Understanding Non-Farm Payroll (NFP) Economic News as a Beginner Forex Trader

Just imagine this as a new trader:

You place a clean buy trade on GBP/USD, feeling confident because your analysis looks solid. But after a short while, you return to check your chart, and suddenly, price has moved violently against you, blowing past your stop loss and even causing slippage. As a beginner, you may stare at your screen wondering, “What on earth caused this massive spike?”

You place a clean buy trade on GBP/USD, feeling confident because your analysis looks solid. But after a short while, you return to check your chart, and suddenly, price has moved violently against you, blowing past your stop loss and even causing slippage. As a beginner, you may stare at your screen wondering, “What on earth caused this massive spike?”

Most times, the culprit is simple: NFP.

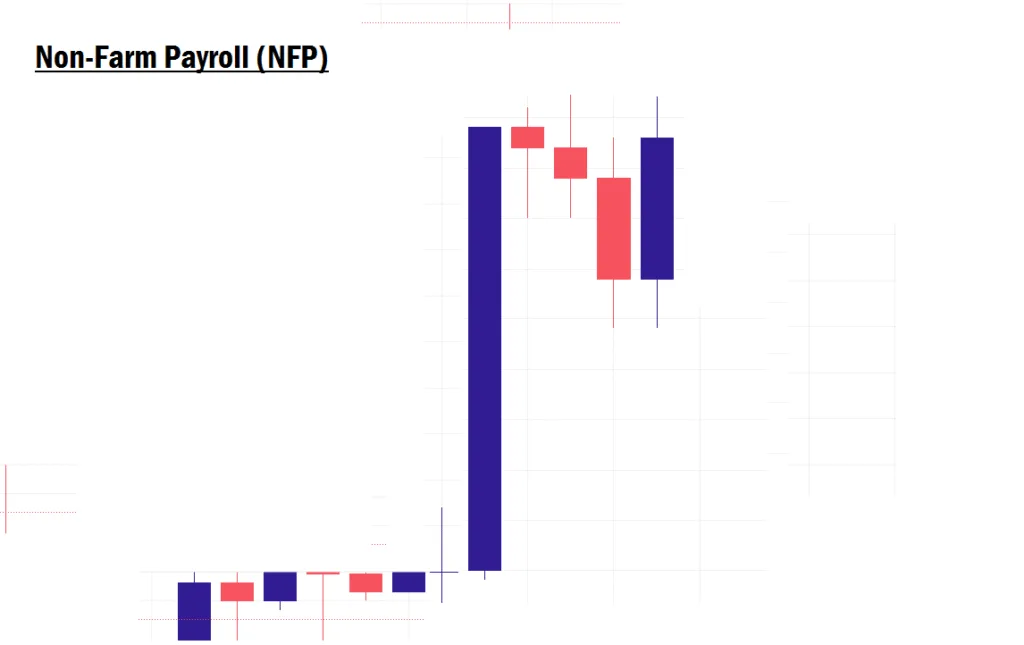

The Non-Farm Payroll (NFP) report is one of the most volatile and market-shaking economic news releases in the entire forex market. For instance, there have been instances where the NFP announcement has caused currency pairs like EUR/USD to spike over 120 pips in just 90 seconds. As a beginner trader, it is absolutely crucial for you to understand how high-impact news, especially NFP, affects price movement and overall market behavior.

NFP can move the market with unbelievable force, so much force that a single release can wipe out a beginner’s entire account within minutes, especially if you’re trading without a stop loss or using poor risk management.

Among all high-impact economic events, NFP stands out as one of the most influential. It is officially known as the Non-Farm Employment Change, and in this article, I will break down everything you need to know about it as a beginner trader, what NFP actually is, why it matters, how it impacts price behaviour, and why you should stay far away from trading during its release until you gain more experience.

What Is NFP in Forex Trading?

The Non-Farm Payroll report is a key U.S. economic indicator released monthly. It measures the change in the number of employed people, excluding farm workers, private household employees, and government workers. This employment data is closely watched as it provides valuable insights into the overall health of the U.S. economy, influencing the Federal Reserve’s monetary policy decisions, particularly interest rate expectations. Understanding this connection helps traders anticipate potential movements in the forex market based on predicted changes in interest rates.

Because it reflects the overall strength of the U.S. economy, it directly affects the U.S. dollar, which in turn impacts almost every major currency pair in the forex market.

How NFP Affects Price Movement

NFP can cause:

- Massive market spikes

- Extreme volatility

- Widened spreads

- Stop loss slippage

- Irregular price behaviour

- Fakeouts and false breakouts

During the first few minutes after the release, price can behave like a wild beast, jumping 50 to 100 pips in seconds. Beginners who do not understand this often get caught in devastating losses.

Why Traders and Investors Care About NFP

The forex market is driven by expectations, economic strength, and investor confidence. NFP gives insight into:

- Employment levels

- Economic health

- Consumer spending power

- Interest rate expectations

This is why banks, institutions, hedge funds, and big-money traders pay close attention to it, and why the market reacts so aggressively when the report is released.

NFP News Trading Strategy

We have to be completely honest with you, there is no reliable or recommendable trading strategy for NFP news, especially for beginner traders. And the reason is simple: during NFP, price becomes wildly unpredictable.

When the NFP report is released, the market can shoot aggressively in any direction without giving any clear technical signal. Even the cleanest chart setups can fail instantly because institutional traders and algorithms react within milliseconds, causing extreme volatility.

During these moments, no trading strategy performs consistently. Anything you try to execute becomes pure guesswork, and guesswork in forex is dangerous.

The price spikes during NFP are often so massive and so fast that:

- Your stop loss may not trigger where you placed it.

- Slippage can occur, causing a bigger loss than expected.

- The spread can widen drastically.

- Market structure temporarily breaks.

- Candles can jump dozens of pips in seconds.

This makes trading NFP extremely risky for your capital. No matter how good your strategy is, NFP can invalidate it within a heartbeat.

Why Beginner Traders Should Avoid Trading NFP

As a beginner, you should avoid trading during NFP because:

- Price becomes unpredictable.

- Technical analysis becomes unreliable.

- Spread widens significantly.

- Your stop loss may not protect you.

- Reversal patterns can fail instantly.

- Market sentiment changes rapidly.

You can always learn to trade the news later when you become more experienced, but during your early stages, it is safer to stay out of the market during NFP.

Important Notice

Forex trading is a high-risk activity that may not be suitable for everyone. As a beginner, never jump into the live market with real money until you have properly tested and mastered your strategy on a demo account.

Remember, nothing works 100% of the time in forex. Protect your capital with solid risk management, a well-defined trading plan, and strict discipline.