How Beginners Can Combine Market Sentiment Analysis with Their Strategies for Better Results In Forex Trading

In this session, we’ll reveal how retail traders can effectively combine market sentiment analysis with their trading strategies to achieve consistent results.

The forex market system is like a physical market, designed to operate in a way that requires a deep understanding of its underlying mechanics for traders to profit. These hidden mechanics, similar to the ebb and flow of supply and demand in a physical market, dictate price movements and trader interactions. Without this knowledge, profiting becomes nearly impossible, explaining why approximately 90% of retail traders lose money. Most traders, whether professionals, intermediates, or beginners, fail to grasp these dynamics, while those who do, such as the big players and market makers, leverage this understanding to their advantage.

But in this episode, we’re going to uncover how the forex market system really operates and how to use the market sentiment to trade forex in a professional way as a beginner.

What Is Market Sentiment in Forex Trading?

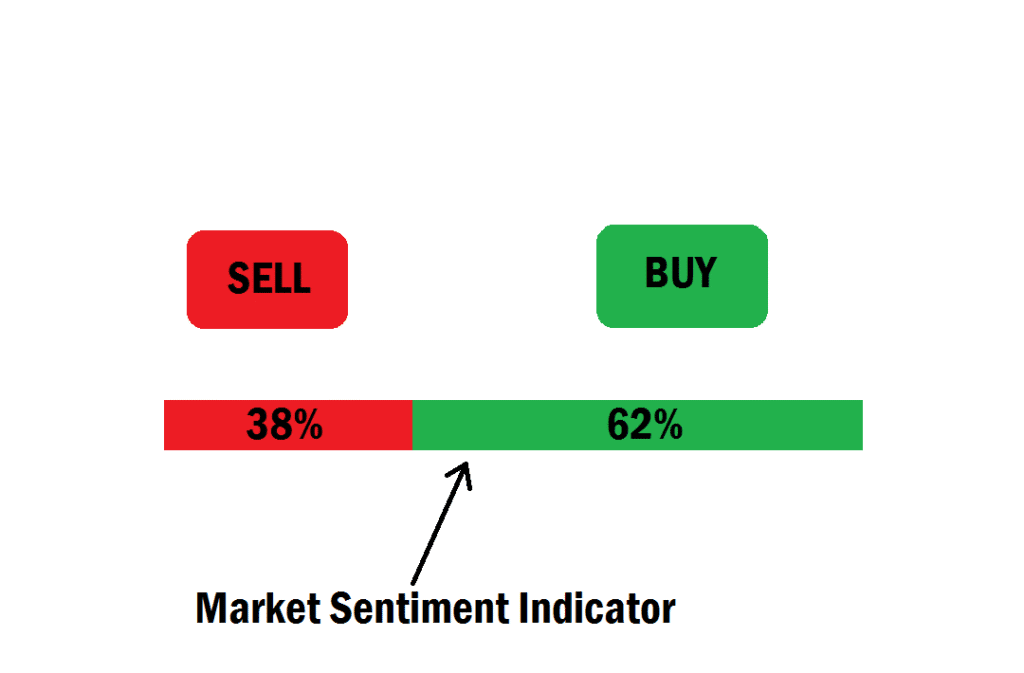

Market sentiment simply means the overall mood or feeling of traders in the market, whether most people are buying or selling a particular currency pair at a given time.

Think of it like this: if you walk into a market and notice that everyone is trying to buy a certain product, the “sentiment” in that market is bullish (positive). But if most people are trying to sell that same product, the sentiment is bearish (negative).

In forex, it works the same way. When most traders believe that a currency pair will go up, we say the market sentiment is bullish. When most traders believe price will go down, the sentiment is bearish.

However, here’s the interesting part in trading: the market often moves against the majority. So, if most traders are buying, price often falls. If most traders are selling, price often rises. This phenomenon, sometimes referred to as market contrarian movement, is often illustrated by the Commitment of Traders (COT) report, which has historically shown that price movements often inverse when large numbers of retail traders are positioned similarly. Understanding market sentiment helps you know what the majority is doing, so you can position yourself smartly with the minority, just like the big players and smart money traders do.

In short:

- Bullish sentiment = most traders are buying.

- Bearish sentiment = most traders are selling.

