How to Flip a $100 Account to $1,000 in a Short Period as a Trader

Imagine entering the forex market with just $100, and within a couple of months, you have grown that account to $1,000 or more. That is a massive return on investment, and it also signals that you are beginning to trade like a professional.

Flipping a $100 account to $1,000 is not impossible in the financial market. However, it is also not an easy task, especially for beginners or struggling traders. The forex market does not reward wishful thinking; it rewards skill, discipline, and experience.

When it comes to making money in the financial market, there are certain things that are non-negotiable. The forex market is not controlled by you as a retail trader; instead, it is dominated by large institutions and major market participants you do not see. This reality makes flipping an account extremely difficult if you lack proper trading knowledge and experience.

Turning $100 into $1,000 within a short period is known as account flipping, and to succeed at it, there are a few critical boxes you must tick perfectly. That is why in this article, we will show you how to flip a $100 account into $1,000, and the three compulsory conditions you must meet before attempting it.

Are you ready? Let’s get into it.

The Three Compulsory Boxes You Must Tick to Flip a $100 Account

To flip a $100 account into $1,000, these three factors are absolutely essential:

- A Solid Trading Strategy and Skillset

- Discipline and Patience

- Proper Risk Management

Understanding Trading Strategy and Skillset

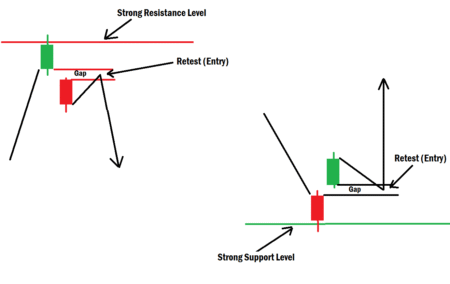

Before you think of making any money in the forex market, trading strategy and skill are non-negotiable. It is not enough to simply learn a profitable strategy; you must also develop personal trading skills around that strategy. We are speaking from our over 11 years expirience in professional forex trading.

A profitable trading strategy combined with refined personal skills is what allows professional traders to remain consistently profitable. To flip $100 into $1,000, consistency is everything.

Developing personal skills around a strategy helps you stand out from other traders using the same method. While others may experience losses using that strategy, your personal observations, experience, and refinements can help you avoid many of those losing trades.

No trading strategy works 100% of the time. This is why blindly following a strategy without personal refinement often leads to failure. Professional traders constantly test, refine, and rebuild strategies before risking real capital for maximum performance.

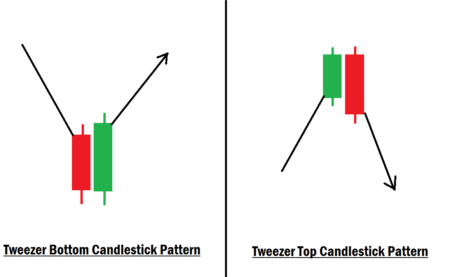

For account flipping, your strategy must meet two key requirements:

- An average win rate of at least 50%

- Proven long-term consistency, not short-term luck

Some strategies work temporarily but later collapse, resulting in significant losses. Such strategies are dangerous for flipping.

Key Takeaway

To successfully flip an account, you need a proven strategy with at least a 50% win rate, backed by long-term consistency. More importantly, you must develop personal skills in conjunction with that strategy to maximize profitability.

Understanding Discipline and Patience

If you have spent any reasonable amount of time in the forex market, you will understand that trading opportunities do not appear every day. Professional traders wait patiently for A+ setups before executing trades.

Patience is the ability to wait for your setup without forcing trades. Many beginner traders struggle with patience because they believe every day is a day to make money. This mindset has cost many traders not only their capital, but also their emotional stability.

Discipline, on the other hand, is your ability to follow your trading rules and plan strictly. Trading plans and rules are what allow any strategy to deliver consistent results. Professional trading is about repeating the same entry and exit process over and over, without emotional interference or unnecessary adjustments.

In simple terms:

- Patience protects your capital.

- Discipline keeps you consistent over the long term.

Together, they prevent you from taking low-quality trades that can destroy your account.

Understanding Proper Risk Management

Even with a high-quality trading strategy, poor risk management can wipe out your account. Proper risk management simply means risking a fixed amount or percentage on every trade.

For example, if you choose to risk $10 per trade on a $100 account, you must maintain that risk consistently. You do not risk $10 on one trade and $5 on another. Inconsistent risk destroys account growth.

