Trade the Forex Market with Trendline Like a Pro

The trendline is one of the most widely used tools in forex trading, a simple yet powerful strategy employed by many professional traders to capture highly profitable moves in the financial market. It has been around for decades and remains relevant today due to its consistent effectiveness. However, while trendlines can serve as a profitable edge, they can also become a trap if used incorrectly.

Different traders apply trendlines in different ways, depending on their level of understanding and trading experience. Every market participant sees the market through their own lens, which is why there’s no one-size-fits-all approach to using trendlines. That’s why you must practice and refine your application of this tool until you’ve found what works best for your style. In this lesson, we’ll show you exactly how we trade using trendlines and how you can too, with precision and confidence.

The Reality of Trading with Trendlines

No trading strategy works 100% of the time in the forex market. Everything operates on probability. And when something is based on probability, that means there’s no certainty, just likelihood. Your job is to act only when the odds are in your favor and step aside when the odds are against you. That’s how you survive and thrive.

What Is a Trendline?

In forex trading, a trendline is a straight line drawn on a chart that connects a series of price points, typically swing highs or swing lows, to highlight the direction of the market trend and to identify possible areas of support or resistance.

For a trendline to be valid, it must connect at least two significant price points. These could be swing lows in an uptrend or swing highs in a downtrend. Without this connection, it’s not a true trendline.

