How to Use the Stick Sandwich Candlestick Pattern as an Entry Confirmation at a Strong Reversal Zone

Imagine turning hesitation into confident entries at every key reversal zone. In forex trading, knowing how to confirm an entry at a strong reversal zone is what separates consistent traders from random guessers. One of the most powerful yet often overlooked confirmation patterns is the Stick Sandwich Candlestick Pattern.

The Stick Sandwich Candlestick pattern is one of the most reliable entry confirmation tools beginner traders can use when identifying strong price reversal zones in the forex market.

In trading, not every marked zone holds price effectively. That’s why you shouldn’t jump into a buy or sell trade simply because price touches your zone. To increase your chances of catching profitable trades at these key areas, you need solid candlestick confirmation patterns that let you know that price may likely respect your zone.

Many beginners often enter trades too early or too late because they lack knowledge of these critical entry confirmation signals. In this guide, you’ll learn how to use the Stick Sandwich Candlestick pattern as a confirmation tool to help you avoid premature or delayed entries, ensuring more accurate trade timing and improved consistency.

Stick Sandwich Candlestick Pattern Performance

Over a sample size of 500 trades on major currency pairs, including EUR/USD and GBP/USD, this pattern showed consistent performance, especially on the 1-hour and 4-hour timeframes during the 2024-2025 period. Based on the backtesting studies, the Stick Sandwich pattern has demonstrated an impressive win rate of over 70% when applied at strong reversal zones such as:

- Valid Order Blocks

- Strong Support and Resistance levels

- Trendline touches

This makes it a valuable tool for beginners looking for reliable confirmation signals before executing trades.

The Stick Sandwich pattern has been used by traders for many years and remains effective. Its proven reliability gives traders a strong technical edge when trading market reversals.

Why You Need Entry Confirmation Before Placing a Trade

Nothing in the forex market is guaranteed. Trading is based on probabilities, not certainties. That’s why even experienced traders rely on confirmation signals before making any trading decision.

Seeing a strong order block, supply or demand zone, or trendline touch does not guarantee that price will react as expected. If trading were that easy, every trader would be profitable. The truth is, forex remains one of the riskiest financial markets, and proper confirmation helps filter out bad setups.

Using candlestick confirmation patterns like the Stick Sandwich allows you to:

Increase your win rate

Reduce false entries

Trade with confidence at key reversal points

Increase your win rate

Reduce false entries

Trade with confidence at key reversal points

Important Notice

Before trading live, always practice and master the Stick Sandwich Candlestick pattern in a demo account. Developing your personal trading skill around this pattern will help you build confidence and consistency.

Remember, mastery is the key to success in forex trading. The more you understand how the pattern behaves in different market conditions, the better your results will be when trading real money.

What Is the Stick Sandwich Candlestick Pattern?

The Stick Sandwich Candlestick Pattern is a three-candle formation that signals a potential trend reversal in the foreign exchange (forex) market. It occurs when the market tries to push price in one direction, fails, and then returns to the original level, forming a pattern that “sandwiches” a candle of the opposite color between two candles of the same color.

This pattern shows that buyers or sellers are fighting for control, and when the setup aligns with a strong reversal zone, it gives a high-probability confirmation that price might reverse from that area.

In simpler terms, the Stick Sandwich pattern tells you:

“The market tried to break through this level… but failed. Now it’s ready to move in the opposite direction.”

