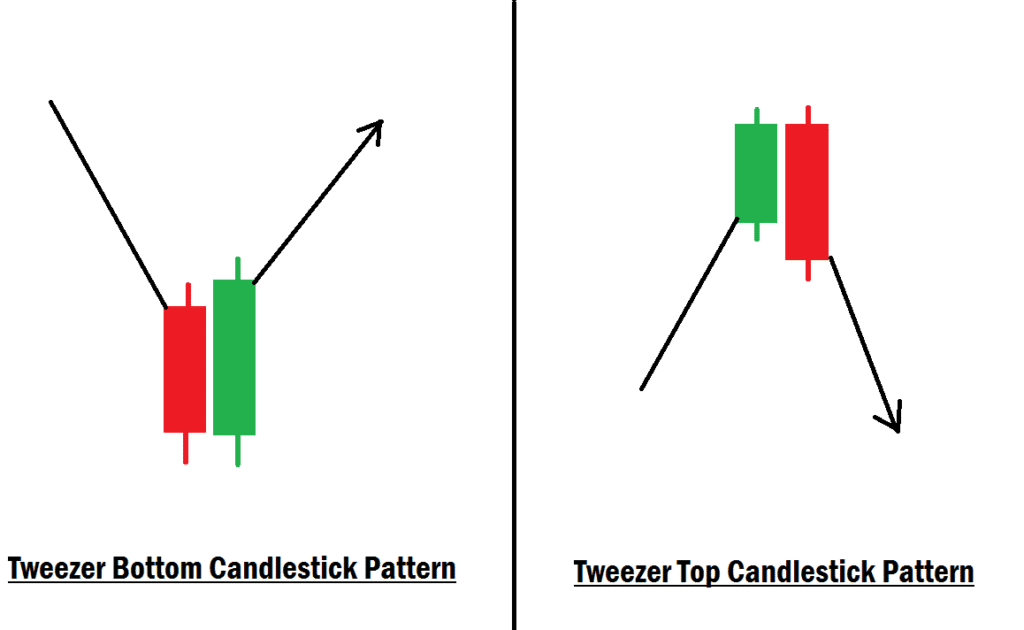

How to Use the Tweezer Top and Tweezer Bottom Candlestick Pattern for Entry Confirmation as a Beginner in Forex Trading

The tweezer top and tweezer bottom candlestick patterns are powerful reversal signals that have stood the test of time in the forex market. Many professional traders rely on these patterns to confirm high-probability trade setups and catch strong market reversals. As a beginner trader, understanding how to properly use confirmation tools like the tweezer pattern can drastically improve your accuracy, confidence, and long-term consistency.

One thing every profitable trader agrees on is this:

Confirmation is the foundation of a successful trading strategy.

Professionals do not enter trades based on guesses or emotions; they wait for the market to give them clear signals before making any move. That is exactly where the tweezer top and bottom patterns become extremely valuable.

Confirmation is the foundation of a successful trading strategy.

Professionals do not enter trades based on guesses or emotions; they wait for the market to give them clear signals before making any move. That is exactly where the tweezer top and bottom patterns become extremely valuable.

You may have seen this pattern appear frequently around your anticipated reversal areas without realizing its significance. In this article, you will learn everything you need to know about the tweezer top and bottom candlestick pattern, and how to use it as a reliable confirmation tool when price approaches key zones such as:

- Order Blocks

- Support and Resistance Levels

- Trendline touches

- Supply and Demand zones

- Any other strong reversal area on your chart

Let’s dive in.

