How Beginners Can Use the Three Black Crows Candlestick Pattern as Entry Confirmation in Smart Money Concept (SMC) Trading

Imagine being a beginner forex trader, eyes glued to your screen, watching as price approaches your marked Point of Interest (POI) in your Price Delivery (PD) array. Your heart races, torn between anticipation and hesitation. You’ve heard stories of traders jumping the gun, only to be stopped out before the real move begins. That’s when the Three Black Crows candlestick pattern appears, like a guiding beacon, providing the bearish reversal signal you need to make a confident entry. In forex trading, entry timing is everything, and this powerful pattern gives traders the assurance to pull the trigger at the right moment.

This guide will break down everything beginners need to know about the Three Black Crows, how to identify it, and how to use it effectively for confirmation within SMC trading.

The Three Black Crows is one of the most powerful reversal candlestick patterns in forex trading. For beginners, it offers a simple yet highly reliable way to confirm entries at a Point of Interest (POI) within the price delivery array. One of the biggest challenges new traders face is not knowing when to actually pull the trigger. You may identify a high-probability POI, but without confirmation, you risk being stopped out by smart money players before the real move begins.

That’s why using a confirmation candlestick pattern like the Three Black Crows can make all the difference. It signals that price is likely to reverse and respect your POI, giving you confidence and clarity in your entry decision.

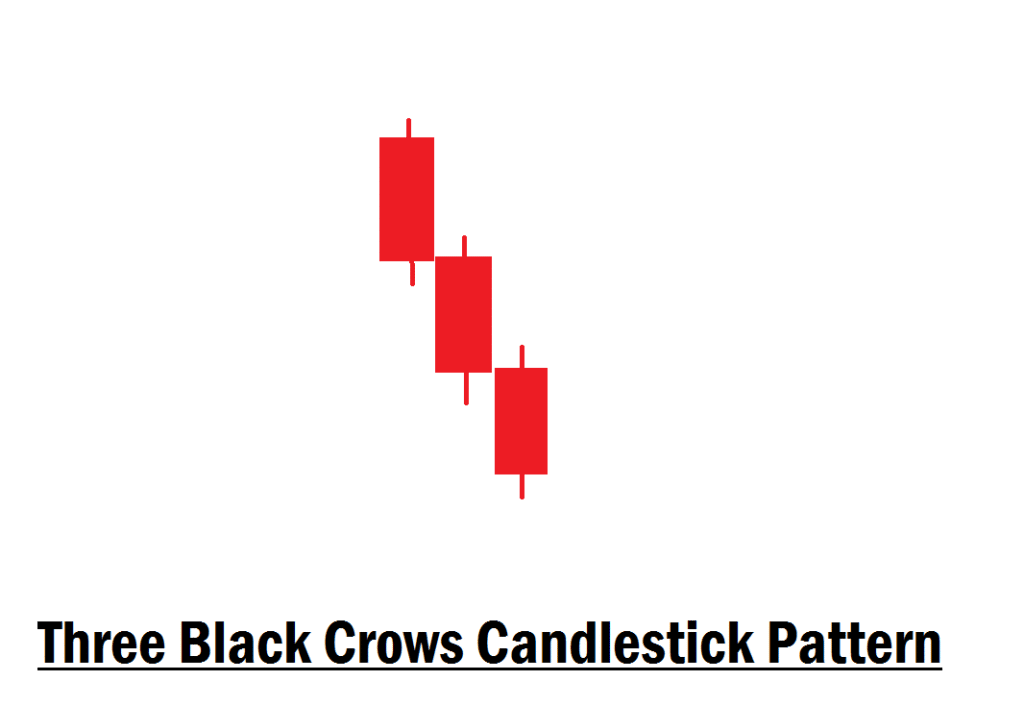

What Is the Three Black Crows Candlestick Pattern?

The Three Black Crows is a bearish candlestick pattern that appears after a bullish run or at the top of a market move. It consists of three consecutive bearish candles in a staircase-like decline. Each candle typically opens within the body of the previous one and closes lower. Long upper wicks on these candles may weaken the pattern’s reliability, suggesting residual buying pressure. Conversely, short or absent upper shadows imply stronger selling momentum. Being aware of these nuances can enhance traders’ real-time recognition of this pattern.

Here are the key characteristics:

- Three consecutive bearish candles – Each candle closes lower than the previous one.

- Opens within the prior candle’s body – Each candle typically opens near the close of the previous candle, showing sustained selling pressure.

