How Smart Money Concept (SMC) Traders Can Use the Morning Star Candlestick Pattern for Effective Trade Entry

When it comes to forex trading, one of the most reliable reversal signals beginners can use is the Morning Star candlestick pattern. This powerful formation often marks the end of a downtrend and signals the beginning of a bullish reversal. For Smart Money Concept (SMC) traders, the Morning Star is more than just a candlestick pattern; it is a valuable entry confirmation tool when price reacts at a Point of Interest (POI) inside the Premium/Discount (PD) array.

One of the biggest challenges beginner SMC traders face is entry confirmation. Many traders make the mistake of entering a position just because price reaches their Point of Interest (POI). But the truth is, not every POI will be respected by price. Before you hit that buy or sell button, you need solid confirmation that the market is likely to move in your favor. That’s where the Morning Star candlestick pattern becomes one of the most reliable entry confirmation tools.

In this article, you’ll learn everything you need to know about the Morning Star candlestick pattern, how to identify it, and how to combine it with SMC concepts for better trade entries.

Why Entry Confirmation Matters in Forex Trading

As a smart money trader, you already know that price does not always respect every POI. Sometimes, price will touch your zone and then completely ignore it, continuing in the opposite direction. If you enter a trade solely based on your POI, without confirmation, you will keep losing money.

This is why marking a POI is important, but confirming your entry is far more important. Price can do whatever it wants regardless of your analysis. With confirmation tools like the Morning Star candlestick, you stack the probabilities in your favor and reduce the chances of unnecessary losses.

The Probabilities of Forex Trading

As a beginner trader, always remember: nothing works 100% in forex trading. This market is a game of probabilities, not guarantees. That’s why it’s considered a risky venture that requires proper education, patience, and discipline. Even when using high-probability setups like the Morning Star, there’s an inherent ‘risk of ruin.’ It’s good to understand that probabilities mean even strong setups can sometimes fail. Incorporating position sizing into your trading strategy can help you withstand inevitable losses. By managing the size of your trades based on risk, you create a practical path to survive the randomness and avoid huge losses.

Before risking your real capital, you must first practice and master your strategy on a demo account. If you can’t be consistently profitable in demo trading, switching to a live account won’t magically make you profitable. Treat your demo like real money, and once you build confidence, you’ll be better prepared for the live market.

Morning Star Candlestick Pattern: A Powerful Entry Tool

The Morning Star candlestick pattern is a strong bullish reversal formation that often signals the end of a downtrend and the beginning of a potential upward move. According to industry statistics and one-year backtest results, this candlestick pattern has shown an average win rate of up to 78% when used as an entry confirmation tool.

This high probability setup makes it one of the best patterns for beginner traders to learn, master, and apply. Another benefit of using the Morning Star candlestick for confirmation is that it helps you:

- Minimize risk by filtering out weak setups.

- Maximize profit potential by entering trades with stronger momentum.

- Trade with more confidence knowing you have a reliable reversal signal that works most times.

What Is the Morning Star Candlestick Pattern?

