In this session, we will be talking about Understanding the ICT Liquidity Concept in Forex

Liquidity is something you can’t afford to ignore if you want to succeed in the forex market. No matter the trading concept you use, understanding liquidity is central to consistent profitability. As a Smart Money Concepts (SMC) trader, once you understand and master PD Arrays, ICT entry models, and the liquidity concept, you’re not far from becoming consistently profitable in the financial markets.

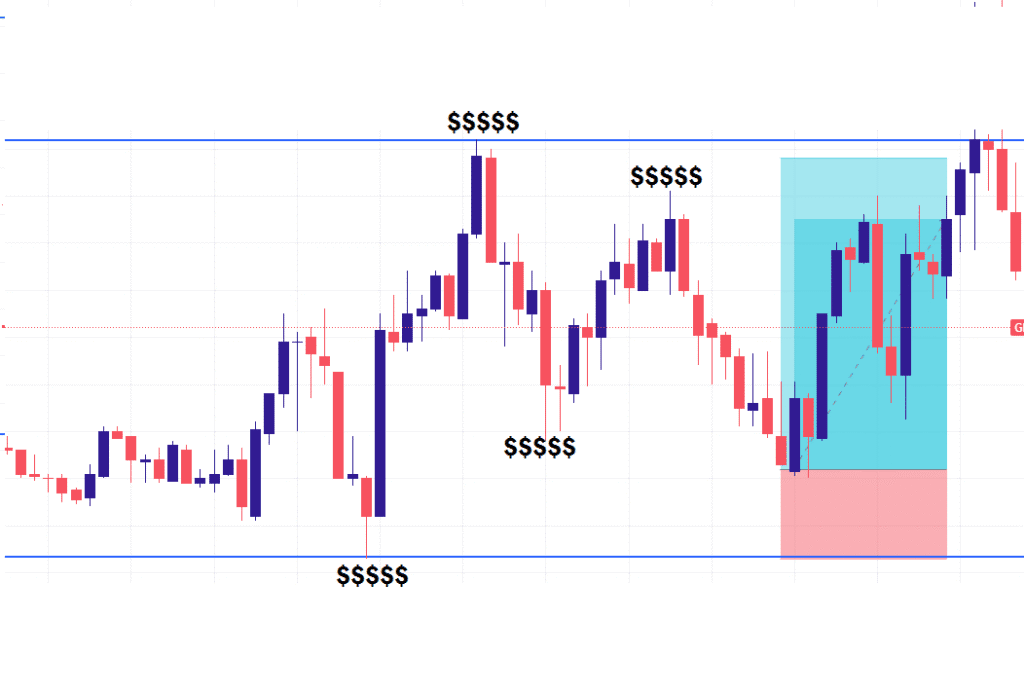

In simple terms, liquidity typically rests around old highs and lows of price swings on the forex chart; these areas attract price like magnets.

The Inner Circle Trader (ICT) provides deep insights into liquidity and how to use it to your advantage. However, remember that nothing works 100% of the time. The forex market is a game of probabilities, not guarantees. That’s why it’s considered risky and requires hard work, discipline, and knowledge. We strongly advise practicing on a demo account to master your skills before going live with real capital.

In this episode, we’ll cover key aspects of liquidity as defined by ICT, and why you must pay attention to it before taking any trade.

What Is Liquidity in Forex Trading?

According to ICT, liquidity is people’s money, clustered in the form of stop-losses, buy stops, sell stops, and pending breakout orders. Liquidity zones are typically found where traders have placed their stops after entering positions. Practically, these zones form around old swing highs and swing lows.

Price naturally moves from areas of lower liquidity to areas of higher liquidity. In other words, liquidity attracts price. When price reaches a concentrated pool of stops, those orders can be used by larger players to get filled, often leading to sharp reactions or reversals.

