Combining the Descending Scallop Chart Pattern with Smart Money Concepts (SMC) for High-Probability Forex Trades

Cut your early-trade losses in half by mastering the combination of chart patterns and Smart Money Concepts (SMC) in forex trading. One such effective setup is the Descending Scallop chart pattern, which has stood the test of time in financial markets. When paired with SMC entry models like Fair Value Gaps (FVGs), Order Blocks (OBs), and ICT Breakaway Gaps, this pattern becomes an excellent tool for identifying high-probability trade entries, especially during retests after a breakout.

If you’re a beginner trader looking to understand how to use this strategy effectively, this guide is for you.

The Descending Scallop pattern has been utilized in financial markets for many years, and professional traders continue to leverage its effectiveness to capitalize on profitable moves. However, one of the biggest challenges retail traders face is knowing the best entry point. This is where SMC trading models come in to refine entries and increase accuracy.

Effectiveness of the Descending Scallop Chart Pattern

According to industry backtesting data and trading records, the Descending Scallop pattern has a strong win rate. The win rate success is approximately 78% of cases across various market conditions. This data is based on a sample size of over 1,000 trades analyzed over a five-year period, demonstrating its reliability as a pattern. This makes it a powerful stand-alone strategy that even beginners can use to capture profitable trades.

The main difficulty, especially for beginners, lies in spotting the right entry point without being stopped out by institutional traders. Imagine a scenario where price suddenly spikes by 20 pips, sweeping stop losses placed by retail traders before reversing direction. This classic stop-hunt tactic leaves newcomers frustrated as they find themselves on the wrong side of the trade. That’s why combining the Descending Scallop pattern with Smart Money Concepts helps traders refine their entries, minimize losses, and trade with confidence.

Introduction to Smart Money Concepts (SMC)

If you are new to trading, you may be wondering: What exactly is Smart Money Concept (SMC)?

SMC is a trading model that focuses on analyzing and following the footprints of institutional traders, also known as smart money players. These institutional traders are responsible for a majority of price movements in the forex market.

Since institutional traders execute large orders, they need liquidity to fill them. This often leads them to drive price into areas where retail traders place their stop losses and pending orders. By understanding these movements, traders using SMC can avoid common traps and align their trades in the same direction as institutional flows.

SMC has become one of the most effective trading models available today. Many traders who master it enjoy consistent profits because it helps them anticipate market moves with precision.

The key SMC entry models include:

- Fair Value Gaps (FVGs): Imbalances left on the chart when price moves too quickly in one direction, leaving unfilled space.

- Order Blocks (OBs): The last bullish or bearish candle before a strong impulsive move, often used by institutions to enter trades.

- ICT Breakaway Gaps: Large gaps are created when price breaks strongly from consolidation, signaling institutional presence.

By combining these tools with the Descending Scallop, traders can identify precise entry points during the retest after a breakout. If you’re new to SMC or still struggling with it, consider starting our free structured masterclass to fully understand how it works.

Why Combine the Descending Scallop Pattern with SMC?

The answer is simple: precision and profitability.

While the Descending Scallop provides a clear picture of price direction, SMC gives you the exact institutional reference points to make refined entries. Instead of relying on guesswork, you can identify:

- Fair Value Gaps (FVGs)

- Order Blocks (OBs)

- ICT Breakaway Gaps

These SMC tools help you avoid being stopped out prematurely and give you confidence in your trade decisions. For beginners, this combination reduces the risk of entering too early or too late, while significantly increasing long-term profitability.

