Understanding Support and Resistance Line Forex Trading Strategy

In this session, we’re diving deep into “Understanding Support and Resistance Line Forex Trading Strategy.” It is one of the most straightforward yet powerful strategies that has stood the test of time in the forex market. It has been used by many consistently profitable traders to identify high-probability trade setups and capitalize on market movements.

But while this strategy can be incredibly effective when applied correctly, it can also lead to losses if misused. So, in this lesson, we’ll break down the concept thoroughly to help you understand how to trade it like a pro.

What Is the Support and Resistance Line Trading Strategy?

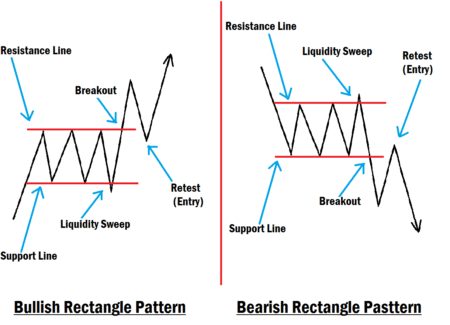

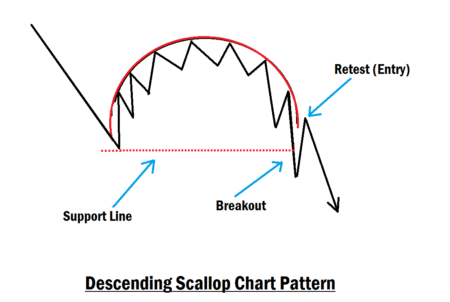

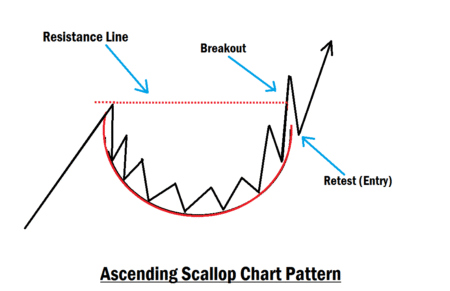

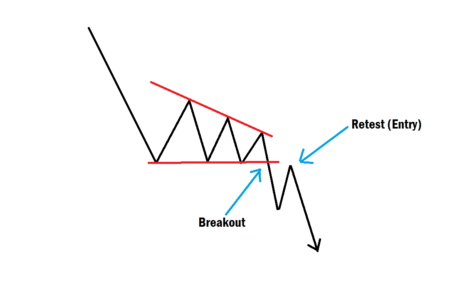

The support and resistance line strategy shares some similarities with the trendline trading method. However, while trendlines perform best in trending markets (uptrends or downtrends), support and resistance lines thrive in consolidating markets, periods when price is moving sideways in a range or accumulation phase.

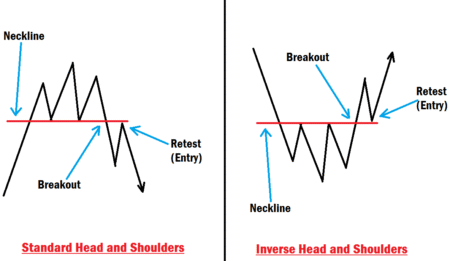

You must always remember: price does not stay in consolidation forever. Eventually, it breaks out of the range, either to continue its previous direction or to reverse. This breakout is what often provides traders with strong trading opportunities.

Now, some traders only trade the breakout, while others prefer trading within the consolidation itself. In this episode, we’ll focus on how to trade the consolidation phase smartly and safely.

Important Note: Never use any trading strategy in a live market until you’ve practiced and mastered it using a demo account. Forex trading is based on probability, not certainty, and it involves real risk.

What Is a Support Line in Forex?

In simple terms, a support line is a price level where a downward move is expected to pause or reverse due to increased buying pressure. It acts as a floor, preventing price from falling further.

A support line is drawn by connecting swing lows where price has previously reversed upward at least twice. The more times price respects that level, the stronger the support becomes. When price approaches this area again, there’s a high probability it will reverse upward, making it a prime zone to look for buying opportunities.

