How To Trade The Breakout Forex Strategy Like A Pro

In this session, we’ll be diving deep into one of the most time-tested and widely used approaches in the forex market, “the Breakout Trading Strategy.” This strategy has proven itself over the years and remains a reliable weapon in the arsenal of many seasoned traders.

Breakout trading is straightforward in theory, yet it can pose a challenge to new traders still finding their footing in the market. When mastered and applied correctly, it’s not only simple but also incredibly profitable. However, if misused or approached without proper understanding, it can easily become a trap that leads to losses.

Remember, forex trading is like a double-edged sword. It can serve as a powerful tool for building wealth, or it can deal heavy losses if handled carelessly. It is why discipline, patience, risk management, and a solid knowledge base are non-negotiable if you want to succeed. The forex market rewards only those who are willing to do the hard work and master their craft.

We always emphasize that there is no holy grail strategy in the forex market that works 100% of the time. Losses are part of the game, even with high-probability setups. That’s why risk management is not just important, but essential.

If you’re a beginner, start with a demo account. Practice until you become consistently profitable before moving on to live trading. If you can’t profit on a demo, you definitely won’t profit with real money. Learning forex is one thing, understanding it is another. Reading gives you knowledge, but practice gives you wisdom. Take your time to understand the game before stepping into the live market.

What Is a Price Breakout?

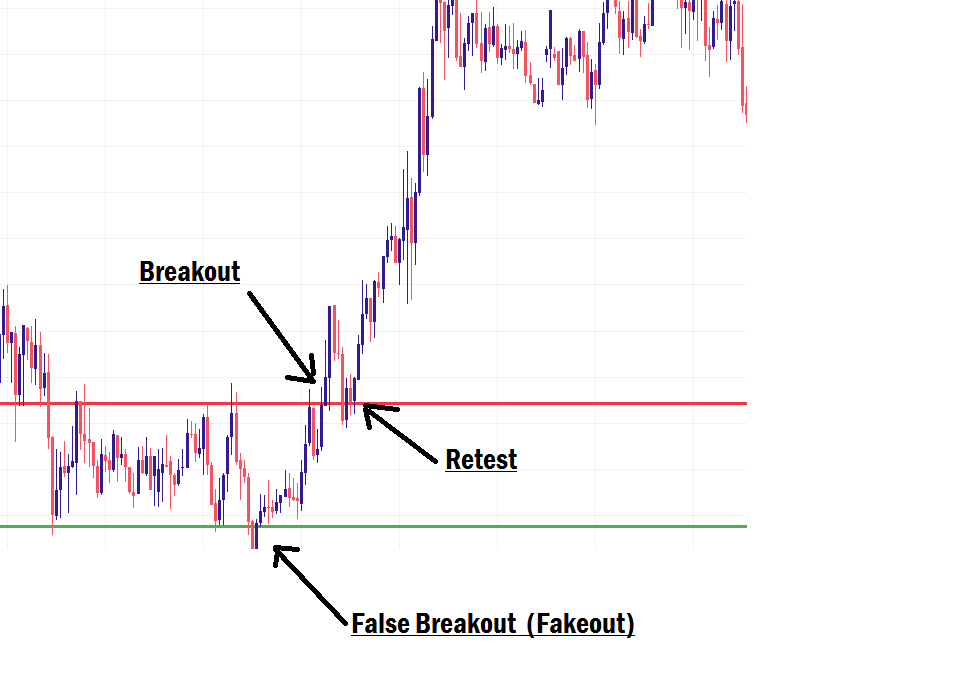

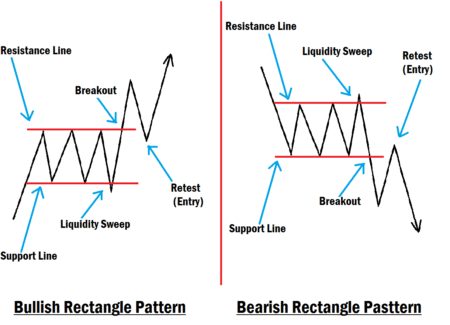

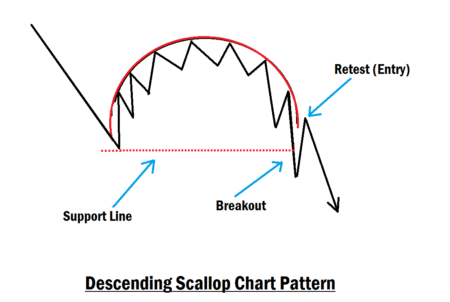

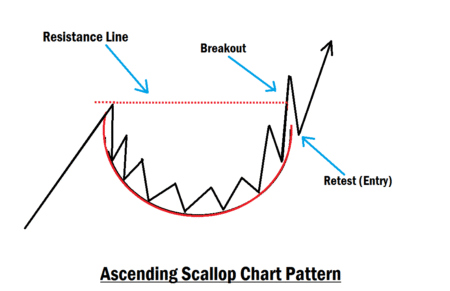

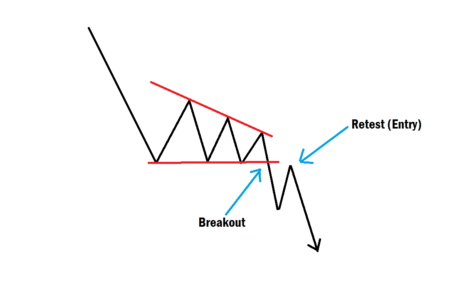

A price breakout occurs when the market moves beyond a well-defined range, either above a resistance level or below a support level. This move typically happens with strong momentum and higher trading volume, signaling the potential beginning of a new trend.

