In today’s session, we will delve into “Mastering the Head and Shoulders Chart Pattern Strategy in Forex.”

The Head and Shoulders chart pattern is one of the simplest yet most powerful trading strategies every beginner forex trader should learn. Its popularity stems from how easily it can be identified on the chart and how effectively it can identify potential market reversals. Many professional traders rely on this pattern to catch profitable moves in the forex market.

However, always remember: no trading strategy works 100% of the time.

Forex trading is based on probabilities, and that inherently makes it a risky venture. The higher the probability of your trade setup, the more confidence you’ll have to enter the market. As professional traders, we only take high-probability setups and walk away from low-probability ones. That’s the secret behind consistent profitability.

We highly recommend practicing and mastering this pattern using a demo account before applying it to a live trading environment. That way, you can gain experience and confidence without risking real money.

What Is the Head and Shoulders Chart Pattern in Forex?

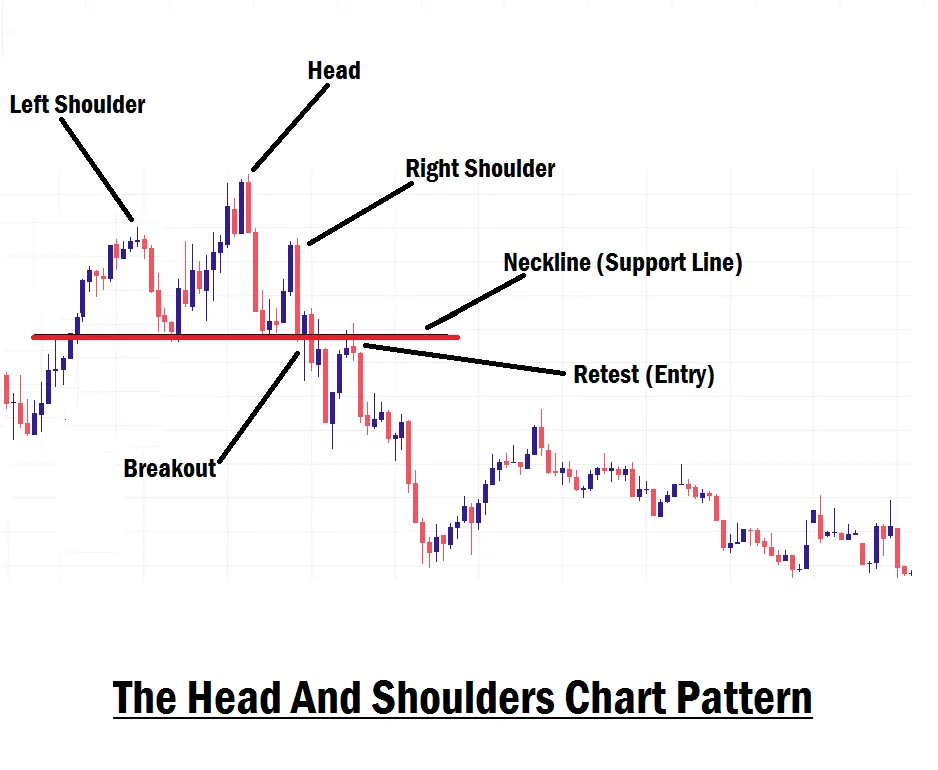

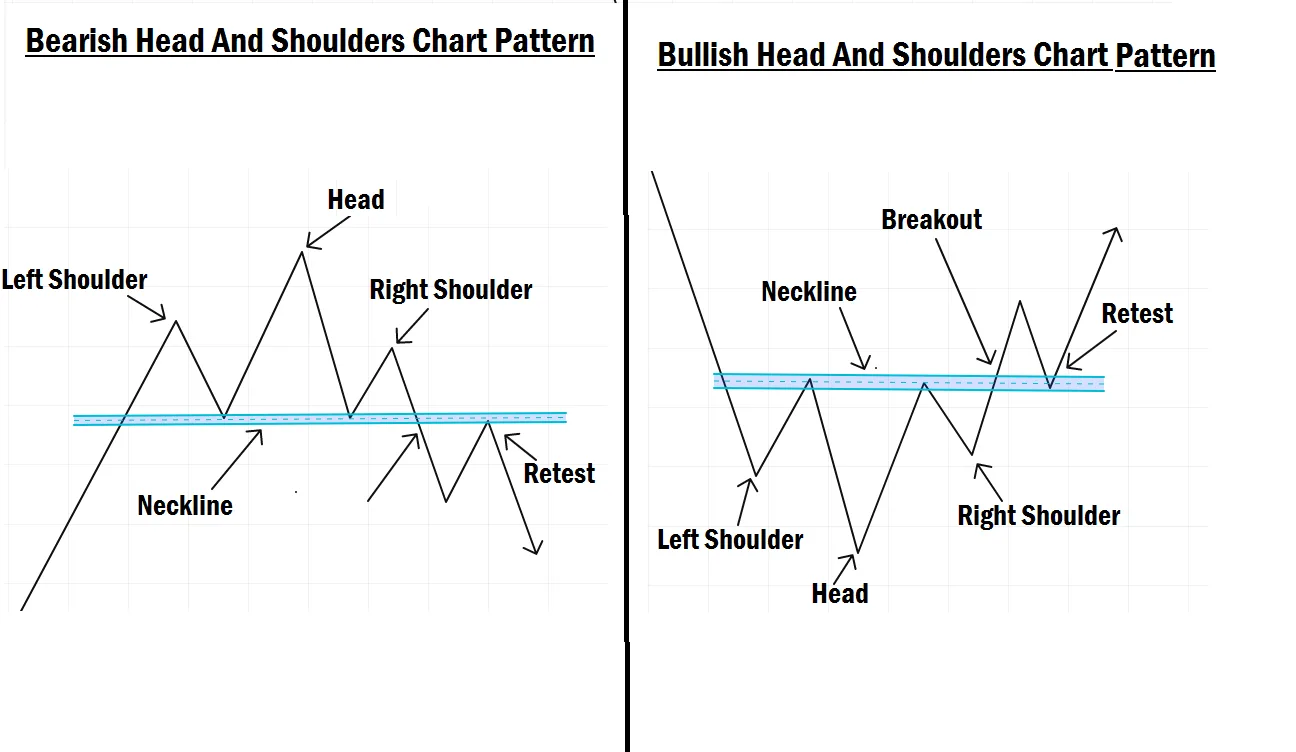

The Head and Shoulders pattern is a popular reversal formation that typically signals a bearish reversal in an uptrend. Three peaks characterize it:

- A central high peak known as the “head”

- Two flanking peaks on either side of the head are known as the “shoulders.”

- A neckline, which connects the two lows between the peaks.

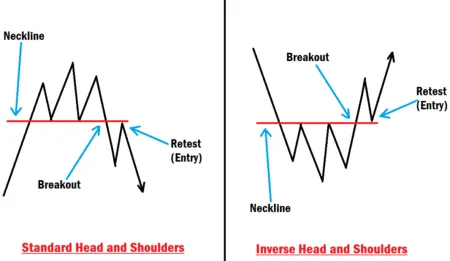

Once price breaks below the neckline, it often signals a potential downward move.

On the flip side, we have the Inverted (or Reverse) Head and Shoulders pattern, which signals a bullish reversal. In this setup:

