Understanding Market Structure Shift (MSS) and Break of Structure (BOS) in forex trading

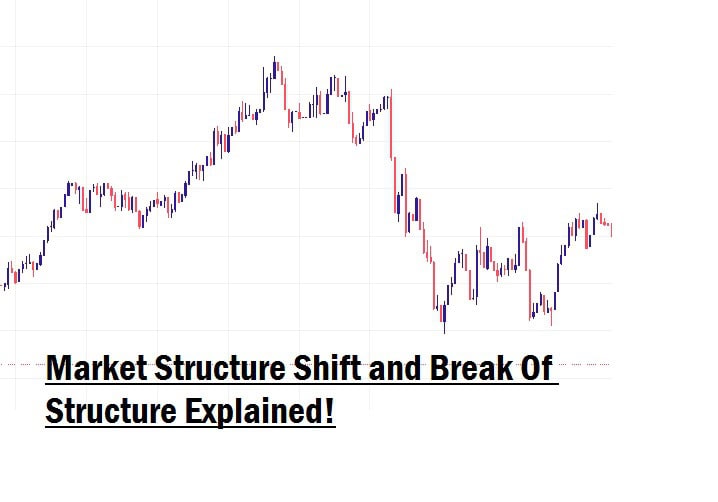

No matter what strategy you are using, gaining a solid understanding of Market Structure Shift (MSS) and Break of Structure (BOS) will greatly enhance your forex trading skills. Mastering these two key price action concepts will help you become a more effective and confident trader. Although we briefly mentioned them in earlier lessons, today’s lesson is entirely dedicated to these two core principles, providing a broader perspective and helping you learn how to apply them to your trading setup.

Market Structure Shift (MSS) – What Is It?

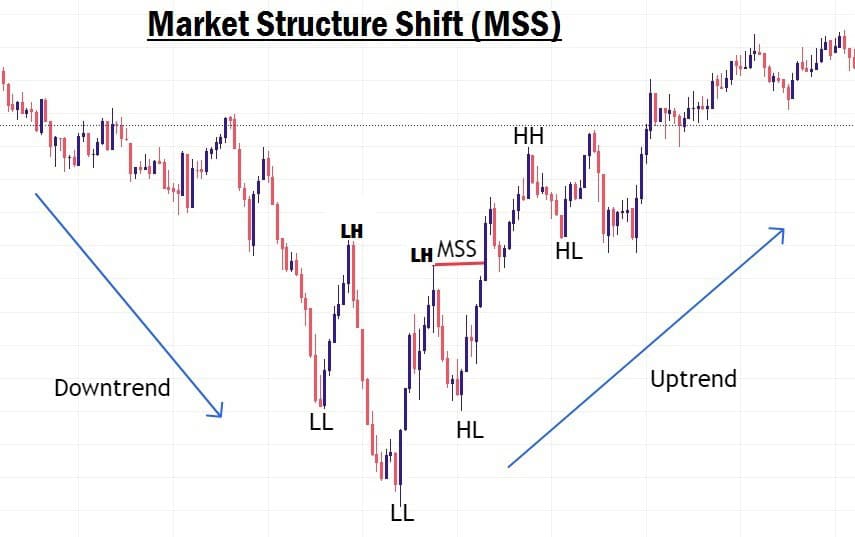

Market Structure Shift, also referred to by some traders as Change of Character (ChoCh), is a powerful reversal signal that indicates a change in market direction. It tells you when a trend, whether an uptrend or downtrend, is coming to an end, and a new direction is likely to begin.

For example, when the market is in a downtrend and suddenly shifts to form higher highs (HH) and higher lows (HL) instead of continuing lower, this indicates a Market Structure Shift from bearish to bullish. Similarly, if the market has been moving upward and then starts to create lower lows (LL) and lower highs (LH), this signals a shift from a bullish to a bearish trend.

This kind of structure shift usually occurs when price fails to create new highs or lows in the current direction and starts forming the opposite structure, which reflects a loss of momentum and a potential reversal.

What Does MSS Tell You?

A Market Structure Shift can indicate:

- A short-term retracement or pullback, which could fake you out if not properly identified.

- A long-term trend reversal, which could mark the beginning of a major directional change.

So, whether it’s a small correction or a complete trend reversal, you’ll often notice a shift in market structure beforehand. Recognizing this shift can help you prepare for what’s coming next in the market.

Example:

Let’s say price is clearly in an uptrend, forming consistent higher highs (HH) and higher lows (HL). At a certain point, the market fails to form a new higher high and instead begins to create lower highs (LH) and lower lows (LL). It is a clear shift from an uptrend to a downtrend. That exact turning point is referred to as a Market Structure Shift (MSS) or Change of Character (ChoCh) by many traders.

On the other hand, if price is in a downtrend forming lower highs and lower lows, but then begins to create higher highs and higher lows, a shift from bearish to bullish structure has occurred.

How to Trade with Market Structure Shift (MSS)

A Market Structure Shift can serve as a powerful entry trigger, especially when aligned with your overall trading strategy. Since MSS is a sign of reversal, you can use it at major key levels or zones where you expect price to turn.

