2 Prop Firm Rules You Must Master Before Buying a Funded Account As a Beginner

Proprietary trading firms (popularly known as Prop Firms) have become an excellent way for beginner forex traders to access large trading capital and scale up their trading careers. However, before diving into any prop firm challenge or evaluation phase, there are two major rules every trader must understand and master. These rules form the foundation of professional trading and determine whether you’ll succeed in getting funded or securing a payout.

Before we get into the rules, it’s important to understand that each prop firm has its own policies and trading conditions. What applies to Prop Firm A might differ slightly from Prop Firm B. Nevertheless, there are two rules that remain common to almost all reputable prop firms.

That’s why every beginner trader should carefully read and understand the terms and policies of any prop firm before purchasing an account, to avoid breaking crucial rules and losing their hard-earned money.

In our previous lesson, we explained “How Prop Firms Operate”, a must-read for every aspiring funded trader. In this article, we’ll focus on the two most important prop firm rules you must master before buying a funded account. Once you’ve fully understood and implemented these principles, you’re already on your way to trading like a true professional.

The two key prop firm rules are:

- Never Close a Trade Manually Before It Hits Take Profit (TP) or Stop Loss (SL)

- Avoid Overtrading

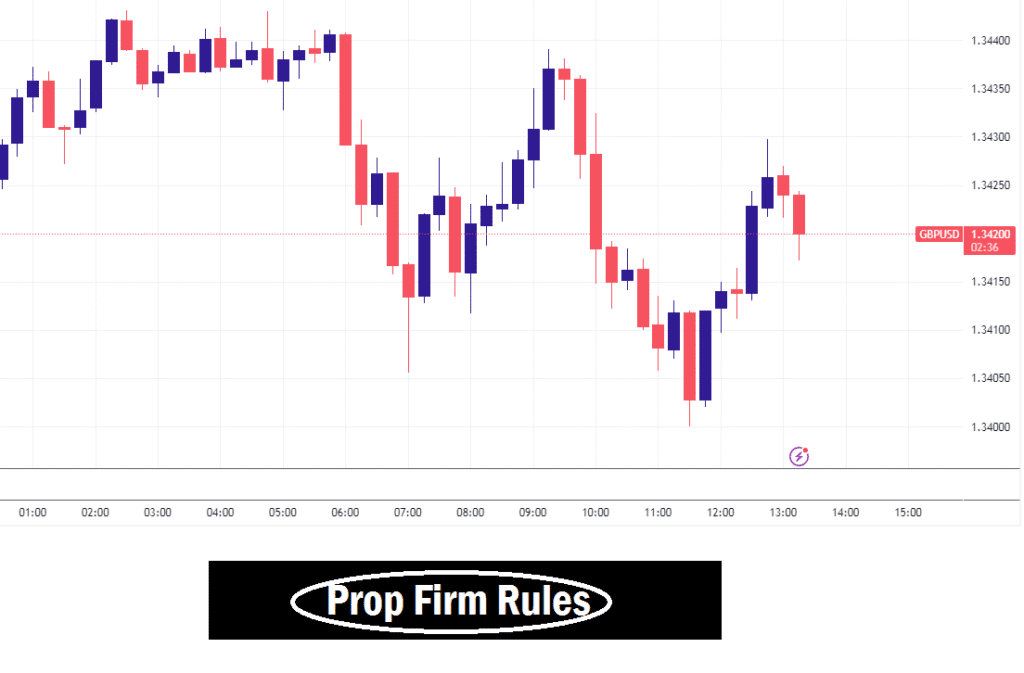

1. Closing a Trade Without Hitting Take Profit (TP) or Stop Loss (SL)

This is one of the most critical and frequently violated prop firm rules. Manually closing your trades before they reach TP or SL levels can easily lead to disqualification, payout denial, or even account termination.

Prop firms take this rule seriously because it reflects a trader’s discipline, patience, and professionalism. Closing trades prematurely is a clear sign of emotional trading, something professional traders avoid at all costs.

In simple terms, if you close trades before they hit your predefined TP or SL, prop firms see it as a lack of trust in your own analysis and poor risk management. This behavior shows you’re trading based on emotion, not strategy, and that’s a red flag. To help maintain discipline, consider implementing a three-step pre-trade checklist: set your Stop Loss and Take Profit levels, walk away from the screen, and review your trades only at the session’s end. By translating the rule into these bite-sized actions, you can mirror how professionals systemize their edge.

Professional traders never close trades halfway. Instead, they only take trades that meet their strict A+ setup criteria. They also never trade without a Stop Loss and Take Profit because they know the market can react unpredictably, especially during high-impact news events.

Imagine entering a trade without a Stop-Loss, and then, unexpectedly, news hits the market. Price could swing aggressively against your position, wiping out a large portion of your capital in seconds. That’s not trading, that’s gambling.

So, to maintain professionalism and secure your prop firm funding or payouts:

Always set your Stop Loss and Take Profit before executing any trade.

Don’t adjust or remove them once the trade is live.

Only trade when the setup truly meets your trading plan criteria.

Always set your Stop Loss and Take Profit before executing any trade.

Don’t adjust or remove them once the trade is live.

Only trade when the setup truly meets your trading plan criteria.

Remember: discipline is part of what separates professional traders from amateurs.

2. Not Overtrading

Overtrading is one of the biggest reasons why many traders fail prop firm challenges. Beginners often make the mistake of wanting to trade every time they open their chart. This habit leads to multiple low-quality trades, frequent losses, and unnecessary emotional stress.

Prop firms are aware of this problem, which is why most of them set a weekly trading limit. Some firms allow 4–7 trades per week, while others may set higher or lower limits. It doesn’t matter whether your trades are profitable, once you exceed that limit, you risk losing your account and forfeiting your payout.

Overtrading is viewed as a lack of patience and discipline, qualities that no professional prop trader should lack.

Professional traders don’t chase trades. They wait for the right setup at the right time. Trading is not about how many positions you take in a day or week, but about how many quality setups you execute successfully.

For example, imagine your prop firm challenge requires a 5% profit target to pass, but because of your overtrading habit, your account equity is already down by 10%. Recovering from that drawdown becomes extremely difficult.

To avoid this:

Trade only high-probability setups.

Follow your trading plan strictly.

Respect the weekly trade limits set by your prop firm.

Trade only high-probability setups.

Follow your trading plan strictly.

Respect the weekly trade limits set by your prop firm.

Remember, less is more in forex trading. The fewer, more precise trades you take, the better your performance and psychological control.

Final Thoughts

To succeed with prop firms, master discipline and patience. Always allow your trades to hit their Stop Loss or Take Profit without interference. Avoid overtrading, as it leads to poor decisions and consistent losses.

Prop firms are built to reward consistency and professionalism, not random gambling. So, before buying any prop firm account, make sure you’ve mastered these two foundational rules.

If you’re still struggling with early trade closures or overtrading, take more time to refine your trading discipline before going for a prop firm challenge. Otherwise, you’ll only end up losing your account and your capital.

Trade smart, trade disciplined, and always trade like the pros.

If you have more questions about prop firm trading or want us to explain specific rules from any firm, feel free to drop a comment below, we’d love to help you grow.