Equal Highs and Equal Lows in Forex Trading (Simplified for Beginners)

Imagine this: You’re observing the EUR/USD chart and notice the market forming two clear peaks at essentially the same level. These are the equal highs, signaling a potential trading opportunity. Equal highs and equal lows play a very important role in technical analysis within the forex market. These formations reveal valuable information about market structure, liquidity, and smart money activities.

If you are a beginner or a struggling trader, understanding equal highs and equal lows will help you uncover one of the biggest mysteries in forex: how liquidity is distributed and manipulated by smart money players. Let’s embark on a transformative journey from a struggling trader to a liquidity hunter through a three-step story arc: Discovery, Practice, and Mastery.

In this lesson, we’ll break down everything you need to know about equal highs and equal lows, why they matter, and how you can use them as part of your trading strategy.

Important Note for Beginners

Forex trading is a high-risk business and not suitable for everyone. It operates on probabilities, not certainties. That’s why you should learn, practice, and master your trading skills on a demo account before risking your real money.

If you’re not yet profitable on a demo account, you’re unlikely to be profitable on a live account either. Trading success comes through mastery, patience, and consistency.

What Are Equal Highs and Equal Lows in Forex?

Equal highs and equal lows are price levels on a chart where the market forms two or more relatively equal points, creating what’s known as a double top, double bottom, triple top, or triple bottom pattern.

These levels are crucial because they represent zones of high liquidity and often act as support or resistance during periods of price consolidation.

It’s important to note that equal highs or lows don’t have to be exactly the same price level; what matters is that they are relatively equal.

In Smart Money Concepts (SMC) or Inner Circle Trader (ICT) theory, these relatively equal highs or lows are known as liquidity pools. They exist because retail traders frequently set their buy/sell orders and stop-loss levels around these areas.

What Is Liquidity in Forex Trading?

To understand why equal highs and lows are important, you must first grasp the concept of liquidity.

In forex, liquidity simply means money, the orders placed in the market by traders. These include pending orders and stop losses. Areas with many orders are known as high-liquidity zones.

For example:

- Retail traders often set stop losses above equal highs or below equal lows. These traders are double top or bottom chart pattern traders.

- Others place pending orders expecting price reversals at the third touch of the area. These traders are support or resistance levels traders.

Because of this, liquidity accumulates around equal highs and lows, and the market (controlled by smart money) naturally seeks to capture or sweep this liquidity before making its next move.

In short:

Price moves toward liquidity. Once it clears it, it often reverses direction to target the opposite side’s liquidity.

Price moves toward liquidity. Once it clears it, it often reverses direction to target the opposite side’s liquidity.

Why Equal Highs and Equal Lows Are Areas of High Liquidity

Equal highs and lows attract huge trading activity because:

- Double top/bottom traders execute trades here.

- Support and resistance traders place orders expecting the “third touch.”

- Triple top/bottom traders anticipate price reversals at these same levels.

All these traders usually keep their stop losses just above or below the previous highs/lows.

As a result, these equal levels become liquidity magnets, where millions of dollars in retail orders are sitting, waiting to be triggered.

That’s why smart money often targets these zones first, to “sweep” liquidity, before moving price in the real intended direction.

Which Equal Highs or Lows Should You Consider Valid?

As a trader who understands liquidity, you should pay more attention to relatively equal highs or lows where:

- The first high/low is slightly higher (or lower) than the second, and

- Liquidity from the first point has not been swept yet.

This setup is more valid because there’s still untouched liquidity resting above or below those levels.

When price revisits these zones, it will usually:

- Sweep liquidity from both equal levels.

- Then show a reversal confirmation, like a Market Structure Shift (MSS) or Change of Character (CHOCH).

That’s the professional’s cue to take action.

How to Trade Equal Highs and Equal Lows Like a Pro

Here’s how to apply this concept practically:

- Wait for the liquidity sweep, don’t jump in too early, the way most retail traders do.

- Once price sweeps equal highs or lows, look for a strong reversal signal (like MSS or CHOCH).

- Enter your trade in the direction of the reversal, targeting the opposite side’s liquidity.

Example:

- If price sweeps equal highs (buy-side liquidity), expect a reversal toward equal lows (sell-side liquidity).

- If it sweeps equal lows, anticipate a reversal upward toward equal highs.

Remember, liquidity acts as a magnet; price always moves toward areas with the most liquidity.

