Boosting Your Forex Trading Performance with Rising Wedge Chart Pattern and Smart Money Concept (SMC)

In today’s fast-moving forex market, traders are always searching for ways to improve their trading performance and boost profitability. One powerful tool that has stood the test of time is the Rising Wedge chart pattern. When combined with Smart Money Concept (SMC) entry models like ICT Breakaway Gaps, Fair Value Gaps (FVGs), Order Blocks, and Liquidity, it becomes a high-probability trading strategy that beginners can use to trade breakouts with confidence.

The Rising Wedge chart pattern has been around for decades in the forex industry. It has a proven track record, demonstrating a win rate of approximately 68% based on a backtest conducted on over 500 historical trade setups. This pattern has consistently helped professional traders identify and capture high-quality, profitable trade setups.

On the other hand, the Smart Money Concept (SMC) is a groundbreaking modern trading approach. It is widely used today by traders who want to understand market structure and trade in alignment with institutional movements. Combining these two powerful techniques will not only boost your trading performance but also build your confidence as a trader.

One important reminder for beginners: nothing works 100% of the time in forex trading. The forex market is based on probabilities, not guarantees. There is no perfect trading strategy that always works because market conditions constantly change. This is why consistent learning and practice are key. Always master your strategy on a demo account before going live with real capital. If you can’t stay profitable on demo, you won’t be profitable trading live funds.

Why Combine the Rising Wedge Chart Pattern with SMC?

The answer is simple: precision and profitability.

By making precise entries in the forex market, you minimize risk while maximizing profit. You’ll know exactly where to set your stop-loss (SL) and take-profit (TP) levels.

By making precise entries in the forex market, you minimize risk while maximizing profit. You’ll know exactly where to set your stop-loss (SL) and take-profit (TP) levels.

Forex trading has evolved into a more advanced market where deeper insights are constantly being uncovered. Thanks to the teachings of the Inner Circle Trader (ICT), SMC has shown traders how to identify and follow the footprints of institutional players. (In simple terms, these are the big entities like banks and hedge funds that can significantly influence the market.) Remember, it’s the activities of institutions that often cause retail traders to lose money in the forex market.

SMC allows you to detect the actions of big players and align your trades with their direction instead of trading against them. Institutions have the capital to move prices toward their desired levels. Smart Money Concepts guide you in using institutional reference points such as ICT Breakaway Gaps, Fair Value Gaps (FVGs), Order Blocks (OBs), and Liquidity zones to execute high-probability trades.

While the Rising Wedge chart pattern is already effective as a standalone strategy, combining it with SMC creates an even stronger edge, like adding fuel to an already burning fire. If you are still struggling to understand SMC, or if this is your first time hearing about it, we highly recommend starting with our free masterclass to build a solid foundation of knowledge.

What is the Rising Wedge Chart Pattern?

