Understanding Liquidity Grab and Liquidity Sweep in Forex Trading

In this session, we will be diving into one of the most important concepts in Smart Money Concept (SMC) trading: Liquidity Grab and Liquidity Sweep.

These two concepts are frequently discussed in the ICT (Inner Circle Trader) trading model, and mastering them will give you deeper insights into how liquidity works within Smart Money trading. In this lesson, we’ll break down both concepts in detail, show you how to identify them on the chart, and explain why they matter for retail traders.

Many new traders often confuse liquidity grab and liquidity sweep, assuming they mean the same thing. However, that is a big mistake. While they are closely related, these two terms are different market behaviors used by institutional traders. Understanding the difference will not only enhance your trading knowledge but also help you avoid being exploited as a liquidity provider by the big players in the financial markets.

Why Liquidity Matters in Forex Trading

Before we dive in, keep this in mind: nothing in Forex works 100% of the time. The market operates on probabilities, not certainties. This is why Forex trading is considered risky and requires proper knowledge, discipline, patience, and solid risk management.

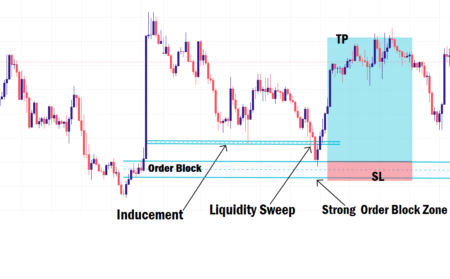

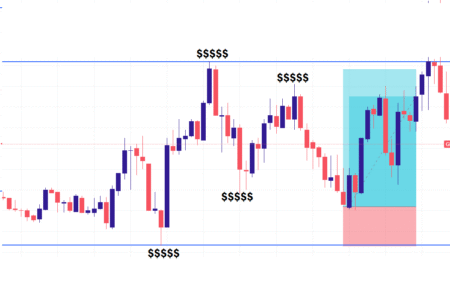

Liquidity is at the heart of market movements. Institutional traders (smart money) constantly seek liquidity to fill their large orders, and unfortunately, that liquidity often comes from retail traders’ stop losses and pending orders. This is where liquidity grabs and sweeps come into play.

What Is a Liquidity Grab in Forex?

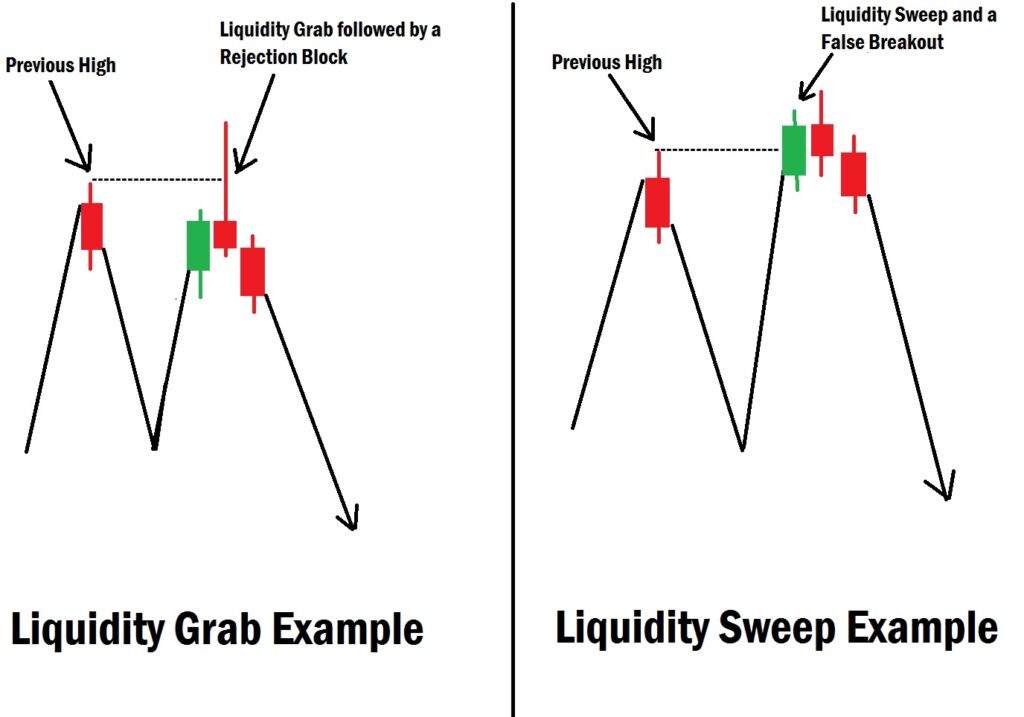

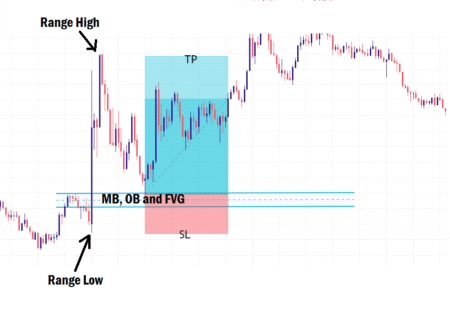

A liquidity grab occurs when institutional traders intentionally drive price into a swing high, swing low, or key order block where clusters of retail traders’ stop losses and pending orders are located. By triggering these orders, smart money players gain enough liquidity to execute their larger trades.

