Combining Descending Triangle Chart Pattern with Smart Money Concept (SMC) for Better Trading Results

The Descending Triangle chart pattern is one of the most powerful and beginner-friendly technical analysis tools in forex trading. It is widely used by professional traders to capture trend continuation trades. When combined with Smart Money Concept (SMC) entry models such as Fair Value Gaps (FVGs), Order Blocks, and ICT Breakaway Gaps, it becomes an advanced yet easy-to-follow strategy for entering high-probability trades after a breakout and retest.

In this article, we’ll cover everything a beginner needs to know about the Descending Triangle chart pattern and how to combine it with SMC concepts for precise trade entries.

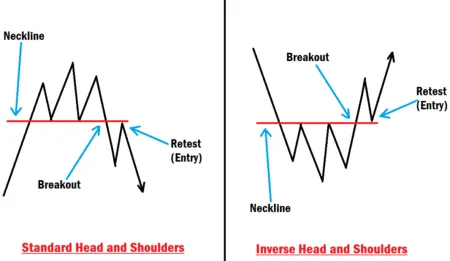

The Descending Triangle chart pattern is one of the most straightforward and beginner-friendly patterns you can find. It’s easy to spot and trade with. However, one drawback of chart patterns is false breakouts (inducements), which often trick inexperienced traders into taking entries that quickly hit their stop loss. To reduce the chances of falling for these fakeouts, the Smart Money Concept (SMC) comes in.

Why consider the Descending Triangle Chart Pattern?

Based on solid backtesting results and industry data, the Descending Triangle chart pattern has a high win rate despite its simplicity. Many professional traders utilize it to identify high-quality trend continuation entries. It is a powerful tool for anticipating trend continuation after a market pause. On its own, the Descending Triangle is already a strong strategy. But when combined with SMC, it becomes even more effective, like adding fuel to an already burning fire.

Smart Money Concept (SMC)

The Smart Money Concept (SMC) is one of the most talked-about trading strategies among retail traders today. Unlike traditional retail methods, SMC focuses on understanding and following the footprints of institutional traders, also known as the smart money players. In simple terms, institutional footprints refer to the significant trading patterns and activities of large financial institutions that are often invisible to smaller traders. These activities, sometimes referred to as liquidity grabs, are the movements where big players buy or sell assets to manipulate price levels, often resulting in losses for unaware retail traders. Understanding these institutional tactics is key to improving your trading game.

By using institutional reference points such as:

- Order Blocks

- Fair Value Gaps (FVGs)

- ICT Breakaway Gaps

- Liquidity Grabs or Sweeps

You’ll gain insights into what these big players and market makers are doing. This allows you to make precise entries with confidence, minimize losses, and maximize profits.

Why Combine Descending Triangle with SMC?

The answer is simple: combining both gives you more accurate entries and boosts your overall profitability.

- With SMC, you can detect inducements and avoid false breakouts.

- You’ll know when the real move begins.

- SMC helps you refine your entry, stop-loss (SL), and take-profit (TP) levels with precision.

Institutional traders are often the reason retail traders lose money, as they hunt liquidity by targeting stop-loss levels. By understanding what institutions are doing, you can align your trades with them and increase your chances of success.

If you’re new to SMC or just hearing about it for the first time, we recommend starting our free masterclass to build a solid foundation.

What Is the Descending Triangle Chart Pattern?

