How Beginners Can Use the Three White Soldiers Candlestick Pattern as a Quality Trade Entry Confirmation In Smart Money Concept (SMC)

In forex trading, one of the biggest challenges beginners face is knowing when to enter a trade. You might correctly mark your Point of Interest (POI) in the Price Delivery (PD) array using Smart Money Concepts (SMC), but without a proper entry confirmation, you risk being stopped out before the real move even begins.

In this article, we’ll break down everything you need to know about the Three White Soldiers pattern, how it works, and how beginners can use it to increase their win rate when trading around POIs in the PD array.

The Three White Soldiers candlestick pattern is one of the most reliable reversal and entry confirmation patterns available to beginner traders. It is simple to identify on the chart, beginner-friendly, and highly effective when combined with SMC principles such as points of interest (POI).

You might correctly identify a high-probability POI, but if your entry lacks proper confirmation, chances are you’ll get stopped out before the real move begins. That’s where candlestick confirmation patterns like the Three White Soldiers become invaluable, they signal that price is likely to reverse and respect your POI.

The Three White Soldiers Pattern Performance

Backtesting and market data have proven the effectiveness of the Three White Soldiers pattern. According to results from multiple tests across major forex pairs such as GBP/USD, EUR/USD, GBP/JPY, USD/CAD, and USD/JPY, this candlestick pattern consistently delivered a win rate above 70% when spotted at high-probability POIs. These tests involved over 300 trades across hourly charts, providing a robust sample size that enhances the credibility of the findings.

The tests were conducted over a one-year period, and the results confirm that this pattern is not only effective but also simple to use, making it especially suitable for beginner traders who need a clear and visual method of confirmation before entering trades.

Why Beginners Need Entry Confirmation

Many beginners believe that once price taps into a POI, it should immediately reverse. But the truth is, price reverses because it wants to, not because you marked a level on your chart. Price can break through your POI and keep moving, leaving your stop loss behind.

Imagine this: you spot a POI, enter a buy or sell trade without confirmation, and within minutes price breaks through, hitting your stop loss. It’s frustrating and painful, especially for beginners.

Many traders lose money not because they mark their charts incorrectly, but because they enter too early. Price can tap into your POI in the PD array and still continue lower or higher, hitting your stop loss.

Entry confirmation helps filter out false moves. By waiting for a pattern like the Three White Soldiers, you’re essentially letting the market prove its intention before you commit your capital.

Key Notes for Beginners

Before you rely on any strategy, there are important truths every beginner trader must keep in mind:

- Forex trading is probability-based, not certainty-based. There’s no strategy that works 100% of the time.

- Risk management is non-negotiable. Always risk only 1% of your total capital per trade and aim for at least 2% or more in returns. By maintaining this approach, your capital is protected and your emotions are in good hands.

- Practice first. Test and master your strategy on a demo account before moving to a live account. If you cannot trade profitably on demo, real money won’t change the outcome.

- Discipline and patience matter. Success in forex requires time, consistency, and mastery of your trading system.

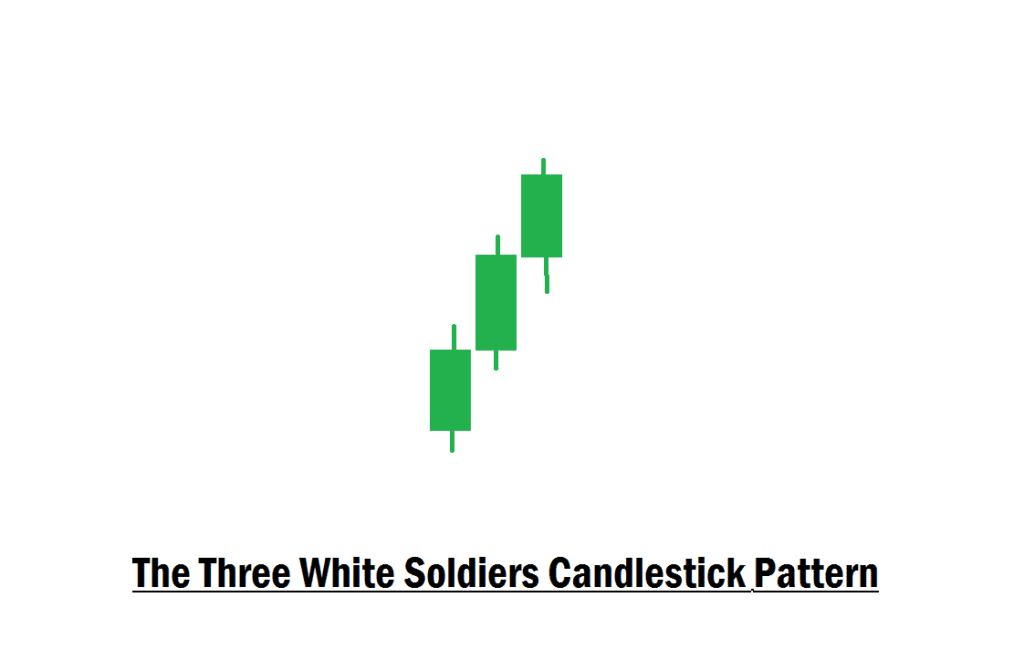

What is the Three White Soldiers Candlestick Pattern?

The Three White Soldiers is a bullish candlestick pattern that signals a potential reversal from a downtrend to an uptrend. It consists of three consecutive bullish candles, each opening within the body of the previous candle and closing higher than the last.

Here’s what makes it unique:

- Each candle shows strong buying pressure.

- The pattern forms after a period of decline or near a support/POI.

- It signals that buyers are stepping in and the market may be ready to push upward.

For beginners, this pattern is simple to recognize: three solid bullish candles marching upward like “soldiers,” which makes it one of the most beginner-friendly confirmation tools.

How to Use the Three White Soldiers for Entry Confirmation in the PD Array

Here’s a step-by-step guide beginners can follow:

- Identify Your POI in the PD Array: Using Smart Money Concepts, mark your high-probability POIs (such as demand zones, order blocks, or fair value gaps).

- Wait for Price to Tap Into Your POI: Don’t rush in immediately. Let price come into your marked zone first.

- Look for the Three White Soldiers: When price is inside your POI, watch for three consecutive bullish candles forming. This is your confirmation that buyers are stepping in.

- Enter After the Third Candle Closes: The safest entry is after the third soldier has closed. This confirms that momentum is building in your favor.

- Set Your Stop Loss and Take Profit: Place your stop loss just below the POI or the low of the pattern. Target at least a 1:2 or 1:3 risk-to-reward ratio.

Key Things Beginners Must Remember

Before you start applying this pattern, keep these important notes in mind:

- No strategy works 100% of the time. Forex is a game of probabilities, not certainties.

- Risk management is essential. Never risk more than 1% of your capital per trade. Target 2% or more in profit.

- Practice first. Test this strategy on a demo account until you’re consistent before trading live.

- Patience is power. Don’t rush into trades; wait for confirmation to avoid unnecessary losses.

Final Thoughts

The Three White Soldiers candlestick pattern is one of the best tools beginners can use for entry confirmation when trading around Points of Interest in the PD array. It’s simple to spot, highly effective, and, when combined with Smart Money Concepts, gives you a clear edge in the market.

By waiting for this pattern at your marked POI, you reduce the risk of premature entries and increase your probability of catching the real move driven by smart money.

Always remember: trading success comes from knowledge, discipline, and consistency, not shortcuts. Apply proper risk management, practice on demo, and stay patient as you master your craft. If you have more questions regarding this topic, drop them in the comments section. Trade with smartness, not fastness!