- Smart traders use this data to trade in the opposite direction of the crowd.

Understanding How the Forex Chart System Operates

The forex chart system is designed to move in the opposite direction of your execution. When you click “buy,” the system often drives price downward. However, it’s important to recognize that this effect can be influenced by other factors like slippage, liquidity, and the timeframe you are operating in.

For example, imagine you are the only trader in the entire forex market. If you execute a buy order, price will fall. When you sell, price will rise. That’s how the system is built, and this isn’t just a theory; it’s a revelation confirmed by insiders who understand how market makers operate.

Let’s break it down further.

If you place a buy order with one standard lot size, another trader must place a sell order larger than yours for you to gain profit. If the opposite order is of the same lot size, price balances out at an equilibrium point. But if another trader executes an even larger sell order, you’ll start seeing profit because the more sellers enter the market, the more price pushes in your favor as a buyer.

In essence:

- Buyers need more sellers to profit.

- Sellers need more buyers to profit.

This principle doesn’t just apply to forex; it applies to all traded financial instruments.

Let’s illustrate this with a simple real-world example.

A Practical Market Example

Imagine 100 people bring 100 mobile phones to sell in a physical marketplace. For them to sell at a good price and make a profit, they need more than 100 buyers who are willing and able to purchase those phones (equivalent to the need for a greater number of buy orders to match sell orders in an order book). If only 50 buyers show up, the first 50 sellers will likely sell their products successfully, while the remaining 50 will struggle. They’ll have to reduce their prices to attract buyers, leading to losses (similar to how prices might fall when there’s an order book imbalance with insufficient demand). But if there are 200 eager buyers, sellers gain control of the market. They can raise their prices due to high demand, thereby increasing their profits (just as price increases when there is a surplus of buy orders over sell orders). This example shows that for sellers to profit, there must be more buyers. Likewise, for buyers to profit, there must be more sellers (reflecting the necessity for a balanced order book where one side benefits from a majority presence on the opposite side).

In forex, this means:

- When there are more buyers, sellers control the market price.

- When there are more sellers, buyers control price movement as well.

This is the hidden logic behind price behavior in financial markets, and only a small percentage of traders understand it. That’s why price tends to move in the direction of the minority side of the sentiment indicator.

If you want to become a consistently profitable trader, never ignore market sentiment analysis, because it drives price movement.

Whenever price reaches your point of interest (POI), make sure it aligns with the lower percentage of traders in the sentiment data provided by your regulated broker. Avoid unreliable sentiment indicators from random websites. Stick to the ones provided by trusted, registered brokers only.

Why Most Strategies Fail and Cause Traders to Lose Money

When you spot a clean bullish setup, understand that you’re not the only one seeing it. Millions of other retail traders using similar strategies are also preparing to buy at the same zone.

This means that your point of interest becomes crowded with buy orders. When the market becomes overloaded with buyers, the sentiment shifts, and since the buying pressure now outweighs the selling pressure, the market moves downward instead.

As a result, stop losses get triggered, and retail traders lose money. Meanwhile, smart money traders and institutions take the opposite direction, using retail traders as liquidity for their profits.

When institutional traders also want to transact at that same zone, they first induce retail traders to enter positions prematurely, only to stop them out and absorb their liquidity before driving price in the true direction.

How to Apply Market Sentiment to Your Strategy

Since traders use different strategies, applying market sentiment becomes even easier. Before executing any trade at your point of interest, always check the sentiment indicator.

- If there are more buyers, focus on sell setups.

- If there are more sellers, focus on buy setups.

In forex trading, the majority lose while the minority profit. Never follow the crowd blindly. Look for setups that align with the minority side of the sentiment indicator provided by your broker.

Always remember:

Price is drawn toward areas with more stop losses than take profits.

Final Thoughts

Having this understanding separates you from the 90% of retail traders who lose money.

The market is constantly seeking liquidity, and that liquidity comes from retail traders’ stop losses. When there are more buyers, there are more stop losses sitting below price (on the sell side). Because the market seeks liquidity, price continues falling until those stops are hit and the ratio between buyers and sellers is balanced again.

From now on, never ignore market sentiment when positioning your trades.

If you have any questions regarding this topic, feel free to let us know in the comments section below. Trade smart, and stay ahead of the crowd.