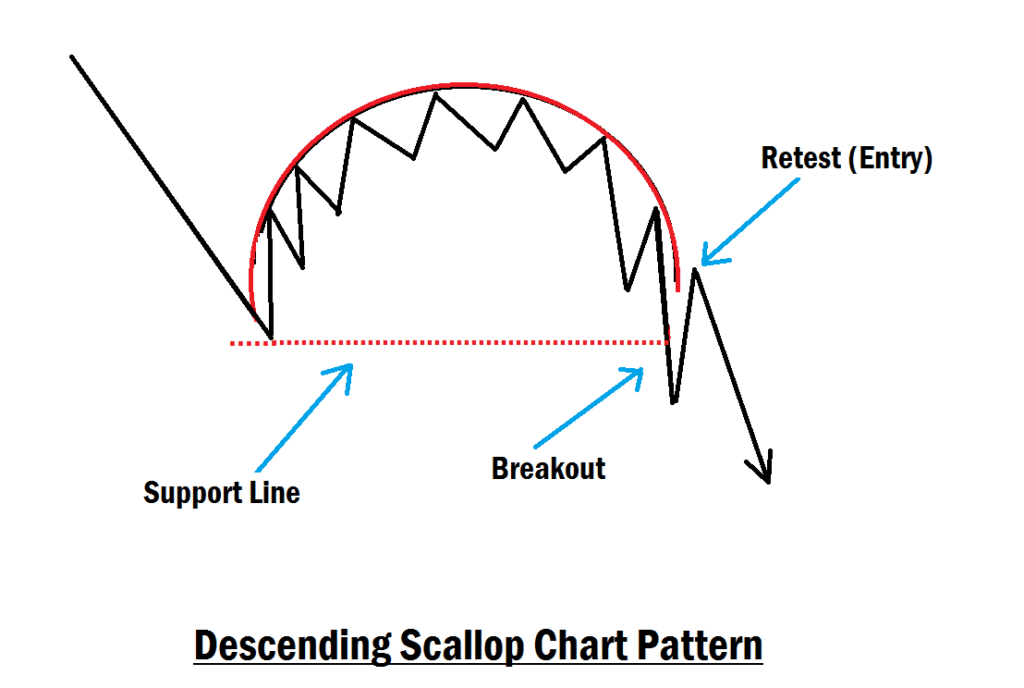

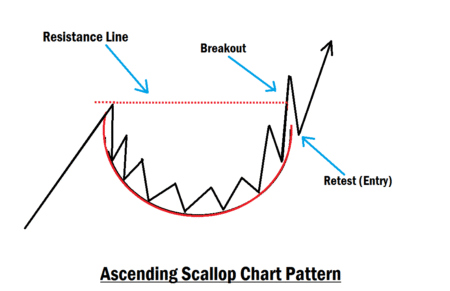

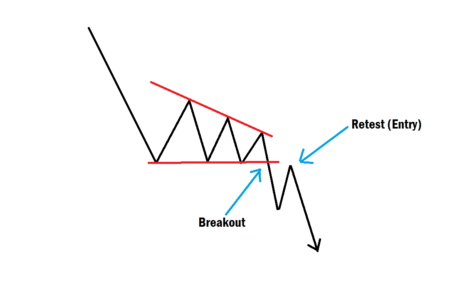

What Is the Descending Scallop Chart Pattern?

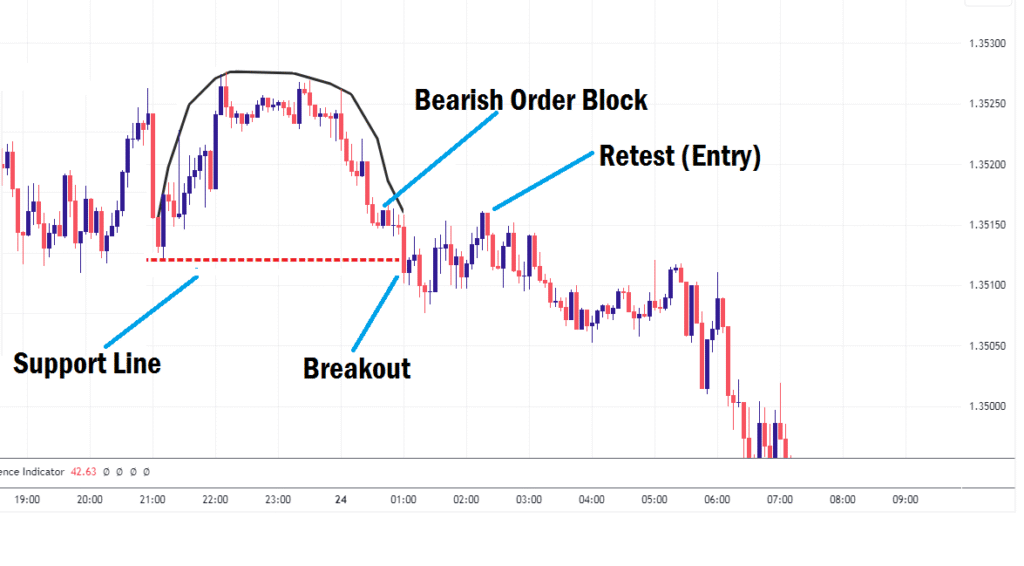

The Descending Scallop pattern is a bearish continuation chart pattern that typically forms during a downtrend. It looks like a curved pullback that slopes downward, resembling a scallop shell.