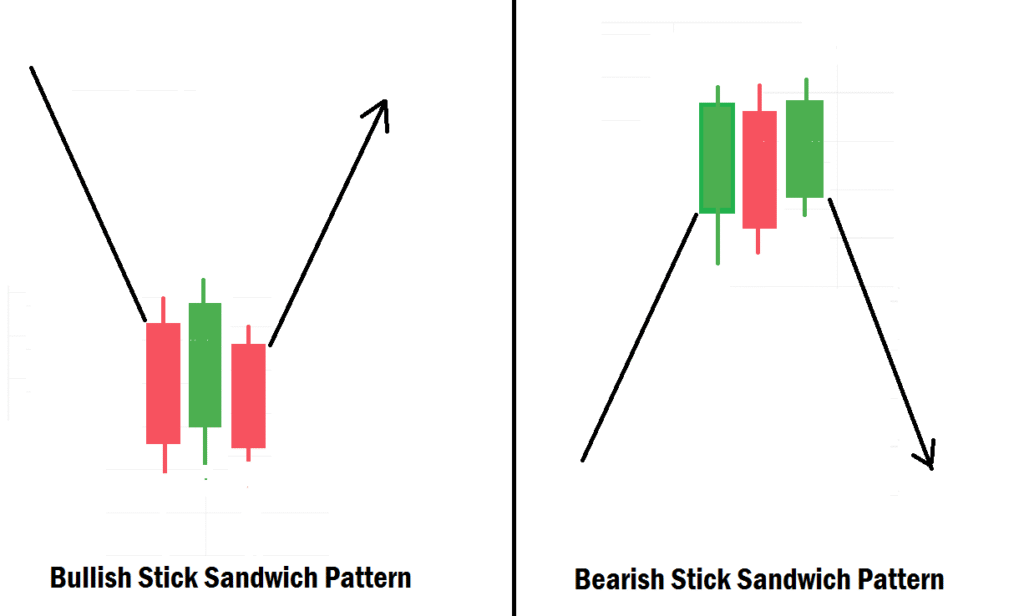

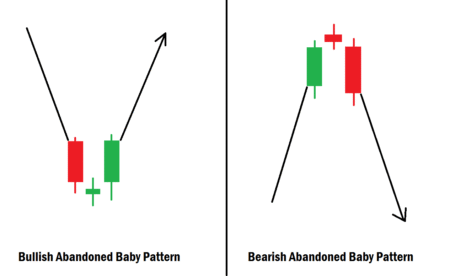

Types of Stick Sandwich Candlestick Patterns

There are two main types of Stick Sandwich patterns, Bullish and Bearish. Each tells a different story about price behavior and where the market could be heading next.

1. Bullish Stick Sandwich

A Bullish Stick Sandwich forms during a downtrend and signals a possible bullish reversal.

Here’s how it looks:

- The first candle is bearish (red), showing sellers are in control.

- The second candle is bullish (green) and closes above the first candle’s body.

- The third candle is bearish again, closing near the same level as the first candle, creating a “sandwich” around the bullish candle.

This formation shows that although sellers tried to push the price lower again, they failed, and buyers are now stepping in strongly.

2. Bearish Stick Sandwich

A Bearish Stick Sandwich forms during an uptrend and signals a possible bearish reversal.

- The first candle is bullish (green).

- The second candle is bearish (red) and closes below the first candle’s body.

- The third candle is bullish again, closing around the same level as the first candle.

It signals that buyers attempted to push higher, but sellers rejected the move, hinting at a potential reversal to the downside.

How Beginners Can Use the Stick Sandwich Pattern as Entry Confirmation

The best way to use the Stick Sandwich pattern is as a confirmation signal, not as a standalone trading setup. On its own, it’s just a pattern. But when combined with a strong reversal zone, it becomes a powerful entry confirmation tool.

Here’s how beginners can apply it step by step:

- Identify a strong reversal zone.

Look for a bullish or bearish order block, support and resistance, or trendline touch where you expect price to reverse. - Wait for the Stick Sandwich pattern to form.

Don’t rush in immediately when price hits your zone. Wait for the Stick Sandwich to appear; this tells you that the market has reacted and is likely to reverse. - Enter your trade and set proper risk management.

After the third and last candle of the Stick Sandwich pattern closes, enter your trade at the open of the next candle and set your stop loss just below or above the reversal zone, and target two to three times the size of your stop loss for a smooth exit. You can even target more depending on your trading style. Don’t forget to risk only 1% of your trading capital per trade as a beginner.

