The Hierarchical Structure of the Forex Market

Welcome to this lesson! Today, we’ll be exploring “Understanding the Hierarchical Structure of Forex.”

The foreign exchange (forex) market is vast, decentralized, and the largest financial market in the world. It is traded globally by both large institutions and individual participants. On average, forex sees a daily trading volume of around $7 trillion.

Despite its decentralized nature, the foreign exchange (forex) market operates within a hierarchical structure. This hierarchy ranks participants based on their level of influence, trading volume, and role in the financial system. As a retail trader, understanding your place within this structure is crucial. It helps you make better trading decisions and understand the limits of your influence on the market.

What Does “Decentralized” Mean in Forex?

When we say the forex market is decentralized, we mean there is no single location or central exchange for transactions. You don’t need to travel, deliver physical items, or meet anyone face-to-face to conduct a trade. Forex transactions can be completed electronically or physically, depending on the platform and participant.

Thanks to modern technology, traders can participate in the market from the comfort of their homes or offices. Prices are not fixed, which means exchange rates vary between dealers. These fluctuations create a dynamic environment where traders can choose to buy or sell at any price that suits them.

The competitive nature of the market ensures that you’re often getting some of the best possible rates, as dealers constantly adjust to market conditions.

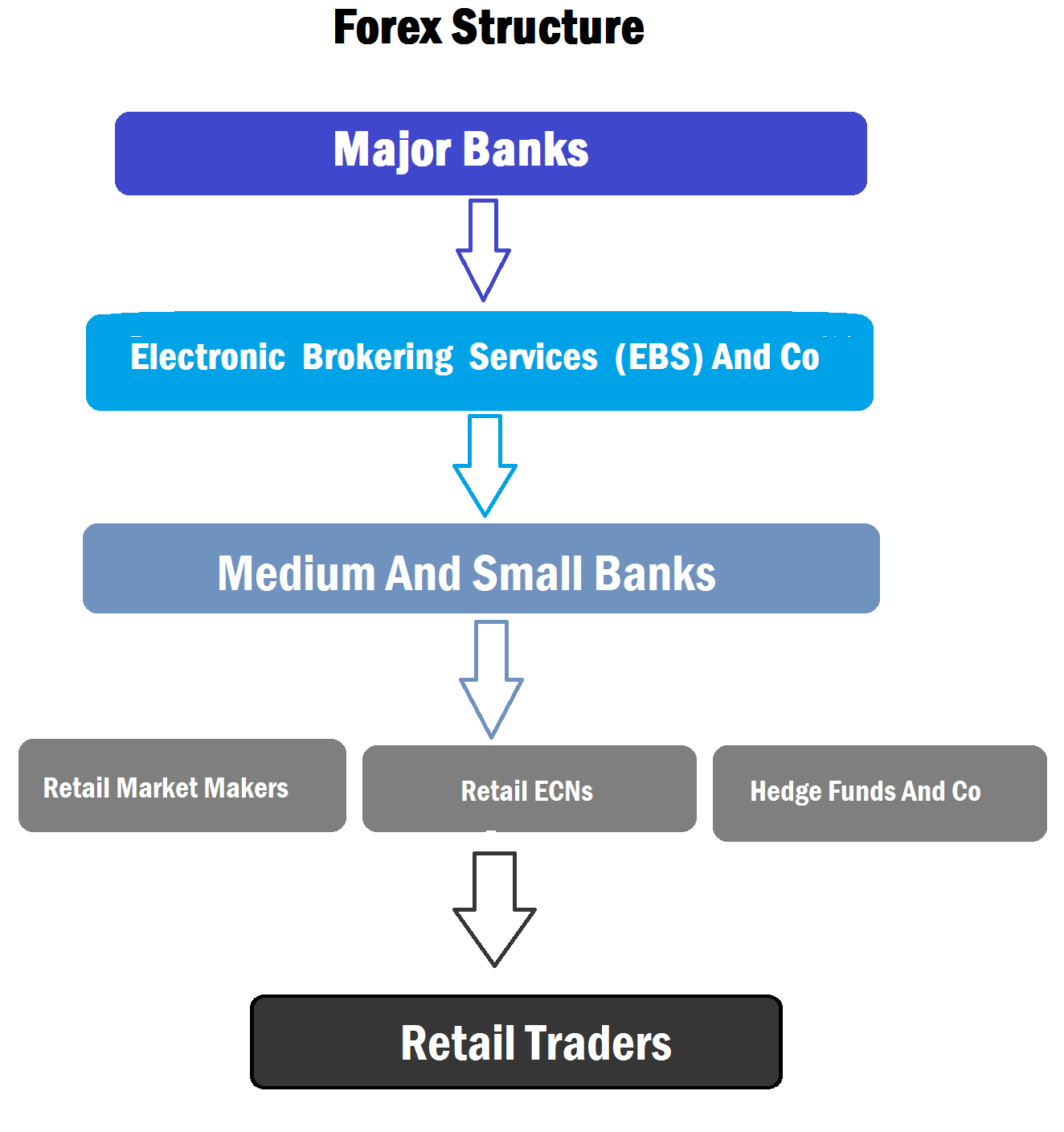

The Forex Hierarchical Structure

Even though the forex market is decentralized, that doesn’t mean all participants are equal. The market is organized in a hierarchy, where participants are ranked based on their trading volume and influence.

Understanding this hierarchy helps you grasp how transactions flow and how different market participants interact. Let’s break down this structure, starting from the top.

1. Interbank Market (Major Banks)

At the top of the structure are the major global banks, often referred to as the interbank market. These institutions trade massive volumes, often in hundreds of millions to billions of dollars, and contribute the largest share of liquidity in the forex market.

These banks trade directly with one another, either bilaterally or through electronic platforms like EBS Market and Reuters Matching.

Even though all banks in the interbank network can see each other’s rates, access to those deals depends on existing credit relationships, just like in real life. If you have a solid reputation and credit standing, you’re more likely to get better rates and access larger volumes.

2. Hedge Funds, Retail Market Makers & ECNs

Next in line are hedge funds, retail market makers, and retail ECNs (Electronic Communication Networks). These players also handle millions or even billions of dollars in trading volume but typically operate through commercial banks rather than directly with the interbank market.

Because of this, they usually get slightly higher and less favorable exchange rates than major banks. Still, they contribute significantly to the market’s liquidity and play a key role in price movements.

3. Retail Traders (You!)

At the bottom of the structure are retail forex traders, individuals like you and me. We participate in the market through online trading platforms provided by retail brokers or market makers.

While retail traders don’t move the market, the rise of internet access, electronic trading, and leverage has opened the doors for everyday people to enter the forex world. Today, anyone can participate with just a small amount of capital, thanks to leverage and the accessibility of online platforms.

Why the Hierarchy Matters

Understanding this structure gives you a clear picture of your position and role in the market. It teaches you that retail traders don’t influence price movements. We react to them. That’s why you can’t always predict whether the price will rise or fall next.

Retail traders operate based on the information available to them. Unfortunately, not all information is accurate, and this can lead to poor decisions and losses.

Final Thoughts

Knowing the hierarchical structure of the forex market is key to becoming a better trader. It sharpens your perspective and helps you make informed decisions rather than trading blindly.

Remember, as a retail trader, your power lies not in moving the market but in responding wisely to its movements.

In our next lesson, we’ll dive into “Understanding the Forex Market Players.”