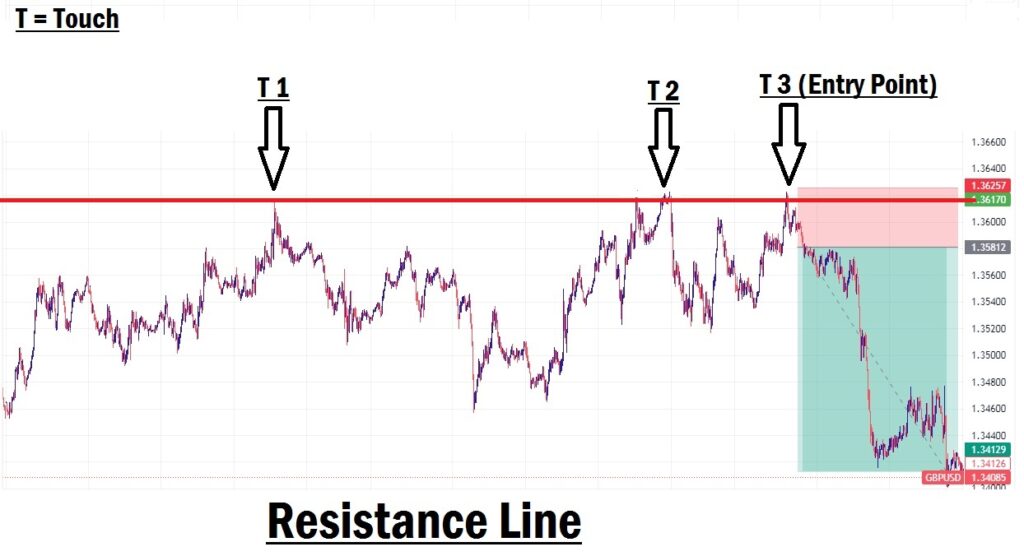

What Is a Resistance Line in Forex?

A resistance line, on the other hand, is the opposite of a support line. It represents a level where price has previously reversed downward due to selling pressure, forming a kind of ceiling that limits upward movement.

To draw a resistance line, you connect swing highs where price has reversed downward more than once. The more rejections at this level, the higher the probability that price may reverse again when it revisits that area.

The Logic Behind Support and Resistance Lines

The core idea behind support and resistance lines in forex is based on repetition and psychology. If price has reversed twice from a certain level, the third touch often becomes significant. Traders anticipate a reaction because many other market participants are watching the same level.

- Support may cause price to bounce back upward.

- Resistance may cause price to reverse downward.

Keep in mind, forex trading is not about guarantees. Nothing works 100% of the time. That’s why it’s critical to focus on high-probability setups and avoid low-quality ones. This mindset will improve your overall win rate.

How to Draw and Trade Using a Support Line

- Start from a Higher Time Frame:

- Open your preferred higher time frame (H4, Daily, or Weekly) and identify a consolidation phase where price forms swing lows and highs.

- Identify the Swing Lows:

- Look for two swing lows where price rejected the downside and bounced up. Connect these points with a line and extend it forward; this is your support line.

- Wait for the Third Touch:

- When price returns to this level the third time, drop down to a lower time frame (M5 or M15) to look for a reversal signal, such as a Market Structure Shift (MSS).

- Entry Strategy:

- Wait for liquidity grab (where price dips into previous wick zones and reverses) or liquidity sweep (where price breaks the previous low and then reverses).

- Look for confirmation like a bullish MSS.

- Place your buy order at the break of the structure.

- Stop Loss: Below the recent low.

- Take Profit: Either 3x your stop loss or aim for the highs of the range for a sniper target (sometimes 10x your stop loss).

How to Draw and Trade Using a Resistance Line

The resistance line strategy is simply the reverse of the support line method:

- Identify Consolidation on a Higher Time Frame:

- Find a range where price has formed at least two swing highs (preferably relatively equal).

- Draw the Resistance Line:

- Connect the two highs and extend the line forward; This is your resistance level.

- Wait for Price to Revisit the Line:

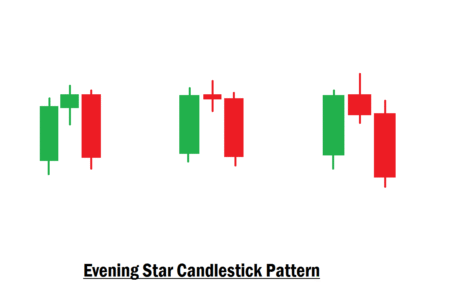

- Once price touches the resistance area the third time, drop to your lower time frame and wait for a bearish MSS or other reversal signal.

- Look for a Liquidity Sweep:

- Wait for price to take out the second high (liquidity sweep) before executing your trade. Enter after confirmation.

- Entry Strategy:

- Place your sell order after the MSS.

- Stop Loss: Just above the recent high.

- Take Profit: 3x stop loss size or down to the support zone for extended targets.

Pro Tip:

Liquidity always rests at relatively equal highs or lows. That’s why it’s smart to wait for liquidity to be swept before you take a trade; it gives your setup higher conviction.

Final Thoughts

The support and resistance trading strategy is not a magic bullet. No strategy in forex guarantees profits. Price doesn’t respect your line just because you drew it. That’s why confirmation is key.

Always perform a top-down analysis to understand the overall market direction. It will help you determine whether to trade from the support or resistance area during a consolidation phase.

Don’t expect perfect touches, price might be messy, especially in real-time trading.

Most importantly, practice with a demo account first. Master the strategy and build your trading edge around it. That’s what separates professional traders from the rest: they personalize and refine their strategy over time.

In our next lesson, we’ll dive into “Breakout Trading Strategy.” Let’s go!