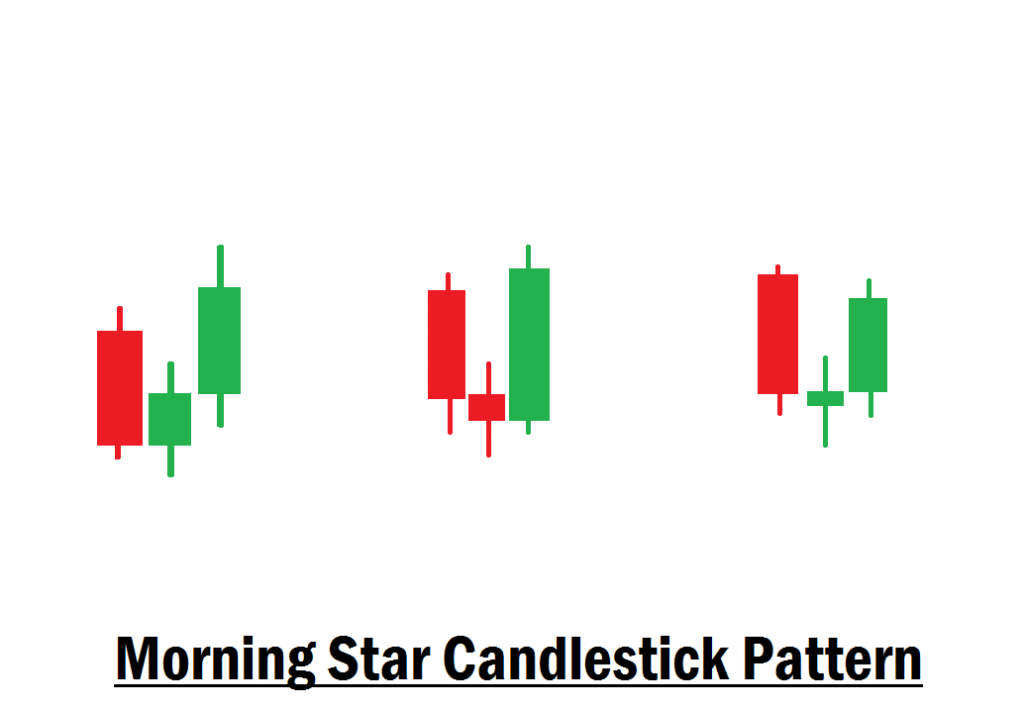

The Morning Star is a three-candle bullish reversal pattern that usually appears at the bottom of a downtrend. It suggests that bearish pressure is weakening, and bullish traders are taking control.

The structure includes:

- First Candle (Bearish): A strong bearish candle showing sellers are in control.

- Second Candle (Indecision/Small Body): A doji or small-bodied candle that indicates market indecision, and selling pressure is slowing down.

- Third Candle (Bullish): A strong bullish candle that closes well into the body of the first candle, signaling a shift in momentum.

Why the Morning Star Works for Beginners

For beginner traders, one of the most challenging aspects is determining when to enter a trade. Just because price hits your POI doesn’t mean it will reverse; sometimes it slices through. The Morning Star provides extra confirmation that price is respecting your level.

Key reasons why it’s effective:

- Clear visual signal: Easy to spot, even for beginners.

- High probability setup: Backtests indicate a win rate of up to 78% when traded correctly.

- Risk management: Helps reduce unnecessary losses by filtering out weak POI reactions.

- Confidence boost: Gives traders more conviction in their entry decision.

Understanding the PD Array in SMC

In Smart Money Concepts, the Premium/Discount (PD) array divides price action into two key zones. The Premium Zone is above 50% of the range and ideal for looking for sell setups in a bearish trading range, while the Discount Zone is below 50% of the range and ideal for buying opportunities in a bullish range. It’s important to note that the 50% line often aligns with prior swing highs and lows, which helps traders connect the PD array to familiar chart landmarks and understand broader market structure.

- Premium Zone (Above 50% of the range): Ideal for looking for sell setups.

- Discount Zone (Below 50% of the range): Ideal for looking for buy setups.

The Morning Star is especially powerful when it forms at a POI inside the discount zone of the PD array. This alignment means you’re not just relying on candlesticks, but also combining them with market structure, liquidity concepts, and smart money footprints. In a bullish setup, the discount zone is the effective place to look for your entry. The discount zone is below 50% of your Fibonacci retracement tool. Learn more about the PD array here.

How to Use the Morning Star for Entry Confirmation at POIs

Here’s a simple step-by-step approach beginners can use:

1. Identify Your Point of Interest (POI)

Mark your key zone (e.g., order block, fair value gap, or breaker) inside the PD array. This is your potential entry area.

2. Wait for Price Reaction

Don’t rush. Allow price to come into your POI. Watch how it behaves. Does it show signs of rejection?

3. Look for the Morning Star Pattern

Check if the Morning Star candlestick forms inside or near your POI:

- Strong bearish candle into the zone.

- Small body/indecision candle (doji or spinning top).

- Strong bullish candle confirming reversal.

4. Confirm with Confluence

Strengthen your setup by aligning it with other SMC tools:

- Liquidity sweep before forming the Morning Star.

- Fair Value Gap (FVG) aligning with your POI.

- Order block where the reversal takes place.

5. Execute the Trade

Enter after the bullish candle of the Morning Star closes. Place your stop-loss just below the pattern or the POI, and target higher PD array levels for take profit.

Example of Morning Star in the PD Array

Imagine GBP/USD is in a downtrend and approaches a bullish order block within the discount area. Price forms:

- A big bearish candle in the order block zone.

- A doji candle showing rejection.

- A strong bullish candle breaking the higher of the doji with momentum.

- Your entry should be immediately the strong bullish candle closes.

This is your Morning Star confirmation. You take a long position with stop-loss below the order block zone and target liquidity above or 3x the size of your stop-loss.

Final Thoughts

For beginners, combining SMC concepts with candlestick confirmation is one of the smartest ways to trade forex. The Morning Star candlestick pattern, when used at your POI inside the PD array, gives you:

- A high-probability entry setup

- A clear confirmation signal

- A way to minimize risk and maximize profits

Remember: forex trading is about probabilities, not guarantees. Always backtest, practice in demo, and master your strategy before going live. Once you learn how to confidently use the Morning Star as confirmation, your trading skills will level up significantly.