Breakouts are a sign that the market has made up its mind. They often indicate the end of a consolidation (ranging) phase, giving way to either a continuation of the previous trend or a possible reversal.

However, not all breakouts are genuine. Some are false breakouts (fakeouts) designed to trap inexperienced traders and wipe them out before the real move begins. It is why careful analysis and risk management are crucial.

The Idea Behind the Breakout Strategy

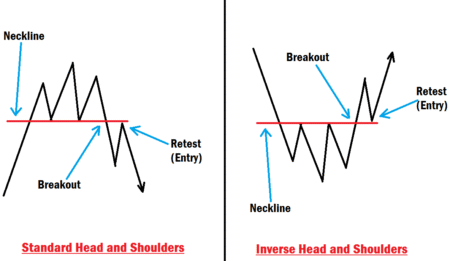

The logic behind breakout trading is fairly simple: when price breaks through a support or resistance level, it will often come back to retest that level before continuing in the breakout direction.

Here’s what usually happens:

- Before a true breakout, price tends to perform a fakeout, a deceptive move that tricks traders into taking the wrong side.

- For example, if price plans to break below support, it might first give a false breakout above resistance to lure in long traders, then swiftly reverse to break through the support and trap them.

- Conversely, if price wants to break above resistance, it might first pretend to break support before snapping upward through the resistance.

These fakeouts are engineered to trap liquidity, forcing early traders out of the market. So, being aware of them is key to trading breakouts effectively.

How to Trade the Breakout Strategy in Forex

To trade breakouts like a pro, follow these steps:

- Start with a Top-Down Analysis

- Begin on the higher time frames to understand the overall market structure and trend direction.

- Identify Consolidation (Ranging Phase)

- On your higher time frame, look for a period where price is moving sideways, creating swing highs and swing lows within a tight range. It indicates indecision in the market.

- Draw Support and Resistance Lines

- Use your line tool to connect swing lows (support) and swing highs (resistance), similar to what you learned in the support and resistance strategy.

- Watch for the 3rd or 4th touch

- Breakouts often occur after the third, fourth, or even fifth touch of the range boundaries. However, remember that slight breaches with weak momentum can be fakeouts, not actual breakouts.

- Wait for a Breakout with Momentum

- A valid breakout is usually accompanied by strong momentum or volume. It is your signal that the market has exited consolidation.

- Wait for the Retest

- After the breakout, be patient and wait for price to come back and retest the broken level (support or resistance). Sometimes, the retest dips slightly back into the range; don’t panic.

- Drop to Your Entry Time Frame

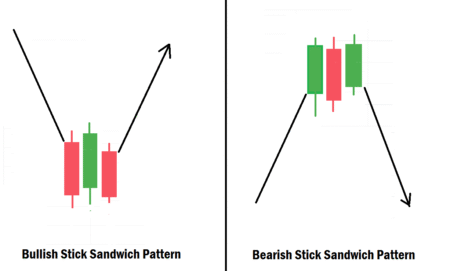

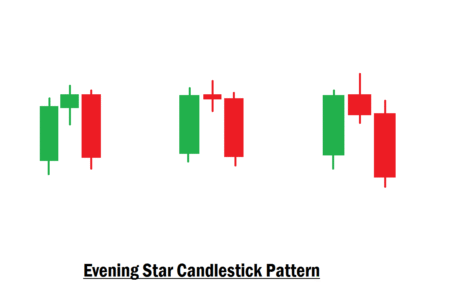

- On a lower time frame, look for reversal confirmation signals like a Market Structure Shift (MSS) before entering the trade.

Practical Example

Let’s say the market is in an uptrend, forming higher highs and higher lows. Suddenly, price stops creating higher highs and instead starts bouncing between horizontal support and resistance. This signals consolidation.

Here’s what you do:

- Mark the swing highs as resistance and the swing lows as support.

- Wait for price to fake out, then break above the resistance with strong momentum.

- After the breakout, wait for price to retest the resistance-turned-support.

- On the lower time frame, identify a bullish market structure shift.

- Place a buy order, with your stop loss (SL) below the MSS low and your take profit (TP) set at a 3:1 risk-to-reward ratio or more.

This same logic applies to bearish breakouts as well, just flipped in the opposite direction.

Final Thoughts

Breakout setups aren’t always clean and textbook-perfect. Some consolidations will be messy, making it hard to clearly define your range. That’s why practice is key. Use your demo account to train your eyes and develop a unique edge before going live.

And always remember: no trading strategy works 100% of the time. The secret is to combine your technical strategy with solid risk management, emotional discipline, and patience. That’s how professionals win over time.

Up Next: In our next lesson, we will be diving into “Trading with Order Blocks Effectively.“ Let’s go there!