Everything a Beginner Should Know About the Retail Sales (M/M, Q/Q, Y/Y) Economic News Report in Forex Trading

The Retail Sales data report is one of the most influential and closely monitored economic indicators in the financial markets. It plays a major role in shaping currency movements, influencing central bank decisions, and driving volatility across forex, gold, and stock markets.

For beginner forex traders, understanding Retail Sales is extremely important, not because you must trade it, but because it explains why price sometimes moves violently without warning. Many beginners lose money simply because they are unaware that a major economic report, such as Retail Sales, is being released.

This article will break down everything a beginner trader needs to know about the Retail Sales economic news report in the simplest and most practical way possible.

Why Retail Sales Matters So Much in the Financial Market

Retail Sales reflects how much consumers are spending in an economy. Since consumer spending accounts for a large portion of economic activity, especially in developed economies like the United States, the United Kingdom, Canada, and Australia, this data is considered a direct measurement of economic strength.

Institutional investors, hedge funds, banks, and central banks pay close attention to Retail Sales because:

- Strong consumer spending fuels economic growth.

- Weak consumer spending signals an economic slowdown.

- Economic strength influences interest rate decisions.

- Interest rates directly impact currency value.

As a retail trader, you must understand one key truth:

Your individual trades do not move the market. Big players do.

Your individual trades do not move the market. Big players do.

That is why you need to pay attention to what institutions are reacting to, not just technical patterns on your chart.

What Exactly Is the Retail Sales Economic Report?

The Retail Sales economic report measures the total value of goods and services sold by retailers over a specific period. It includes sales from:

- Supermarkets and grocery stores.

- Clothing and footwear retailers.

- Electronics and appliance stores.

- Furniture and household goods.

- Car dealerships.

- Online and e-commerce platforms.

Some Retail Sales reports may also include:

- Core Retail Sales, which exclude volatile items like automobiles or fuel

This report gives a clear picture of consumer confidence and purchasing power within an economy.

Retail Sales M/M, Q/Q, and Y/Y Explained Simply

Retail Sales data is released in different formats to help analysts understand short-term and long-term trends.

Retail Sales Month-over-Month (M/M)

- Compares retail sales to the previous month.

- Highly sensitive to recent economic changes.

- Causes strong short-term volatility.

- Watched closely by day traders and institutions.

Because it reacts quickly to changes in consumer behavior, M/M data often causes sharp price spikes during release.

Retail Sales Quarter-over-Quarter (Q/Q)

- Compares retail sales across a three-month period.

- Smooths out monthly noise.

- Helps identify developing economic trends.

- Useful for swing and position traders.

This data is less volatile than M/M but still very important.

Retail Sales Year-over-Year (Y/Y)

- Compares current sales to the same period last year.

- Removes seasonal effects (holidays, sales seasons, weather).

- Offers a long-term economic perspective.

- Closely watched by investors and policymakers.

Y/Y data is often used to confirm whether an economy is expanding or contracting over time.

Why Retail Sales Is Classified as High-Impact News

Retail Sales is considered high-impact because it directly affects:

- Economic growth expectations.

- Inflation outlook.

- Interest rate forecasts.

- Central bank monetary policy.

Any data that influences interest rates will always move the forex market aggressively.

This is why Retail Sales releases often lead to:

- Sudden volatility.

- Spread widening.

- Slippage.

- Stop-loss hunting.

How Retail Sales Impacts a Currency When It Rises or Falls

What truly moves price is not the number itself, but how the data compares to market expectations (forecast).

When Retail Sales Is Better Than Expected

- Signals strong consumer confidence.

- Suggests economic expansion.

- Supports higher interest rates.

- Attracts foreign capital.

Result: The currency usually strengthens.

When Retail Sales Is Worse Than Expected

- Signals reduced consumer spending.

- Suggests economic slowdown or recession risk.

- Lowers interest rate expectations.

- Reduces investor confidence.

Result: The currency usually weakens

Retail Sales Effect on the US Dollar (USD)

Retail Sales has a major influence on the US dollar because the US economy is heavily driven by consumer spending.

Strong US Retail Sales strengthens the USD, supports a hawkish Federal Reserve, and pressures gold and risk assets. On the other hand, weak US Retail Sales weakens the USD, and Increases rate-cut expectations. It also supports gold and risk-on assets.

