How To Use The Rising Three Candlestick Pattern As a Price Continuation Confirmation at an Anticipated Reversal Zone

If you’ve ever marked a beautiful reversal zone, maybe an order block, support or resistance level, or trendline touch. Later, the market still moved against you without respecting it; you’re not alone. One of the biggest challenges beginners face in forex trading is entering trades without proper confirmation.

The Rising Three Candlestick Pattern is one of the most reliable bullish continuation patterns that beginner traders can use to confirm price direction, especially when trading around key reversal zones.

In forex trading, not every zone holds price effectively. Sometimes, price may react briefly and continue in its original direction. That’s why you should never place a buy or sell trade simply because price reaches your marked-out zone. To increase your chances of catching profitable moves, you need candlestick confirmation patterns that reveal whether price is likely to continue or reverse.

Unfortunately, many beginners enter trades without a proper understanding of these significant confirmation signals. In this article, we’ll explain how to use the Rising Three Candlestick Pattern as part of your entry confirmation strategy. By mastering it, you’ll reduce the chances of being stopped out and improve your overall trading accuracy.

Performance of the Rising Three Candlestick Pattern

According to backtesting results and industry data, the Rising Three Pattern has an impressive win rate of over 70% when used correctly at key reversal zones such as order blocks, support and resistance zones, or trendline touches. This statistic is based on a sample of over 1,000 trades conducted over a six-month period across various market conditions, predominantly focusing on the EUR/USD and GBP/USD currency pairs.

Its reliability makes it an excellent confirmation tool for beginners who want to filter out false reversals and increase their win probability. Because this pattern has been used by traders for decades, it remains one of the most respected price continuation confirmation tools in technical analysis.

When spotted at the right level, it often signals that price will continue in the same direction after a brief consolidation, instead of reversing.

Why Do You Need Confirmation Before Placing a Trade?

Nothing in the forex market is guaranteed. Every trade is based on probabilities, not certainties. That’s why you should always seek confirmation before entering a position, whether you’re trading from an order block, supply and demand zone, support or resistance level, or trendline touch.

Just because you identified a strong zone doesn’t mean price will respect it. If it does, every trader would be profitable! Confirmation candlestick patterns like the Rising Three help you filter weak setups, avoid emotional entries, and increase your overall success rate.

By waiting for confirmation, you let the market show its intention, giving you more confidence to take the trade.

Important Notice

Before applying this pattern in live trading, practice and master it on a demo account first. Building experience and skill around this setup is essential. Remember, mastery is the key to forex success, not rushing into trades.

Once you’ve practiced and gained confidence, you can begin using the Rising Three Candlestick Pattern as a reliable confirmation tool to refine your entries and improve your trading consistency.

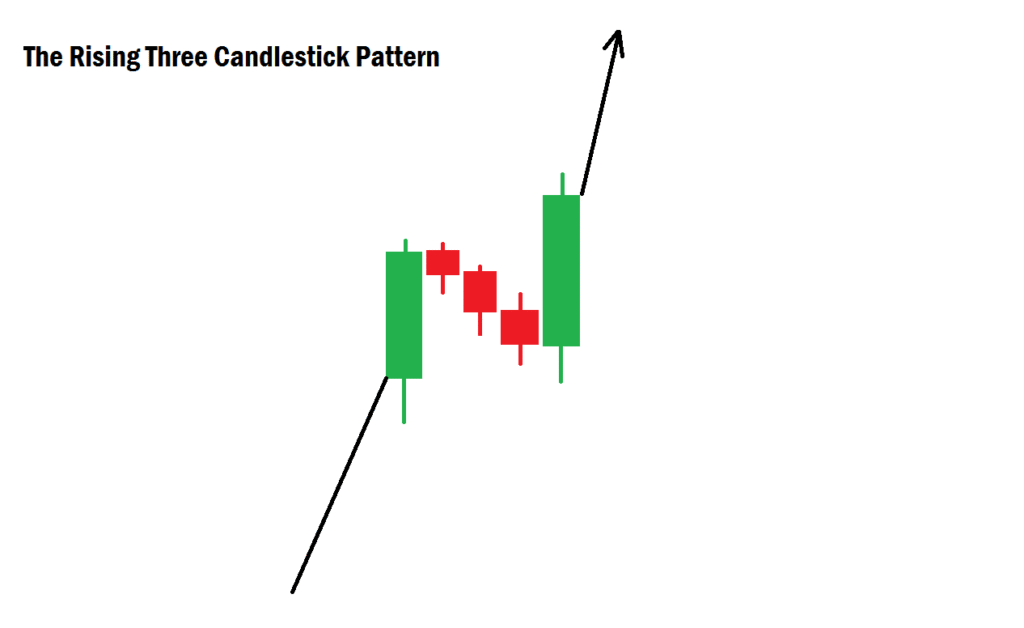

What Is the Rising Three Candlestick Pattern?

The Rising Three Pattern is a bullish continuation candlestick formation that appears during an uptrend. It shows a short period of consolidation or minor pullback before buyers regain control and push the price higher.

This pattern usually consists of five candles:

- The first candle – a large bullish candle that sets the tone for an uptrend.

- The next three candles – small bearish or neutral candles that remain within the range of the first big bullish candle, showing a temporary pause.

- The fifth candle – another strong bullish candle that breaks above the high of the first candle, confirming that the bulls are back in control.

The overall message is simple: buyers are still in charge, and price is likely to continue upward.

How Beginners Can Use the Rising Three Pattern for Confirmation

For beginner forex traders, confirmation is everything. You don’t just buy or sell because the market touched your key zone. You wait for signs that show price respects your level, and the Rising Three Pattern is one of those signs.

Here’s how to use it effectively at major reversal zones:

1. At a Bearish Order Block

When price retests a bearish order block and forms a Rising Three Pattern, it’s a strong signal that buyers are stepping back in. The final bullish candle confirms continuation, giving you confidence to enter a buy trade instead of a sell trade.

2. At a Resistance Level

If price tests a resistance level and forms this pattern, it tells you that the level is not holding. The appearance of the fifth bullish candle breaking upward confirms the continuation of the existing uptrend. You should be looking for a buy trade instead of a sell trade.

3. At a Down Trendline Touch

When price pulls back to a down trendline and forms the Rising Three Pattern, it’s a beautiful confluence. It suggests that the trendline may not be respected, and price will likely break it and change the trend direction.

Why the Rising Three Pattern Matters

In forex, confirmation increases probability, and trading is all about probabilities, not guarantees.

The Rising Three Pattern helps you:

- Avoid false reversals.

- Gain confidence before entering a trade.

- Filter out weak setups and increase your win rate.

- Understand when the market is just taking a “breather” before continuing.

According to performance studies and backtests, the Rising Three Pattern shows an impressive 70% accuracy rate when used at anticipated reversal zones like order blocks or trendlines.

That makes it a perfect confirmation tool for beginners looking for clarity in their setups.

Final Thoughts

The Rising Three Candlestick Pattern is one of those timeless tools that can help beginners trade with more confidence. When used correctly at your anticipated reversal zones, like order blocks, support or resistance levels, and trendline touches, it becomes a reliable confirmation for price continuation.

It doesn’t just help you spot strong momentum; it protects you from jumping into false reversals that wipe out your stop-loss.

So before you place your next trade, don’t just rely on your zone. Wait for confirmation, and let the Rising Three Pattern be one of your best allies in the market.

If you have more questions regarding this topic, don’t hesitate to let us know in the comments section. Stay blessed!