Why Liquidity Matters in Trading

When price moves, it’s seeking liquidity. It travels from lower-liquidity zones to higher-liquidity pools where there are enough opposing orders to facilitate large transactions. That’s why:

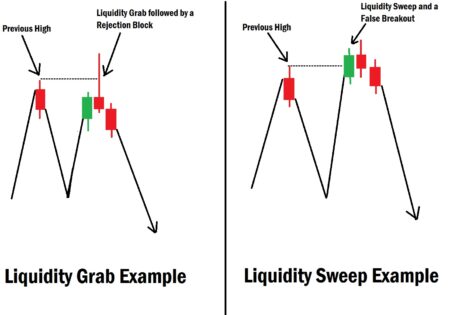

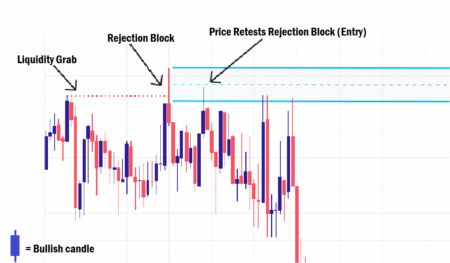

- High-liquidity areas often get cleared (stop hunts/liquidity grabs).

- After liquidity is cleared at a significant high or low, the price frequently reverses and seeks the opposite side of the range where more liquidity is typically found.

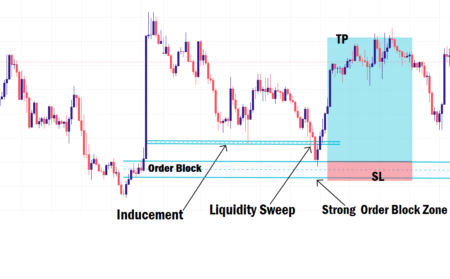

- A practical approach is to wait for liquidity to be taken and then look for confirmation (e.g., price displacement, Fair Value Gap (FVG), Order Block (OB)) before entering.

- Trading within a valid dealing range helps you identify high-probability trading opportunities.

The Two Major Types of Liquidity

- Buy-Side Liquidity (BSL)

- Sell-Side Liquidity (SSL)

What Is Buy-Side Liquidity?

Buy-Side Liquidity sits above market highs. It’s composed of:

- Stop-losses from traders who sold short,

- Buy stop (breakout) orders from traders expecting continuation.

These levels accumulate liquidity for large players to match big orders. Price often runs up to clear BSL and then retraces or reverses, especially when that run completes a liquidity grab and leaves behind a valid entry model (e.g., displacement and an FVG).

What Is Sell-Side Liquidity?

Sell-Side Liquidity sits below market lows. It includes:

- Stop losses from traders who went long,

- Sell stop (breakout) orders from traders expecting a breakdown.

Similarly, price will often run down to clear SSL and then retraces or reverses once the liquidity is swept. It is best traded when paired with an ICT entry model and a clear dealing range formed after the liquidity sweep.

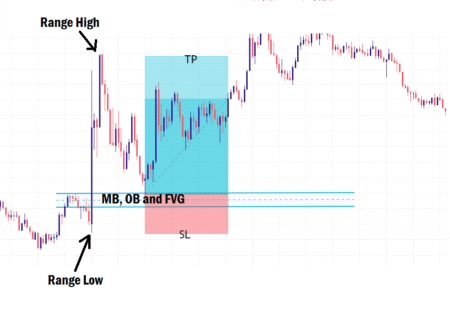

Liquidity Inside a Dealing Range: External vs. Internal

Beyond simple highs and lows, liquidity also forms within a valid, established dealing range, typically segmented into premium (above equilibrium) and discount (below equilibrium) zones.