Here’s how it works:

- Price aggressively pushes into a key support, resistance, or order block.

- A long wick forms, taking out the swing high/low and triggering stop-loss orders.

- The move is followed by a sharp rejection and reversal.

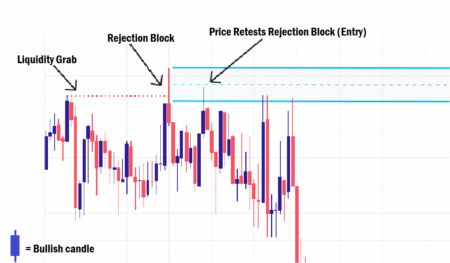

- This often creates a Rejection Block and sometimes leaves behind a Fair Value Gap (FVG).

When a liquidity grab occurs, you will see price spike above a resistance zone, quickly reverse, and leave a long wick behind. That wick is the rejection block, a strong clue that smart money just grabbed liquidity.

As a Smart Money trader, your point of interest (POI) after a liquidity grab should be the imbalance (FVG) or the rejection block. If price returns to mitigate the imbalance, it can provide a high-probability trade entry.

What Is a Liquidity Sweep in Forex?

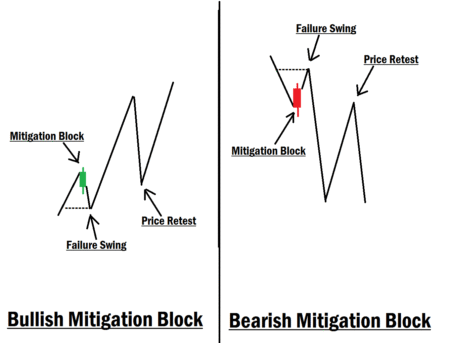

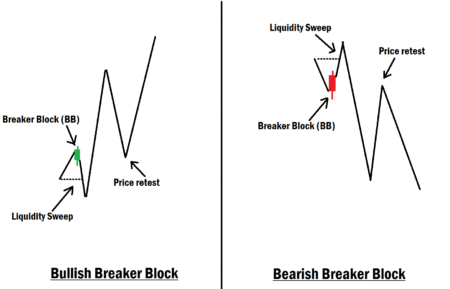

A liquidity sweep, on the other hand, is slightly different and may trick most beginners into taking breakout trades. In this case, institutional traders push price through a key zone or order block, creating the illusion of a breakout.

Here’s how it works:

- Price pushes beyond a weak support or resistance zone.

- Stop losses are cleared, and pending breakout orders are triggered.

- Instead of continuing higher or lower, price quickly reverses back, trapping breakout traders.

This is why liquidity sweeps are often called false breakouts. Unlike a liquidity grab (which leaves a rejection wick), a sweep gives traders the false impression that a breakout has occurred, only for the market to reverse sharply.

Pro Tip: A true breakout typically comes with strong momentum. If the move lacks momentum and quickly reverses, it’s more likely a liquidity sweep.

The Key Difference Between Liquidity Grab and Liquidity Sweep

While liquidity grabs and liquidity sweeps involve institutional traders seeking stop losses at key zones, there are important differences you need to know, which are:

- Liquidity Grab

- Done with a long wick.

- Creates a Rejection Block at a strong zone or order block.

- Gives the impression that price will reverse (and often does).

- Liquidity Sweep

- Appears as a false breakout beyond a zone or order block.

- Clears stop losses and pending breakout orders.

- Traps traders expecting continuation, then reverses against them.

Simply put, a liquidity grab signals a reversal with a rejection block, while a liquidity sweep tricks traders into believing a breakout is happening, only to reverse immediately.

Final Thoughts

Because institutional traders constantly hunt liquidity, uninformed retail traders lose money repeatedly by falling into these traps. This is why it’s important not to blindly enter trades at support or resistance zones.

Always wait for confirmation before entering. Confirmations could be:

- An Engulfing Candlestick Pattern

- A Market Structure Shift (MSS)

- Price reacting at a rejection block or FVG

By understanding liquidity grabs and sweeps, you’ll be able to trade smarter, avoid being used as liquidity, and improve your win rate as a Smart Money Concept trader.

If you have any questions or want more clarity on this topic, drop them in the comments below. See you in the next session (Rejection Block)!