In this session, we will be looking into the Pennant Chart Pattern Modern Trading Strategy.

Boost your trading performance in 2025 by mastering the pennant chart pattern combined with the Smart Money Concept (SMC). According to recent industry data, the average breakout success rate in forex trading has significantly increased, reaching an impressive 70% over the past year. Recognizing this trend, the combination of pennant patterns and SMC becomes even more crucial for maximizing profits. In this session, we will show you how to merge the pennant chart pattern with SMC to achieve optimal trading results.

The pennant chart pattern is a simple yet powerful trading strategy that has provided professional traders with consistent and profitable opportunities in the financial markets over time. It remains one of the most beginner-friendly trading strategies, and once you master the skill of identifying it on the forex chart, it can give you a strong edge in the market.

The most effective way to use a pennant chart pattern in modern-day trading is by combining it with Smart Money Concept (SMC) trading models such as order blocks, fair value gaps (FVGs), liquidity, and ICT breakaway gaps. Bringing these concepts together can significantly boost your win rate while giving you more confidence in your trading approach.

However, one thing beginners must understand is that nothing works 100% of the time in the financial markets. Trading is based on probabilities, not guarantees, which is why it is considered risky and requires consistent mastery. To build this mastery, you must first practice your trading strategy on a demo account before moving into the live market with real money. If you cannot trade profitably on a demo account, it will be nearly impossible to succeed with real capital.

Why Combine Pennant Chart Pattern with SMC?

The answer is simple: precision and profitability.

When you take precise entries in the forex market, you minimize losses while maximizing profits. This professional approach sets you on the right path toward long-term trading success. Combining the pennant chart pattern with SMC is like adding fuel to the fire; it amplifies your trading results.

This is because SMC reveals the footprints of institutional traders (smart money players) who often target retail traders’ stop-losses. Understanding how these big players operate in the market will help you make smarter and more profitable trading decisions.

If you are new to SMC or this is your first time hearing about it, we recommend you start with our free masterclass to gain in-depth knowledge of the Smart Money Concept.

What Is a Pennant Chart Pattern?

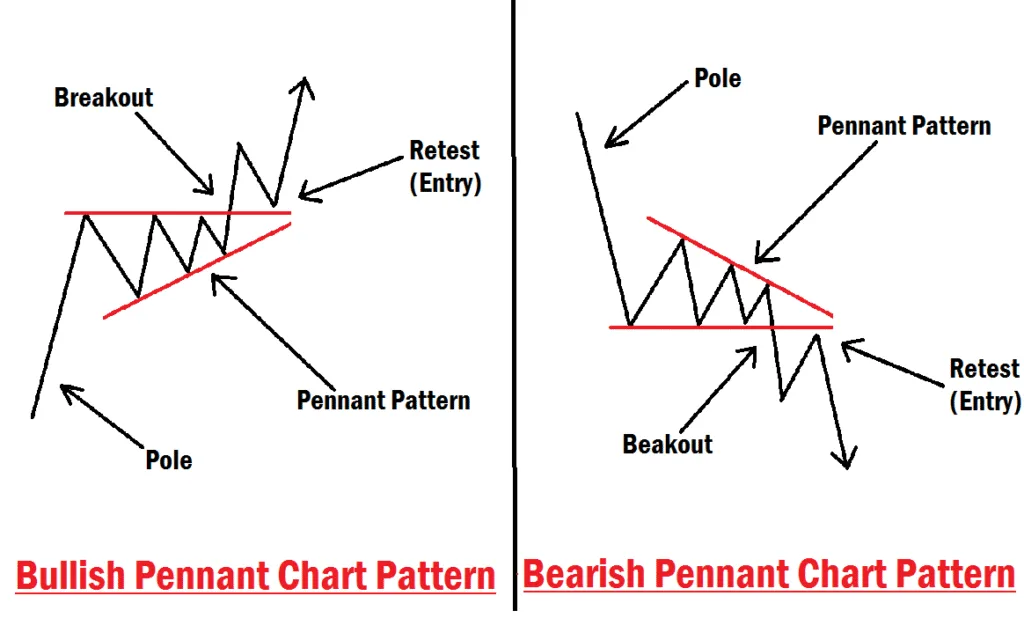

A pennant chart pattern is a continuation pattern that forms after a strong price movement, often called the “flagpole.” Once the flagpole forms, the market goes into a period of consolidation, where price action becomes tighter and creates a triangular shape, which is the pennant.

