Mastering the Cup and Handle Chart Pattern with Smart Money Concepts (SMC)

Double your winning trades in 2025 by mastering the Cup and Handle Chart Pattern Forex Trading Strategy. In this session, we will be guiding you through the steps to make this powerful strategy work for you.

The Cup and Handle chart pattern has been around for a very long time in the forex market, and it has consistently delivered quality results over time. Many professional traders rely on this powerful chart pattern to capture profitable trading opportunities.

One of the hardest parts of a beginner’s journey in trading is finding a strategy that is both simple and effective. If you fall into this category of traders, mastering the Cup and Handle chart pattern and combining it with Smart Money Concepts (SMC) can help you identify high-quality setups that yield consistent results.

However, one thing you must understand about forex trading is that nothing works 100% of the time. Trading is all about probabilities, not guarantees. That’s why it’s important to focus on high-probability setups and practice proper risk management. Always test and master any strategy on a demo account before moving to live trading with real funds. If you can’t stay profitable on a demo account, the chances of succeeding with real money are very slim.

In the world of forex trading, chart patterns play a huge role in helping traders understand price behavior and predict possible moves. One of the most reliable continuation patterns that beginner traders need to know is the Cup and Handle chart pattern.

This pattern does not just show market consolidation; it signals strength and a possible bullish continuation when identified correctly. Imagine the price swooping like a ladle into its lowest point before surging upward with renewed momentum. To make it even more powerful, combining the Cup and Handle with Smart Money Concepts (SMC) entry models, such as Fair Value Gaps (FVGs) and Breakaway Gaps, can give traders an edge in timing their entries with precision.

Why Combine the Cup and Handle Chart Pattern with SMC?

The answer is simple: combining Smart Money Concepts (SMC) with the Cup and Handle pattern gives you precision and profitability.

With SMC, you gain insight into how institutional traders move the market. SMC reveals the footprints of big players and helps you identify the most effective entry points with confidence. When you combine this knowledge with the Cup and Handle chart pattern, you’re not just trading a retail setup; you’re trading in alignment with institutional flows.

Think of it this way: combining these two powerful trading models (Cup and Handle and SMC) is like adding fuel to an already burning flame. It enhances accuracy, increases profitability, and minimizes false breakouts.

If you are new to Smart Money Concepts, we highly recommend enrolling in our free SMC Masterclass to gain a full understanding of how to apply it effectively in your trading.

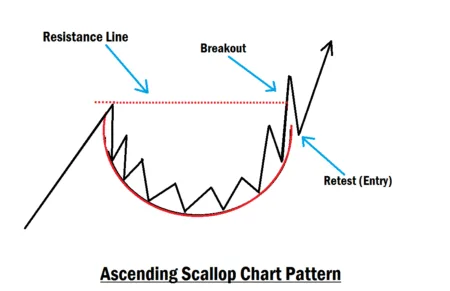

What is the Cup and Handle Chart Pattern?

