In today’s session, we’ll be diving into “Break of Structure in Forex Trading.”

In forex trading, Break of Structure (BOS) is a key price action concept that every beginner trader must understand and master before aiming to become consistently profitable. Without a solid understanding of price action, navigating the forex market becomes extremely challenging.

Price follows a structural pattern that reflects the collective behavior of market participants. It doesn’t move in a straight line; instead, it flows in a structured and predictable manner based on market psychology.

As a beginner, you must keep in mind that forex trading involves significant risk. If you don’t know what you’re doing, you could lose your capital quickly. That’s why acquiring quality knowledge about how forex truly works is essential before committing real funds. Always begin with a demo account and use it to practice and refine your strategy. Remember, probabilities drive the forex market; nothing is guaranteed. If you’re not profitable on a demo account, you won’t be profitable trading live.

Understanding Break of Structure (BOS) provides a clearer picture of market direction, helping you align with what the price is doing and the actions you should take. Price moves in three primary phases:

- Uptrend Phase

- Downtrend Phase

- Accumulation or Consolidation Phase

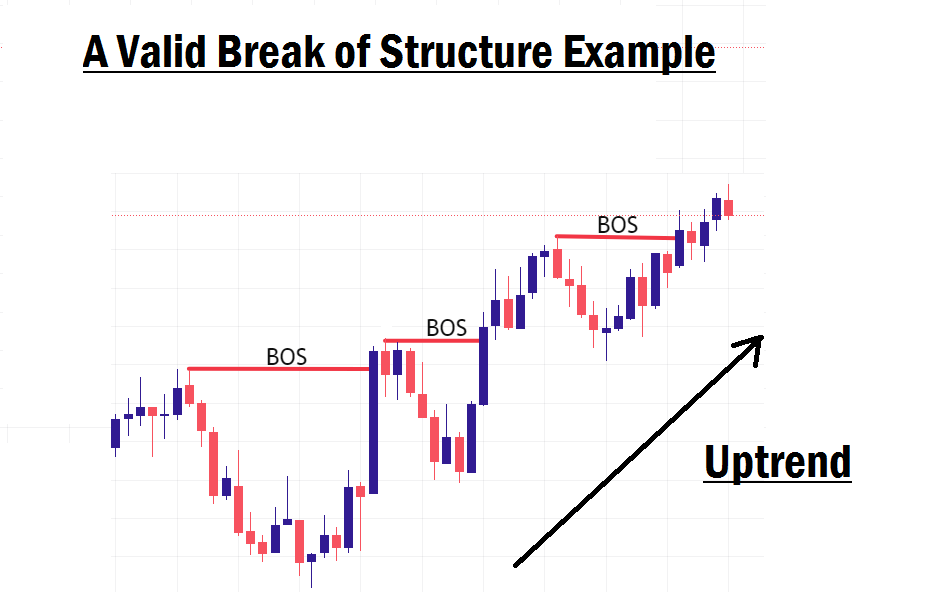

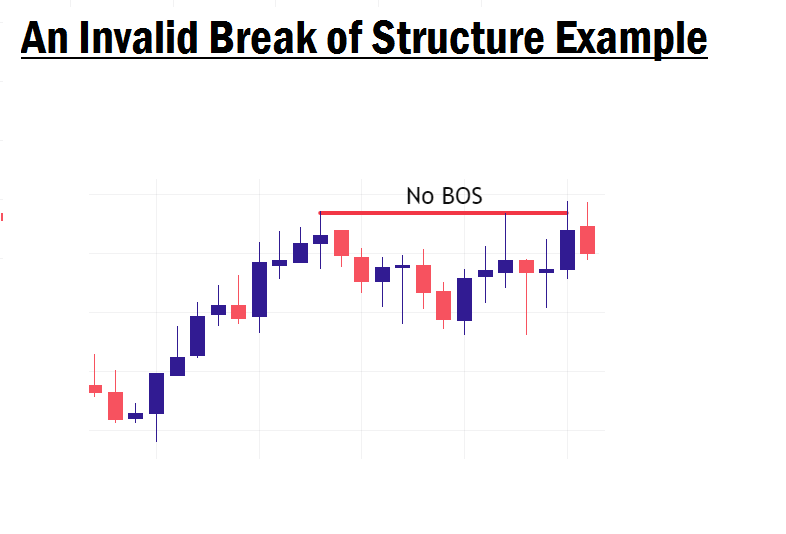

During trending phases, either upward or downward, the Break of Structure becomes the primary indicator to watch. However, during the accumulation or consolidation phase, price typically does not break structure. Valid trends are characterized by a series of structure breaks, and that’s our focus in this lesson. Since BOS doesn’t apply during consolidation, we will be focusing on trend phases in this context.

