How Smart Money Concept (SMC) Traders Can Use the Evening Star Candlestick Pattern for Effective Trade Entries

In this session, we’re going to explore how Smart Money Concept (SMC) traders can enhance their trading efficiency by adopting a risk-first, reward-second mindset. By understanding trade entries through the lens of risk management, traders can use the Evening Star candlestick pattern not just as a visual pattern-spotting exercise, but as a proactive risk filter. This approach ensures that traders confirm Points of Interest (POI) with the underlying principle that informed risk assessment paves the way for potential rewards. We will uncover how mastering this strategy makes way for more powerful and effective trade entries in the forex market.

One of the biggest challenges beginner SMC traders face is entry confirmation. Many traders mistakenly believe that once the price touches a Point of Interest (POI), it is automatically the right time to enter a trade. But the truth is, you don’t just jump into a position simply because price has reacted to your zone. Before placing any trade, you need strong confirmation that price is likely to respect your POI. One of the most reliable and widely used confirmation tools is the Evening Star candlestick pattern.

Why Entry Confirmation Matters in SMC Trading

As a smart money trader, you already know that not every POI will be respected by price. Sometimes, price may reach your zone and blow right through it without a proper reversal. If you blindly enter trades just because the market touches your POI, you will end up losing money repeatedly.

This is why marking out POIs is important, but confirming your entry is even more important. Remember, the market doesn’t owe anyone respect for their zones. Price will always do what it wants, so your job as a trader is to wait for clear confirmation signals before committing your capital.

The Reality of Forex Trading for Beginners

If you’re just starting out, always keep this truth in mind: nothing in forex works 100% of the time. Forex trading is a business of probabilities, not certainties. This is what makes it both exciting and risky. To succeed, you need the right blend of knowledge, discipline, and patience.

Instead of rushing into live trading, start with a demo account. Use that period to practice, learn, and master your trading strategy. If you’re not profitable in demo trading, there’s no magic that will suddenly make you profitable in the live market. Your trading success comes from consistency, not chance.

Evening Star Candlestick Pattern Performance

The Evening Star candlestick pattern is one of the most effective reversal patterns in forex trading. According to industry backtesting results conducted over a one-year period, using major currency pairs like EUR/USD, GBP/USD, and USD/JPY, the Evening Star showed an impressive average win rate of 76%. These tests were carried out on various timeframes, such as the 1-hour and 4-hour charts. While this pattern performed consistently well in trending markets, results varied in ranging market conditions, with a slightly reduced win rate. This detailed breakdown reinforces the need for context and encourages traders to consider these factors before attempting to replicate the setup.

This makes it a high-probability entry confirmation tool every beginner should learn and master. By using the Evening Star pattern at your POIs, you greatly minimize risk while maximizing profit potential, the perfect formula for trading the forex market effectively.

Key Takeaway: The Evening Star candlestick pattern is not just a chart formation; it is a confirmation model that helps SMC traders filter out false entries, reduce unnecessary losses, and increase overall profitability.

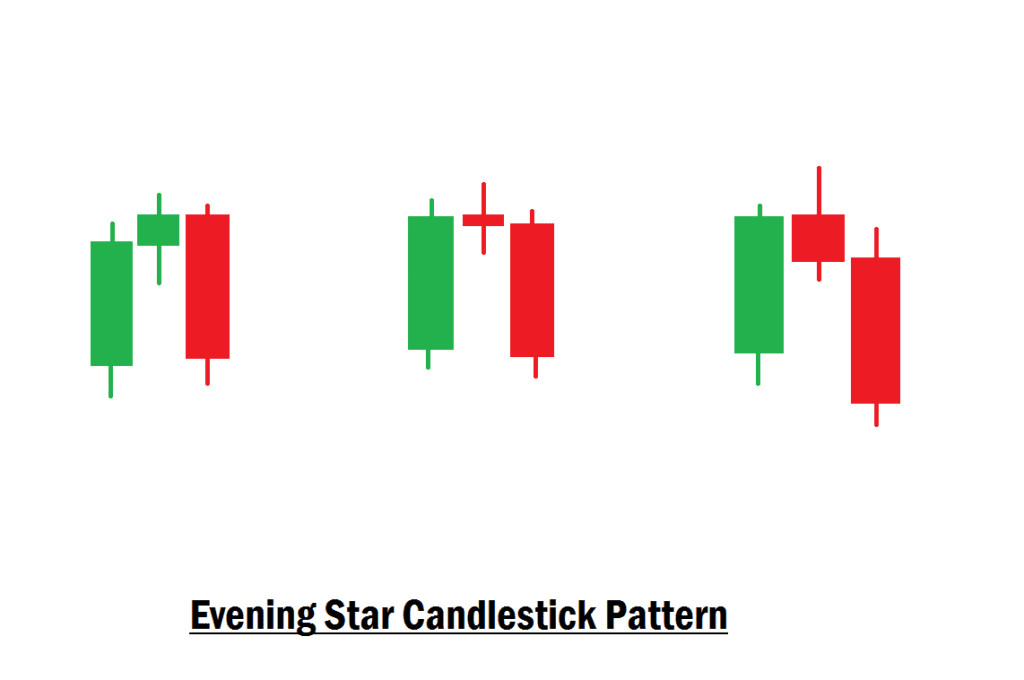

What Is the Evening Star Candlestick Pattern?