The key forms are:

- External Range Liquidity (ERL)

- Internal Range Liquidity (IRL)

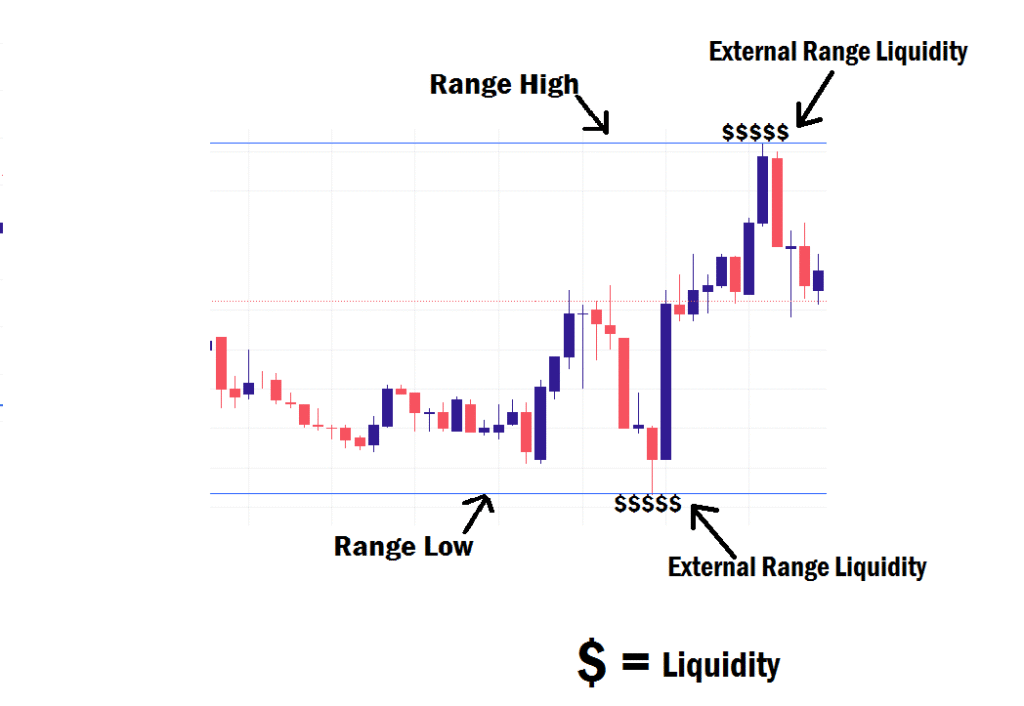

What Is External Range Liquidity?

External Range Liquidity rests at the highs and lows of the active dealing range. It’s the liquidity that sits outside the body of the price range, essentially, the range boundaries.

- When price clears the range high or low, it is said to have swept external liquidity.

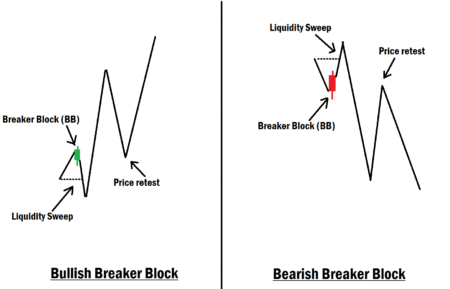

- This is often the final liquidity grab before a meaningful pullback into the range, especially when confluence aligns inside the range (FVG and breaker block or mitigation block).