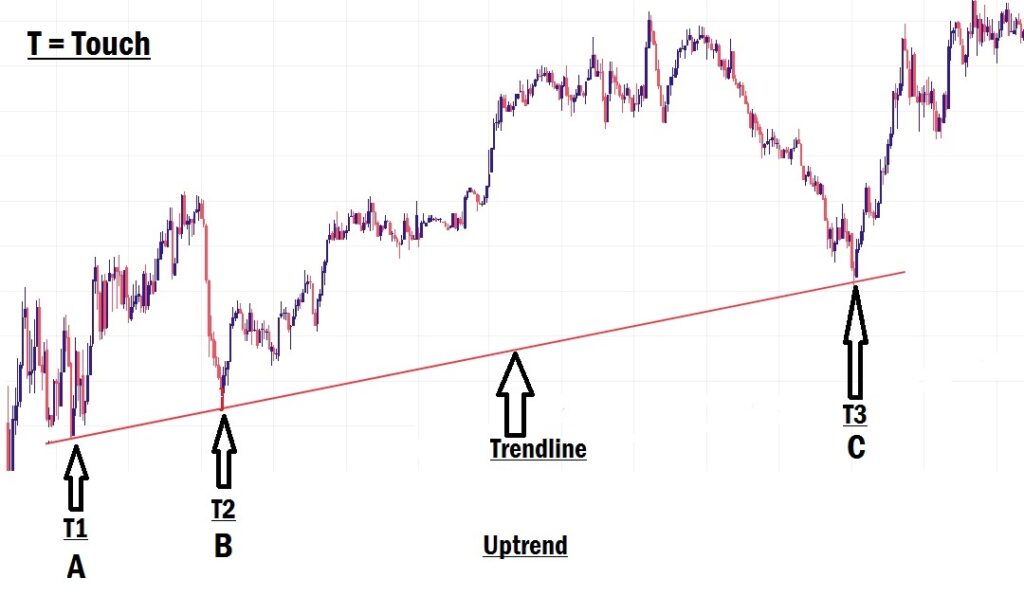

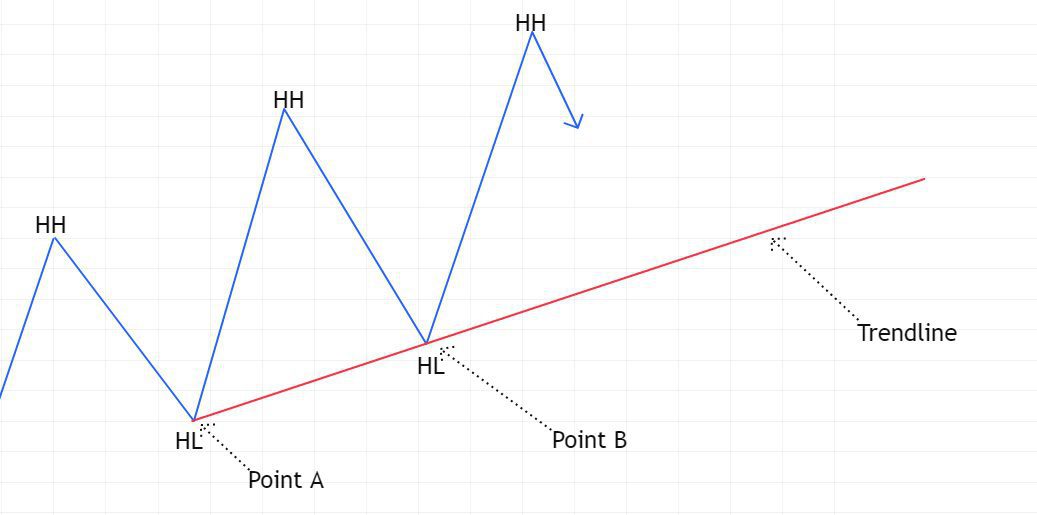

Example:

Suppose the market is in an uptrend, forming a sequence of higher highs (HH) and higher lows (HL). To draw your trendline, ignore the highs and focus on connecting the two most recent higher lows. Extend that line forward. This sets the foundation for anticipating future price behavior, especially the third touch, which often offers a quality trade entry.

The Ideology Behind a Trendline

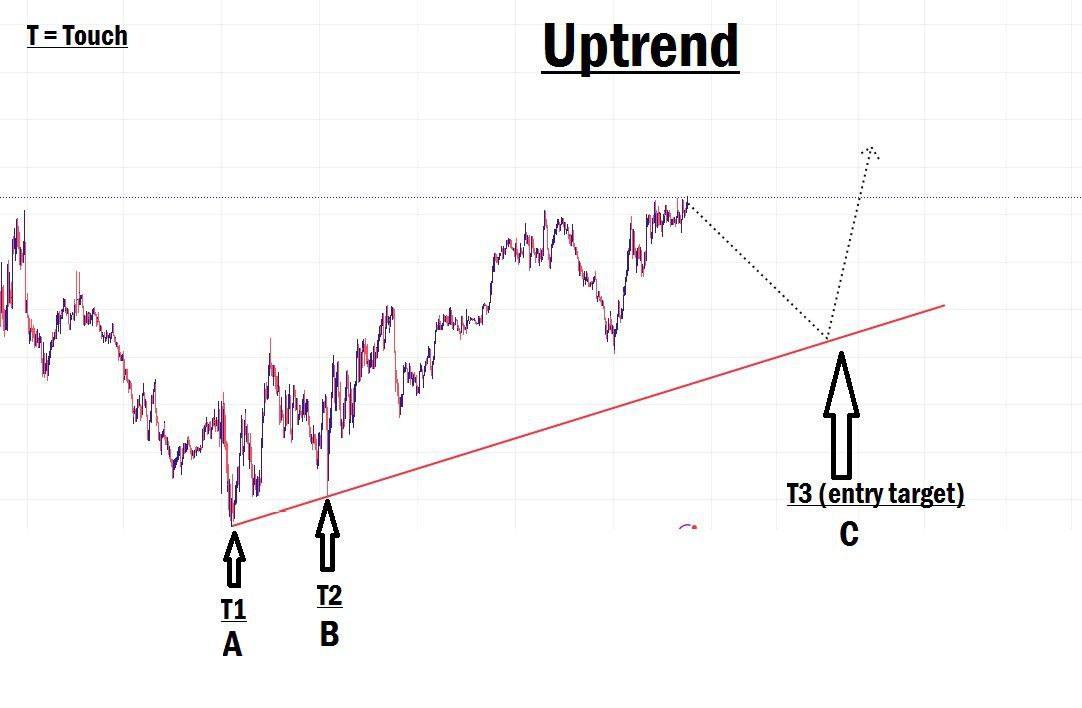

When drawn correctly, a trendline suggests that price will likely return to touch it for the third time before resuming its original direction. That anticipated third touch creates what we call a point of interest, and that’s your potential entry point.