After this consolidation, the market usually breaks out in the same direction as the initial strong move. That is why the pennant is considered a continuation pattern; it signals that the trend is likely to continue after a short pause.

The pattern has two main parts:

- Flagpole: The strong price move that precedes the pennant formation.

- Pennant: The consolidation phase, where the price forms converging trendlines.

Types of Pennant Chart Patterns

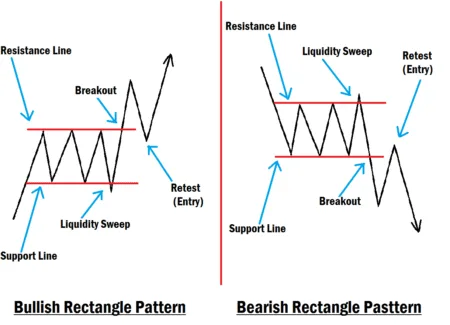

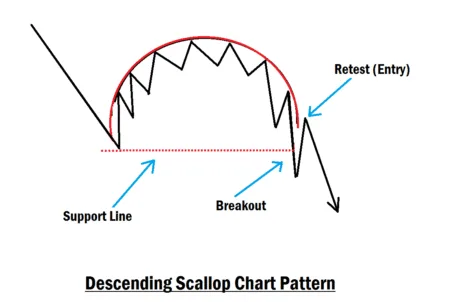

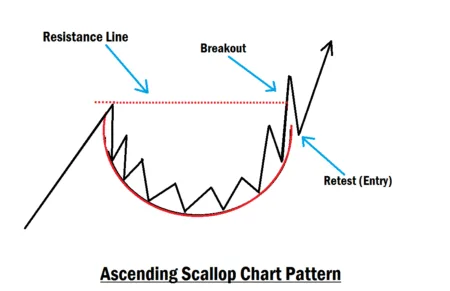

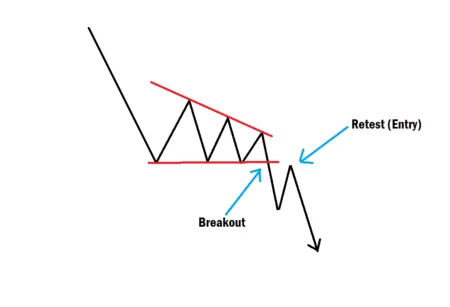

Just like other chart patterns, the pennant pattern comes in two forms: Bullish and Bearish. While their structures are similar, the trading approach is applied in opposite directions:

- Bullish Pennant: Signals a buying opportunity. Wait for a breakout to the upside, then enter your trade on the retest of the resistance line, which now acts as support.

- Bearish Pennant: Signals a selling opportunity. Wait for a breakout to the downside, then enter your trade on the retest of the support line, which now acts as resistance.

The entry method for both scenarios remains the same: wait for a breakout, then trade on the pullback or retest. Make no mistake about it. The pennant chart pattern, when combined with SMC, can give you a professional edge in forex trading.

How to Trade the Pennant Chart Pattern

Trading the pennant pattern is straightforward:

- Identify the flagpole – look for a strong directional move.

- Spot the consolidation – the price should form converging lines (like a small triangle).

- Wait for the breakout – don’t rush in. The market can fake out.

- Confirm entry at retest – enter your trade after the price retests the broken level (support/resistance flip).

- Place your stop-loss wisely – just below the structure for bullish setups, or just above for bearish setups.

- Set a realistic target – often, the size of the flagpole can be used to project your target.

How To Combine Pennant Pattern with Smart Money Concept (SMC)

While the pennant chart pattern is powerful on its own, combining it with SMC principles gives you more precision and confidence. The Smart Money Concept focuses on how institutional traders (the big players) move the markets.

When you combine SMC with the pennant pattern, you’re not just trading breakouts blindly; you’re aligning with the footprints of the big money. This improves your win rate and helps you avoid common mistakes made by retail traders.

Here’s how SMC fits in:

- Order Blocks: Look for bullish or bearish order blocks around the breakout area to confirm the strength of the move.

- Fair Value Gaps (FVGs): Use FVGs as potential entry zones after the breakout. If the market pulls back into an FVG after breaking out of the pennant, it often provides a high-probability setup.