What Is a Break of Structure (BOS) in Forex Trading?

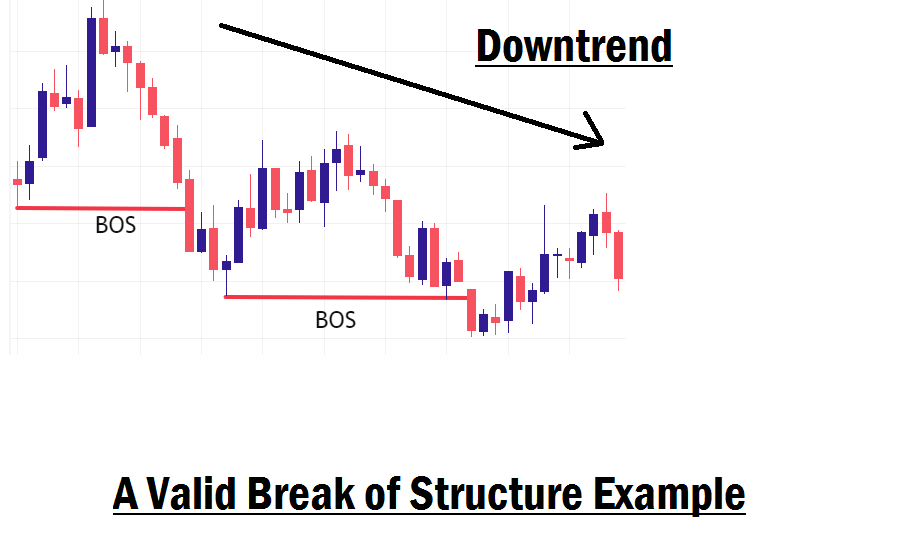

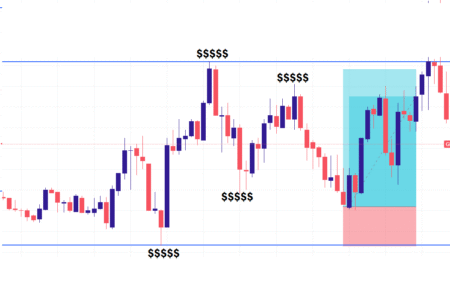

A Break of Structure occurs when price moves beyond a previous swing high in an uptrend or a swing low in a downtrend. This break signifies a continuation of the trend and reveals which group is currently in control, bulls (in an uptrend) or bears (in a downtrend).

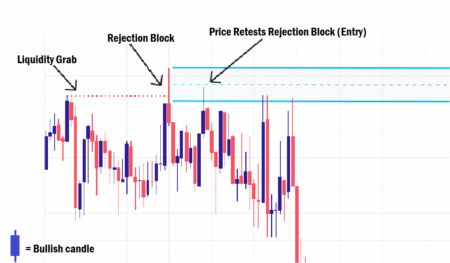

- In an uptrend, a valid BOS happens when price closes above the previous swing high with the body of the candlestick, creating a Higher High (HH).

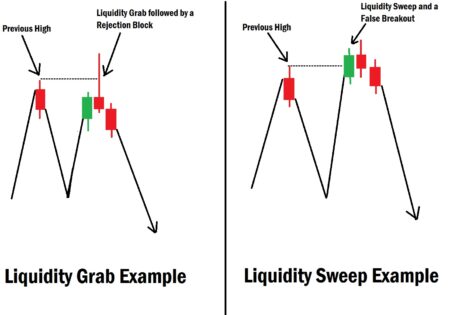

- If price only breaks the high with a wick or shadow (and not the candlestick body), it’s considered a liquidity sweep, not a BOS.

- In a downtrend, a valid BOS occurs when price closes below the previous swing low with the candlestick body, forming a Lower Low (LL).

- If the low is breached only by the wick or shadow, it’s also treated as a liquidity sweep, not a structural break.