Here’s how it works:

- Price is already in a downtrend.

- The market makes a temporary upward retracement in a curved shape.

- After the retracement, price breaks down below the support level to continue the bearish trend.

This pattern signals that sellers are still in control of the market, and the pullback is simply a pause before the continuation of the downward move.

Why the Descending Scallop Works for Beginners

The Descending Scallop is beginner-friendly because:

- It provides a clear visual structure of trend continuation.

- It helps traders avoid guessing whether the trend will reverse or continue.

- It often leads to strong breakout moves when combined with volume analysis or liquidity concepts.

However, the main challenge beginners face is identifying the right entry point after the breakout. This is where SMC tools refine the strategy.

Trading the Descending Scallop with SMC Entries

Here’s how beginners can approach trading this setup:

1. Identify the Descending Scallop Pattern

Look for the curved retracement during a downtrend. Confirm that price breaks below the support level of the scallop, signaling continuation.

2. Wait for the Breakout

Do not enter immediately after the breakout. Institutions often manipulate price to trap retail traders. Instead, wait for a retest of the breakout level.

3. Use SMC Entry Models for Precision

On the retest, use SMC tools to refine your entry:

- Fair Value Gaps (FVGs): Check if price left an imbalance (FVG) while breaking out. This is often where institutions fill orders.

- Order Blocks (OBs): Look for the bearish order block near the breakout area that caused price to break out, leaving an imbalance. This provides a strong confluence for entry.

- ICT Breakaway Gaps: If the breakout with momentum creates a gap, wait for price to revisit it during the retest for a high-probability entry.

4. Place Stop Loss and Take Profit

- Stop loss: Above the order block or the most recent swing high of the scallop.

- Take profit: Use the next key support or use a 1:2 or 1:3 risk-to-reward ratio for easy exit.

This approach minimizes risk while maximizing reward.

Imagine GBP/USD forms a Descending Scallop during a downtrend. After breaking below the scallop’s support, price pulls back to retest the breakout zone. At the same level, you spot:

Example Scenario

Imagine GBP/USD forms a Descending Scallop during a downtrend. After breaking below the scallop’s support, price pulls back to retest the breakout zone. At the same level, you spot:

- A bearish order block

- An FVG left behind after the breakout.

- Use the FVG or the bearish order block as your point of interest (POI) for a quality sell position.

- Your stop-loss should be below the order block, and your take-profit should be two to three times the size of your stop-loss.

This confidence gives you the ability to enter short at the retest, knowing you’re aligned with institutional order flow.

Key Tips for Beginners

- Don’t chase breakouts. Always wait for the retest and use SMC models for entry.

- Use Confluence. Combine the Descending Scallop with at least one SMC entry model.

- Practice first. Backtest this setup on the demo before risking real money.

- Risk management is everything. Never risk more than 1–2% of your capital per trade.

Note for Beginners

It’s important to remember that no trading strategy is a holy grail. The Descending Scallop combined with SMC is powerful, but trading is always a game of probabilities.

Before trading live with real money, always:

- Practice and master the strategy on a demo account.

- Develop your personal skills and trading psychology.

- Understand that even the best strategies don’t work 100% of the time.

With the right practice and patience, combining the Descending Scallop chart pattern with Smart Money Concepts can help you trade smarter, avoid institutional traps, and steadily grow your profitability in the forex market.

Final Thoughts

The Descending Scallop chart pattern is a reliable continuation pattern that, when combined with Smart Money Concepts, provides traders with a refined, rules-based approach to entering trades. By waiting for the retest after the breakout and aligning with FVGs, Order Blocks, and ICT Breakaway Gaps, beginners can avoid common traps, reduce losses, and trade with confidence.

Trading is never about perfection; it’s about probabilities. With patience, discipline, and consistent practice, this strategy can help you grow as a trader and steadily build profitability. As you reflect on this guide, consider this: What will you do differently in your next trade to leverage these insights effectively? If you have more questions concerning this topic, do let us know in the comments section.