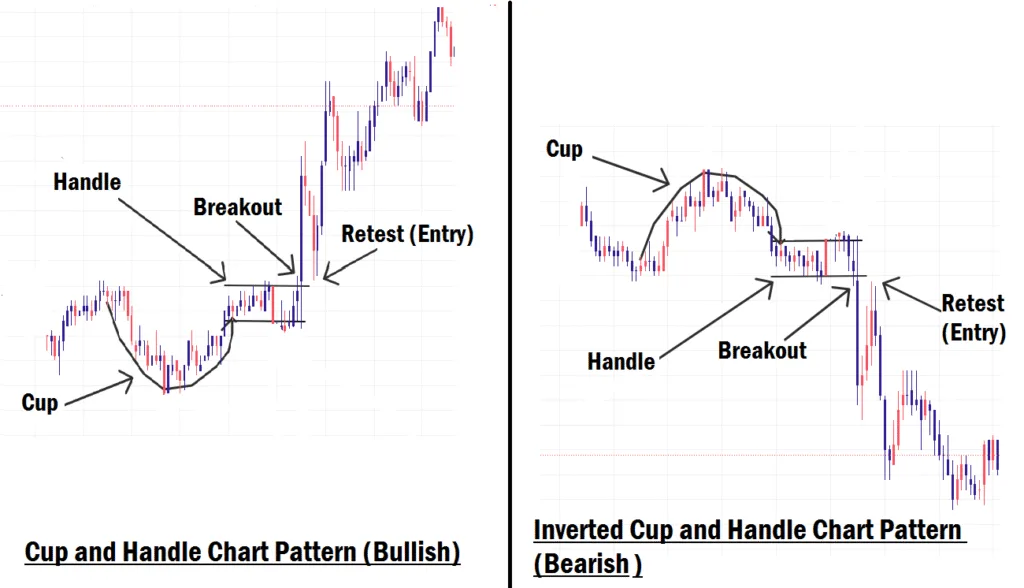

The Cup and Handle chart pattern is a bullish continuation pattern. It often forms after a strong uptrend, indicating that the market is pausing before resuming its upward momentum.

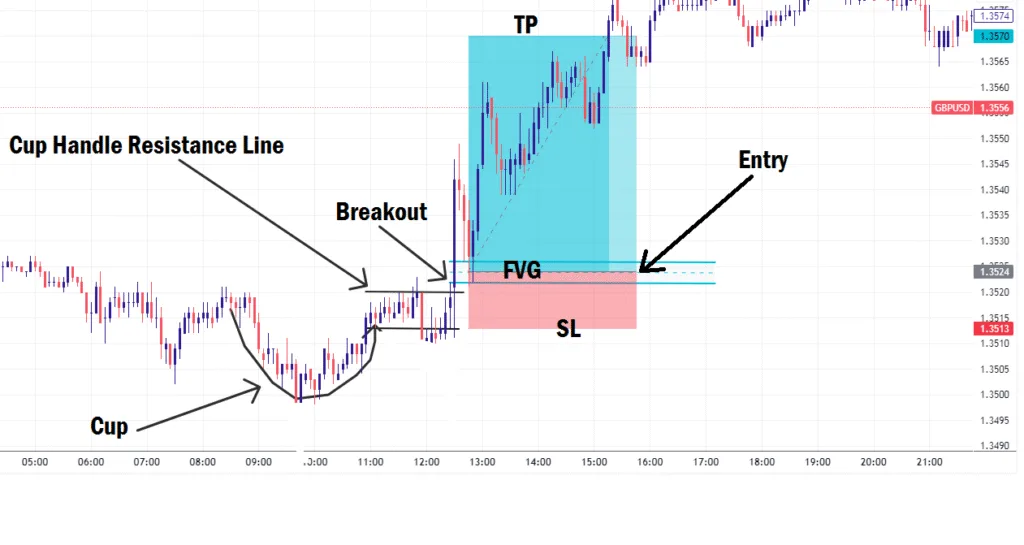

- The Cup: Looks like a rounded bottom or a “U” shape. This section illustrates consolidation following a bullish run. Sellers try to push price down, but buyers step in and slowly regain control.

- The Handle: After the rounded cup forms, price pulls back slightly, creating a smaller dip on the right side. This forms the “handle,” which is usually a short-term retracement.

- The Breakout: Once the handle completes, price often breaks out above resistance, signaling a continuation of the bullish trend.

Think of it like this: the Cup is the market taking a breather after a long run, and the Handle is the last little shakeout before buyers push price higher.

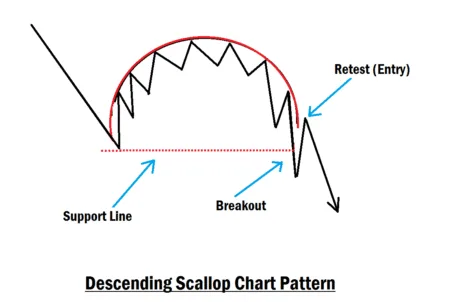

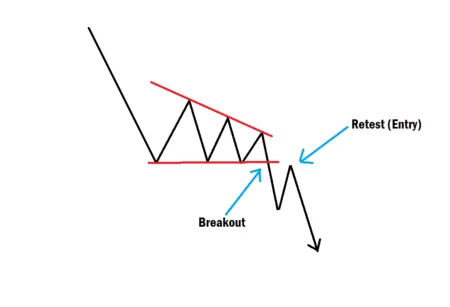

Inverted Cup and Handle Chart Pattern

The inverted cup and handle chart pattern is the direct opposite of the cup and handle pattern. It strongly indicates a bearish continuation, and the trade entry is the same as a cup and handle. Whatever entry method in a cup and handle is exactly the same as the inverted cup and handle, but in the opposite direction. The cup and handle is a bullish continuation indicator, while the inverted cup and handle chart pattern indicates a bearish continuation.

