforms into an uptrend (marked by HHs and HLs), or vice versa, we say a trend reversal has occurred. This signifies a major shift in market sentiment, usually followed by significant price movement in the opposite direction.

Price does not move in a single direction forever. It continuously transitions from one trend to another. However, it’s important to differentiate between short-term pullbacks and long-term reversals. Short-term reversals, often referred to as pullbacks, are temporary price corrections that typically occur within the context of a larger trend on higher timeframes.

The forex market is fractal in nature, meaning price patterns repeat themselves across different timeframes. For example, what appears as a long series of candles on the 1-minute or 5-minute chart could be represented by a single candle on the daily chart. This fractal structure makes long-term trend reversals a more lucrative target, as they offer greater profit potential.

What Is a Trend Reversal Strategy in Forex?

A Trend Reversal Strategy is a method used to detect when a current trend is about to change direction. It allows traders to capitalize on price movements as they begin to head the other way. The key lies in identifying reversal signals and using technical analysis tools to confirm them.

It’s essential to understand that price doesn’t reverse just because it’s been trending for a long time. Price typically reverses when it encounters a strong key support or resistance level, especially on higher timeframes like the 4-hour, daily, or weekly charts.

Why higher timeframes? Because institutional traders and big market participants execute large-volume trades at those levels, which can influence price significantly. These large trades introduce a lot of volatility and “noise” on the lower timeframes. Therefore, performing top-down analysis becomes critical before making trading decisions.

How Do I Trade Trend Reversals Effectively?

Price can give false reversal signals multiple times before an actual reversal takes place. It is why many inexperienced traders fall victim to liquidation and massive losses. Price doesn’t reverse just because you entered a trade; it reverses based on market dynamics.

The two primary objectives of price are:

- To grab liquidity, and

- To fill imbalances (fair value gaps).

Once price has absorbed liquidity in one direction, it often reverses to seek liquidity or imbalances in the opposite direction. These zones are typically found near order blocks on the higher timeframes.

Price also tends to reverse at key support and resistance zones, areas on the chart where price has historically rejected multiple times. When price revisits these zones, it often gathers liquidity before reversing in the opposite direction.

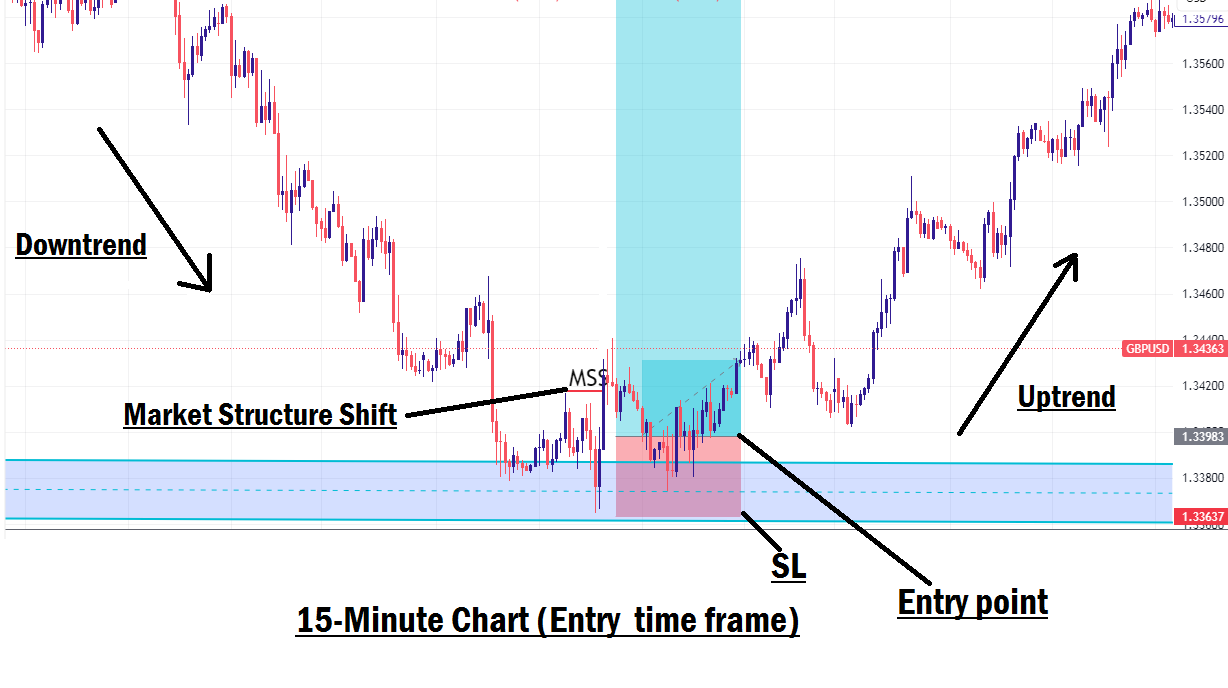

So, when price trades into strong areas like higher timeframe order blocks or significant support/resistance levels, you should anticipate a high-probability reversal. After marking these areas on a 4-hour, daily, or weekly chart, switch to your entry timeframe (such as the 15-minute chart) and wait for price to approach the zone.

One of the most reliable signals that price is about to reverse is a clear Market Structure Shift (MSS). Once you spot an MSS in these key areas, it becomes a high-probability trade opportunity.

Example:

Let’s say you’ve identified a bullish key zone (support area) on the 4-hour chart. You then drop down to your entry timeframe (like the 15-minute chart) and wait for price to return to that zone. After some time, price enters the key area and prints a clear market structure shift, indicating a possible reversal.

Because the level was marked from a higher timeframe, there is strong confluence and a high likelihood that the shift is genuine. You can now confidently enter the trade, place your Stop Loss (SL) just below the market structure shift, and target the swing high on the 4-hour chart or any suitable Take Profit (TP) level.

Final Thoughts

Forex trading is a probability-based venture. There are no certainties or guarantees. That’s why mastering your strategy through consistent demo practice is non-negotiable. While the Trend Reversal Strategy isn’t a magical solution, it offers a tremendous reward-to-risk ratio, making it a go-to method for sniper traders who love precision and timing.

Trade wisely, always manage your risk, and protect your capital, because in forex, your capital is everything.

In the next lesson, we’ll be diving into “Double Top Chart Pattern Trading Strategy in Forex.”

See you there!