- The market forms a low (left shoulder), followed by a lower low (head), and then a higher low (right shoulder).

- A break above the neckline, which connects the highs between the lows, signals a potential uptrend and possible entry for a long (buy) trade.

Structure of the Head and Shoulders Pattern

Bearish Head and Shoulders

- Left Shoulder: Price makes a swing high, then retraces to form a support (neckline).

- Head: Price rallies to a new higher high, then pulls back again.

- Right Shoulder: Price attempts another move up but fails to create a higher high, forming a lower high instead.

Bullish (Inverted) Head and Shoulders

- Left Shoulder: Price makes a swing low, then retraces upward to form resistance (neckline).

- Head: A lower low is created, followed by a pullback.

- Right Shoulder: Price fails to create another lower low, instead forming a higher low.

Keep in mind: the two shoulders don’t always have to be perfectly symmetrical in height or width. Likewise, the neckline may be slightly slanted rather than perfectly horizontal. What matters most is understanding the behavior of price action around these levels, particularly at the right shoulder and neckline.

Interpreting the Head and Shoulders Pattern

At its core, the Head and Shoulders pattern reflects a battle between buyers and sellers:

- The left shoulder represents a swing high or low, where liquidity is gathered.

- A retracement follows, forming the neckline, which serves as support or resistance.

- Then, price aggressively moves to form the head, sweeping liquidity at previous highs or lows.

- Price pulls back again, grabs liquidity at the neckline, and forms the right shoulder, signaling buyer or seller exhaustion (failure swing).

- Finally, a breakout below (or above) the neckline confirms the reversal.

This pattern is a strong visual cue that a trend is likely to reverse, from bullish to bearish or vice versa.