Why the Cup and Handle is Important for Beginners

For beginner traders, the Cup and Handle pattern is easy to recognize and provides a clear trading plan. Here’s why it matters:

- Predictability – The pattern provides a clear breakout point (above the handle’s resistance).

- Risk Management – The handle gives a natural place to set a stop-loss below its low.

- Trend Continuation – It helps traders join a strong trend with confidence instead of guessing. To enhance risk management, consider aiming for a risk-to-reward ratio such as risking 1% of your capital to aim for a 2% gain. This approach not only supports disciplined trading but also provides a structured framework for making trading decisions.

But here’s the truth: relying on the pattern alone can lead to false breakouts. That’s why combining it with SMC concepts is key.

Combining Cup and Handle with Smart Money Concepts (SMC)

Smart Money Concepts (SMC) focuses on understanding institutional footprints in the market (think of this as the trading habits of big banks and financial institutions). While retail traders may just see a breakout, institutions usually leave behind clues like Fair Value Gaps (FVGs), Order Blocks, Liquidity Grabs, or Breakaway Gaps.

When you combine the Cup and Handle with these concepts, your entries become more accurate and less prone to fakeouts.

1. Fair Value Gap (FVG) Or Breakaway Gap Entry

- After the Cup and Handle forms and a breakout from the cup’s handle resistance line occurs, look for a Fair Value Gap or Breakaway Gap caused by the breakout. The breakaway gap or FVG serves as your point of interest for entry if price pulls back to mitigate it. Your stop-loss (SL) should be below the last candle before FVG or breakaway gap. Then your take-profit (TP) should be at least two times the size of your stop-loss or more.

- Another powerful entry is: If the handle retracement taps into a breakaway gap around the body of the cup. This could be a high-probability entry point because it gives you early entry before the breakout. Your stop-loss should be set below the last candle before the breakaway gap. Target at least two or more times the size of your stop-loss as your take-profit. But if you’re not a pro, wait for the breakout instead.

2. Order Block Confirmation

- Often, the handle forms when price returns to a bullish Order Block (OB).

- If you spot a valid bullish OB aligning with the handle, it strengthens your entry.

- Enter when price retests the OB, placing your stop just below it.

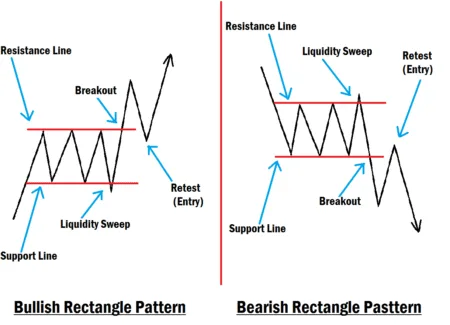

3. Liquidity Grab Before Breakout

- Sometimes, the handle dips below the low of the cup to grab or sweep liquidity before the real breakout. If that happens before the breakout, it should give you more confidence to trade the breakout.

Example Trading Plan

Here’s a simple step-by-step approach:

- Identify the Cup forming after a bullish trend.

- Wait for the Handle retracement to take shape.

- Spot an FVG, Breakaway gap, or Order Block inside the handle zone. You can wait for the breakout instead.

- Place your entry at the SMC point of interest (FVG or Breakaway Gap).

- Set your stop-loss just below the handle low. You can also place it below the last candle before the Breakaway Gap or FVG.

- Target at least twice the size of your stop-loss or more, depending on the market condition.

Final Thoughts

The Cup and Handle chart pattern is one of the most beginner-friendly yet powerful patterns in forex trading. It signals continuation and gives traders a structured plan. But when you combine it with Smart Money Concepts (SMC) like Fair Value Gaps, Order Blocks, and liquidity sweeps, it becomes a high-probability strategy.

For beginners, the key is patience. Don’t just jump in because you see a “cup” forming; wait for confirmation with SMC tools. This way, you align retail patterns with institutional footprints, putting you on the same side as the smart money.

By mastering this approach, you’ll not only trade the Cup and Handle effectively but also build the discipline and confidence needed to grow as a forex trader. If you have any questions or want us to discuss any topic for you on this platform, use the comment section to let us know. Trade with precision, not guesswork.