Economic News Trading in Forex: A Powerful Strategy for Smart Traders

In today’s session, we’ll be diving into a powerful strategy known as “Economic News Trading in Forex.”

Among the easiest and most accessible trading approaches for beginners, news trading stands out as a strategic way to capture significant moves in the forex market, if executed correctly. One of its biggest advantages is that it doesn’t require you to sit in front of the charts all day. You simply need to be ready to act around the time key economic news is scheduled for release.

A Word of Caution

Forex remains a high-risk market regardless of the strategy you use. As a beginner, never rush into live trading without first arming yourself with the right knowledge. Take the time to learn, practice on demo accounts, and sharpen your skills before putting real money on the line.

Many of us who are now making consistent profits didn’t get there overnight. We spent time learning, observing the market, and developing personalized strategies. If we come to the chart and don’t see a quality setup, we step aside. You, too, can succeed with the right mindset.

Why News Trading Can Be Risky

While news trading is simple when properly understood and practiced, it comes with high volatility, which makes it risky, especially for new traders. If you’re still struggling to find your footing in the market, it’s best to avoid trading during economic news events.

However, if you’ve mastered your trading strategy and understand how price reacts to news, a volatile market can offer quick profits. But remember: just as fast as it can reward you, it can also take everything away if you’re not prepared.

What Is Economic News in Forex?

In forex, economic news refers to the release of financial data or government announcements that reflect a country’s economic health. These include GDP reports, inflation statistics, and interest rate decisions, among others. Such data can significantly move the markets as traders react to the strength or weakness of an economy.

Every currency is tied to its country’s economy. For example, the USD represents the economic performance of the United States. Whenever economic news is released by the U.S., traders across the globe pay attention. The outcome of that news, positive or negative, impacts how the USD is valued in the forex market.

The Idea Behind News Trading

News trading is based on the idea that the better an economy performs, the stronger its currency becomes, and vice versa. When a country releases strong economic data, investor confidence typically increases, leading to a demand for that currency. On the other hand, weak data can cause investors to lose interest and shift their funds elsewhere, leading to depreciation.

How to Trade Economic News Like a Pro

If you want to trade news effectively, consider these three strategic approaches:

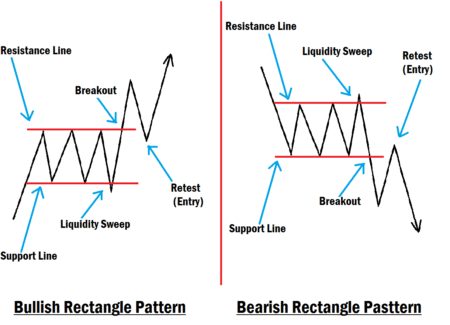

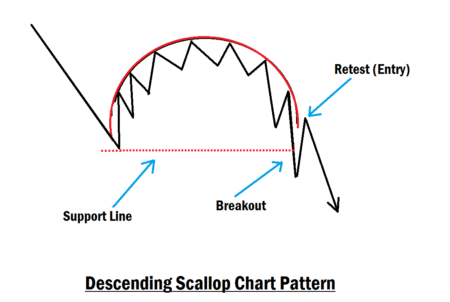

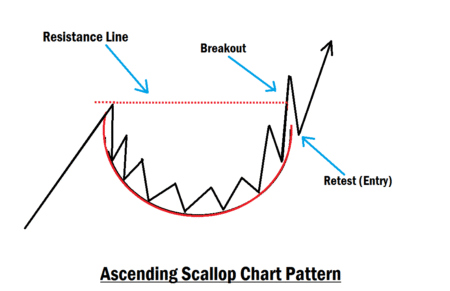

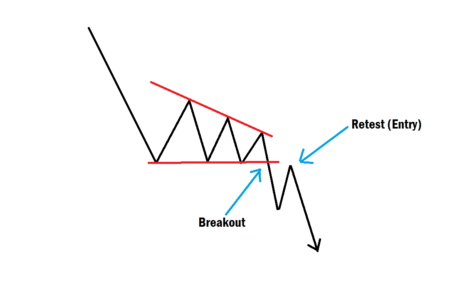

1. Breakout and Retest Strategy

Often, just after a major economic release, price breaks out of a consolidation zone (range). If this happens, wait for the price to retest the broken level (support or resistance) before entering your trade. This helps avoid false breakouts.

