In this session, we will be talking about “How to Trade With The Flag Chart Pattern Like A Pro.”

The flag chart pattern is another powerful yet simple trading strategy that every beginner trader should consider mastering. In some of our previous sessions, we’ve explored various reversal trading strategies. However, it’s important to understand that reversals don’t always occur in the market. Sometimes, the price doesn’t reverse at all; it simply continues in its original direction. The flag chart pattern gives you a strong edge in identifying and capitalizing on these price continuation moves.

Why the Flag Chart Pattern Is So Effective

One of the most appealing qualities of the flag chart pattern is its simplicity. It’s easy to spot on the chart, even for new traders. In fact, among the various chart patterns in forex trading, the flag pattern is one of the most straightforward to recognize and apply.

Its simplicity, however, does not reduce its effectiveness. Many professional traders depend on this pattern to identify high-probability, profitable trade opportunities in the forex market. But as with every trading tool or strategy, it’s important to manage your expectations.

Just because a strategy is simple and effective doesn’t mean it’s a guaranteed money-maker. There’s no such thing as a “holy grail” in trading. No strategy works 100% of the time. Forex trading is based on probabilities, not certainties. That’s what makes it risky. To succeed, you need to focus on trading only when the probabilities are clearly in your favor.

If you’re a beginner, never trade with real money until you have tested and mastered the strategy on a demo account. Build your skill, confidence, and consistency before stepping into the live market.

What Is a Flag Chart Pattern in Forex?