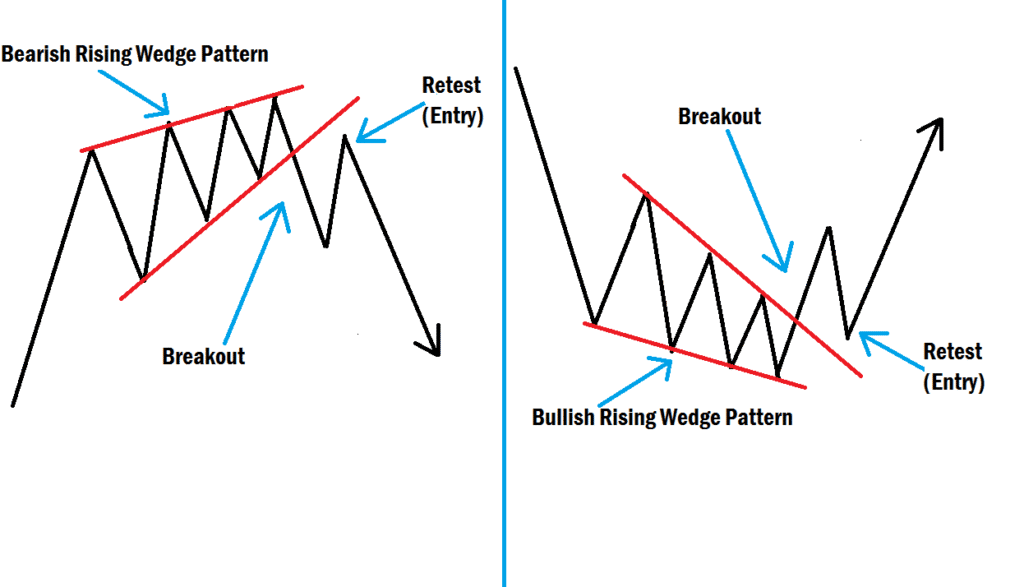

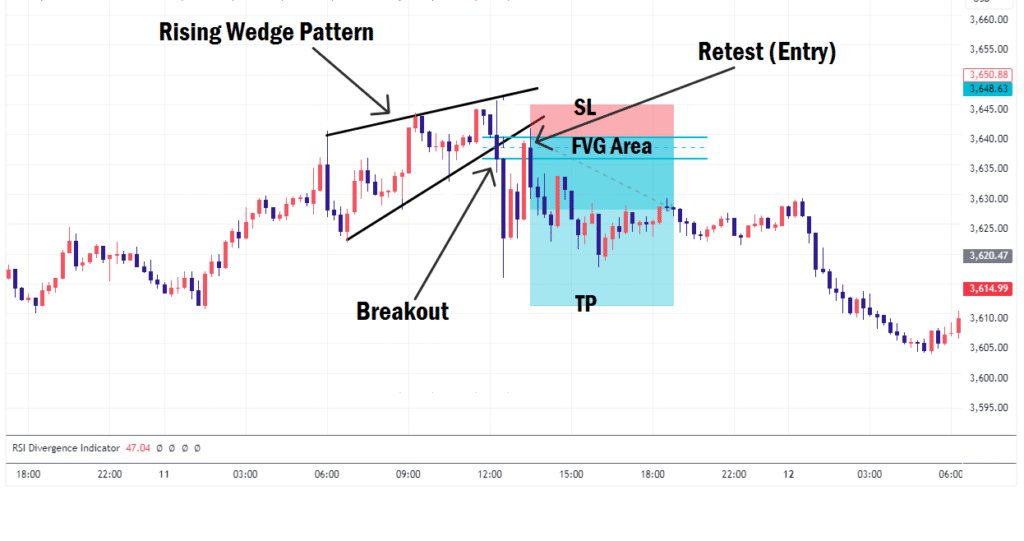

The Rising Wedge is a bearish reversal chart pattern that forms when the market is trending upward but gradually losing momentum. Price makes higher highs and higher lows, but the slope of the highs is weaker than the slope of the lows. This creates a wedge-shaped pattern that slopes upward.

It often signals that the bullish trend is running out of steam, and a downward breakout may follow. In other words, the Rising Wedge warns traders that sellers (bears) are gaining control while buyers (bulls) are losing strength.

Key characteristics of a Rising Wedge:

- Formed during an uptrend.

- Price creates higher highs and higher lows within converging trendlines.

- Volume often decreases as the pattern develops.

- A bearish breakout usually occurs once the lower trendline is broken.

Why the Rising Wedge Works

The reason the Rising Wedge is so effective is that it reflects the real battle between buyers and sellers. While price continues to rise, the upward momentum weakens, showing signs of exhaustion. Institutions often use this as an opportunity to trap retail traders buying at the top before pushing the price lower. Picture this: a bank trading desk observes the overconfident retail traders buying into a rising wave, already planning to reverse their positions. Just as the retail stops are triggered, the bank swiftly pushes the price downward, leaving the traders caught off guard and watching helplessly as their profits dissolve into thin air. This illustrates the invisible force that reinforces the power dynamics in the market.

This is where combining it with the Smart Money Concept (SMC) makes your trading more precise and profitable.

Introduction to Smart Money Concept (SMC)

The Smart Money Concept (SMC) is a modern trading model popularized by the Inner Circle Trader (ICT). It focuses on understanding how institutional traders (big players) move the market and how retail traders can align their trades with them instead of against them.

SMC equips you with tools like:

- ICT Breakaway Gaps – areas where price aggressively leaves a zone, showing strong institutional activity.

- Fair Value Gaps (FVGs) – inefficiencies in price where institutions left imbalances that price often returns to fill.

- Order Blocks (OBs) – the last bullish or bearish candle before a major price move, representing institutional footprints.

- Liquidity – zones where stop-losses and pending orders are placed, often targeted by institutions before a reversal.