How to Trade a Break of Structure in Forex with Smart Money Concepts (SMC)

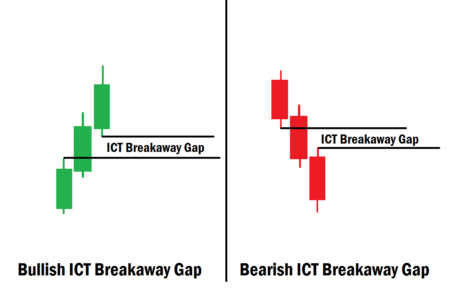

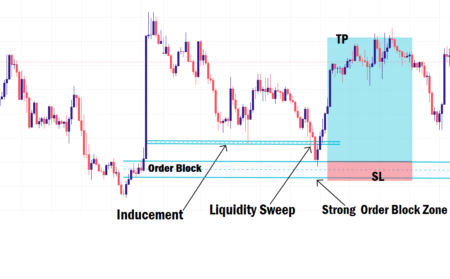

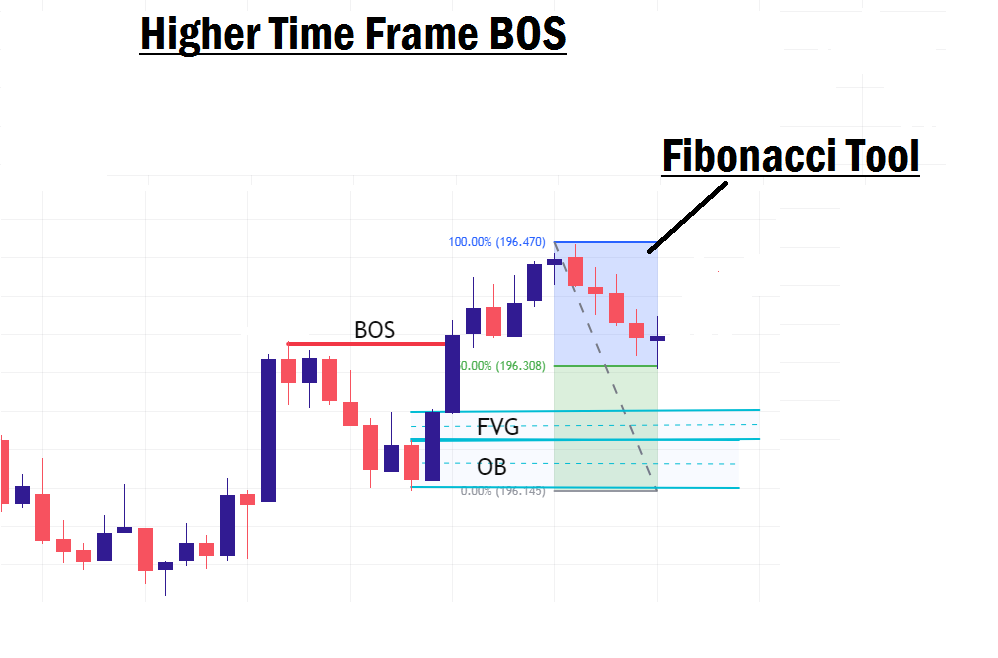

Trading the Break of Structure is simple and straightforward, but you must apply a tactical and disciplined approach. In smart money concept (SMC) trading, once BOS occurs, you don’t jump in immediately. Instead, you wait for price to retrace into a Fair Value Gap (FVG) and Order Block (OB) that was responsible for the break.

These two key elements (FVG and OB) must align with the appropriate areas on your Fibonacci retracement:

- Premium zone for bearish setups

- Discount zone for bullish setups

⚠️ If there’s no valid order block, skip the trade. It’s likely a low-probability setup. To qualify as valid, an order block must have caused an imbalance (i.e., a Fair Value Gap) in price delivery.

Example: Bullish Scenario

Suppose price is trending upward, and you spot a valid BOS on your preferred higher time frame.

Steps:

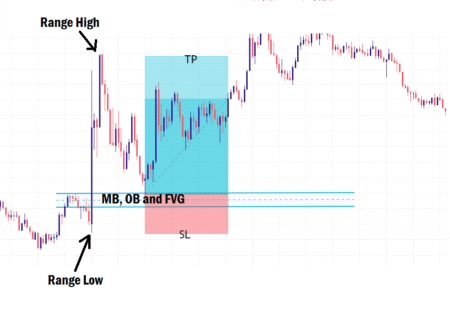

- Use your Fibonacci tool to measure from the new Higher High (HH) formed after the BOS down to the swing low just before the break occurred.

