Everything a Beginner Trader Should Know About Interest Rate Economic News Release

Interest rate announcements are among the most significant pieces of economic news in the financial market. Investors, banks, and major market participants pay close attention to them because interest rates reveal a lot about a country’s economic health and future direction.

Imagine this: you place a buy trade on GBP/USD, feeling confident in your analysis. A few moments later, you return to check your chart, only to find that price has spiked aggressively against your position, even causing slippage at your stop-loss level. As a beginner, you might wonder, “What just happened?”

One of the most common causes of such sudden and violent price movements is the Interest Rate news release.

One of the most common causes of such sudden and violent price movements is the Interest Rate news release.

Understanding how interest rate announcements impact the foreign exchange market is crucial for every beginner. High-impact economic news can move the market unpredictably, and in some cases, wipe out your trading account within minutes, especially if you’re trading without a stop loss. Among all the major economic events, interest rate decisions are some of the most powerful and market-moving.

In this article, we’ll break down everything a beginner trader needs to know about interest rate news, including:

- What interest rates mean in forex trading

- How rate hikes or cuts affect currency strength

- Why investors and traders care so much about interest rate decisions

- How price typically reacts during these announcements

- Why beginners should avoid trading during interest rate releases

Let’s dive in.

What Are Interest Rates in Forex Trading?

Interest rates represent the cost of borrowing money within an economy. Central banks, such as the Federal Reserve, Bank of England, Bank of Japan, or European Central Bank, set these rates to control inflation, stabilise the economy, and manage growth.

In forex trading, interest rates influence a currency’s value. When interest rates change, the market often reacts instantly because the adjustment reflects the central bank’s view of the country’s economic performance. For instance, in January 2022, a surprise interest rate hike by the Bank of England caught traders off guard, leading to a swift movement of over 100 pips in the GBP/USD currency pair. This example illustrates how unexpected rate decisions can cause rapid market swings, emphasising the importance of understanding interest rate impacts.

How Interest Rate Changes Affect Currencies

1. Interest Rate Increase (Rate Hike)

When a central bank raises interest rates, the currency typically strengthens. This happens because higher rates attract foreign investors seeking better returns, increasing demand for that currency. Investors love high interest rates because their returns will be bigger. Once there is a rate hike, investors become more interested in that currency, causing a rise in demand. The rise in the demand for such currency will make it gain more strength in the financial market.

Example: If the previous interest rate was 5.25% and the current rate is 5.50%,

➡️ The rate has increased (because 5.50% is higher than 5.25%).

2. Interest Rate Decrease (Rate Cut)

A rate cut usually weakens a currency. Lower rates mean reduced returns for investors, which decreases demand and often leads to selling pressure.

These reactions can cause sudden spikes, rapid reversals, or extreme volatility, something beginners must be cautious about.

Example: If the previous rate was 5.75% and the current rate is 5.50%,

➡️ The rate has decreased (because 5.50% is lower than 5.75%)

Once there is a rate cut, investors lose interest in that particular currency. Because investors lost interest, the demand will reduce, causing the currency to lose strength in the financial market.

Why Investors and Traders Care About Interest Rate News

Interest rate decisions strongly influence:

- Inflation

- Economic growth

- Investment flows

- Currency strength

- Market sentiment

Because they carry so much weight, interest rate announcements often cause markets to move sharply, making them high-impact events on economic calendars.

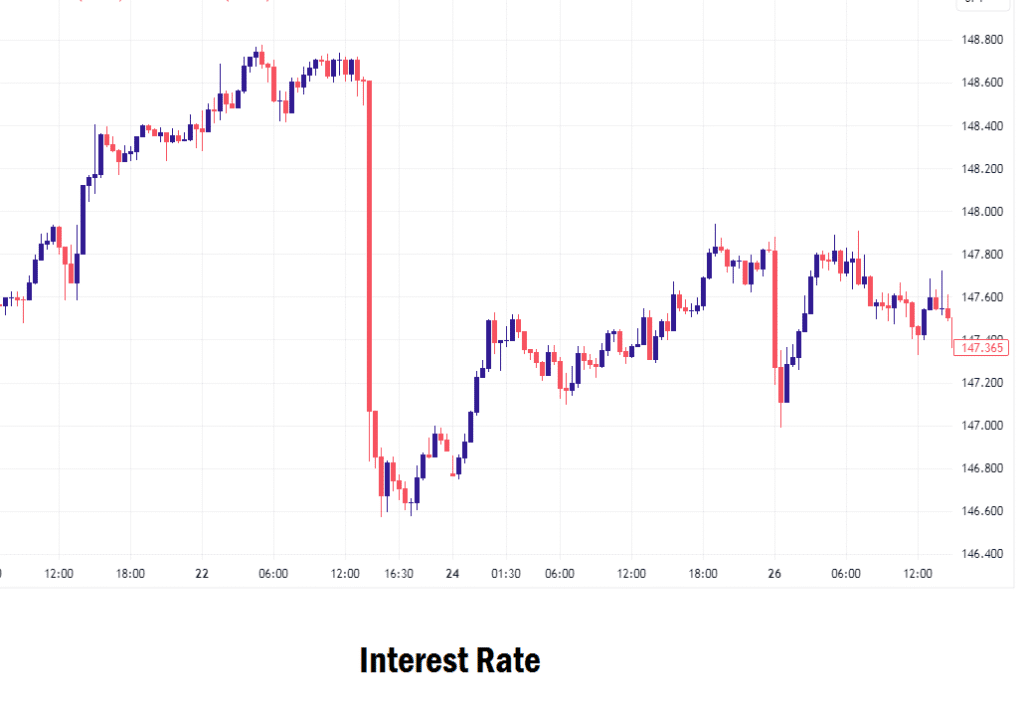

How Price Reacts to Interest Rate Releases

During an interest rate announcement, price can:

- Spike rapidly in either direction.

- Whipsaw violently before choosing a direction.

- Break major support and resistance levels.

- Cause unexpected slippage

- Trigger stop losses even before price reaches them

For beginners, this environment is very dangerous. Even experienced traders avoid entering trades during interest rate releases unless they have a solid strategy and understand how to manage extreme volatility.

Why Beginners Should Avoid Trading During Interest Rate News

As a beginner, it’s crucial to stay away from the charts during major news events like interest rate releases. Here’s why:

- Price moves too fast to react manually.

- Technical analysis becomes unreliable.

- Spreads widen significantly

- Slippage becomes common

- Your account can blow quickly without proper risk management.

Instead, use this time to observe how the market behaves and learn from it. Knowledge and patience go a long way in forex trading.

Trading Strategy for Interest Rate News

There is no proven trading strategy that consistently works during an interest rate news release. This is because price can move unpredictably in any direction without giving clear signals. For this reason, we do not recommend using any trading strategy during high-impact interest rate announcements.

As a beginner, it’s strongly advised that you close your trades and stay away from the market during these releases. The volatility is often so massive and sudden that it can wipe out an entire trading account within minutes, even with stop losses in place.

Staying on the sidelines during interest rate news is not a sign of weakness; it’s smart risk management.

Important Notice

Forex trading is risky and not suitable for everyone. Never jump into the live market with real money as a beginner without first mastering your strategy on a demo account. Remember, no strategy works 100% of the time. Protect your capital with proper risk management and a solid trading plan.

If you have more questions about interest rate news release, feel free to let us know in the comments section. Continue learning and growing as a trader!