Practical Example (EUR/USD)

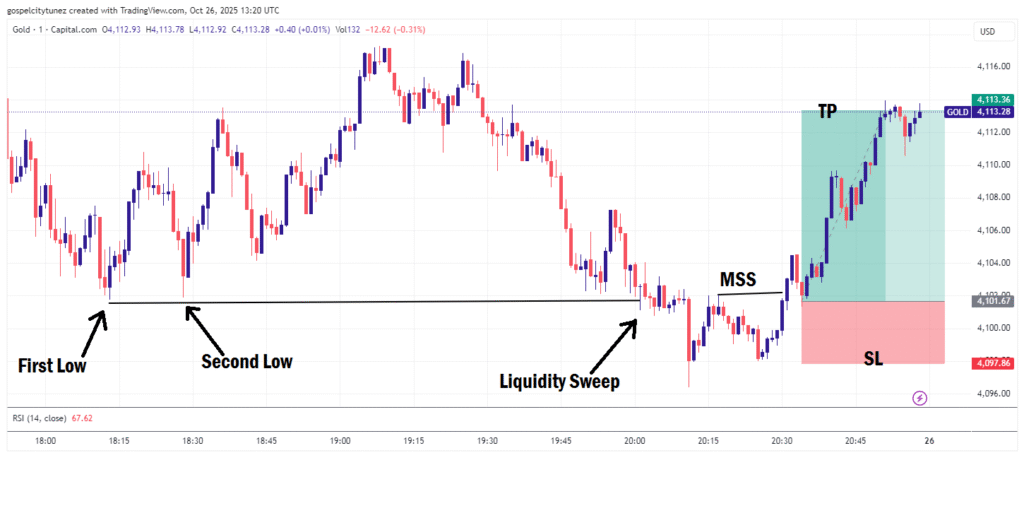

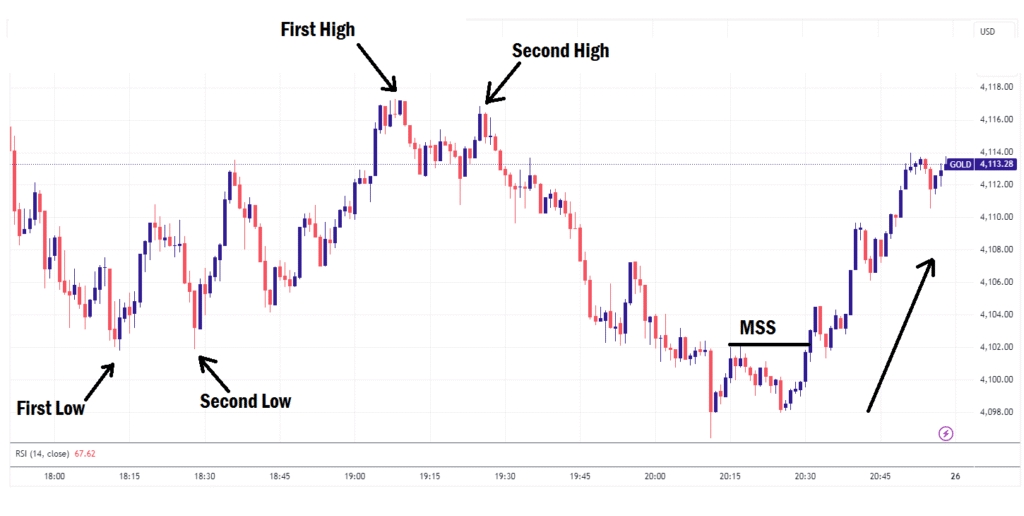

Looking at a typical EUR/USD chart example below:

- You might see two relatively equal lows where the first low is slightly higher than the second.

- When price returns to that zone, it sweeps the liquidity, confirms a market structure shift, and reverses upward.

- Professional traders would enter their positions after the MSS is confirmed, targeting the opposite equal highs for profit.

That’s the smart money approach: simple, strategic, and effective.

Final Thoughts

Liquidity is the primary target of price in the forex market.

When you master the concept of equal highs and equal lows:

When you master the concept of equal highs and equal lows:

- You stop adding liquidity, and

- You start taking liquidity from the market, just like professional traders.

Where you place your trade determines whether you’ll be the hunted or the hunter in the market.

Take your time to study, practice, and observe how liquidity behaves around equal highs and lows. Once you understand it deeply, your trading confidence and accuracy will greatly improve.

If you have questions about this topic, feel free to drop them in the comments, and remember:

Become a liquidity taker, not the liquidity itself!

Become a liquidity taker, not the liquidity itself!