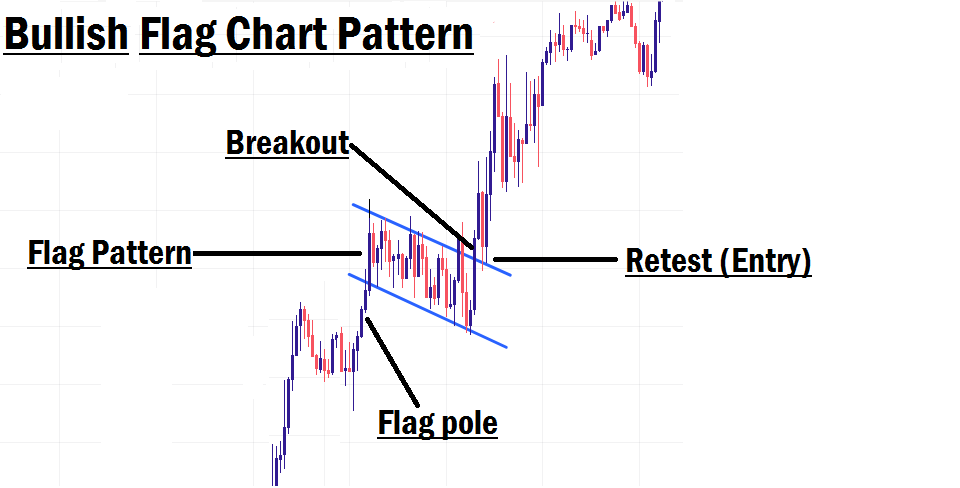

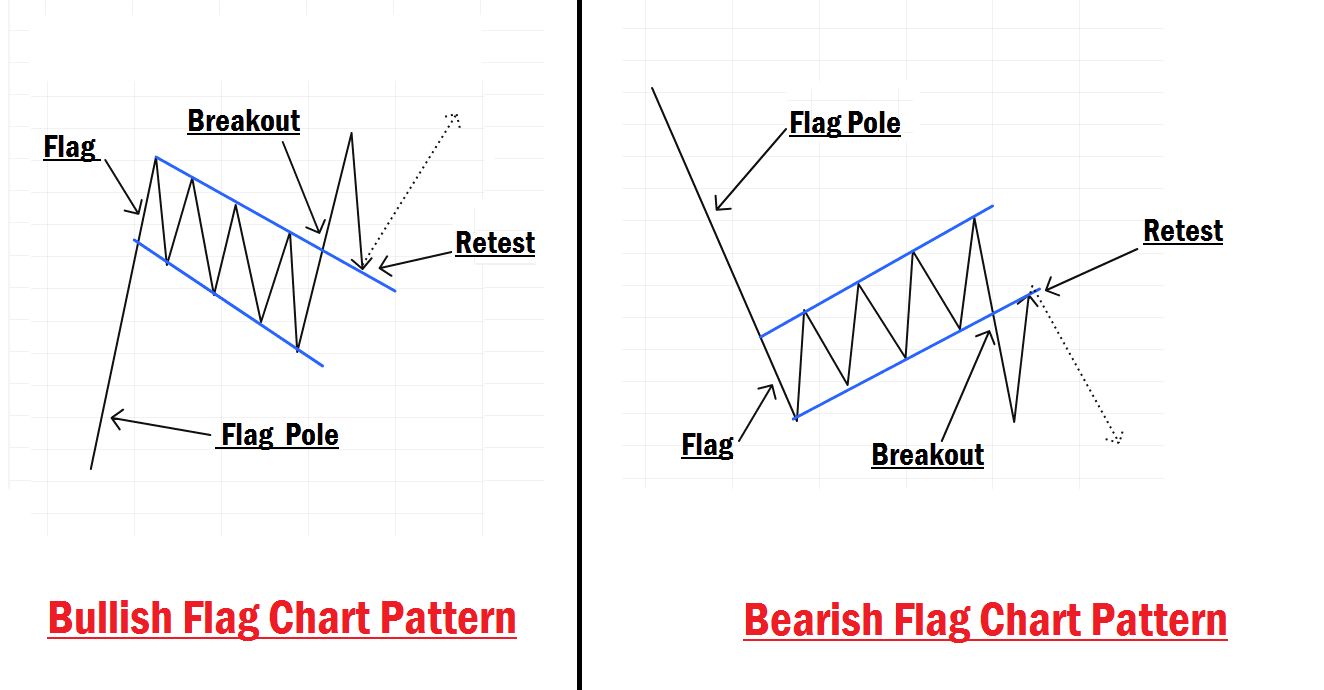

A flag chart pattern is a technical continuation pattern that signals the potential resumption of a prevailing trend. It gets its name from its appearance: a sharp price movement (known as the “flagpole”) followed by a period of consolidation that resembles a flag, before the price resumes its original direction.

Typically, this pattern forms when there’s a strong and aggressive price movement in one direction, followed by a temporary pause or pullback where price consolidates sideways. These setups often present excellent short-term trading opportunities.

This pattern commonly appears when price hits a weak support or resistance zone, consolidates in a tight range, and then gathers enough momentum to continue moving in the original direction without reversing.

Two Main Types of Flag Chart Patterns in Forex Trading

- Bullish Flag Chart Pattern

- Bearish Flag Chart Pattern

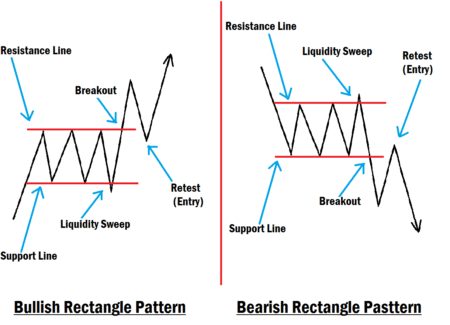

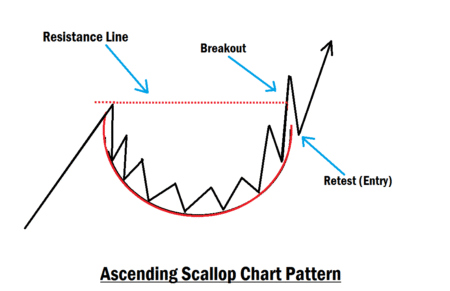

Bullish Flag Chart Pattern

This pattern forms during a strong uptrend. After an aggressive bullish move, price hits a weak resistance level or a bearish order block and begins to pull back or retrace slightly, forming a flag-like shape. Once enough momentum builds, the bullish trend continues.

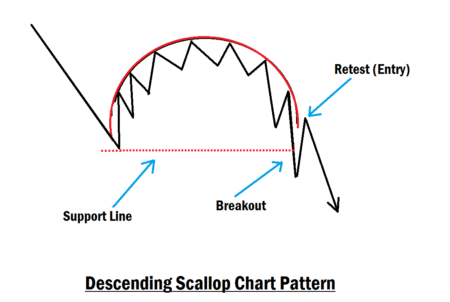

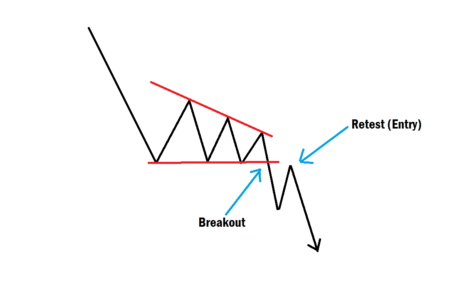

Bearish Flag Chart Pattern

This pattern appears during a strong downtrend. Price moves aggressively downward, hits a weak support level or a bullish order block, and then consolidates in an upward-sloping flag pattern. Eventually, the bearish trend resumes with momentum.