How to Trade the Head and Shoulders Pattern in Forex

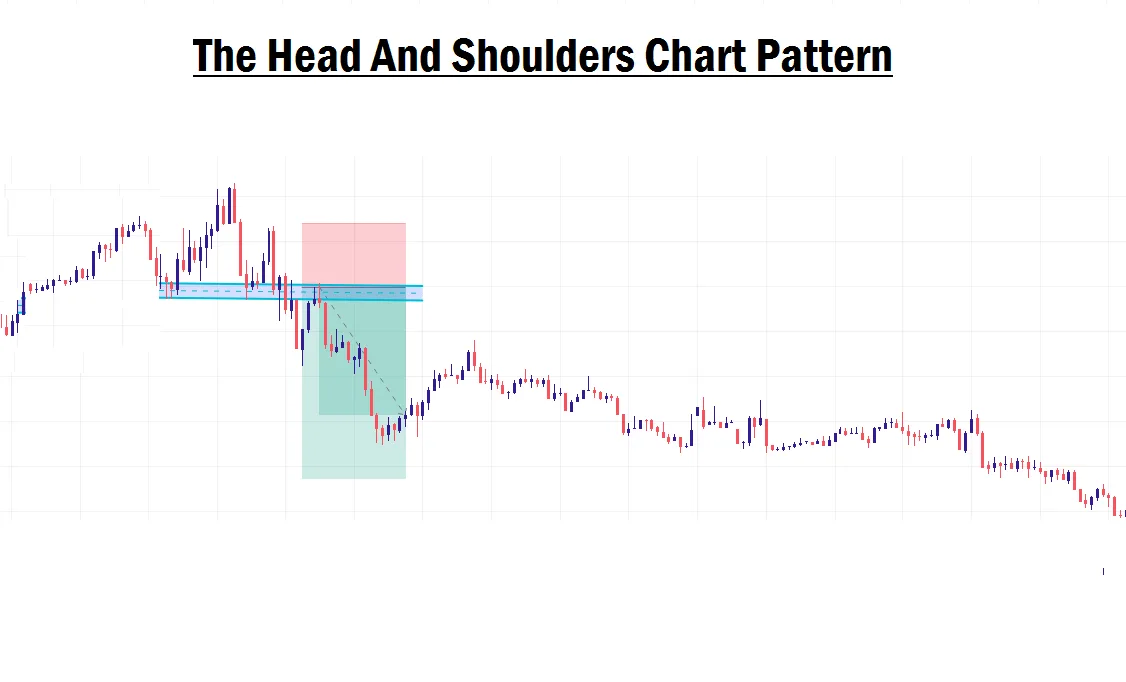

The best time to enter a trade using this pattern is after the neckline has been broken and retested. Here’s how to trade it effectively:

Bearish Setup (Head and Shoulders)

- Wait for the neckline to break with strong momentum.

- Wait for a retest of the broken neckline (now acting as resistance).

- Enter a sell trade during the retest.

- Place your stop-loss (SL) just above the right shoulder.

- Set your take profit (TP) target at 2–3 times your stop-loss size or based on the distance between the head and the neckline.

Bullish Setup (Inverted Head and Shoulders)

- Wait for the neckline to break upward with momentum.

- Look for a retest of the neckline, which now acts as support.

- Enter a buy trade at the retest.

- Place your stop-loss (SL) just below the right shoulder.

- Set your take profit (TP) 2–3 times your stop-loss or based on the distance between the head and neckline.

Important Tip:

Always ensure the breakout comes with strong momentum. A weak breakout could be a fakeout, used to trap traders and cause liquidations. Strong momentum confirms real market interest in the reversal.

Example Scenario

Let’s say the market has been trending bullishly, forming higher highs (HH) and higher lows (HL). Suddenly, price fails to make another higher high and instead forms a lower high (LH). Here’s what to do:

- Connect the two recent swing lows using a trendline to identify the neckline.

- Wait for a break of the neckline with strong bearish momentum.

- When price retests the neckline, enter a sell trade.

- Place your stop-loss above the right shoulder and your take profit 3x your stop-loss size or based on the pattern’s height.

Use the same steps in reverse for an inverted Head and Shoulders in a bearish trend, signaling a bullish reversal.

Final Thoughts

The Head and Shoulders pattern does not have to appear perfectly formed to be valid. Sometimes, the structure might look messy, but once you’ve mastered price behavior, you’ll be able to spot the pattern with ease. That’s why practice is essential. Use your demo account to train your eyes and instincts to recognize and trade this setup confidently.

And always remember: the momentum of the neckline breakout is key. It determines whether a pattern is likely to succeed or fail. Be patient. Observe. Execute.

In our next lesson, we’ll dive into “Trend Reversal Trading Strategy.”

See you there!