How To Use the Dark Cloud Cover Candlestick Pattern for Entry Confirmation As a Beginner in Forex Trading

The Dark Cloud Cover candlestick pattern is a powerful bearish reversal signal that has stood the test of time in the forex market. Many experienced traders rely on it to spot high-quality reversal opportunities and catch profitable moves with precision. As a beginner, understanding confirmation is one of the most important steps toward becoming a consistently profitable trader.

Professional traders do not enter trades blindly. They always wait for confirmation before making any trading decision, and you should do the same. Quite often, this candlestick pattern appears right at your anticipated reversal zones, but without understanding its meaning, you may overlook a perfect trading opportunity.

In this guide, you’ll learn everything a beginner needs to know about the Dark Cloud Cover pattern and how to use it effectively as a confirmation entry signal at key reversal areas such as:

- Order Blocks

- Resistance Levels

- Trendline Touches

- Supply Zones

Let’s dive in.

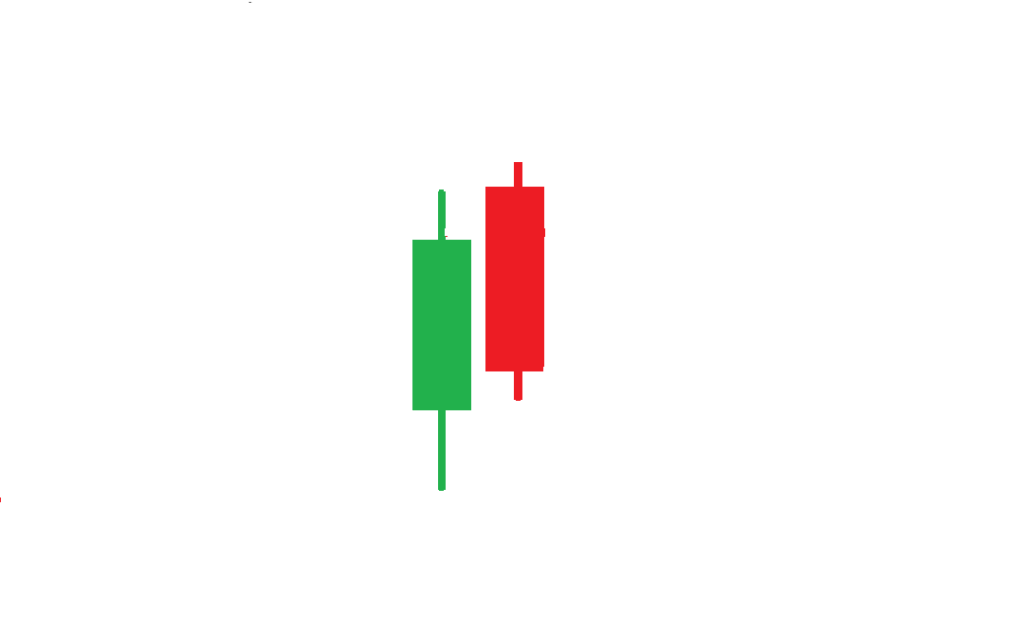

What is the Dark Cloud Cover Candlestick Pattern?