Pairs commonly affected include:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- XAU/USD (Gold)

Retail Sales Effect on Gold (XAU/USD)

Gold reacts to Retail Sales through its relationship with:

- The US dollar

- Interest rates

- Inflation expectations

Strong Retail Sales Will Give You:

- Stronger USD

- Higher rate expectations

- Gold tends to fall

Weak Retail Sales Will Give You:

- Weaker USD

- Lower rate expectations

- Gold tends to rise

This explains why gold can move violently during Retail Sales releases.

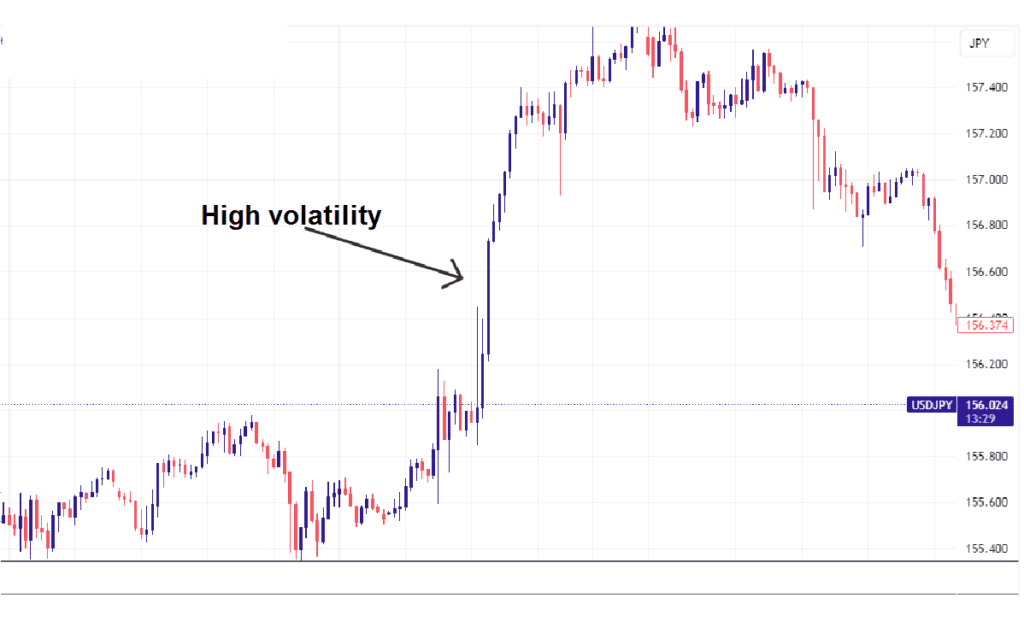

What Usually Happens on the Chart During Retail Sales Release

When Retail Sales data is released, price may:

- Spike aggressively within seconds.

- Create false breakouts.

- Sweep liquidity above highs and below lows.

- Reverse sharply after initial reaction.

- Ignore technical levels temporarily.

This behavior is mostly driven by algorithms and institutional execution, not retail traders.

Why There Is No Recommended Trading Strategy for Beginners

There is no safe or consistent beginner strategy for trading Retail Sales releases because:

- Price behavior is unpredictable.

- Execution quality declines.

- Risk-to-reward becomes distorted.

- Technical analysis often fails temporarily.

Many beginners blow accounts not because they lack knowledge, but because they trade during news releases they do not fully understand.

When and How Often Retail Sales Is Released

Retail Sales is usually released:

- Once per month.

- During the London or New York sessions.

- Classified as red-folder (high-impact) news.

Exact dates and times vary by country.

Where to Check Retail Sales Economic Data

Always monitor Retail Sales using reliable economic calendars such as:

- Forex Factory

- Investing.com

- Government statistical agencies

Pay attention to:

- Previous value

- Forecast value

- Actual value

Why Smart Traders Avoid Trading During Retail Sales

Professional traders often:

- Close trades before release.

- Reduce exposure.

- Wait for the post-news structure.

- Trade the aftermath, not the spike.

Avoiding unnecessary risk is a sign of trading maturity.

Important Risk Warning for Beginner Traders

Forex trading involves significant risk. As a beginner:

- Practice on a demo account first.

- Use proper risk management.

- Avoid over-leverage.

- Respect high-impact news.

- Accept that losses are part of trading.

Capital preservation should always come before profit.

Final Thoughts

Retail Sales is a powerful economic indicator that explains many sudden price movements in the forex and gold markets. You do not need to trade it, but you must understand it.

Knowing when not to trade will save your account faster than any strategy. If you have any further questions regarding this topic, do let us know in the comments section. Stay blessed!