By combining the Rising Wedge pattern with these SMC models, you can identify breakout points with more accuracy and avoid common retail trader traps.

How to Trade the Rising Wedge Breakout with SMC

When a rising wedge forms, you are supposed to wait for price to break out of the wedge pattern. Then, enter your trade when price pulls back to retest the breakout area before continuing. Let’s break it down step by step so beginners can apply it with confidence:

1. Identify the Rising Wedge Pattern

First, spot the wedge. Draw two trendlines, one connecting the higher highs and the other connecting the higher lows. You should see the price squeezing into a tighter range while moving upward.

2. Wait for the Breakout

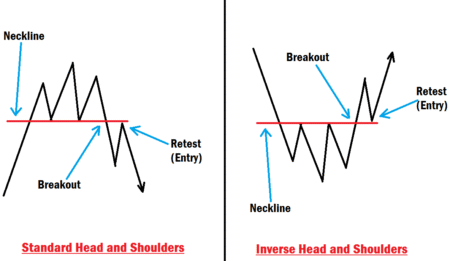

The breakout usually happens when price breaks below the lower trendline. However, don’t rush to enter the trade yet. This is where SMC tools come in to confirm your entry.

3. Confirm with SMC Entry Models

- ICT Breakaway Gaps: Check if there is a breakaway gap forming as price breaks out of the wedge. This signals institutional strength behind the move. Ask yourself: Did price create a Breakaway Gap during the breakout?

- Fair Value Gaps (FVGs): Look for FVGs around the breakout zone. If price retraces to fill these gaps after breaking down, it’s often a perfect entry point. Ask yourself: Did price create an FVG during the breakout?

- Order Blocks (OBs): Mark any bearish order block near the wedge’s upper structure. Price often retests these areas before continuing the bearish move. Ask yourself: Did price create an order block during the breakout?

- Liquidity Grabs: Institutions love to hunt liquidity. If price sweeps liquidity above the wedge highs before breaking down, it adds more confirmation to your setup. Ask yourself: has liquidity been grabbed effectively?

4. Plan Your Entry, Stop-Loss, and Take-Profit

- Entry: After confirmation from SMC tools, enter a sell trade once price retests the breakout zone.

- Stop-Loss (SL): Place your SL above the last swing high or above the wedge structure.

- Take-Profit (TP): Target liquidity zones below, major support levels, or the next fair value gap.

This way, you’re not just relying on the Rising Wedge alone; you’re trading with institutional logic. Don’t forget to always aim two to three times the size of your stop-loss as your take profit. For instance, you are risking $100, targeting $200 to $300 as profit is ideal.

This same entry method is also applicable in a bullish or bearish scenario, but in the opposite direction. If price has been in a bearish trend, a bullish rising wedge chart pattern forms. All you need to do is wait for the upside breakout, then enter your buy trade with SMC entry models during the retest phase. The bearish rising wedge pattern offers the opportunity to sell, while the bullish one offers the opportunity to buy.

Example of Combining Rising Wedge with SMC

Imagine the market is trending upward, and you spot a Rising Wedge forming. As price breaks the lower trendline, you notice an FVG just below the breakout point. Price retraces to fill the gap, taps into a bearish order block, and then continues downward.

By waiting for the SMC confirmations, you avoided a false breakout and caught a high-probability trade aligned with institutional flow.

Why Beginners Should Use This Strategy

- Simplicity: The Rising Wedge is easy to spot on charts.

- Precision: SMC helps you refine entries and avoid false signals.

- Risk Management: You’ll know exactly where to place SL and TP.

- Confidence: Understanding institutional movements builds trust in your strategy.

Final Thoughts

The Rising Wedge chart pattern is already a proven trading strategy, but when combined with Smart Money Concept (SMC) entry models like ICT Breakaway Gaps, Fair Value Gaps, Order Blocks, and Liquidity, it becomes a game-changer for forex traders.

As a beginner, don’t just memorize the pattern; practice it on a demo account and master how to align it with SMC confirmations before going live. Remember, forex trading is based on probabilities, not guarantees. By learning how institutions move the market, you’ll trade smarter, more confidently, and more profitably.

If you’re still struggling to understand SMC or just hearing about it for the first time, we recommend joining our free masterclass to build a strong foundation. With time, practice, and the right knowledge, you’ll be able to turn the Rising Wedge breakout into a powerful edge in your trading journey.