Everything a Beginner Should Know About the Purchasing Managers’ Index (PMI) Economic News Report in Trading

The Purchasing Managers’ Index (PMI) is one of the most influential economic indicators in the financial market. Investors, institutions, and major market participants pay close attention to this report because it provides deep insight into a country’s economic strength, business conditions, and future performance.

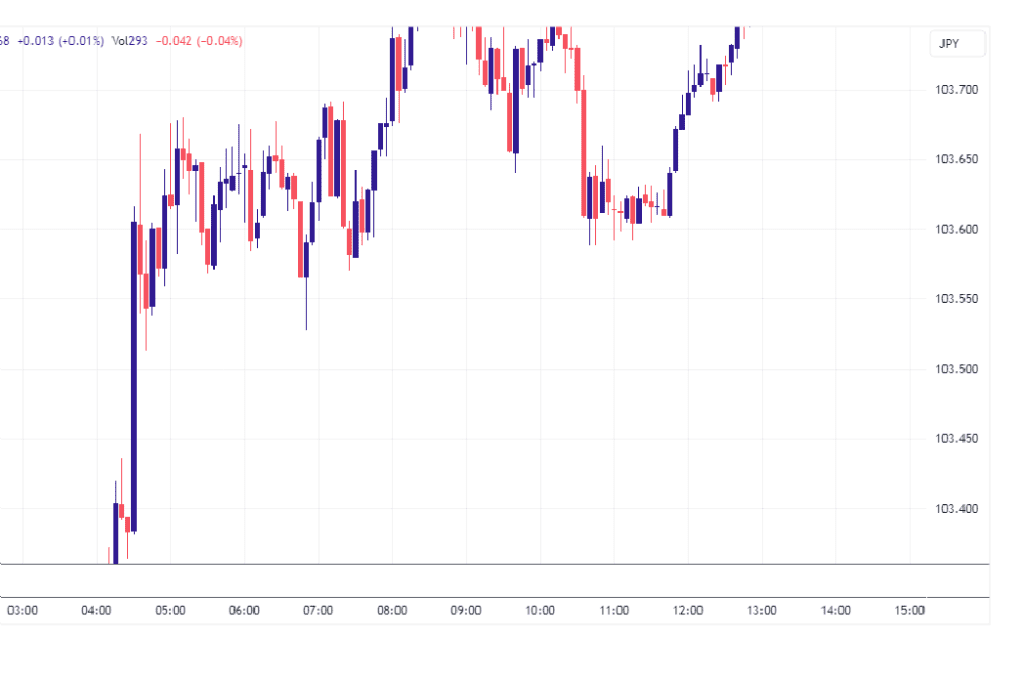

As a retail trader, understanding how the PMI works can help you avoid costly mistakes, especially those sudden price spikes that hit your stop loss or cause slippage without warning. Many traders have placed buy or sell orders, only to return minutes later and find the market has violently reversed against them. In many cases, the cause is a high-impact news release like the PMI report.

This article will break down everything a beginner should know about the PMI, including what it measures, why investors care, how price reacts when it rises or falls, and why you should avoid trading during its release time. Let’s dive in.

What Is the Purchasing Managers’ Index (PMI)?

The Purchasing Managers’ Index (PMI) is an economic report that measures the overall health of the manufacturing and services sectors of an economy. It is based on surveys from purchasing managers, professionals who have direct insight into whether their companies are expanding, contracting, or staying neutral.

The PMI covers areas such as:

- New orders

- Production levels

- Employment

- Supplier delivery times

- Inventory levels

Because purchasing managers sit close to the heart of business operations, their responses help investors understand whether economic activity is improving or slowing down.

Why the PMI Matters in Forex Trading

No investor or institutional player wants to put money into a weak or uncertain economy. Strong PMI data signals economic expansion, which attracts investors and strengthens a country’s currency. Weak PMI data shows slowing business activity, scaring investors away and weakening the currency.

As a beginner trader, you must pay close attention to what the big players are doing. Their decisions move the market, not yours. Understanding PMI helps you align your trades with market direction instead of fighting against it.

How PMI Affects Currency Strength

1. When PMI Rises (Better-than-expected data)

A rising PMI indicates economic growth. This usually results in:

- Stronger currency

- Increased investor confidence

- Bullish momentum in the market

For example, if the UK’s PMI rises sharply, the GBP may strengthen against other currencies like USD or JPY.

2. When PMI Falls (Worse-than-expected data)

A falling PMI signals economic slowdown. This often leads to:

- Weaker currency

- Lower investor confidence

- Bearish movement in the market

This is why traders experience sudden market drops or spikes immediately after the release.

How the Market Reacts When PMI Is Released

The PMI report is considered a high-impact economic news release, meaning it can cause extreme volatility in just a few seconds. This includes:

- Wide spreads

- Heavy slippage

- Sharp price reversals

- Rapid movements with no clear direction

Beginners often get caught in these moves because they don’t check the economic calendar before trading.

When Is PMI Released?

PMI reports are released monthly, usually during the first two business days of the new month. You can track the exact release time on economic calendars such as:

- Forex Factory

- Investing.com

- MyFXBook

Always check before entering trades.

Should You Trade PMI as a Beginner?

No.

There is no proven, reliable, or safe trading strategy for the PMI release. The market becomes extremely unpredictable because:

There is no proven, reliable, or safe trading strategy for the PMI release. The market becomes extremely unpredictable because:

- Liquidity drops.

- Big players reposition their orders.

- Spreads widen drastically.

- Price can spike in both directions.

As a beginner, it is strongly recommended that you close your open trades or stay away until the market stabilizes.

Why Beginners Must Avoid PMI Releases

Trading during PMI can:

- Blow your account if you are over-leveraged.

- Trigger stop losses unexpectedly.

- Cause massive slippage.

- Leads to emotional trading due to sudden losses.

High-impact news events are dangerous for inexperienced traders. Avoiding them protects your capital.

Important Notice for Beginners

Forex trading is risky and not suitable for everyone. Never jump into the live market with real money until you have fully mastered your strategy on a demo account. Remember:

- No strategy works 100% of the time.

- Use proper risk management.

- Protect your capital at all times.

- Trade with discipline and a solid plan.

Now, let’s empower you with clarity as you continue your trading journey, my love.

Frequently Asked Questions (FAQs)

1. What PMI number shows expansion?

A PMI reading above 50 indicates economic expansion. Below 50 indicates contraction.

2. Is PMI good for predicting future market movements?

Yes. PMI is considered a leading indicator, meaning it gives early signals about the future direction of the economy.

3. Which currencies react strongly to PMI?

Currencies from major economies such as:

- USD

- GBP

- EUR

- CAD

- AUD

- JPY

These pairs may experience massive volatility during PMI releases.

4. Can I scalp PMI news?

Scalping high-impact news is risky even for experienced traders. Beginners should avoid it entirely.

5. Is PMI more important than NFP or interest rate decisions?

It depends on the market, but PMI consistently provides strong insight into economic activity and often moves markets significantly.

If you have more questions concerning this topic, feel free to let us know in the comments section.