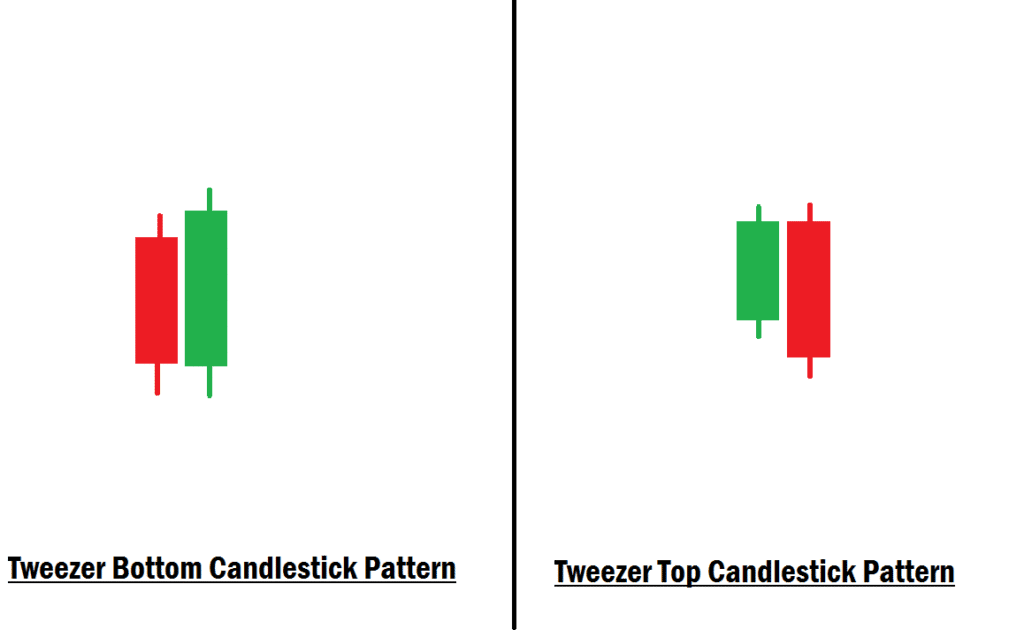

What Is the Tweezer Top & Tweezer Bottom Candlestick Pattern?

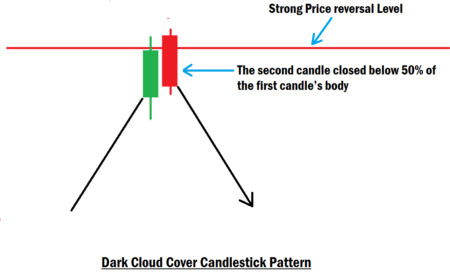

The tweezer top signals a potential bearish reversal, while the tweezer bottom signals a potential bullish reversal. Each pattern consists of two candles with almost identical highs (tweezer top) or identical lows (tweezer bottom). This indicates a strong rejection from a price level and suggests that the market is poised to reverse direction.

These patterns become even more powerful when they form at a key technical zone where you already expect the market to react.

Performance of the Tweezer Top & Bottom Pattern (Backtested Results)

Based on our backtesting across popular currency pairs such as GBP/USD, EUR/USD, and GBP/JPY, the tweezer top and bottom candlestick patterns produced an impressive average win rate of 70%.

Here’s how the backtest was conducted:

- 200 trades were tested on each currency pair

- 6-month trading period

- 1-hour chart for higher-timeframe analysis

- 5-minute chart for precise entries

- Trades were only taken at strong reversal zones

- Average Risk-to-Reward Ratio: 1:3

This strong performance makes the tweezer pattern one of the best reversal confirmation tools for beginners and even struggling traders looking to add structure and precision to their strategy.

Why the Tweezer Pattern Works So Well

The tweezer pattern works because it exposes market rejection and buyer or seller exhaustion. When price attempts to break beyond a level but gets rejected twice with almost the same wick or body placement, it communicates a clear message:

The market does not want to go higher (tweezer top) or lower (tweezer bottom).

When this happens at a key reversal zone, it gives you a high-probability signal that a strong move is about to begin.

How Beginner Traders Can Use the Tweezer Pattern for Entry Confirmation

To use this pattern effectively:

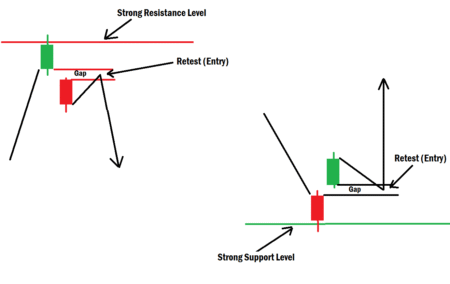

1. Mark Your Reversal Zone First

Before anything else, identify where you expect price to reverse:

- A fresh Order Block

- A supply or demand zone

- A clean support or resistance level

- A trendline touch

Your reversal zone is the foundation of your setup.

2. Wait for the Tweezer Pattern to Form

Do not enter prematurely.

Let the market show the complete two-candle pattern with equal wicks.

Let the market show the complete two-candle pattern with equal wicks.

3. Enter With Good Risk Management

A common approach:

- Stop-loss: Slightly above the tweezer top or below the tweezer bottom

- Take-profit: Use a minimum of 1:3 RRR for better long-term consistency

4. Look for Confluence

More confluences = more confidence.

Combine the tweezer pattern with:

Combine the tweezer pattern with:

- Market structure shifts at a lower timeframe

- Liquidity sweeps

- Checking Higher timeframe bias

For instance, if a tweezer chart pattern forms at your key level on your higher timeframe chart, the best thing to do is come down to your entry timeframe to look for a clear market structure shift. This will give you more confidence to take that particular trade.

Important Note for Beginners

Forex trading involves risk and is not suitable for everyone. No strategy or candlestick pattern works 100% of the time. That is why mastering your skills is more important than chasing shortcuts.

Here’s what you must keep in mind:

Forex trading thrives on mastery, not magic.

Forex trading thrives on mastery, not magic.

Practice everything you learn in a demo account until you are confident enough to trade the live market.

Now that you understand the power of the tweezer top and bottom candlestick pattern, you are ready to begin your journey toward more accurate and confident trading decisions.

If you have more questions concerning this topic, don’t hesitate to let us know in the comments section. Trade like a pro!