- Identify the discount zone of the Fibonacci retracement.

- Mark the bullish order block and the Fair Value Gap that led to the BOS. These become your Point of Interest (POI).

- Wait for price to retrace back into that POI.

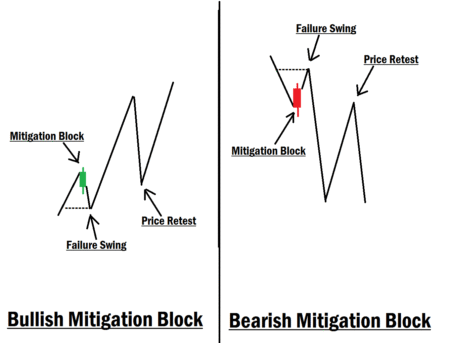

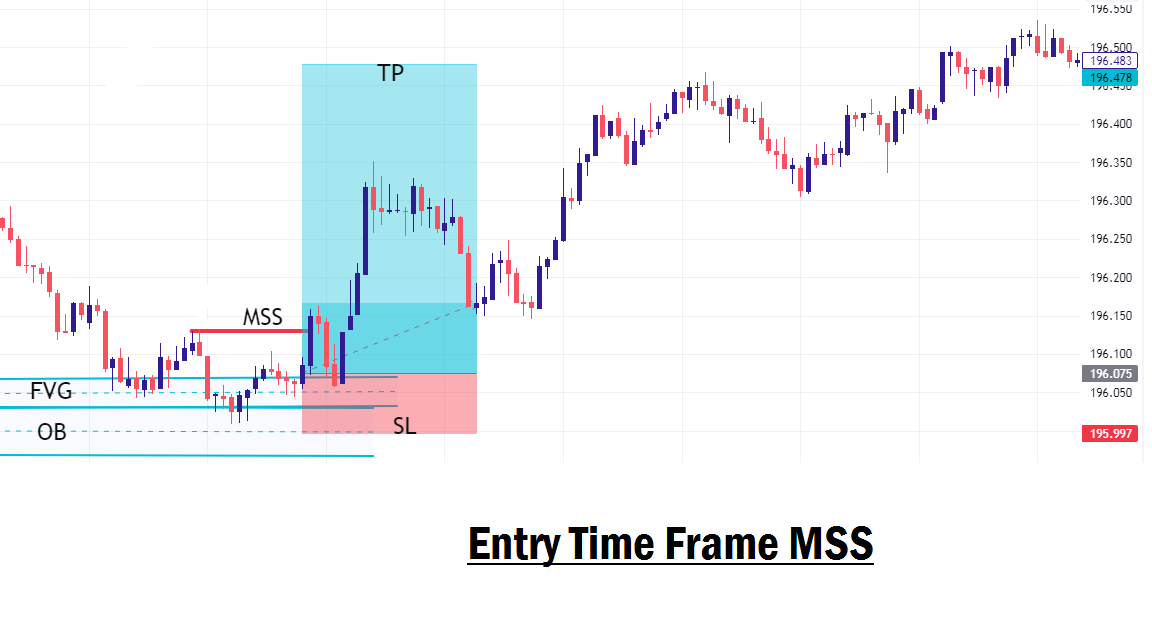

- Drop to your entry timeframe and look for a Market Structure Shift (MSS) around the POI.

- Once MSS is confirmed, you may place your buy trade.

- Set your Stop Loss (SL) just below the swing low of the MSS.

- Your Take Profit (TP) should be at least 3x your stop loss or more, depending on your risk profile.

Example: Bearish Scenario

Follow the same approach for bearish setups:

- After a BOS in a downtrend, use Fibonacci to measure from the new Lower Low (LL) to the swing high just before the break.

- Focus on the premium zone of the Fibonacci tool.

- Identify a bearish order block and its corresponding Fair Value Gap as your POI.

- Wait for price to retrace into the POI.

- On your entry timeframe, look for a Market Structure Shift (MSS) for entry confirmation.

- Once confirmed, enter your sell trade.

- Set your SL above the swing high of the MSS.

- Set your TP to be at least 3x the size of your stop loss.

Final Thoughts

Practice leads to improvement. Test this method thoroughly on a demo account to refine your skill and build confidence. Understand that no strategy is perfect or guarantees success. Always implement proper risk management to safeguard your capital.

In our next lesson, we’ll explore “Liquidity Void.” Don’t miss it!