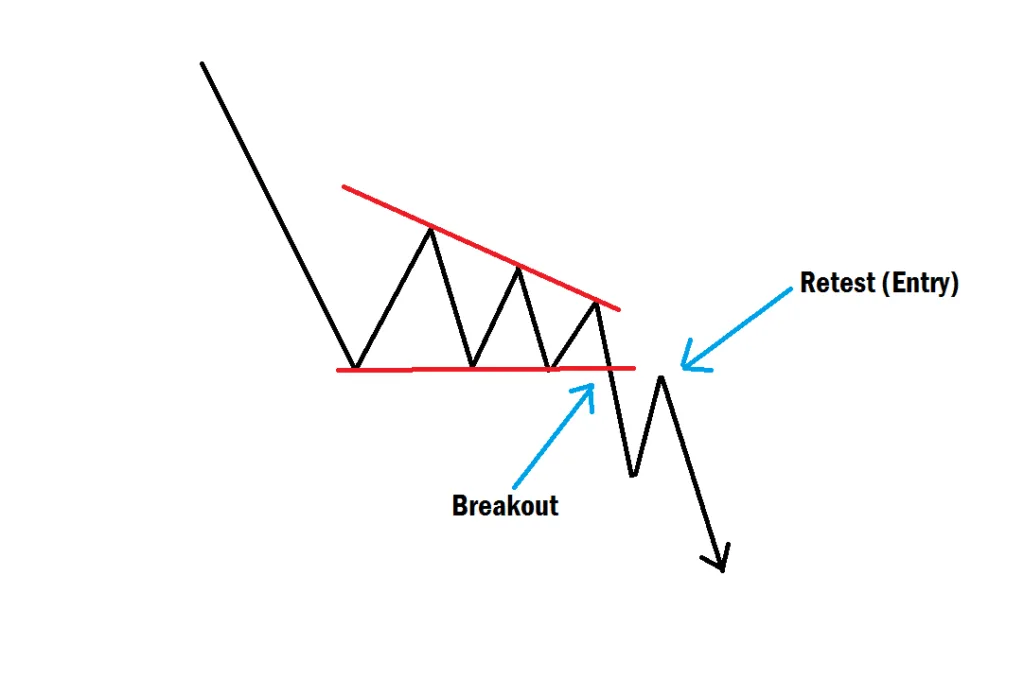

The Descending Triangle is a bearish chart pattern that forms when price consolidates in a narrowing range. It is characterized by:

- A horizontal support line at the bottom.

- A descending trendline connecting lower highs at the top.

This formation shows that sellers are becoming stronger, pushing the price lower each time, while buyers struggle to hold the same support level. Eventually, the support breaks, and the market continues downward, creating a trend continuation breakout.

How to Identify the Descending Triangle

To spot a Descending Triangle on your chart, look for:

- At least two equal lows forming a horizontal support line.

- Lower highs forming a descending trendline.

- Price consolidating between support and descending resistance.

- A breakout usually happening in the direction of the prevailing trend (most often bearish).

This makes the Descending Triangle an easy-to-recognize pattern, even for beginners.

How to Trade the Descending Triangle Chart Pattern

The traditional way to trade the Descending Triangle is:

- Wait for a clear breakout below support.

- Enter a trade either on the breakout itself or after the price retests the broken support (now resistance).

- Place your stop-loss above the most recent lower high.

- Target profit levels using measured moves or key support zones.

While this method works, it can sometimes lead to false breakouts (inducements) where price briefly breaks support, reverses back, and stops traders out. This is why combining the Descending Triangle with SMC entry models gives a more precise and professional edge.

