Mastering the ICT Breakaway Gap in Foreign exchange market

Transform your trading uncertainty into confident decision-making with mastery of the ICT Breakaway Gap. This crucial concept in forex trading helps you secure high-probability trade entries, reshaping your understanding of the market and leading to consistent profitability. By understanding these gaps, or price delivery imbalances, you can elevate your trading strategy from confusion to clarity.

However, one of the most common mistakes beginner traders make is confusing a Breakaway Gap with a Fair Value Gap (FVG). Imagine spotting a Breakaway Gap but mistaking it for an FVG. You take your entry when price pulls back into what you think is a Fair Value Gap, only for the market to reverse and stop you out. The truth is, what you thought was an FVG could have actually been a Breakaway Gap.

It’s important to remember that in forex, no strategy works 100% of the time. Trading is based on probabilities, not guarantees. This is why beginners are always advised to practice and master their edge in a demo account before trading with real money.

In this lesson, we’ll break down the ICT Breakaway Gap so you can understand it clearly. You’ll learn what it is, how to identify it, and how to trade it effectively. Let’s dive in.

What Is an ICT Breakaway Gap in Forex?

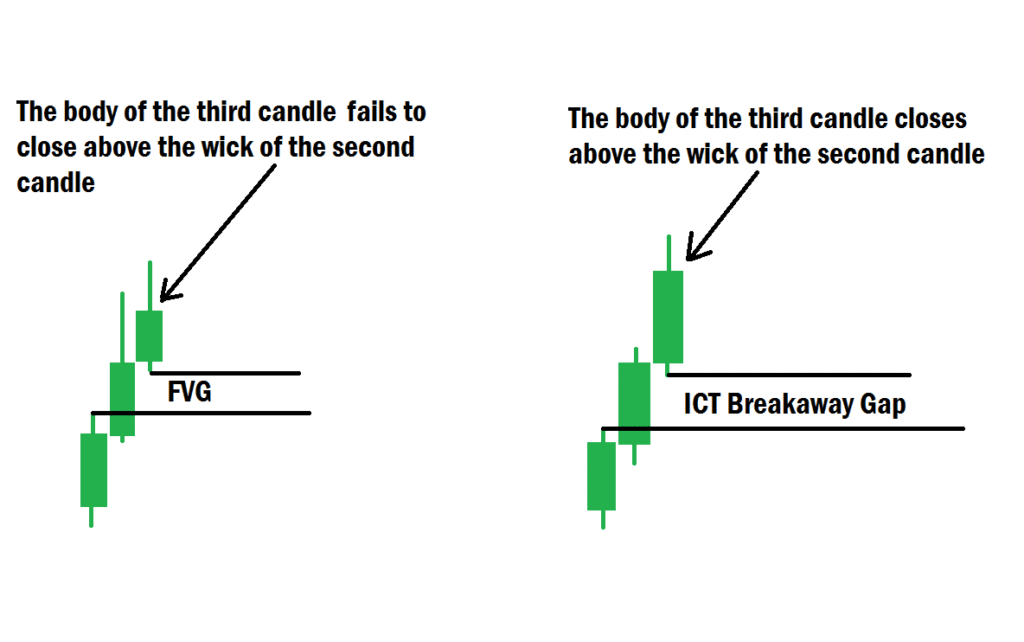

The ICT Breakaway Gap is an imbalance in price delivery that resembles a Fair Value Gap. It occurs in a three-candlestick sequence. Imagine this sequence as a runner preparing for a race: the first candlestick is like the initial burst of energy at the start; the second candlestick depicts the steady stride, showing potential momentum; and the third candlestick represents the powerful launch as it pushes forward, with its wick failing to overlap with the first candlestick and its body closing beyond the wick of the second candlestick. In essence, a Breakaway Gap is a form of FVG created after a strong price move, but unlike regular FVGs, price often does not return to mitigate it because of the momentum driving the move.

Types of Breakaway Gaps in Forex

Just like Fair Value Gaps, Breakaway Gaps come in two types: bullish and bearish.

- Bullish Breakaway Gap: Occurs in a bullish three-candlestick sequence where the third candlestick’s wick does not overlap with the first candle’s wick, and its body closes above the wick of the second candlestick.

- Bearish Break Away Gap: Occurs in a bearish three-candlestick sequence where the third candlestick’s wick does not overlap with the first candle’s wick, and its body closes below the wick of the second candlestick.