To recap:

- Connect Point A and Point B (two swing points).

- Wait for the price to return to the trendline.

- Enter the trade at Point C (third touch), ideally after a confirmation like a Market Structure Shift (MSS).

The purpose of using trendlines is to help you join the existing trend, especially long-term trends that offer high-probability sniper entries.

But remember, as a retail trader, you have no control over the market. The market doesn’t respect your trendline just because you drew it. Only you see it. So don’t treat trendlines like gospel; treat them like a framework for opportunity, not a guarantee.

How to Draw and Use a Trendline Effectively in Forex

The effectiveness of your trendline depends entirely on how you draw it. A poorly drawn trendline can mislead you and cause unnecessary losses.

Key rule: Only draw trendlines during clear, established trends, not during consolidation. Draw the trendline touching the wicks of the two swing points, not the bodies of the candles.

- In an uptrend, connect two higher lows (HL) to project bullish continuation.

- In a downtrend, connect two lower highs (LH) to project bearish continuation.

Here’s how to approach this using multi-timeframe analysis:

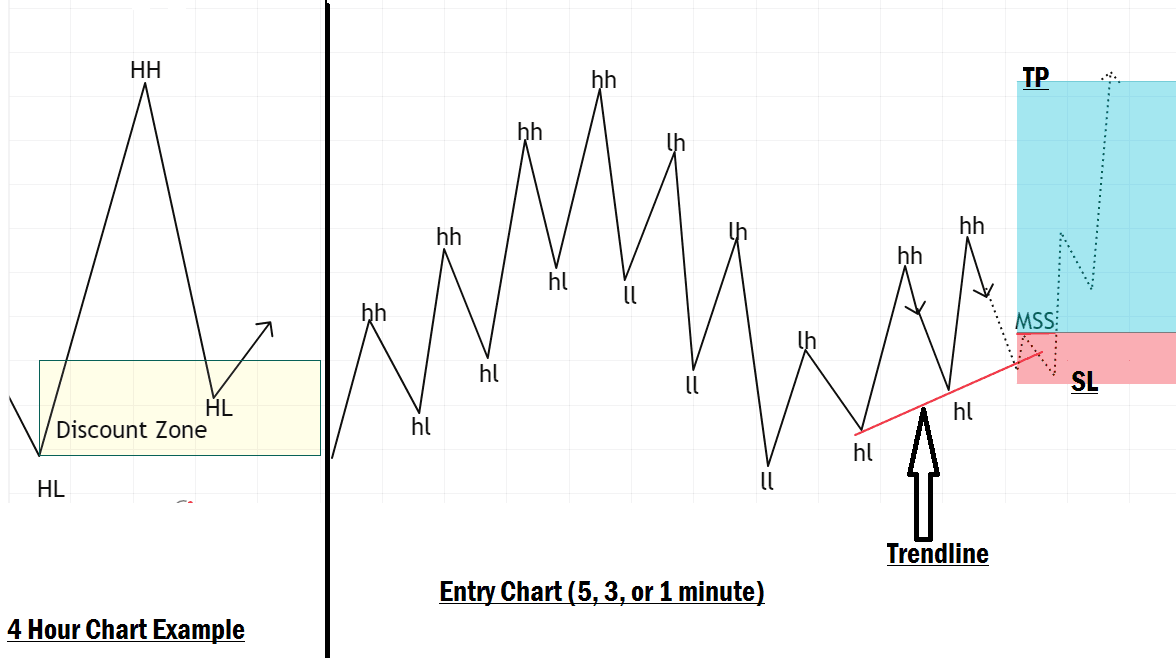

Step 1: Analyze the Higher Time Frame

Start by identifying the overall trend direction on a higher timeframe (Weekly, Daily, 4H, or 1H). The higher time frame sets the context. Remember:

A small retracement on the 4H might look like a massive trend on the 5M or 1M chart. Don’t be deceived by short-term noise.

Wait for a retracement in the higher time frame to complete, usually into the discount zone (for buys) or premium zone (for sells) of your Fibonacci tool, and then prepare for the next impulse.