Using SMC Entry Models with the Descending Triangle

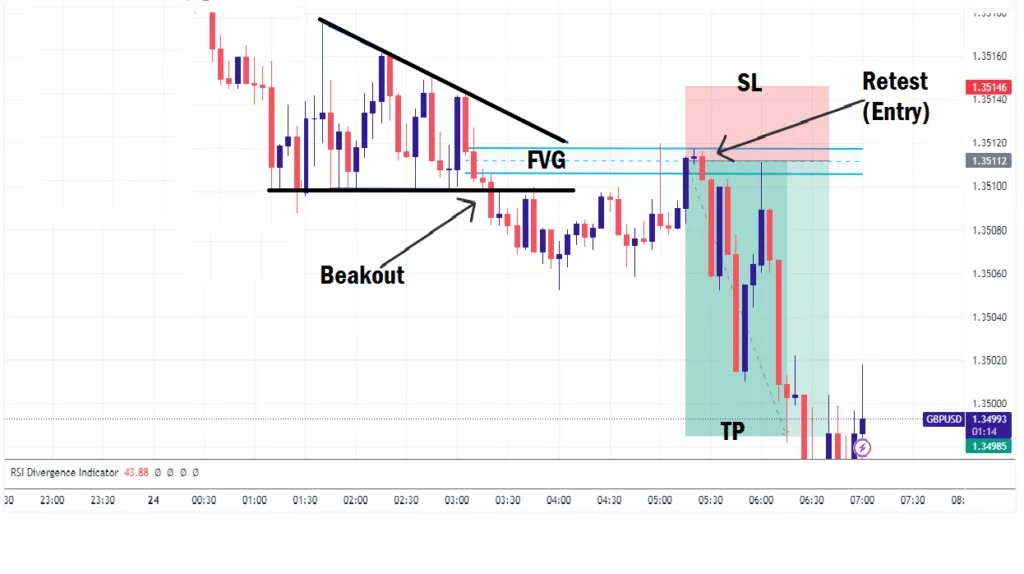

1. Fair Value Gaps (FVGs)

After a Descending Triangle breakout, wait for the market pullback to an imbalance (Fair Value Gap) it created during the breakout. This imbalance occurs because there are unfilled institutional orders, revealing where institutional traders might have left orders unexecuted. Understanding this concept helps you anticipate where smart money will likely re-enter their trades, offering you a strategic entry point. This insight into FVGs can transform a simple rule into a deeper understanding that enhances your trading strategy.

Entry Tip: Place a pending sell order inside the FVG during the retest for a high-probability entry.

2. Order Blocks

An Order Block represents the last bullish candle before a strong bearish move that led to the breakout (in a bearish setup). After the breakout of the Descending Triangle, price often pulls back to test the order block before resuming downward.

Entry Tip: Mark out the bearish order block within the breakout area. Use it as a refined entry point with your stop-loss just above the order block.

3. ICT Breakaway Gap

The ICT Breakaway Gap occurs when price strongly breaks out of a level, leaving a visible gap or imbalance behind. In the case of a Descending Triangle, this often happens when support is finally broken with strong momentum.

Entry Tip: Wait for the retest of the breakaway gap zone after the breakout. This is usually where smart money re-enters the market, providing an excellent opportunity to follow along.

Step-by-Step Strategy for Beginners

- Identify the Descending Triangle on your chart.

- Confirm the breakout with strong bearish momentum.

- Wait for a retest of the broken support (now resistance).

- Use SMC models to refine your entry.

- Look for an FVG around the retest area.

- Spot the Order Block that led to the breakout.

- Check if an ICT Breakaway Gap is formed.

- Enter your trade at the FVG or ICT breakaway gap with a stop-loss above the order block or recent swing high.

- Set your take-profit at the next major support or based on a 1:3 risk-to-reward ratio.

Benefits of Combining Descending Triangle with SMC?

- Filters fakeouts: SMC helps you avoid inducements by refining entries.

- Precision entries: Instead of entering blindly at the breakout, you use institutional footprints for accuracy.

- Higher win rate: Combining pattern recognition with institutional logic boosts profitability.

- Confidence in trading: You align with what smart money is doing, not against it.

Final Thoughts

The Descending Triangle chart pattern is one of the easiest patterns for beginners to recognize and trade. On its own, it offers great opportunities, but when combined with SMC concepts like FVGs, Order Blocks, and ICT Breakaway Gaps, it becomes a high-precision trading strategy.

If you’re new, start by practicing this setup on a demo account until you build confidence. Remember, no strategy works 100% of the time, but with proper risk management and the right knowledge, you can significantly improve your trading results. If you have more questions, drop them in the comment section. Learn to trade with reasons, not feelings.