Imagine risking $5 and winning, then risking $10 and losing the next trade. That single loss can erase multiple wins. This is extremely dangerous when flipping an account.

If you decide to risk $10 per trade until your account reaches $500, then you must maintain that $10 risk no matter how good a setup looks.

Proper risk management ensures:

- Consistent account growth

- Controlled losses

- Balanced profitability over time

Turning $100 Into $1,000 in a Short Period

Now let’s assume you have ticked all the boxes above.

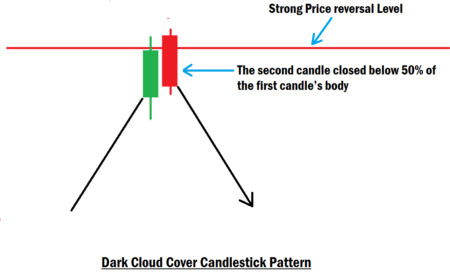

If your trading strategy delivers a 50% win rate or more, it means that out of every 10 trades, you win at least 5. This is a solid foundation for flipping.

Another critical rule is the risk-to-reward ratio. You should have no business taking 1:1 trades. Every trade must have at least a 1:2 risk-to-reward ratio or higher.

This means:

- Risk $10 → Target $20 or more

Now, let’s break it down practically.

Assume you take six trades in a week:

- You lose three trades = −$30

- You win three trades at 1:2 RR = +$60

Your net profit for the week becomes $30.

That $30 profit is added to your original $100, giving you $130. As this process continues, your account compounds faster and faster. Using this approach consistently, your account can grow to $1,000 within a few months.

That is the essence of account flipping.

Final Thoughts

Account flipping is extremely risky because it involves risking a higher percentage of your trading capital. That is why it is not suitable for beginners or traders who do not fully understand the forex market.

Flipping requires experience, emotional control, and deep market understanding. A beginner attempting to flip an account can lose that $100 in just a few trades.

The key takeaway is this:

Turning a $100 account into $1,000 requires expertise, discipline, proper risk management, and a strong understanding of how the financial market works.

Turning a $100 account into $1,000 requires expertise, discipline, proper risk management, and a strong understanding of how the financial market works.

If you are a beginner or still struggling, avoid account flipping. Instead, grow your account gradually, even if it takes years. Slow growth is far better than blowing an account.

As a beginner, you are advised to risk only 1% per trade. This allows you to stay in the market longer while mastering your skills over time.

Frequently Asked Questions (FAQs) About Flipping a $100 Forex Account

Can a $100 forex account really be flipped to $1,000?

Yes, it is possible to flip a $100 forex account to $1,000, but it requires advanced trading skills, discipline, proper risk management, and a proven trading strategy. It is not guaranteed and is not suitable for beginners or struggling traders.

How long does it take to flip a $100 account to $1,000?

The timeframe depends on your win rate, risk-to-reward ratio, market conditions, and consistency. With a solid strategy and proper execution, it can take a few months, but there is no fixed timeline.

Is account flipping safe in forex trading?

Account flipping is high-risk because it involves risking a larger percentage of capital per trade. Without proper experience and discipline, it can quickly lead to account blowouts.

What win rate is required to flip a forex account?

A trading strategy used for flipping should have a minimum win rate of 50%, combined with a risk-to-reward ratio of at least 1:2. This ensures profitability even with losing trades.

What risk-to-reward ratio is best for account flipping?

For account flipping, a 1:2 risk-to-reward ratio or higher is essential. Lower ratios make it very difficult to grow a small account consistently.

How much should I risk per trade when flipping a $100 account?

Risk must be fixed and consistent. For example, risking $10 per trade should remain the same until a specific account milestone is reached. Inconsistent risk management can ruin the flipping process.

Can beginners flip a $100 forex account?

No. Account flipping is not recommended for beginners. Beginners should focus on skill development and risk only 1% per trade to preserve capital and gain experience.

Why do most traders fail at account flipping?

Most traders fail due to:

- Lack of patience

- Poor discipline

- Inconsistent risk management

- Trading without a proven strategy

- Emotional decision-making

Is account flipping considered gambling?

Account flipping becomes gambling only when done without rules, discipline, or strategy. When executed professionally with proper risk management, it is a calculated high-risk trading approach.

What is the biggest mistake traders make when flipping accounts?

The biggest mistake is overconfidence, followed by increasing risk randomly, revenge trading, and abandoning the trading plan after a few losses.

If you have more questions about account flipping, feel free to drop them in the comments section.

Trade wisely and remain blessed.