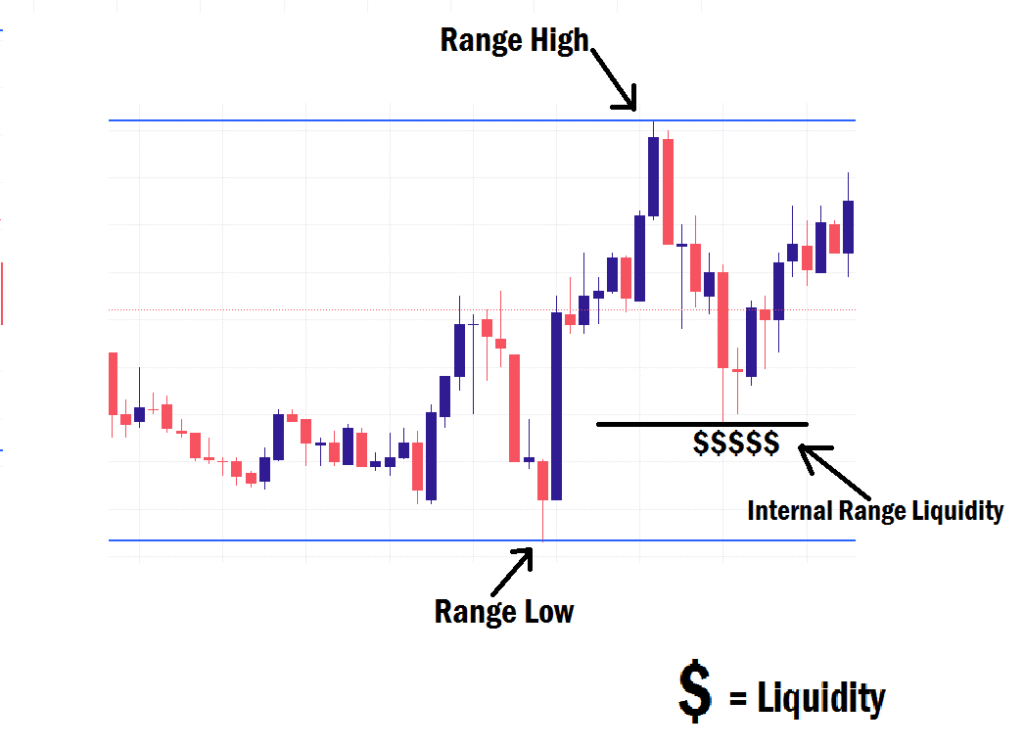

What Is Internal Range Liquidity?

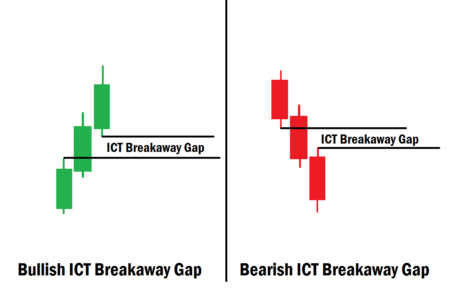

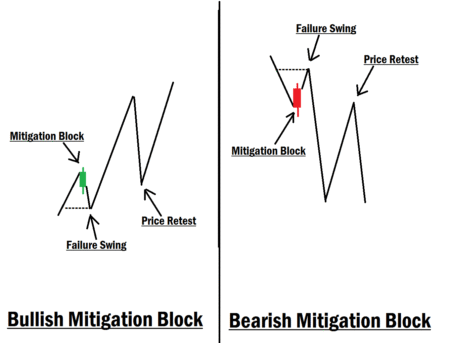

Internal Range Liquidity focuses on imbalances inside the range, especially Fair Value Gaps (FVGs) and other institutional footprints (e.g., Order Blocks, Breaker Blocks, Mitigation Blocks).

- These zones represent areas where price is likely to rebalance.

- They serve as points of interest (POIs).

- When price interacts with internal liquidity (e.g., fills an FVG inside the range), it often reverses decisively and continues toward the opposing liquidity pool.

Putting It All Together (Quick Guide)

- Mark swing highs/lows to map out BSL and SSL.

- Define your dealing range (recent significant swing high to swing low).

- Identify external range liquidity at the range boundaries and internal range liquidity (FVGs, OBs) inside the range.

- Wait for internal range liquidity sweep (mitigation of FVG inside the range).

- Look for confirmation (market structure shift after price mitigates the FVG inside the range).

- Align with PD Arrays (premium/discount) to improve risk-to-reward.

- Manage risk strictly.

Final Thoughts

Liquidity is the primary driver of price in the forex market. Mastering this concept moves you from providing liquidity (being stop-hunted) to taking liquidity like a professional. Pay close attention to where liquidity is resting before you trade, so you don’t become the liquidity.

In our next lesson, we’ll be talking about “Liquidity Grab and Liquidity Sweep.” See you there!