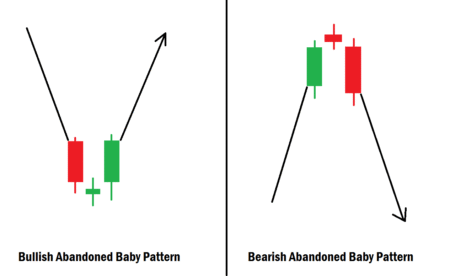

The Evening Star is a three-candle reversal pattern that forms at the top of an uptrend. It signals a potential shift in momentum from bullish to bearish, making it one of the strongest bearish reversal signals in technical analysis.

Here’s how it forms:

- First Candle (Bullish Candle): A strong bullish candle that continues the existing uptrend.

- Second Candle (Indecision Candle): A small candle (can be bullish, bearish, or a doji) showing market indecision.

- Third Candle (Bearish Candle): A strong bearish candle that closes deep into the body of the first bullish candle, confirming the reversal.

This combination shows that buyers are losing strength, sellers are stepping in, and momentum is shifting downward.

Why Is the Evening Star Important for Beginners?

For beginner traders, the Evening Star is one of the easiest and clearest candlestick patterns to identify. Unlike some patterns that require advanced interpretation, this setup gives you a straightforward signal: the uptrend is likely over, and a downtrend may be starting.

However, it’s crucial to remember: no candlestick pattern works 100% of the time. The Evening Star works best when combined with a strong Point of Interest (POI) in your SMC trading plan. That’s where confirmation comes in.

Using the Evening Star for Entry Confirmation in the PD Array

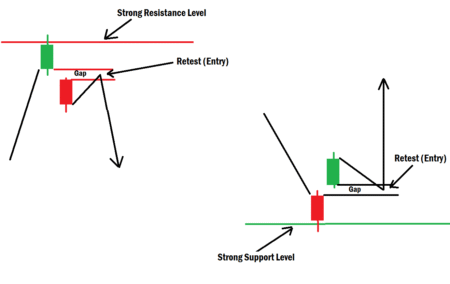

In Smart Money Concepts (SMC), you mark out Points of Interest (POIs) in the PD Array, such as Order Blocks, Fair Value Gaps (FVGs), or Supply Zones, where price is likely to react. But not every POI gets respected. Sometimes price will blow right through your zone.

That’s why using the Evening Star as confirmation is powerful. Here’s how you can do it:

- Identify Your POI: First, mark out your zone in the PD Array (e.g., a bearish Order Block or Supply Zone).

- Wait for Price Reaction: Be patient as price enters your POI. Don’t enter blindly.

- Look for the Evening Star: Watch the candlestick formation. If an Evening Star pattern appears inside your POI, that’s your confirmation that sellers are likely taking control.

- Place Your Entry: Once the pattern is confirmed, you can take a short position. Ideally, your stop loss should go just above the POI or above the high of the Evening Star.

- Target Profit Zones: Aim for liquidity pools, imbalances, or demand areas below as your take-profit levels.

Example of Evening Star Confirmation in SMC Trading

Imagine a price rally breaking into a bearish Order Block on the 4-hour chart. Instead of entering right away, you look for a confirmation signal on a 15-minute timeframe. Inside that zone, an Evening Star forms, showing you that buyers are exhausted and sellers are stepping in. That’s your green light to enter the trade. Your entry should be once the strong bearish candlestick that confirms the evening star pattern closes. Your stop loss should be above the zone or above the evening star formation. Your take profit should be the next liquidity area or two to three times the size of your stop loss. By waiting for the Evening Star confirmation, you’ve reduced the chance of getting stopped out and increased the probability of catching a high-quality reversal.

However, not every setup guarantees success. Consider a scenario where the Evening Star forms, but price unexpectedly continues upward and hits your stop loss. This is a reality in trading where market dynamics can sometimes contradict expectations. In such cases of failed setups, it’s crucial to adapt by measuring market conditions and ensuring that your risk management strategies are in place. This experience can be a lesson in the importance of evaluating other factors, such as market sentiment or news events, that might have influenced the price action. Preparing for these inevitabilities helps in developing a more resilient and adaptable trading approach.

By combining evening star with SMC POIs, you’re not just trading a candlestick in isolation; you’re trading a confluence setup, which greatly improves your accuracy and risk-to-reward ratio.

Tips for Beginners

- Always confirm the Evening Star at your POI in the PD Array (don’t trade it in random areas).

- Use a multi-timeframe approach: Mark your POI on higher timeframes, then look for the Evening Star on lower timeframes.

- Don’t risk more than you can afford to lose. Always apply proper risk management by risking only 1% of your trading capital per trade.

- Practice spotting the pattern on demo before risking real money.

Final Thoughts

The Evening Star candlestick pattern is a powerful reversal signal that beginners can easily spot and apply in their trading. When combined with Smart Money Concepts and used for entry confirmation at your POIs in the PD Array, it becomes a high-probability tool that helps you trade smarter, not riskier.

Remember, forex trading is not about finding certainty; it’s about stacking probabilities in your favor. The Evening Star pattern is one of those tools that can tilt the odds toward your success when used with patience, discipline, and strategy. If you have any questions concerning this topic, let us know in the comments section. Trade wisely!