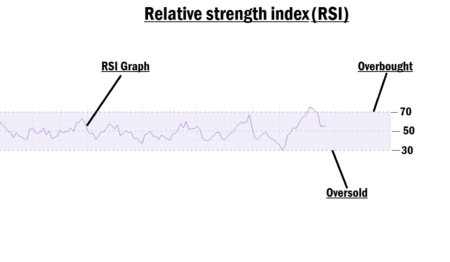

For instance, if you are watching a key support level and you anticipate a bullish reversal, spotting an MSS in that area strengthens your confidence in the setup. However, always remember, no signal is 100% guaranteed in forex. You should always combine MSS with other confirmation tools like candlestick patterns, supply and demand zones, or indicators for higher probability entries.

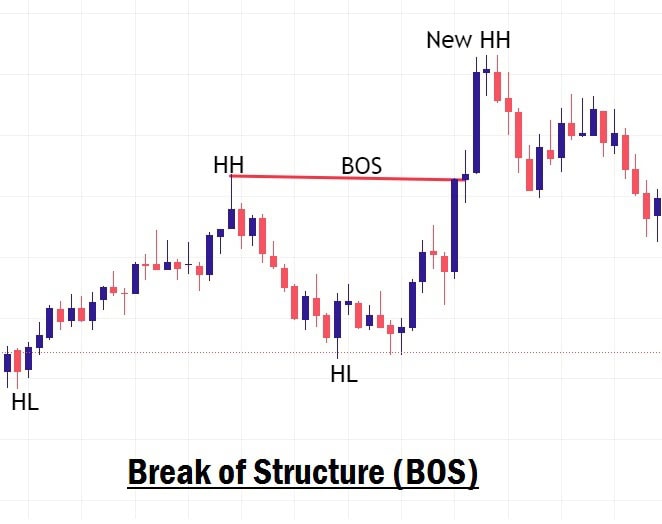

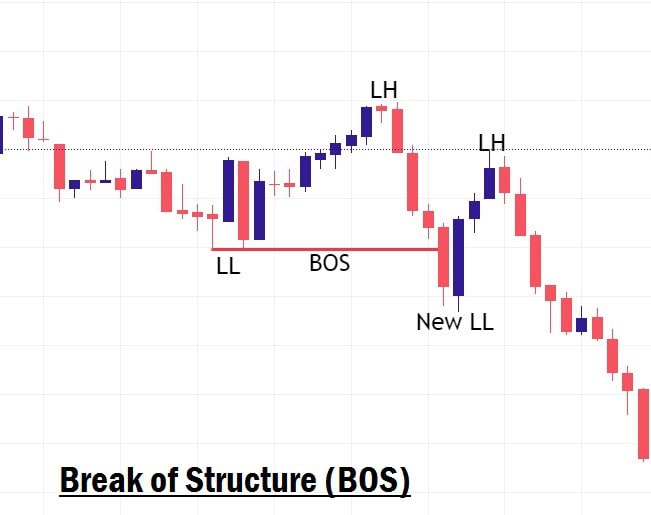

What is Break of Structure (BOS) in Forex Trading?

Break of Structure (BOS) is a trend continuation signal that confirms the ongoing strength of a trend. In simple terms, BOS occurs when the market breaks through a previous swing high (in an uptrend) or a previous swing low (in a downtrend), signaling that the market will likely continue in the same direction.

How to Confirm a BOS

A valid BOS is confirmed when the body of the candlestick closes beyond the previous high or low. A wick alone is not enough to confirm a BOS. It must be a strong, decisive close above or below the previous level.

Example:

Imagine price is in a steady uptrend, forming higher highs and higher lows. When the price closes above a previous higher high using the body of the candlestick, it confirms a Break of Structure, indicating that the bullish trend is still intact.

If price only wicks above the level without a full-bodied close, it is not considered a valid BOS. It could simply be a liquidity grab or a fakeout.

Similarly, in a downtrend, BOS is confirmed when the body of the candlestick closes below the previous lower low, confirming continued bearish pressure.

How to Trade the Break of Structure (BOS)

Once a BOS is confirmed, the most strategic approach is to wait for a pullback or retracement before entering a trade. This pullback often offers a low-risk entry opportunity to join the dominant trend before the next leg begins.

Here’s how you can trade it:

- Identify the trend and wait for a BOS confirmation.

- Wait for price to retrace, often to a key level like a support, resistance, or order block.

- Look for confirmations (e.g., candlestick patterns, volume spikes, FVGs) and then enter in the direction of the trend continuation.

Final Thoughts

Both Market Structure Shift (MSS) and Break of Structure (BOS) are vital concepts every forex trader must understand, regardless of the trading strategy you employ. They help you read the market more clearly, identify high-probability reversal and continuation zones, and most importantly, give you a better understanding of price behavior.

As we move deeper into Smart Money Concepts (SMC) in our future lessons, you’ll see how these two concepts, MSS and BOS, play a key role in building institutional-grade strategies.

In our next lesson, we will dive into “Risk Management and Discipline in Forex Trading.”

Make sure you don’t miss it.