2. Order Block Strategy

Economic news often causes institutional-level movements, leaving behind clear order blocks. Wait for the price to return to these areas and look for confirmation signals before entering a trade.

3. Trend Reversal Approach

Let’s say GBP/USD has been trending upward, and then the U.S. releases a strong economic report favoring the dollar. This may cause a trend reversal. Wait for a market structure shift (MSS) to confirm the change before placing your trade.

⚠️ Important: There is no perfect or holy grail strategy in forex. Always test your strategies using a demo account before going live.

Three Major Categories of Economic News

- GDP (Gross Domestic Product)

- Inflation Rate

- Interest Rate Decisions

1. What is GDP (Gross Domestic Product)?

GDP is the total value of all goods and services produced within a country. It is one of the most important indicators of economic strength. A growing GDP suggests a healthy economy, which tends to strengthen the country’s currency.

How GDP Affects Currency

- Higher-than-expected GDP = Strong economic growth → Bullish for the currency.

- Lower-than-expected GDP = Weak economy → Bearish for the currency.

Example:

If the UK releases better-than-expected GDP data at 8 a.m. GMT, GBP may strengthen against the USD, causing GBP/USD to move higher. However, if the data is weaker than expected, GBP may fall.

Note: Traders often react more to how the actual data compares to the forecasted figure than to the number itself.

2. Inflation Rate News

Inflation measures how much prices are rising in an economy. When inflation is high, purchasing power decreases. Central banks watch inflation closely because it affects their decisions on interest rates, which in turn impact currency values.

Key Inflation Indicators

- CPI (Consumer Price Index): Measures the average change in prices paid by consumers.

- Higher CPI = Bullish for currency

- Lower CPI = Bearish

- PPI (Producer Price Index): Reflects the prices of goods and services at the wholesale level.

- Higher PPI suggests future inflation = Bullish.

- Lower PPI suggests disinflation = Bearish.

- Inflation Expectation Surveys: Predict future inflation.

- Rising expectations may prompt central banks to raise rates = Bullish.

- Falling expectations = Dovish = Bearish

- Central Bank Speeches:

- Hawkish (tightening) = Bullish

- Dovish (loosening) = Bearish

- Unemployment Rate:

- Lower = Bullish (strong economy)

- Higher = Bearish (weak economy)

- Non-Farm Payrolls (NFP):

- Higher NFP = Bullish for USD

- Lower NFP = Bearish for USD

- Employment Change (AUS, UK, CAD):

- Higher-than-expected = Bullish

- Lower-than-expected = Bearish

3. Interest Rate News

Interest rate decisions by central banks are arguably the most significant news events in the Forex market.

Key Types of Interest Rate News

- Central Bank Decisions:

- Surprise rate hike = Bullish

- Surprise rate cut = Bearish

- No change = Depends on the statement and market expectations.

- Monetary Policy Statements:

- Hawkish = Indicates rate hikes → Bullish

- Dovish = Indicates possible cuts → Bearish.

- FOMC Statement (U.S.):

- Even if the rate remains unchanged, a shift in tone (e.g., more cautious or aggressive) can trigger major moves in USD pairs.

Final Thoughts

Economic news events can bring enormous opportunities. But it also has high risks. If not managed properly, they can wipe out your trading account in seconds.

Tips for News Trading Success:

- Wait for the initial spike to calm down before entering.

- Always look for confirmation before placing a trade.

- If you’re a beginner, practice on a demo account until you’ve mastered your strategy.

- Focus on risk management above all else.

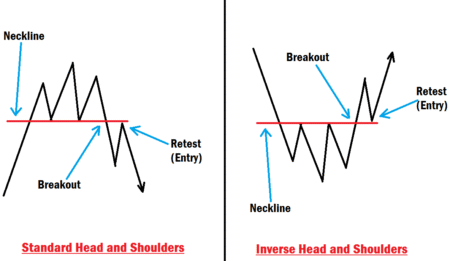

In our next lesson, we will be discussing “Head and Shoulder Chart Pattern Trading Strategy.” See you there, champ!