- Liquidity: Understand where liquidity rests (above highs or below lows). Breakouts often target these zones, so aligning pennant breakouts with liquidity sweeps gives you cleaner exits.

- ICT Breakaway Gaps: When price breaks out with a strong gap, such as a breakaway gap, it can signal institutional activity and strengthen the pennant breakout confirmation. Make your trade entry when price pulls back to mitigate the breakaway gap.

Example: Using Pennant + SMC for Entry

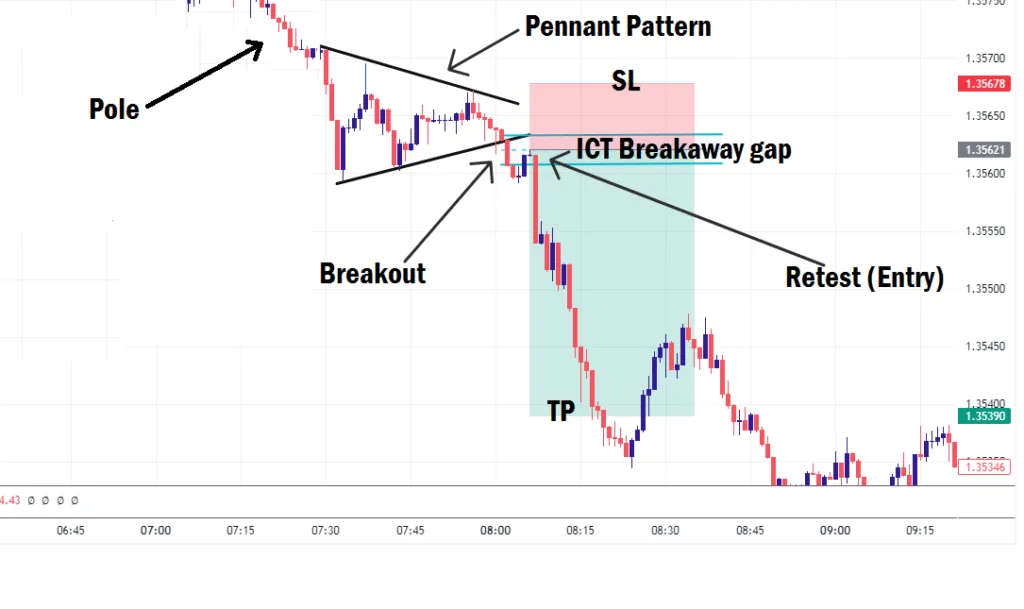

Let’s say GBP/USD forms a bearish pennant after a strong downward rally.

- You spot the flagpole and the consolidation (pennant).

- Price breaks downward, but instead of jumping in immediately, you wait.

- You notice there’s a bearish order block just above the breakout zone, followed by a breakaway gap.

- Price retests the broken resistance, tapping into the gap and fill the breakaway gap.

- You enter your sell trade there, placing your stop-loss just above the order block.

- Your target is measured by the size of the flagpole, providing a realistic take-profit level. You can also target three times the size of your stop-loss as take-profit.

This is a perfect example of how combining the pennant with SMC turns a simple breakout strategy into a precise, institutional-level entry model.

Key Takeaways for Beginners

- The pennant chart pattern is one of the easiest continuation patterns to spot, making it beginner-friendly.

- Always wait for the breakout and retest before entering; this reduces fake-out risk.

- Combining pennants with SMC tools such as order blocks, FVGs, liquidity zones, and breakaway gaps increases accuracy.

- Practice on a demo account before risking real money. If you can’t master it on demo, don’t expect to succeed in live trading.

- Trading is about probabilities, not certainties. No strategy works 100% of the time.

Final Thoughts

The pennant chart pattern is simple and effective, but when combined with the Smart Money Concept, it becomes a highly effective strategy for modern-day forex trading. It allows you to trade alongside institutional footprints while minimizing risk and maximizing reward.

If you’re a new trader, start by practicing how to identify pennant patterns, then gradually layer in SMC concepts to sharpen your edge. With patience, consistency, and discipline, this strategy can become one of your most reliable tools in 2025 and beyond.

If you have more questions regarding this topic or want us to cover a specific topic for you on this platform, let us know in the comments section. Learn to trade with precision.