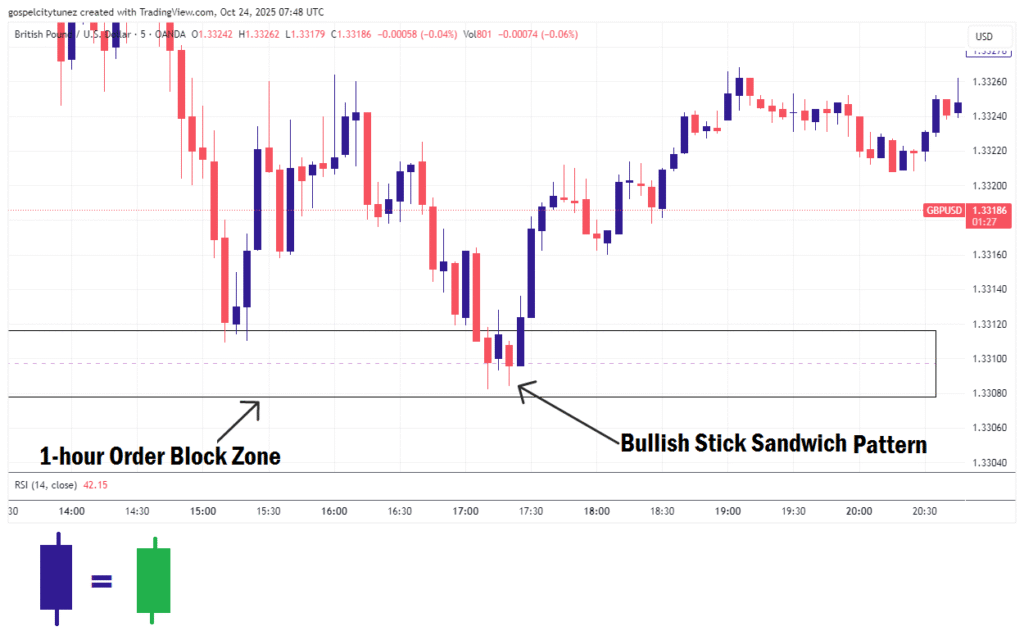

Bullish Example Using a Bullish Order Block

Let’s say you marked a bullish order block on the 1-hour timeframe and dropped down to the 15-minute timeframe to look for entry confirmation. Price drops into the zone, and instead of bouncing immediately, it starts forming candles that show indecision.

Here’s what happens next:

- The first candle is bearish, signaling sellers are still active.

- The second candle turns bullish, showing buyers are reacting to your order block.

- The third candle closes bearish again, but right at the same level as the first candle’s close.

This forms a Bullish Stick Sandwich pattern inside your order block zone, a perfect confluence.

This pattern confirms that buyers defended the zone successfully, rejecting further downward pressure. You can then confidently take a buy entry at the open of the next candle with your stop loss slightly below the order block. Your take profit should be at least two to three times the size of your stop loss or more.

That’s how you use the Stick Sandwich pattern as confirmation to enter with precision and avoid guessing the reversal.

Why It Works So Well

The Stick Sandwich pattern is effective because it shows rejection and commitment at the same time.

- The first candle represents the initial push.

- The second candle shows a strong counter-move.

- The third candle’s close proves that the market respects that zone.

It’s not magic, it’s psychology in action. Price tells a story, and this pattern simply helps you read it clearly.

Final Words for Beginners

The Stick Sandwich Candlestick Pattern is one of the easiest yet most powerful confirmation patterns every beginner should learn. It helps filter bad trades, confirms your reversal zones, and increases your win rate when used with other smart money concepts like Order Blocks, FVGs, and Break of Structure.

But before going live, practice this pattern in a demo account until you master how it behaves in different market conditions. With time, patience, and discipline, it will become one of your most trusted confirmation tools.

If you have more questions regarding this topic, do let us know in the comments section. Stay blessed!