Everything A Beginner Should Know About the Producer Price Index (PPI) Economic News Report in Forex Trading

The Producer Price Index (PPI) is one of the most important high‑impact economic news reports in the financial market, especially in forex trading. It is closely monitored by institutional investors, hedge funds, banks, and other major market participants because it provides early insight into inflationary pressure, production costs, and overall economic health.

As a retail trader, understanding the PPI report is not optional; it is essential. This is because price movements in the forex market are primarily driven by big players, not retail traders. To trade profitably and consistently, beginners must learn to pay attention to what institutional traders are watching and how they react. The PPI is one of those key data releases. By mastering this knowledge, you can gain the vital skill of spotting dangerous volatility before it hits, thus enabling you to make informed and timely trading decisions.

Why the Producer Price Index (PPI) Matters in Forex Trading

The PPI measures the average change in prices received by domestic producers for their goods and services over time. In simple terms, it shows how much producers are paying to produce goods before they reach consumers.

No serious investor or institution is willing to commit large amounts of capital to a country whose economy shows signs of weakness or instability. Since the PPI reflects changes in production costs and inflation at the producer level, it plays a major role in shaping investor confidence, central bank decisions, and currency valuation.

This is why retail traders must align themselves with the direction of institutional money flow. When big players are buying, price goes up. When they are selling, price goes down. Trading against them is one of the fastest ways to lose money in the forex market.

How PPI Can Cause Sudden and Aggressive Price Movements

Imagine placing a buy trade on GBP/USD, only to return moments later and find price has violently moved against your position, sometimes even causing slippage beyond your stop loss. As a beginner, this can feel confusing and frustrating.

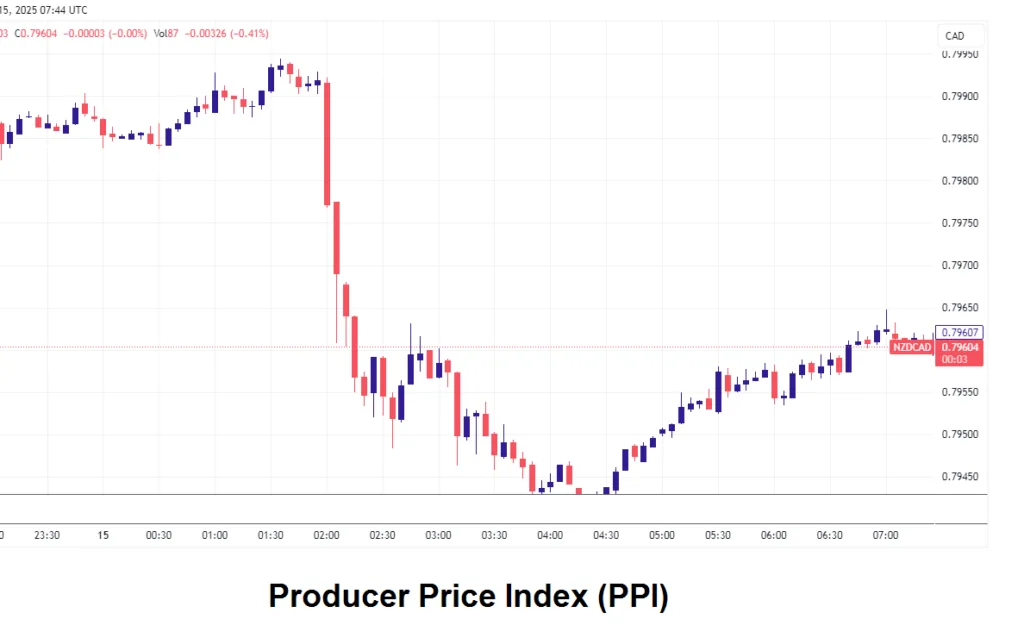

In many cases, such aggressive price spikes are caused by the release of high‑impact economic news, and the Producer Price Index (PPI) is one of them.

When PPI data is released, institutional traders quickly reassess inflation expectations and future interest rate policies. This often leads to rapid repositioning in the market, resulting in sharp price movements within seconds.

The Relationship Between PPI and Inflation

The PPI is considered a leading indicator of inflation. This is because changes in producer prices often flow down to consumers.

- If producers pay more to manufacture goods, those higher costs are usually passed on to consumers.

- This eventually reflects in consumer inflation data such as the Consumer Price Index (CPI).

Because central banks aim to control inflation, PPI data helps them anticipate future inflation trends. As a result, traders and investors use PPI to predict interest rate decisions, which directly impact currency strength.

How the Forex Market Reacts to PPI Data

The market reaction to the PPI depends on how the released data compares with forecasted and previous figures.

When PPI Comes Out Higher Than Expected

- Signals rising inflationary pressure.

- Increases the likelihood of a tighter monetary policy.

- Often strengthens the currency.

When PPI Comes Out Lower Than Expected

- Indicates easing inflation pressure.

- Reduces expectations of interest rate hikes.

- Often weakens the currency.

However, it is important to understand that initial reactions can be volatile and misleading, especially for beginners.

Why PPI Is Dangerous for Beginner Traders

High‑impact news like the PPI can be extremely risky, especially for beginners who:

- Over‑leverage their accounts.

- Trade without stop‑loss orders.

- Enter the market without a clear trading plan.

Within minutes, or even seconds, price can move aggressively enough to wipe out an under‑managed trading account.

This is why it is critical to always check the economic calendar before placing any trade.

PPI Data Release Schedule and Where to Check It

The Producer Price Index is usually released monthly, depending on the country. For forex traders, the most impactful PPI reports are from:

- United States (USD)

- United Kingdom (GBP)

- Eurozone (EUR)

- Canada (CAD)

You can always check upcoming PPI releases on trusted economic calendars such as Forex Factory, where data is categorized by impact level.

Why There Is No Recommended Trading Strategy for PPI

There is no reliable trading strategy specifically designed for trading PPI releases, especially for beginners.

This is because:

- Price spreads widen.

- Slippage increases.

- Market behavior becomes unpredictable.

- Liquidity can temporarily drop.

Even experienced traders often choose to stay out of the market during the release and wait for the post‑news structure and confirmation.

Why Beginners Should Avoid Trading During PPI Releases

As a beginner, your main goal should be capital preservation, not excitement.

Avoid trading during PPI releases because:

- Volatility is extremely high.

- Emotional decisions increase.

- Technical analysis becomes unreliable.

Instead, allow the news to pass, let the market settle, and then look for high‑probability setups aligned with the new market direction.

Frequently Asked Questions (FAQs)

What Is the Producer Price Index (PPI)?

The PPI measures changes in prices received by producers for goods and services, serving as an early indicator of inflation.

Is PPI More Important Than CPI?

PPI is a leading indicator, while CPI reflects consumer‑level inflation. Both are important, but they serve different purposes.

Does PPI Affect Interest Rates?

Yes. Central banks use PPI data to anticipate inflation trends, which can influence future interest rate decisions.

Should Beginners Trade PPI News?

No. Beginners are strongly advised to avoid trading during PPI releases due to high volatility and unpredictable price action.

Important Notice

Forex trading is risky and not suitable for everyone. As a beginner, do not trade live with real money until you have mastered your strategy using a demo account.

No trading strategy works 100% of the time. Always protect your trading capital with proper risk management, disciplined position sizing, and a solid trading plan.

Trade smart. Protect your capital. Let experience, not impulse, guide your journey in forex trading.

If you have any questions regarding this topic, do not hesitate to let us know in the comments section. Remain blessed!