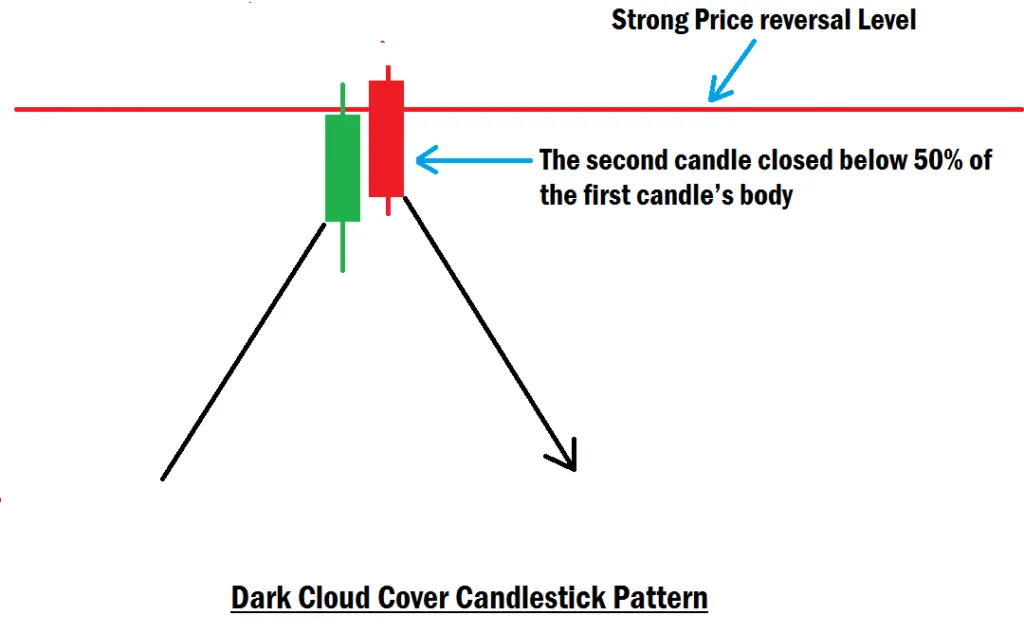

The Dark Cloud Cover is a bearish reversal pattern that appears at the top of an uptrend or at a strong premium zone. It signals that buyers are losing strength while sellers are stepping into the market with momentum.

This pattern is formed by:

- A strong bullish candle, which is the first candle in the pattern.

- A bearish candle that opens above the first candle’s high but closes below 50% of the first candle’s body, showing aggressive seller rejection. The second gap opens above the close of the bullish candle, then comes down and closes below the 50% level of the bullish candle’s body as a bearish candle.

Whenever you see this pattern at your anticipated reversal zone, it’s a sign that price may start reversing downward.

Dark Cloud Cover Pattern Performance

Based on our internal backtest results across major pairs such as GBP/USD, EUR/USD, and GBP/JPY, the Dark Cloud Cover pattern achieved an average win rate of 72% when tested at strong reversal zones. However, it is essential to consider the risk-to-reward ratio alongside the win rate. For example, a 72% hit rate paired with a reward-to-risk ratio of 2:1 can significantly enhance overall trading expectancy, emphasizing that true trading edge lies beyond just raw accuracy.

Backtesting Details

- Pairs Tested: GBP/USD, EUR/USD, GBP/JPY

- Sample Size: 400 trades per pair

- Duration: 6 months

- Timeframes Used:

-

- 1H chart for higher-timeframe directional bias

- 5-minute chart for precise entries

- Entry Zones:

-

- Order Blocks

- Trendline touches

- Supply

- Resistance

This strong performance shows that the Dark Cloud Cover pattern is a reliable confirmation tool for beginners, especially when combined with major reversal zones.

How Beginners Should Use the Dark Cloud Cover Pattern

To get the best results, follow this simple confirmation process:

1. Identify a Strong Reversal Zone

Wait for price to approach:

- A bearish order block

- A major resistance level

- A supply zone

- A trendline touch at the top of a swing high

2. Wait for the Pattern to Form

Do not rush. Allow the full pattern to complete.

3. Confirm Momentum Shift

Ensure the bearish candle closes deep into the previous bullish candle, ideally beyond 50%.

4. Execute Your Entry

Use:

- Market execution

- A sell stop below the confirmation candle

- Or a limit entry at the candle’s midpoint

Choose what fits your strategy.

5. Protect Yourself

Set stop loss above the swing high or above the bearish candle, and remember to risk 1% to 2% of your capital per trade. Your take profit should be two or three times the size of your stop loss or even more, depending on your trading style.

Important Note for Beginners

Forex trading carries risk and is not suitable for everyone. No candlestick pattern works 100% of the time. That’s why you must learn, practice, and master this pattern in a demo account before using real money in the live market.

Trading success is built on mastery, not magic.

If you understand this, you’ve already taken one of the biggest steps toward becoming a profitable trader. If you have any questions concerning this topic, do let us know in the comments section.