- Strong downward momentum – The pattern signals that buyers are losing control and sellers are taking over.

This simple visual structure makes it beginner-friendly and highly reliable when used correctly.

Performance of the Three Black Crows Candlestick Pattern

Backtesting results and forex market data confirm that the Three Black Crows pattern has a solid win rate, especially when traded at high-probability POIs.

When tested across major currency pairs such as GBP/USD, EUR/USD, GBP/JPY, USD/CAD, and USD/JPY, this pattern showed a win rate above 70% over a one-year period. These tests were conducted on the 15-minute, 4-hour, and daily timeframes, examining a sample size of 500 trades. These results highlight not only the pattern’s effectiveness but also its beginner-friendly nature.

Why Do You Need Entry Confirmation Before Taking Trades?

One of the most common mistakes beginners make is entering trades blindly at a POI without waiting for confirmation. Here’s the reality:

- Price doesn’t reverse just because you marked a zone.

- Sometimes, price taps into your POI and continues moving against you, hitting your stop loss.

- Entering without confirmation increases your chances of being stopped out unnecessarily.

To avoid this, professional traders always wait for entry confirmation before committing to a position. When a strong candlestick pattern like the Three Black Crows forms at your POI, it increases the probability that price will respect that zone and reverse. This not only protects your capital but also boosts your confidence in taking the trade.

Why Is the Three Black Crows Pattern Important for Beginners?

One of the biggest challenges beginners face is figuring out when to enter a trade without being trapped by fakeouts. Smart money players know where retail traders place their entries and stops, which is why many beginners often get stopped out before the real move even begins.

The Three Black Crows acts as a confirmation tool. When it forms at your POI, it signals that:

- The market is rejecting higher prices.

- Sellers are stepping in with momentum.

- The probability of price respecting your POI has increased.

Instead of blindly entering your zone, you can wait for this candlestick confirmation to increase your odds of catching a quality trade.

How to Spot the Three Black Crows in Your PD Array

When you are working with Smart Money Concepts, identifying the Three Black Crows pattern can elevate your trading strategy. To guide you through this process, here are three quick filters that will help you fuse this pattern with SMC tools effectively:

- Order Blocks

- Fair Value Gaps (FVGs)

- Liquidity Sweeps or Grabs

Here’s how to combine these with the Three Black Crows:

- Mark your POI in the PD array – For example, a bearish Order Block above liquidity high.

- Wait for price to tap into the POI – Don’t enter immediately; let the market show its hand.

- Look for the Three Black Crows – Once the pattern forms, it confirms bearish rejection of the zone.

- Enter on confirmation – After the third candle closes, you can enter short, with your stop loss placed safely above the POI. Your take profit should be at least two times the size of your stop loss or more.

This process saves you from blind entries and increases your confidence in the trade.

Example of Using the Three Black Crows as Confirmation

Let’s say you’ve identified a bearish Order Block on the 15-minute chart. Price taps into the zone, but instead of rushing into a sell, you wait.

- Candle one: Bearish rejection.

- Candle two: Continues the sell momentum.

- Candle three: Confirms strong bearish intent.

Now, you have a confirmed bearish setup with high probability. You enter short after the third candle closes, place your stop above the zone, and aim for at least a 1:2 risk-to-reward ratio.

This patience in waiting for the Three Black Crows can make the difference between getting stopped out and catching the big move.

Beginner’s Note

If you’re new to forex, here’s what you need to keep in mind:

- Trading is probability-based, not certainty. No strategy works 100% of the time.

- Patience, discipline, and consistency are the keys to long-term success.

- Always apply proper risk management. Risk only 1% of your capital per trade and aim for at least a 2% reward. For example, if you have a $5,000 trading account, risking 1% means only putting $50 at stake per trade. This concrete number can help you maintain discipline and consistency, even under pressure.

- Before going live, practice on a demo account until you’re consistently profitable. If you can’t succeed in demo trading, you won’t magically succeed in live trading.

Final Thoughts

The Three Black Crows candlestick pattern is a powerful tool for beginners learning Smart Money Concept (SMC) trading. By using it as an entry confirmation at your POIs within the PD array, you avoid unnecessary stop-outs and increase your probability of catching profitable moves.

When combined with SMC tools like Order Blocks, Fair Value Gaps, and Liquidity Sweeps, this pattern becomes even more effective.

If you’re serious about mastering forex trading, candlestick confirmations like the Three Black Crows should become a key part of your entry model. If you have questions concerning this topic, let us know in the comments section. Trade responsibly!