Understanding What Risk Management Is in Forex Trading

In this session, we will be diving into “Explaining What Risk Management means in Forex Trading.”

No matter how skilled you are as a trader, if you do not have a full understanding of risk management in forex trading, you will continue to struggle in the market. Let’s consider an example: imagine a new trader called Sam who mastered his trading strategy but ignored risk management. After entering a trade, a high-impact news release hit social media. The market reacted sharply against his position, and within minutes, his entire trading account was wiped out. When Sam checked his chart, he was shocked to find his account balance gone. This simple scenario illustrates the importance of risk management in the foreign exchange market.

In this lesson, we’ll walk you through the meaning of risk management in forex and how to apply it correctly. By the end, you’ll be able to calculate and cap your maximum loss on any forex trade. Let’s get started.

What Is Risk Management in Forex Trading?

Risk management in forex is the act of identifying, analyzing, accepting, and minimizing the uncertainties that come with trading in order to protect your capital. These uncertainties can arise from various forex hazards such as liquidity void, where sudden price displacement can lead to unexpected losses, or slippage, where the executed price differs from the intended price. The goal of risk management is simple: reduce losses and maximize gains.

Risk management involves using strategies such as:

- Setting stop-loss orders

- Applying the right risk-to-reward ratio

- Choosing the correct lot size and leverage

- Starting with a trading strategy that has at least a 50% win rate

- Risking 1% of your trading account per trade

For example, as a retail trader, you should only risk 1% of your trading account per trade. Imagine risking 10% of your capital on a single trade; it would only take 10 losing trades in a row to wipe out your entire account. But risking 1% will only take 10% of your trading capital, giving you more room to trade further.

Trading without stop-loss orders is another dangerous mistake many beginners make. Anything can happen in the market, unexpected news, economic reports, or sudden volatility, and without a stop-loss, a single trade can cause catastrophic losses.

Why Risk Management Matters in Forex Trading

By understanding risk management, you gain the confidence to face uncertainties that can negatively affect your open positions. It also helps you maintain consistent profitability, as long as your trading strategy has a good win rate.

Forex trading is based on probabilities, not guarantees. That’s why it is considered a high-risk venture and is not suitable for everyone. Before you risk your real money, you must practice and master your trading edge using a demo account. Success in forex thrives on consistent practice, which leads to mastery.

How to Apply Proper Risk Management in Forex Trading

Proper risk management is what determines long-term success in forex. Just as running a physical business requires careful capital protection to ensure consistent growth, trading also necessitates careful capital management to ensure consistent growth. Below are four simple but powerful ways to manage risk:

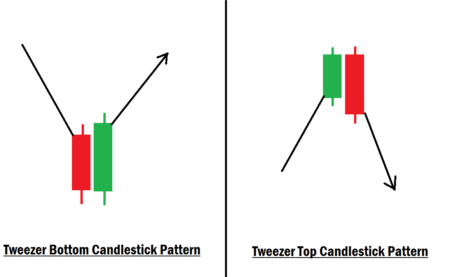

1. Use a Quality and Simple Trading Strategy

Your trading strategy is the foundation of your risk management. A poor win rate makes it nearly impossible to be profitable. A solid trading strategy should:

- Have at least a 50% win rate

- Be backtested to prove the profitability over a long period

- Be simple and easy to follow

A complicated strategy often leads to confusion and mistakes. Keep it simple, master it, and you’ll reduce unnecessary losses.

2. Apply a Good Risk-to-Reward Ratio

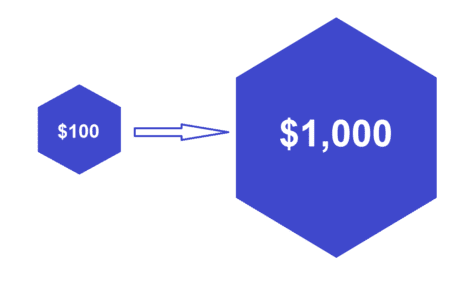

Even with a 50% win rate, a poor risk-to-reward ratio like 1:1 will still keep you unprofitable. A good risk-to-reward ratio will keep you consistently profitable. The recommended ratio is 1:2 or 1:3.

For example:

- Trading with $100 capital, you risk 1% ($1) per trade.

- With a 1:2 ratio, you aim to make $2 for every $1 risked.

- If you take 10 trades in a month and win 5 while losing 5, your losses total $5, but your wins give you $10.

That leaves you with a net profit of $5, or a 5% return on your trading account, despite a 50% win rate. This demonstrates how a strong risk-to-reward ratio ensures your profits outweigh your losses.

3. Use the Right Lot Size for Your Trading Capital

Thanks to leverage, many beginners overtrade by using larger lot sizes than their accounts can handle due to the fact that stop-loss sizes vary depending on market conditions.

Imagine spotting a great trade setup, but the stop-loss size represents 3% of your account. Instead of skipping the opportunity or risking too much, the smarter move is to reduce your lot size so that the risk aligns with the recommended 1% per trade.

This ensures you don’t miss quality setups while still protecting your capital. Remember: risk less to gain more, not the other way around.

4. Always Use a Stop-Loss

Trading without a stop-loss is gambling, not trading. No matter how confident you are in your analysis, market conditions can shift suddenly.

Picture this: you open a trade without a stop-loss. Minutes later, breaking news triggers unexpected volatility, and your account suffers a 10% loss. At that point, you’re forced to close at a huge loss.

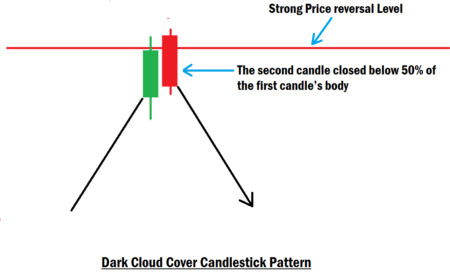

A stop-loss order protects your trading account from unpredictable market events. Always combine stop-loss with take-profit levels; it’s the professional way to trade forex and reduce the effect of sudden price displacement that goes against your prediction.

Final Thoughts

Risk management is the bedrock of consistent profitability in forex trading. Before risking your money, you must practice and master risk management until it becomes second nature.

In a market built on probabilities, managing risk is what shields you from the worst outcomes while keeping you profitable in the long run.

If you have further questions about forex risk management or would like us to cover another trading concept, drop your thoughts in the comment section. See you in the next session, and remember: always protect your trading capital.