How to Trade the Flag Chart Pattern Like a Pro

When a price approaches a weak support or resistance level, it doesn’t simply cut through it as if it were nothing. Every zone, strong or weak, gets respected. The difference is in how price reacts: strong zones often lead to reversals, while weak zones usually cause brief consolidations before the price breaks through.

When you notice price consolidating at a weak zone and forming a flag pattern, it’s often a strong indication that the price is likely to continue in the direction of the prevailing trend. The flag pattern is most effective in trending markets when price is clearly bullish or bearish.

Here’s how to trade it step-by-step:

- Identify a Strong Trend: Make sure price is trending strongly upward or downward.

- Spot the Flag Formation: After the initial impulse move (flagpole), look for a tight, corrective consolidation (the flag).

- Use a Trendline Tool: Draw a trendline to connect the swing highs and lows of the flag formation.

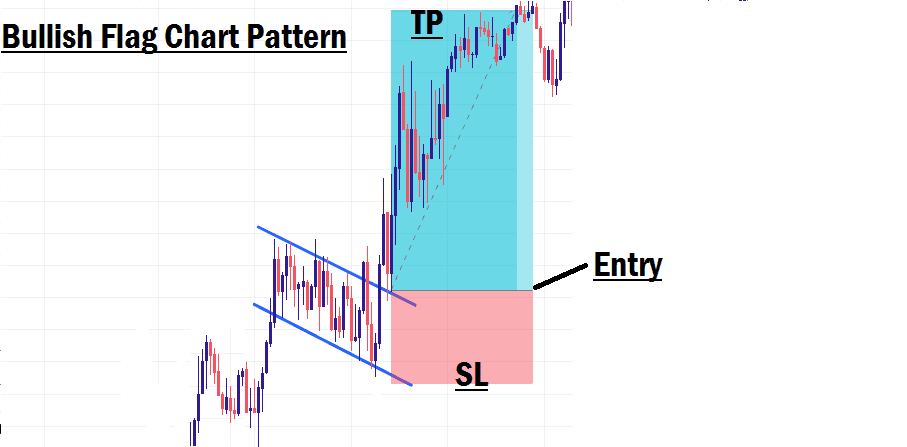

- Wait for the Breakout: Don’t rush into a trade. Wait for price to break out of the flag structure with visible momentum.

- Confirm the Retest: After the breakout, wait for the price to retest the broken trendline.

- Enter the Trade: Enter a buy or sell trade (depending on the direction) once the retest confirms the breakout.

- Set Your SL and TP: Place your stop loss below the most recent low (for buys) or above the recent high (for sells). Target at least 2–3 times your stop-loss size for your take-profit target.

Example

Let’s say price is in a strong bullish trend. After a significant upward move, you notice price consolidating downward, forming a bullish flag pattern. Draw your trendlines to mark the upper and lower bounds of this flag. Wait for a breakout from the upper trendline with strong bullish momentum.

Once the breakout occurs, let the price retest the broken flag boundary. If it holds, enter your buy trade. Place your stop loss below the most recent swing low before the breakout. For your take profit, aim for at least three times your stop loss distance to maintain a solid risk-to-reward ratio.

This same process works for the bearish flag pattern, only in reverse. Watch for downward breakouts, wait for the retest, and then enter a sell trade.

Final Thoughts

Don’t expect the flag pattern to always form with perfect symmetry or textbook visuals. Market price action can be messy, and patterns might not look exactly how you imagined them. That’s why it’s so important to practice identifying and trading this pattern using a demo account. Train your eyes to spot it, even in less-than-ideal conditions.

Master this strategy thoroughly before using it with real capital. With enough experience, you’ll be able to take advantage of high-probability continuation setups with confidence.

In our next lesson, we’ll be diving into the “Smart Money Concept in Forex Trading.” Don’t miss it. It will open your eyes to how the market really works and sharpen your edge as a trader. See you there!