Step 2: Drop to a Lower Time Frame for Entry

Once the higher time frame signals a continuation of the main trend, drop down to a lower timeframe (15M, 5M, or 1M) and wait for a clear trend to resume.

Uptrend Example:

- The higher time frame is bullish.

- The price has retraced and is now reversing upward.

- On your lower timeframe, wait for two higher lows to form.

- Draw a trendline connecting the two HLs.

- Extend it forward and wait for the third touch.

- Confirm the entry with a Market Structure Shift (MSS); this is your green light.

Set your Stop Loss (SL) just below the swing low that follows the MSS.

Set your Take Profit (TP) at a risk-to-reward of at least 1:3, or even higher if targeting the next major high on the higher timeframe (you could achieve 10–20x risk if it plays out well!).

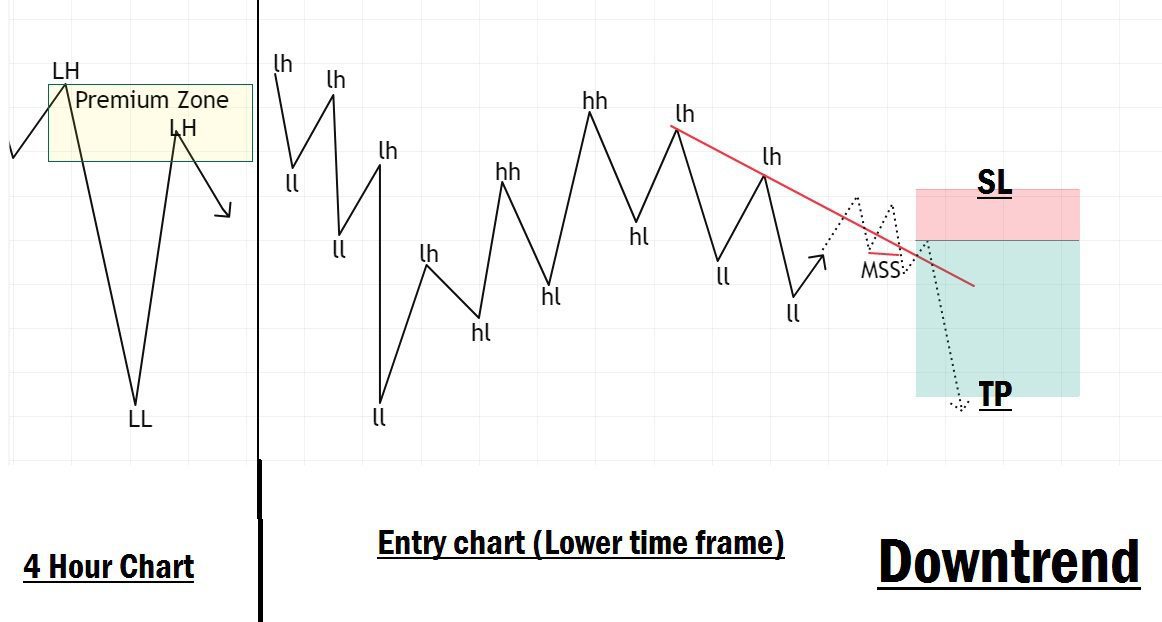

Downtrend Example:

- The higher time frame is bearish.

- Price has retraced to the premium zone and is now reversing lower.

- On your lower timeframe, wait for two lower highs to form.

- Draw a trendline connecting those LHs.

- Look for the third touch.

- Confirm with a MSS, then enter your trade.

Place your SL just above the swing high after MSS, and your TP can be at least 3 times your SL, or even at the next lower low of the higher timeframe for sniper precision.

Final Thoughts

Don’t expect the third touch to always happen with perfect precision. Sometimes the price reverses slightly above or below the trendline. It is why confirmation is key. Always wait for a signal, like Market Structure Shift, before placing your trade. It builds your confidence and improves your win rate over time.

As a beginner, your task is to practice this strategy consistently using a demo account. Master the approach, adapt it to your personality, and don’t be afraid to make it your own. But if it doesn’t suit your style, that’s okay, simply move on to the next lesson.

Up Next:

In our next lesson, we’ll be diving into the “Support and Resistance Trading Strategy.”

Let’s go there!