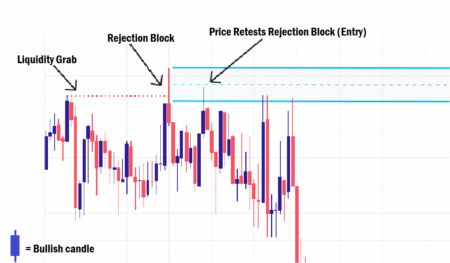

Breakaway Gap (BWG) vs. Fair Value Gap (FVG)

At first glance, a Breakaway Gap looks very similar to a Fair Value Gap. Both are formed in a three-candle sequence. However, the key difference lies in the third candlestick’s close.

- Fair Value Gap (FVG): The third candlestick’s body fails to close above (bullish) or below (bearish) the wick of the second candle.

- Break Away Gap (BWG): The third candlestick’s body does close above (bullish) or below (bearish) the wick of the second candle.

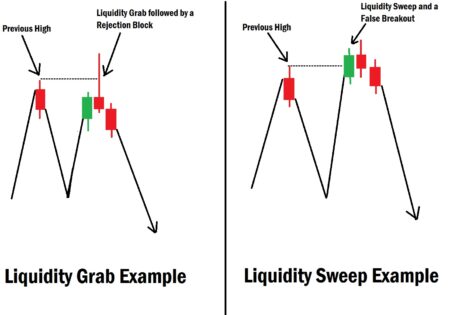

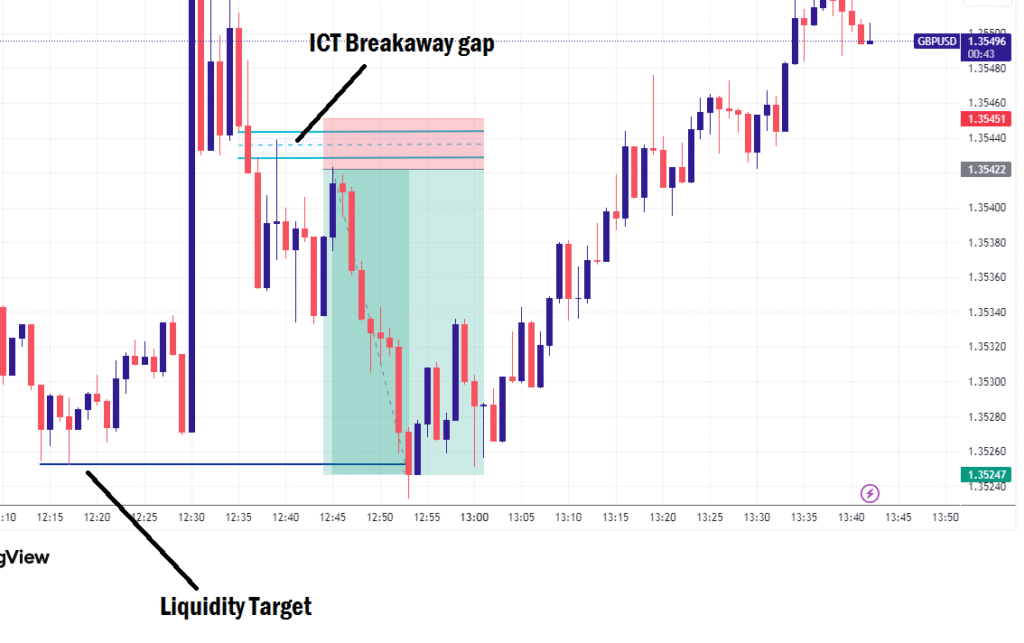

This subtle difference is powerful. A Break Away Gap signals momentum and often indicates that price is targeting liquidity (such as a swing high or low) before considering a retracement to fill imbalances. Once price clears its liquidity target, the probability of the Breakaway Gap holding as support or resistance reduces significantly.

Why Does a Breakaway Gap Occur?

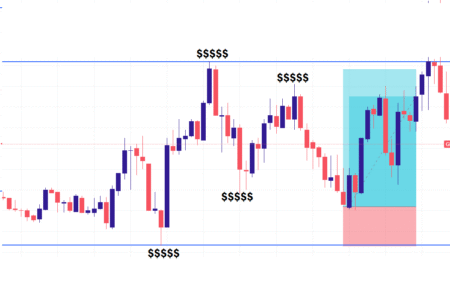

According to ICT, Breakaway Gaps occur when the market shows strong momentum while targeting liquidity at a swing high or swing low. Smart money players deliberately re-price an asset, driving price aggressively to sweep liquidity levels before reversing or retracing. For example, if smart money players re-priced the market, creating a distinct Breakaway Gap. The market will aggressively target a swing low or high, sweeping liquidity levels by triggering stop orders from retail traders. Following this sweep, the price retraced momentarily before continuing its original momentum, providing a clear illustration of this trading concept in action..

Think of it like this:

Mr. Paul is heading to the mall to buy some items. Just before he arrives, he remembers he forgot his watch at home. However, since the items at the mall are more important than the watch, he chooses to get the items first before returning home.

Mr. Paul is heading to the mall to buy some items. Just before he arrives, he remembers he forgot his watch at home. However, since the items at the mall are more important than the watch, he chooses to get the items first before returning home.

- The items represent the liquidity target.

- The watch represents the imbalance created by price.

- Mr. Paul represents the smart money players.

Just like Paul prioritizes the items before the watch, smart money prioritizes liquidity before imbalances. Only after securing liquidity do they consider returning to fill gaps.

How to Trade ICT Breakaway Gaps Effectively

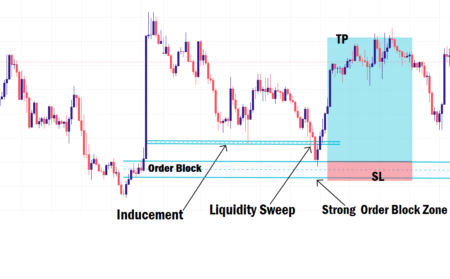

Trading Breakaway Gaps is very similar to trading Fair Value Gaps since both involve imbalances. However, the key to success lies in prioritizing liquidity. Cultivating a mindset shift is essential here: always consider liquidity first before imbalances. Make it a habit to consistently ask yourself, ‘Where is liquidity hiding?’ before every chart scan. This ritual not only anchors the priority of focusing on liquidity but also fosters disciplined decision-making.

Here’s a simple approach:

- Identify the Breakaway Gap – Spot the bullish or bearish sequence on your chart.

- Check for Liquidity Targets – Mark nearby swing highs (bullish) or swing lows (bearish).

- Wait for Price Action – If price sweeps liquidity first, the gap may no longer hold. But if price approaches the Breakaway Gap before liquidity is taken, it could present a solid trading opportunity.

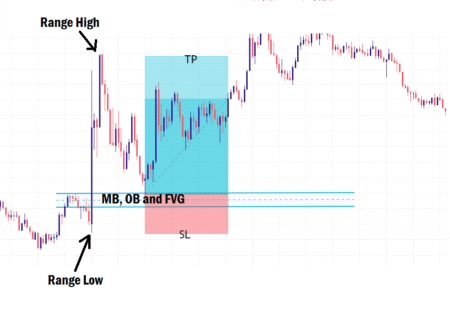

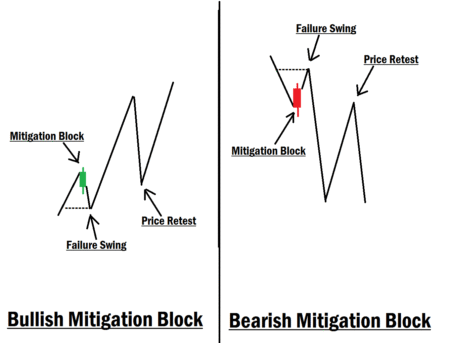

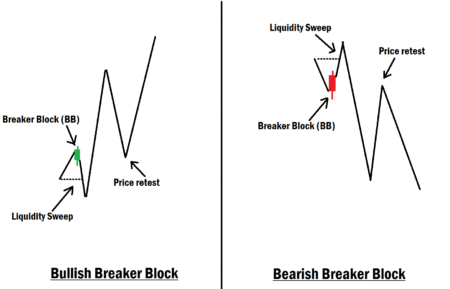

- Look for Confirmation – Drop to a lower timeframe inside the gap. Look for a mitigation block, breaker block, or a Market Structure Shift (MSS) to confirm your entry. Your stop loss should be beyond the second candle in the breakaway three-candle sequence, and your take profit at the liquidity target. Consider risking one for a potential return of three at the liquidity target. This 1:3 risk-reward ratio provides a clear framework for evaluating your trade setups.

Always remember: once liquidity is swept, price often reverses completely, leaving Breakaway Gaps ineffective.

Final Thoughts

One of the biggest mistakes beginner traders make is confusing a Fair Value Gap with a Breakaway Gap. While they look similar, a Breakaway Gap is a liquidity-driven imbalance.

Key takeaways:

- Always prioritize liquidity over imbalance.

- Avoid relying on Breakaway Gaps for entries once price has already hit its liquidity target.

- Understand that imbalances are secondary to liquidity; the market’s primary objective is always liquidity.

By mastering ICT Breakaway Gaps, you’ll not only improve your chart analysis but also avoid costly mistakes that most beginners fall into.

If you have questions about Break Away Gaps or want us to cover another ICT concept, feel free to leave a comment below. Always approach the market with caution, and let liquidity guide your decisions.

In our next session, we will explore “market structure shift (MSS).” Let’s go!